March 2026

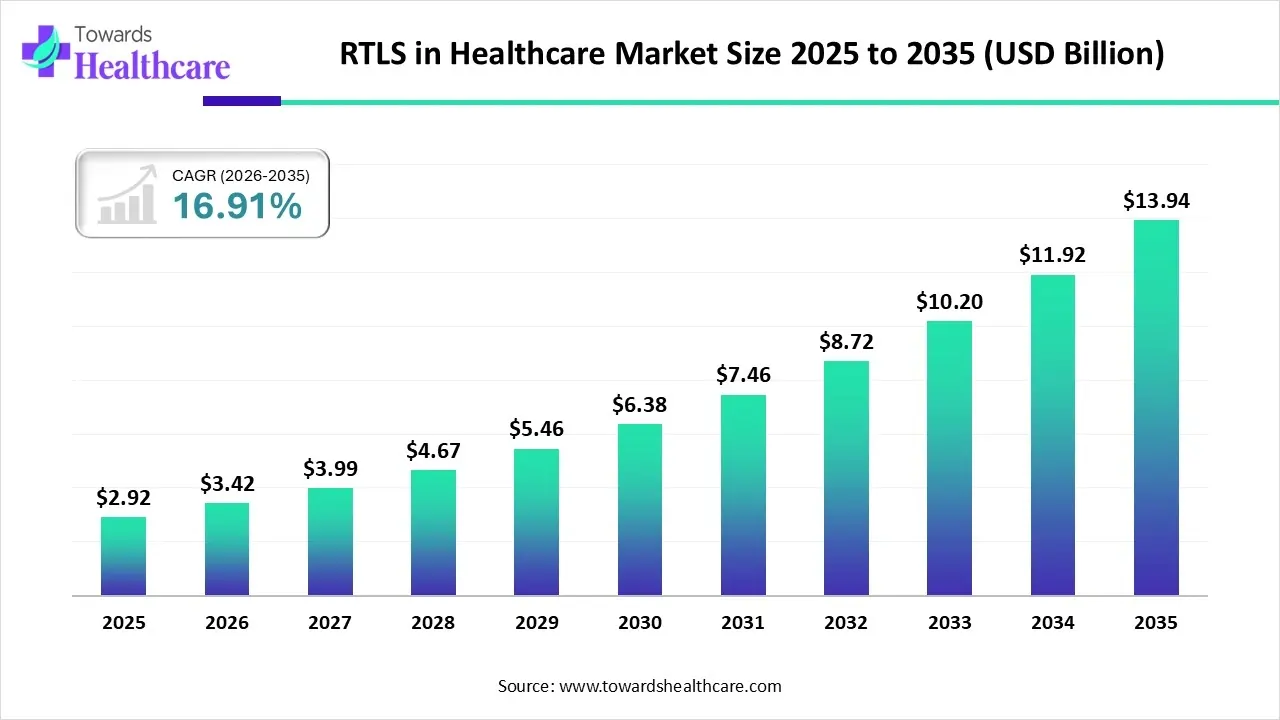

The global RTLS in healthcare market size is calculated at USD 2.92 billion in 2025, grew to USD 3.42 billion in 2026, and is projected to reach around USD 13.94 billion by 2035. The market is expanding at a CAGR of 16.91% between 2026 and 2035.

| Key Elements | Scope |

| Market Size in 2025 | USD 2.92 Billion |

| Projected Market Size in 2035 | USD 13.94 Billion |

| CAGR (2025 - 2035) | 16.91% |

| Leading Region | North America |

| Market Segmentation | By Component, By Application, By Facility Type, By Deployment Mode, By End-User, By Distribution Channel, By Region |

| Top Key Players | Navigine, Cognosos, Idox, Vertiv, Kyndryl Healthcare Solutions, ARISTA, Blueiot, Litum |

The RTLS in healthcare market is primarily driven by the growing complexities in healthcare operations and the increasing need for real-time monitoring. Healthcare organizations adopt innovative technologies to streamline their supply chain infrastructure. Artificial intelligence (AI)-based sensors revolutionize real-time product tracking. Regulatory agencies establish a framework to promote the use of real-time location systems (RTLS) in the healthcare sector.

The RTLS in healthcare market is experiencing robust growth, driven by the increasing hospital digitization, rising demand for asset utilization optimization, growing patient safety requirements, workforce efficiency needs, aging healthcare infrastructure, and adoption of smart hospital technologies. It includes hardware, software, and services used to track, monitor, and manage the real-time location of medical assets, equipment, staff, and patients within healthcare facilities. RTLS solutions use RFID, BLE, Wi-Fi, infrared, and ultrasound technologies to improve operational efficiency, reduce equipment loss, enhance patient safety, streamline workflows, and optimize hospital resource utilization

AI plays a vital role in RTLS to streamline healthcare operations and possess predictive capabilities. AI and machine learning (ML) algorithms process location data streams in real-time, identifying patterns, predicting bottlenecks, and suggesting operational adjustments before issues arise. AI-based predictive analytics enable healthcare professionals to make proactive decisions. AI and ML automate supply chain management based on usage patterns and optimize room turnover scheduling. Automated workflow optimization reduces staff fatigue, improving patient care and saving time.

Which Component Segment Dominated the RTLS in Healthcare Market?

The hardware segment held a dominant position in the market in 2024, due to the need for complete control over the system. Healthcare organizations that have specialized facilities are installing hardware systems. This helps them tailor their operations without internet connectivity. Hardware components of RTLS include tags or transponders and receivers. A tag is mounted on a person or object to identify them uniquely. A receiver sends and receives signals from several tags.

Software

The software segment is expected to grow at the fastest CAGR in the RTLS in healthcare market during the forecast period. Advances in software technologies, such as RFID, BLE, Wi-fi, IR, and UWB, promote the segment’s growth. The integration of software tools in healthcare facilities eliminates the need for a specialized infrastructure, saving installation costs. Some software instances include location engine software, middleware, and application software.

Services

The services segment is expected to grow significantly, driven by high affordability and relevant expertise. RTLS service providers offer a variety of services, including installation, integration, and maintenance. They have skilled professionals to provide tailored services and expertise to providers.

How the Asset Tracking & Management Segment Dominated the RTLS in Healthcare Market?

The asset tracking & management segment held the largest revenue share of the market in 2024, due to the need for improving workflow efficiency and timely delivery of medical products. Asset tracking is essential as it streamlines both administrative and maintenance workers’ jobs by providing accurate, detailed logs of asset information. Professionals can track real-time data, thereby preventing theft. Bar codes, LPWAN, RFID, BLE, and GPS are used for asset tracking and management.

Patient Tracking & Safety

The patient tracking & safety segment is expected to grow with the highest CAGR in the RTLS in healthcare market during the studied years. Patient tracking is essential for all types of patients, especially those suffering cognitive and physical impairments. This helps healthcare staff to monitor patient location at all times and prevent falls and injuries. It is estimated that approximately 1 million patients experience falls during hospital admissions annually, with 25% of falls resulting in injury and 10% resulting in serious injury.

Inventory & Supply Chain Management

The inventory & supply chain management segment is expected to show lucrative growth, driven by reduced supply chain costs and optimized logistics management. RTLS provides real-time insights into inventory management, allowing healthcare staff to maintain product quantity. It plays into cutting-edge analytics solutions, which are capable of forecasting needs and updating inventory accordingly.

What Made On-premise the Dominant Segment in the RTLS in Healthcare Market?

The on-premise segment accounted for the highest revenue share of the market in 2024, due to favorable infrastructure and suitable capital investments in healthcare organizations. On-premise tools provide complete control over confidential data. As on-premise tools do not require the internet and are operated by local staff, they have less chance of data leakage.

Cloud-based

The cloud-based segment is expected to witness the fastest growth in the RTLS in healthcare market over the forecast period. The demand for cloud-based RTLS is increasing owing to its superior benefits over on-premise RTLS. Cloud-based RTLS can store large amounts of data, allowing healthcare professionals to access data from anywhere and at any time. Cloud solutions offer automatic updates and scalability, enabling staff to expand their tracking capabilities.

Hybrid

The hybrid segment is expected to grow in the coming years, due to the ability to provide synergistic effects of both on-premise and cloud-based tools. Hybrid RTLS is a comprehensive system that features cutting-edge hardware, software, and tools. The system is flexible and scalable, as well as preventing data leakage and security breaches.

How the Public Hospitals Segment Dominated the RTLS in Healthcare Market?

The public hospitals segment contributed the biggest revenue share of the market in 2024, due to the increasing number of hospital admissions and the need to optimize staff workflows. Some studies have shown that nurses spend up to 60 minutes per shift searching for equipment, resulting in an estimated $14 billion in annual productivity. RTLS overcomes numerous challenges faced by healthcare staff and patients.

Ambulatory Surgical Centers (ASCs)

The ambulatory surgical centers (ASCs) segment is expected to expand rapidly in the RTLS in healthcare market in the coming years. ASCs have skilled professionals to provide personalized treatment and care. They offer outpatient services to patients, eliminating the need for patients to stay overnight. RTLS enhances patient safety and improves overall patient safety.

Long-term Care Facilities

The long-term care facilities segment is expected to expand rapidly in the market in the coming years. RTLS is commonly leveraged by long-term facilities to monitor wandering behavior. Patient tracking is essential in long-term facilities as RTLS can prevent medical errors and speed up processes. There are more than 15,600 nursing facilities in the U.S. with over 1.7 million licensed beds.

Which Distribution Channel Segment Led the RTLS in Healthcare Market?

The direct sales segment led the market in 2024, due to the need for affordable solutions. Developers directly sell their RTLS products to healthcare providers, bypassing any wholesaler or distributor. These sales are increasingly facilitated through manufacturers, reducing distribution costs. Direct sales enable healthcare providers to purchase the desired product from a wide range of options.

System Integrators

The system integrators segment is expected to show the fastest growth in the RTLS in healthcare market over the forecast period. System integrators have relevant expertise in implementing or replacing software, integrating applications, and building workflow automation. They have long integrated IT systems from different vendors and managed IT resources for organizations. Healthcare providers can access multiple options from a single system integrator.

Online Platforms

The online platforms segment is expected to grow in the upcoming years, due to the burgeoning e-commerce sector and advances in internet connectivity. Online platforms enable developers to sell their products to numerous healthcare professionals across diverse geographical locations.

North America dominated the global market in 2024. The availability of a robust healthcare infrastructure, favorable regulatory support, and the increasing adoption of advanced technologies are factors that govern market growth in North America. The presence of key players and increasing investments contribute to market growth. Healthcare facilities in North America focus on improving patient safety, workflow efficiency, and asset management.

Key players, such as HID Global, CenTrak, and Securitas Healthcare, are major providers of RTLS solutions to the U.S. market. There are over 6,093 hospitals in the U.S. In addition, more than 34 million admissions were reported in the U.S. This necessitates the adoption of RTLS in healthcare organizations. It is estimated that approximately 25% of the U.S. hospitals have adopted RTLS.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The burgeoning healthcare sector and the increasing number of hospital admissions foster market growth. Government bodies of Asia-Pacific countries provide funding to enable healthcare organizations to adopt advanced technologies. The increasing R&D investments and collaborations among key players facilitate the development of innovative RTLS solutions.

The Chinese government launched a plan to integrate AI across its healthcare system over the next five years, focusing on enhancing grassroots capabilities and improving patient services at hospitals. Through this plan, the government established a robust foundation of high-quality, reliable healthcare datasets and trusted data spaces by 2027.

Europe is expected to grow at a considerable CAGR in the upcoming period. Favorable government support and regulatory policies propel the market. European nations launch initiatives to support the adoption of digitalization in the healthcare sector. The European Medicines Agency (EMA) regulates the approval of RTLS and other healthcare IT solutions in Europe. People are becoming more aware of advanced technologies and their applications and benefits.

The National Health Service (NHS) is currently undergoing the largest digital health transformation program in the world, with a total investment of over £1 billion annually. The 10 Year Health Plan for England by the UK government aims to improve the management of medicine shortages and strengthen the supply chain resilience.

South America is showing strong upward momentum in the RTLS in healthcare market within healthcare. Modernization of urban hospitals and better infrastructure development are primary drivers. Brazil is a leading nation with growing digitization and private sector interest, boosting deployments focused on asset tracking and staff efficiency.

Brazil is a key market, experiencing significant uptake driven by a rising focus on patient safety and operational compliance. Its healthcare facilities are increasingly implementing RTLS to improve staff response times and reduce medical errors. Hardware components, such as tags and readers, are currently the largest revenue-generating segment.

MEA Healthcare Investment Fuels RTLS

The Middle East and Africa region is witnessing robust growth in the RTLS in healthcare market, largely due to major government initiatives and substantial investments in modernizing healthcare infrastructure. The demand for systems that improve patient experience and operational transparency is accelerating the adoption of RTLS solutions for various applications.

GCC countries are at the forefront of this regional expansion, with Saudi Arabia and the UAE leading due to ambitious digital transformation agendas. New government regulations mandate RTLS adoption for asset tracking and patient safety in hospitals, ensuring standardized practices and enhancing overall quality of care.

| Companies | Headquarters | Offerings |

| Siemens Healthineers | Erlangen, Germany | It provides RTLS consulting that helps healthcare organizations design customized RTLS solutions or use existing RTLS implementations. |

| HID Global | Texas, United States | HID’s RTLS provides faster operations, improved health and safety, cost savings, inventory management, and asset protection and utilization. |

| CenTrak | Pennsylvania, United States | CenTrak’s RTLS solutions claim to reduce patient wait times by 50%, increase care time by 50%, and save 90 minutes of daily staff time. |

| Tsingoal | Beijing, China | The UWB RTLS solution delivers 10 cm high accuracy and real-time location tracking, supporting seamless indoor and outdoor operation. |

| Securitas Healthcare | Nebraska, United States | Its RTLS healthcare solutions and systems for hospitals help improve care, reduce costs, and increase efficiency. |

Company Overview: A global leader in providing enterprise-level Automatic Identification and Data Capture (AIDC) solutions, including mobile computers, RFID, and RTLS technologies, to digitize and automate workflows, with a major focus on the healthcare sector.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview: Provides end-to-end solutions that combine hardware, software (Workcloud, Savanna data platform), and services to create real-time visibility and actionable intelligence for optimizing critical workflows.

Business Segments/Divisions:

Geographic Presence: Global operations with a significant footprint across North America, EMEA, Asia-Pacific, and Latin America.

Key Offerings:

End-Use Industries Served: Healthcare, Retail/e-commerce, Manufacturing, Transportation & Logistics, Government.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations: Maintains an extensive, global channel partner ecosystem (VARs, ISVs) for solution integration and deployment.

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals: Products comply with relevant regional and industry standards (e.g., FCC, CE).

Distribution channel strategy: Utilizes a vast global network of channel partners and distributors, supported by a direct sales force for large, strategic enterprise accounts.

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Company Overview: A dedicated healthcare safety and security solutions provider that became part of Securitas AB in 2024. It combines advanced RTLS (from the former CenTrak business) with comprehensive security and patient protection solutions (formerly Stanley Healthcare) to deliver clinical visibility and security.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview: Offers a unified Enterprise Location Services platform for hospitals, providing certainty-based location data for tracking assets, patients (including infant protection), and staff (duress/safety), and automating clinical workflows.

Business Segments/Divisions:

Geographic Presence: Strong presence in North America, with expanding reach into Europe, Australia, and the Middle East, leveraging the Securitas AB global network.

Key Offerings:

End-Use Industries Served: Acute-Care Hospitals, Senior Living Facilities, Clinics, and other specialized healthcare settings.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals: Solutions hold necessary certifications for mission-critical healthcare applications (e.g., UL certified for emergency call systems).

Distribution channel strategy: A combination of a direct sales force with clinical consultants and a network of strategic integrators and partners, all backed by the global scale of Securitas AB services.

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

By Component

By Application

By Facility Type

By Deployment Mode

By End-User

By Distribution Channel

By Region

March 2026

March 2026

February 2026

February 2026