February 2026

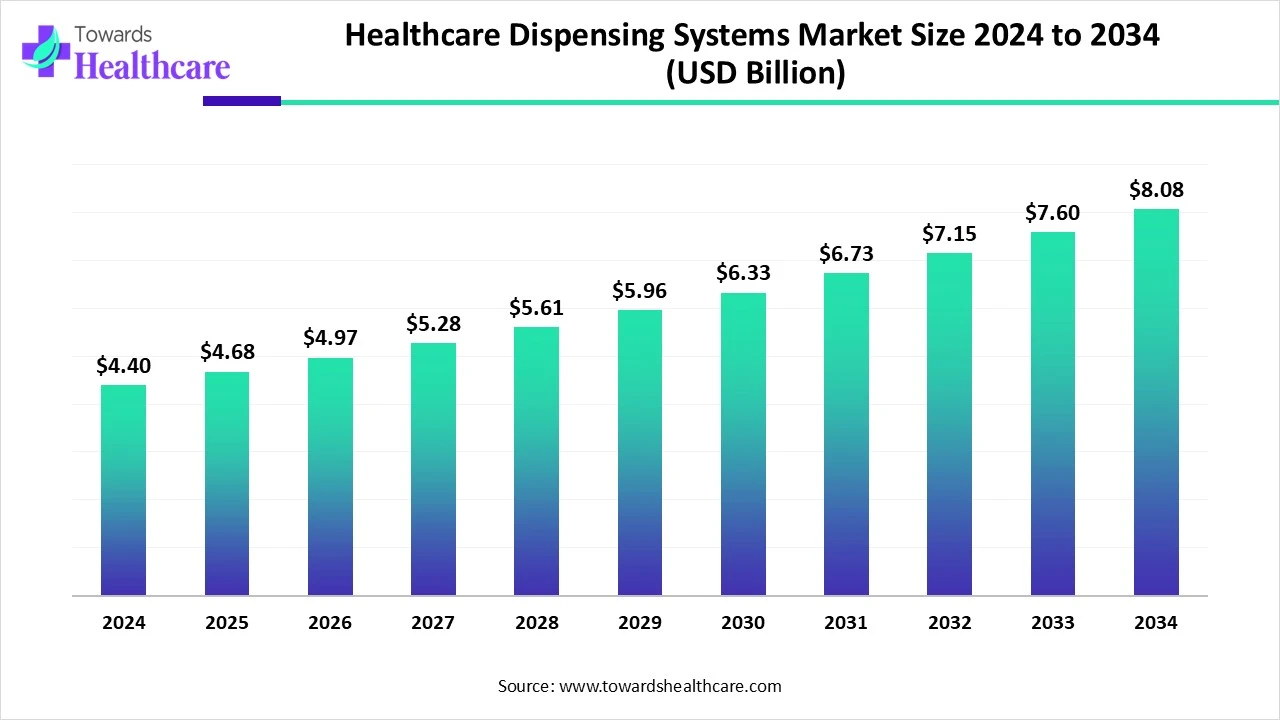

The global healthcare dispensing systems market size is calculated at USD 4.4 billion in 2024, grew to USD 4.68 billion in 2025, and is projected to reach around USD 8.08 billion by 2034. The market is expanding at a CAGR of 6.26% between 2025 and 2034.

The healthcare dispensing systems market is witnessing steady growth, driven by the increasing need for accurate, efficient, and secure medication management in hospitals, pharmacies, and clinics. Rising prevalence of chronic diseases, aging populations, and heightened focus on patient safety are fueling adoption. Technological advancements, including automated dispensing cabinets, barcode verification, and RFID-based systems, are enhancing accuracy, reducing errors, and optimizing inventory control. Stringent regulatory requirements for medication tracking and the integration of dispensing systems with digital healthcare infrastructure further support market expansion. Additionally, growing efforts to reduce healthcare costs and wastage are encouraging healthcare facilities to adopt advanced dispensing solutions.

| Table | Scope |

| Market Size in 2025 | USD 4.68 Billion |

| Projected Market Size in 2034 | USD 8.08 Billion |

| CAGR (2025 - 2034) | 6.26% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By End-User Setting, By Delivery Mode / Deployment, By Application, By Distribution Channel, By Region |

| Top Key Players | Omnicell, BD (Becton Dickinson – Medication Management Solutions, BD Rowa), McKesson (Automated Dispensing Solutions), Swisslog Healthcare, ARxIUM (Kirby Lester lineage), Parata Systems, ScriptPro, Capsa Healthcare (Capsa Solutions, Accu-Chart), Willach (Getinge Group), Getinge (PillPick), Liberty Drug Automation (AmerisourceBergen), PharmASSIST (Cerner), Talyst (Omnicell subsidiary), Baker (CPEC compounding systems), Baxter Medication Management Solutions, ProScript (Talyst heritage), Rowa (BD Rowa), CareFusion (BD legacy), Yuyama, Innovation Associates |

Healthcare dispensing systems are specialized devices or automated solutions used in hospitals, pharmacies, and clinics to store, manage, and dispense medications and medical supplies with accuracy and efficiency. These systems are designed to ensure the right patient receives the correct medication in the right dosage at the right time, thereby minimizing errors and enhancing patient safety. They often integrate with hospital information systems (HIS) and electronic medical records (EMR) to streamline workflows, track inventory, and maintain compliance with regulatory standards. Examples include automated dispensing cabinets, pill counters, and unit-dose packaging machines. By improving medication management, reducing wastage, and saving time for healthcare staff, dispensing systems play a vital role in optimizing operational efficiency and the overall quality of patient care.

Telepharmacy is enabling dispensing in facilities without on-site pharmacists, such as long-term care centers or universities, through automated systems controlled remotely and linked via video consultations.

In August 2025, Capsa Healthcare, a healthcare workflow and supply management solutions company, revealed that it had acquired BlueBin, a reputable pioneer in supply chain systems based on Kanban and predictive analytics for medical purposes. With this calculated action, two complementary capabilities are combined that improve dependability, efficiency, and visibility all the way through the clinical supply chain.

Hospitals are adopting autonomous pharmacy frameworks integrating robotics, barcoding, and data systems to automate medication dispensing, inventory, and packaging. Institutions like Stanford Health Care and Texas Children’s Hospital are leading the charge.

Next-generation machines like JVM’s MENITH use robotic arms to auto-exchange canisters and dispense up to 120 pouches per minute, double the speed of traditional models. The robot "Zing" (also nicknamed Bodhi) automates the preparation, pouring, labeling, sealing, and capping of methadone doses at opioid treatment clinics. This innovation has freed nurses from repetitive tasks, allowing them more patient interaction time. Over 1 million doses have already been prepared by 2025.

New research is optimizing system layouts and drug retrieval sequencing in automated dispensing environments, demonstrating that certain designs (e.g., dual input/output points) significantly increase prescription fulfillment efficiency.

AI integration can significantly enhance the healthcare dispensing systems industry by improving accuracy, efficiency, and patient safety. Artificial intelligence can analyze prescription data, patient histories, and drug interaction information to ensure correct medication dispensing and prevent errors. In inventory management, AI can forecast demand, track stock levels in real time, and automate reordering, reducing shortages and wastage. Machine learning algorithms can optimize dispensing workflows, minimizing wait times and improving operational efficiency in pharmacies and hospitals.

AI-enabled systems also support telepharmacy services, allowing remote prescription verification and patient counseling. Additionally, AI can help detect unusual patterns or misuse of medications, strengthening compliance and security. By integrating AI with robotics, barcoding, and IoT devices, healthcare facilities can achieve greater automation, free up staff for patient-focused care, and deliver faster, safer, and more reliable medication services, ultimately improving treatment outcomes and reducing healthcare costs.

Rising Prevalence of Chronic Diseases and Aging Population

The growing number of patients with long-term conditions like diabetes, cancer, and cardiovascular diseases increases the need for continuous and error-free medication dispensing. Aging populations further amplify demand for efficient, automated solutions to manage complex prescriptions.

Limited Adoption in Low-Resource Settings & Integration Challenges with Existing Systems

These systems often require specialized technical knowledge to operate and maintain. Lack of skilled staff or resistance to learning new technology can hinder effective implementation. Linking dispensing systems to existing hospital information systems (HIS) or electronic medical records (EMR) can be complicated and costly, especially in facilities with outdated digital infrastructure.

Stringent Regulatory Requirements for Medication Safety and Tracking

Governments and healthcare authorities enforce strict standards for drug tracking, storage, and dispensing to ensure patient safety. Automated dispensing systems help institutions comply with these rules by maintaining detailed records and ensuring traceability.

The automated medication dispensing cabinets segment dominated the healthcare dispensing systems market due to its ability to enhance medication safety, improve inventory management, and streamline workflow in healthcare settings. These cabinets reduce medication errors by securely storing drugs and allowing controlled access, which boosts patient safety. Their integration with electronic health records (EHR) and pharmacy systems enables real-time tracking and efficient replenishment. Additionally, AMDCs support regulatory compliance and reduce drug theft or diversion risks. Hospitals and clinics increasingly adopt these systems to optimize operational efficiency, reduce labor costs, and ensure timely medication administration, driving their dominance in the market.

The automated intravenous admixture/compounding systems segment is the fastest-growing in the healthcare dispensing systems market due to increasing demand for precision, safety, and efficiency in preparing IV medications. These systems minimize human errors by automating the complex compounding process, which is critical for chemotherapy, nutrition, and other specialized treatments. Growing patient safety concerns and stringent regulatory requirements are pushing healthcare providers to adopt automated compounding to ensure accurate dosages and sterility. Additionally, rising incidences of chronic diseases and cancer drive the need for personalized IV therapies, further fueling market growth. The integration of these systems with hospital information technology improves workflow efficiency and reduces contamination risks, making automated IV compounding an essential investment for modern healthcare facilities.

The hospitals & health systems segment dominates the healthcare dispensing systems market due to their large-scale medication management needs and focus on patient safety. These facilities require efficient, accurate dispensing solutions to handle high patient volumes and complex medication regimens. Hospitals prioritize reducing medication errors, ensuring compliance with regulations, and optimizing inventory control, all of which drive adoption of advanced dispensing systems. Additionally, increasing investments in healthcare infrastructure and the integration of technology in patient care further boost demand. The need to improve workflow efficiency and reduce labor costs also makes hospitals and health systems the primary end-users, reinforcing their dominant position in the market.

The long-term care/assisted living facilities segment is the fastest-growing end-user in the healthcare dispensing systems market due to the rising elderly population requiring continuous medication management. These facilities face challenges such as complex medication schedules and the need to prevent errors, making automated dispensing systems essential for improving safety and efficiency. Growing awareness of patient safety, coupled with regulatory pressures to ensure proper medication administration, drives adoption. Additionally, these facilities aim to streamline operations and reduce staff workload through technology integration. Increasing investments in senior care infrastructure and the demand for enhanced quality of care further accelerate the growth of this segment.

The fixed-location systems segment dominates the market due to its reliability, security, and ability to serve high-traffic healthcare environments efficiently. These systems are typically installed in specific areas such as nursing stations or pharmacies, providing centralized medication storage and controlled access. Their fixed placement allows seamless integration with hospital workflows and electronic health records, enhancing accuracy and accountability. Additionally, fixed location systems support large medication inventories and help reduce errors and theft. Their widespread adoption in hospitals and clinics, where consistent and immediate access to medications is critical, reinforces their dominant position in the market’s delivery mode segment.

The cloud-connected/network systems segment is the fastest-growing delivery mode in the healthcare dispensing systems market due to its ability to offer real-time data access, remote monitoring, and enhanced scalability. These systems enable seamless integration across multiple healthcare facilities, improving coordination and inventory management. The growing emphasis on digital transformation and telehealth accelerates adoption, as cloud connectivity supports data-driven decision-making and regulatory compliance. Additionally, cloud systems reduce IT infrastructure costs and enable timely software updates, increasing operational efficiency. The flexibility and enhanced security features of cloud-connected systems make them increasingly attractive to healthcare providers seeking innovative, scalable medication dispensing solutions.

The inpatient medication dispensing segment dominates the market due to the critical need for precise, timely, and secure medication delivery within hospital settings. Inpatients often require complex, high-risk drug regimens that demand strict control to prevent errors and adverse events. Hospitals prioritize inpatient dispensing systems to improve patient safety, streamline workflows, and comply with stringent regulatory standards. The large volume of medications administered in inpatient care, coupled with the need for real-time tracking and inventory management, drives widespread adoption. Additionally, increasing hospital admissions and advances in healthcare infrastructure further reinforce the dominance of this segment.

The IV admixture/compounding segment is the fastest-growing application in the healthcare dispensing systems market due to rising demand for precise and sterile preparation of complex intravenous medications. Increasing cases of chronic diseases and cancer necessitate customized IV therapies, driving the need for automated compounding systems that minimize human error and contamination risks. Strict regulatory guidelines on medication safety and quality also propel adoption. Additionally, advancements in technology enable efficient workflow integration and accurate dosing, enhancing patient outcomes. Growing awareness of infection control and the need for improved operational efficiency in hospitals and pharmacies further accelerates growth in this segment.

The direct sales segment dominates the market due to its ability to provide personalized service, tailored solutions, and strong customer support. Manufacturers prefer direct sales to maintain close relationships with healthcare providers, ensuring better understanding of client needs and faster response times. This channel allows seamless installation, training, and maintenance services, enhancing customer satisfaction and system performance. Additionally, direct sales help companies gather real-time feedback for product improvements. The complexity and critical nature of healthcare dispensing systems make direct engagement essential, driving healthcare facilities to rely on trusted manufacturers for reliable, end-to-end solutions, thus reinforcing the dominance of the direct sales channel.

The channel partners/system integrators segment is the fastest-growing distribution channel in the healthcare dispensing systems market due to their ability to offer localized expertise, broad market reach, and customized integration services. These partners help manufacturers expand into new regions and healthcare settings by providing installation, training, and technical support tailored to specific client needs. Their strong relationships with end-users and knowledge of regulatory requirements enhance adoption rates. Additionally, system integrators enable seamless interoperability between dispensing systems and hospital IT infrastructure, improving workflow efficiency. The growing complexity of healthcare technologies and demand for turnkey solutions drive rapid growth in this distribution segment.

North America dominates the market due to its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and strong focus on patient safety. The region has a well-established network of hospitals, clinics, and retail pharmacies that readily integrate automated dispensing systems to streamline operations and reduce medication errors. Stringent regulatory requirements from agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada ensure accurate drug tracking, storage, and dispensing, driving demand for compliant systems.

Additionally, the high prevalence of chronic diseases and an aging population create sustained demand for efficient medication management solutions. The presence of leading market players and continuous investment in research and development foster innovation in AI-powered, robotic, and RFID-enabled dispensing systems. Moreover, strong reimbursement structures, digital healthcare adoption, and the shift toward automation to reduce operational costs further reinforce North America’s leadership in the global healthcare dispensing systems market.

The U.S. market is driven by large hospital systems, retail pharmacy chains, and aggressive investment in automation, robotics, and enterprise medication-management software. Recent high-profile moves include Swisslog Healthcare’s partnership with BD to integrate robotic automation with BD’s Pyxis Logistics (announced Dec 2024), which targets enterprise-level inventory and workflow automation across multi-site health systems. Hospitals and health systems continue replacing legacy cabinets with modern solutions (for example, Omnicell deployments in 2025) and piloting fully automated, on-site dispensers (InstyMeds launched at Cape Cod Hospital in May 2025).

Retail pharmacy chains are expanding robotic micro-fulfillment centers (Walgreens is boosting its network in 2024–25) to centralize high-volume dispensing, lower costs, and speed turnaround. These developments reflect a shift from point solutions toward integrated, enterprise automation (robotics + medication-management software + telepharmacy), improving accuracy and throughput but also raising focus on IT integration and workforce re-skilling.

Canada’s market growth is led by hospital and community pharmacy modernization, telepharmacy expansion, and targeted adoption of automation to relieve pharmacist workload and improve adherence. Telepharmacy/remote dispensing programs and antimicrobial stewardship at a distance have been highlighted across Canadian hospital networks in 2024–25, increasing demand for remote-capable dispensing hardware and secure software.

Canadian pharmacies are gaining access to newer automation equipment and software (recent vendor rollouts and product availability), and market studies forecast strong growth in pharmacy automation for Canada through the rest of the decade. Practical drivers include an aging population, pharmacist shortages, centralized fill models in provincial pharmacy chains, and initiatives to integrate dispensing systems with provincial e-health records. The result is steady uptake of automated dispensing cabinets, central-fill robotics, and cloud-enabled inventory solutions focused first on safety and labor optimization rather than full retail centralization seen in the U.S.

The Asia-Pacific region is the fastest-growing market for healthcare dispensing systems due to rapid technological adoption and strong government support for healthcare infrastructure development. Countries like China, India, and Japan are heavily investing in modernizing hospitals and pharmacies, which drives demand for automated medication dispensing solutions. The integration of AI and machine learning into these systems has improved medication accuracy and operational efficiency.

Additionally, the region’s aging population and increasing prevalence of chronic diseases are intensifying the need for reliable, automated medication management. Growing awareness about patient safety and efforts to reduce medication errors further encourage adoption. Together, these factors create a dynamic environment that accelerates the growth of healthcare dispensing systems across the Asia-Pacific.

China is a significant player in the APAC healthcare dispensing systems market, driven by its large population and rapid urbanization. The Chinese government has been investing heavily in healthcare infrastructure, leading to increased adoption of automated dispensing systems in hospitals and pharmacies. Recent developments include partnerships between local healthcare providers and international companies to introduce advanced dispensing technologies. For instance, in 2023, a leading Chinese hospital collaborated with a global automation firm to implement robotic dispensing systems, aiming to reduce medication errors and improve efficiency.

India's healthcare dispensing systems market is expanding due to the growing demand for quality healthcare services and the increasing prevalence of chronic diseases. The Indian government has been promoting digital health initiatives, encouraging the adoption of automated dispensing systems in both urban and rural areas. In 2024, a major Indian pharmacy chain launched a pilot project in collaboration with a technology provider to test AI-powered dispensing systems in select stores, aiming to enhance accuracy and customer satisfaction.

Japan's aging population and advanced technological landscape make it a leader in the adoption of healthcare dispensing systems. Japanese hospitals and pharmacies have been integrating robotic and AI-based dispensing solutions to address the challenges posed by a shrinking workforce. In 2023, a prominent Japanese hospital network implemented a centralized automated dispensing system, significantly reducing medication dispensing time and improving patient safety.

South Korea's healthcare system is characterized by its advanced technological capabilities and high healthcare standards. The country has been integrating automated dispensing systems to enhance medication safety and operational efficiency. In 2024, a South Korean pharmacy chain implemented a robotic dispensing system in collaboration with a technology provider, aiming to improve accuracy and reduce labor costs.

The European healthcare dispensing systems market is experiencing notable growth, driven by several key factors. The aging population across Europe is increasing the demand for efficient medication management solutions. Technological advancements in automation and robotics are enhancing the accuracy and efficiency of dispensing systems.

Additionally, stringent regulatory requirements are pushing healthcare providers to adopt systems that ensure compliance and reduce errors. Recent developments include the implementation of automated dispensing systems in hospitals and pharmacies to streamline operations and improve patient safety. For instance, in 2024, a leading hospital in Germany integrated a robotic dispensing system, resulting in a significant reduction in medication errors and improved workflow efficiency. These factors collectively contribute to the robust growth of the healthcare dispensing systems market in Europe.

Germany leads the European market, driven by its advanced healthcare infrastructure and strong emphasis on patient safety. The country has been integrating automated dispensing systems in hospitals and pharmacies to enhance medication accuracy and efficiency. In 2023, a major German hospital network implemented a robotic dispensing system, resulting in a significant reduction in medication errors and improved workflow efficiency.

France is witnessing a steady adoption of healthcare dispensing systems, particularly in hospital settings. The French government has been promoting digital health initiatives, encouraging the implementation of automated dispensing solutions. In 2024, a leading French hospital introduced an automated medication dispensing system, aiming to streamline operations and enhance patient safety.

The U.K. healthcare system is increasingly adopting automated dispensing systems to address challenges related to medication errors and operational efficiency. National health initiatives and funding have supported the integration of technology in healthcare settings. In 2022, a prominent UK hospital implemented a centralized automated dispensing system, leading to improved medication management and reduced dispensing errors.

In July 2025, Michael Palone, VP of Product Management for Swisslog Healthcare, announced that the company had released the PillPick Octave. It helps Swisslog Healthcare customers ‘scale up efficiencies. "PillPick Octave represents Swiss Healthcare’s ongoing dedication to innovation in pharmacy automation, ensuring healthcare providers can focus more on patient care.

By Product Type

By End-User Setting

By Delivery Mode / Deployment

By Application

By Distribution Channel

By Region

February 2026

February 2026

January 2026

December 2025