January 2026

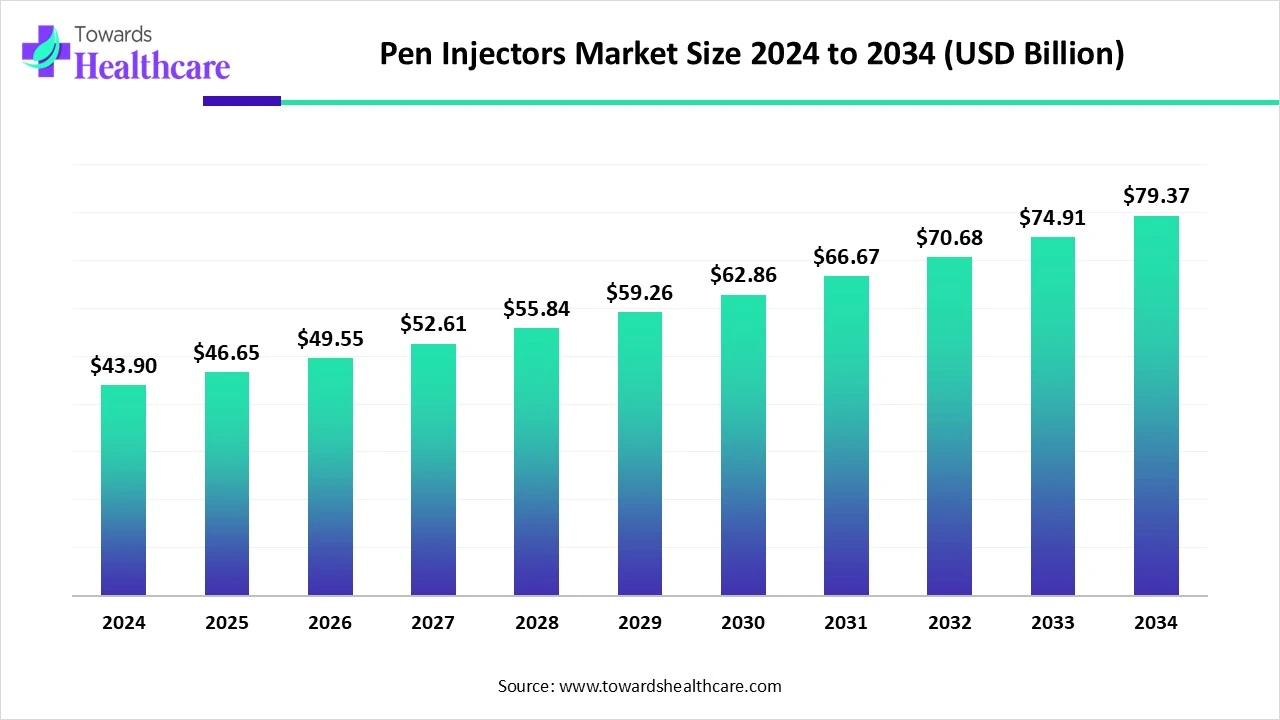

The global pen injectors market size is calculated at US$ 43.9 billion in 2024, grew to US$ 46.65 billion in 2025, and is projected to reach around US$ 79.37 billion by 2034. The market is expanding at a CAGR of 6.34% between 2025 and 2034.

Chronic diseases requiring regular dose are best suited for injector pens. The growing popularity of creative reusable injection pens and the rising need for automated injection pens are further factors propelling the market. Because automated injection pens are safe, easy, convenient, and accurate, more and more medical professionals are using them to give medication. Globally, the number of diabetes patients is increasing, and their severity has made insulin injections necessary. Innovations in technology are transforming the injection pen sector. Features that improve patient adherence and convenience include dosage memory, variable dosing, and ergonomic designs.

| Table | Scope |

| Market Size in 2025 | USD 46.65 Billion |

| Projected Market Size in 2034 | USD 79.37 Billion |

| CAGR (2025 - 2034) | 6.34% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Drug Class/Indication, By Technology/Mechanism, By End User/Setting, By Value Pool/Revenue Stream, By Region |

| Top Key Players | Novo Nordisk, Sanof, Eli Lilly, Becton, Dickinson & Co. (BD), Ypsomed, Owen Mumford, SHL Medical, Haselmeier, Nemera, West Pharmaceutical Services, Gerresheimer, Stevanato Group, Nipro, Aptar Pharma, Sensile Medical, Enable Injections, Credence MedSystems, Antares Pharma, Vetter, Catalent, Recipharm |

The pen injectors market encompasses mechanical and electromechanical devices used to deliver predetermined doses of liquid medications (typically in cartridges or prefilled syringes) via subcutaneous injection. Pen injectors include disposable prefilled pens, reusable (reloadable) pens, and electromechanical/connected smart pens that add dose reminders, logging, and connectivity. Major clinical uses are insulin for diabetes and an expanding set of biologics for autoimmune, growth-hormone, fertility, and other chronic diseases. The market is driven by the rising prevalence of chronic diseases (notably diabetes), patient preference for easy self-administration, the growth of high-volume biologics delivered subcutaneously, and demand for adherence-supporting connected devices.

Market Expansion: Key players are expanding their market and are launching their products in various countries. As the cases of diabetes are rising in developing countries, a lot of key players are going to invest or launch products in countries with growing cases of diabetes.

For instance,

Wireless sensing technologies may help patients use injectors and inhaler pens more accurately. The innovative technology combines artificial intelligence (AI) and wireless sensing to control when a patient uses a pen and identify possible mistakes in the patient's administration technique. AI reduces the amount of work patients must do to determine the appropriate dosages at the appropriate times. AI improves progressiveness and self-administration for patients. Additional cybersecurity is introduced by AI autoinjectors. Real-time monitoring, remote clinical trials, individualised medical treatments, and prompt medical interventions are all made possible by AI, which also improves functioning. AI-powered autoinjectors offer more precise medication delivery and individualised care based on each patient's need.

Rising Cases of Diabetes are Driving the Pen Injectors Market

The World Health Organisation (WHO) estimates that by 2025, there will be over 463 million people with diabetes mellitus (DM), and by 2050, the prevalence is expected to rise to 1.31 billion people globally. This will directly affect healthcare costs and the use of hospital supplies to sustain these treatments. An estimated USD 2.1 trillion would be spent on diabetes and its consequences worldwide by 2030, a 61% increase from 2015.

For instance, insulin pens offer clear benefits over vials and syringes, including better adherence, more precise dosage, less injection site discomfort, and increased patient satisfaction. Second-generation insulin pens have been designed with USB or Bluetooth capabilities to allow for tighter medication monitoring as the number of people with diabetes rises globally.

Injectors can Cause Infection

A user runs the danger of infection if they forget to take care of their pen injector. Regular injector sterilisation is required to stop bacteria, viruses, and fungus from developing on the device. The user is at danger of infection if these bacteria are injected with insulin.

Weight-Loss Drugs will Promote the Pen Injectors Market’s Growth

Billions of dollars are being spent by contract pharma makers to establish or expand facilities that fill the injectable pens needed to give treatments in an effort to capitalise on the massive market for weight-loss medications. Analysts predict that the weekly weight-loss injections might be valued at up to $100 billion in ten years, as they are part of a family of medications called GLP-1 agonists.

By product type, the disposable/prefilled pens segment held the largest share of the pen injectors market in 2024. There are a number of tools available to make injectable medicine administration as precise, pleasant, and convenient as possible. Auto injectors, reusable pens, and disposable pen injectors are some of the most often used technologies. There is no need to bother about cleaning or refilling the pen because it is already full. Just insert the needle, dial in the appropriate dosage, and inject.

By product type, the electromechanical/connected smart pens segment is estimated to be the fastest-growing during 2025-2034. The most recent innovations in the pen industry are "connected" pens, which have the ability to send insulin application data to a smartphone app or the cloud. Clinicians will work in a "Digital Diabetes Ecosystem" in the future, which combines the new smart pens to support therapy with constant Internet access, and the Internet of Medical Things, which consists of linked physiological and behavioural sensors embedded within various medical devices worn or used by an individual.

By drug class/indication, the insulin for diabetes segment was dominant in the pen injectors market in 2024. Because smart insulin pens are often more cost-effective, simple to use, and provide several advantages and enhancements for those who rely on insulin to control their diabetes, the market for these devices is expanding quickly. With a smart pen, you may have many of the benefits of an insulin pump without having to pay as much or deal with the discomfort or inconvenience of having a device attached to your body.

By drug class/indication, the biologics for autoimmune/inflammatory diseases segment is estimated to achieve the highest growth during the forecast period. In order to assist manage these chronic conditions, autoinjectors have become an invaluable tool for delivering medication. They offer a workable approach that increases the efficacy of therapies. The necessity for frequent hospital stays is eliminated by these devices, which enable patients to self-administer drugs in the convenience of their homes or while on the road for those who lead active lives.

By technology/mechanism, the purely mechanical spring-driven dosing segment led the pen injectors market in 2024. By twisting the torsion spring, the injector's mechanical power mechanism modifies the dosage while also storing energy. The necessary dosage is automatically administered by pushing the injection push button, and following the injection, the dose is automatically reset to zero.

By technology/mechanism, the electromechanical (motorized) pens segment is anticipated to grow at the highest rate during the predicted timeframe. Electromechanical (motorised) pens are sophisticated injection tools that automate and regulate drug administration using an electric motor. With improved dosage precision, regulated force, and user-friendly features, this technology sets them apart from conventional spring-loaded or manual pen injectors.

By end-user/setting, the patient self-administration/home use segment held the major revenue of the pen injectors market in 2024. With flexible constructed pens and auto-injectors giving patients a sense of independence and more usage flexibility, self-administration of pharmaceuticals is becoming more popular. As self-administration becomes more popular, traditional syringes are being replaced by auto-injectors. In addition to treating allergic responses, auto-injectors are being utilised more and more in other fields where repeated dosages are needed over time, such hormone therapy or the treatment of orphan illnesses in cancer. Patients can give the medication more readily at home rather than scheduling many medical visits over a few weeks to obtain injections.

By end-user/setting, the long-term care & assisted living segment is estimated to witness the fastest CAGR during the upcoming period. Several studies have found that the prevalence of diabetes in the long-term care (LTC) population varies from 25% to 34%. Additionally, paid elder care services are now more accessible due to the proliferation of long-term care insurance products and growing earnings in many regions, which has aided in the expansion of the business. Prescription medications and consulting pharmacist services are provided to hospice, assisted living, and nursing home patients by specialised long-term care pharmacies.

By value pool/revenue stream, the device sales bundles with branded drug segment led the pen injectors market in 2024. In the pen injector market, device sales bundles with branded medications are a dominant factor, propelling growth by combining the medicine with the pen injector device, making it easier for patients to use and boosting compliance for long-term diseases like diabetes. This "bundle" strategy is one of the main factors driving the pen injector industry ahead, along with technology developments and the rise in chronic illness cases.

By value pool/revenue stream, the digital services & connectivity subscriptions segment is anticipated to be the fastest-growing during the forecast period. Usually provided through subscription-based systems, digital services and connectivity for pen injectors aid in the management of long-term illnesses like diabetes or obesity. These services employ "smart" pen injectors to automatically gather data on each injection. The data is then sent via Bluetooth or NFC to a companion app. A vast array of services, including dose-tracking and sophisticated clinical assistance, are accessible through subscriptions.

North America dominated the pen injectors market in 2024. because of a number of important elements, such as a strong healthcare system, a large investment in healthcare innovation, and high patient awareness. The region's high prevalence of long-term conditions including diabetes and growth hormone insufficiency fuels the demand for self-administration devices. Additionally, robust reimbursement rules for emerging medical technology help to advance the use of injectable pens. Furthermore, North America continues to lead the injectable pen market due to the presence of many international pharmaceutical inventors and ongoing advancements in pen technology for improved patient experience and compliance.

With a significant amount of its manufacturing being exported to other nations, the U.S. is one of the world's top exporters of insulin. Out of 5,520 products, insulin in dose was the 555th most exported item from the U.S. in 2024, with $517 million in exports. The U.S.’s top export destinations for insulin dosages in 2024 were Mexico ($275M), Canada ($186M), Denmark ($25.3M), Egypt ($8.99M), and Brazil ($6.7M).

In Canada, diabetes is one of the most prevalent chronic illnesses that afflict people. In Canada, around 3.7 million people, or 9.4% of the total population, have been diagnosed with diabetes. The number of Canadians with diabetes has doubled in the past ten years and is predicted to rise more as the country's population ages and expands. An estimated $27 billion was spent on diabetes in 2018; by 2028, that amount might rise to almost $39 billion.

Asia Pacific is estimated to host the fastest-growing pen injectors market during the forecast period. due to the growing burden of chronic illnesses, the growing number of elderly people, and the rising spending in healthcare. Due to an increase in the prevalence of diabetes and other chronic illnesses, warmer nations like China, India, and Japan are also witnessing a surge in injection pen use. Furthermore contributing to the market's overall expansion are the development of healthcare infrastructure in this region of the developing globe and the introduction of highly skilled medical technology for treatment in emerging nations.

The phases involved in pen injector research and development (R&D) include concept conception, prototype construction, and market research. The next step is detailed design, which includes usability engineering and material selection. Thorough testing for performance, safety, and accuracy comes next, and then process validation and regulatory filing.

Companies: Becton Dickinson (BD), Novo Nordisk, Ypsomed, and Owen Mumford, alongside device manufacturers such as Nemera and Gerresheimer.

A stable and sanitary medication formulation is placed inside a pen injector. Attaching a fresh, sterile needle to the device's reservoir and giving it a "prime shot" to eliminate any air is the last step in the dose preparation process. Before injecting, the user dials the precise dosage.

Companies: Becton Dickinson (BD), Novo Nordisk, Ypsomed, and Owen Mumford, alongside device manufacturers such as Nemera and Gerresheimer.

Digital platforms that provide training and support, dedicated phone lines for enquiries, financial assistance programmes, and instructional papers on how to use and store the device are all examples of patient support services for pen injectors.

Companies: Novo Nordisk, Eli Lilly, and Pfizer

In August 2025, at Trividia Health, our top goal is to provide a variety of solutions easily accessible so that people may successfully manage their diabetes. According to Jonathan Chapman, President and CEO of Trividia Health, the TRUEplus 5-Bevel Pen Needles' registration as a product in the UK gives medical professionals the opportunity to provide patients affordable, high-quality pen needles to help control their diabetes.

By Product Type

By Drug Class/Indication

By Technology/Mechanism

By End User/Setting

By Value Pool/Revenue Stream

By Region

January 2026

January 2026

January 2026

January 2026