December 2025

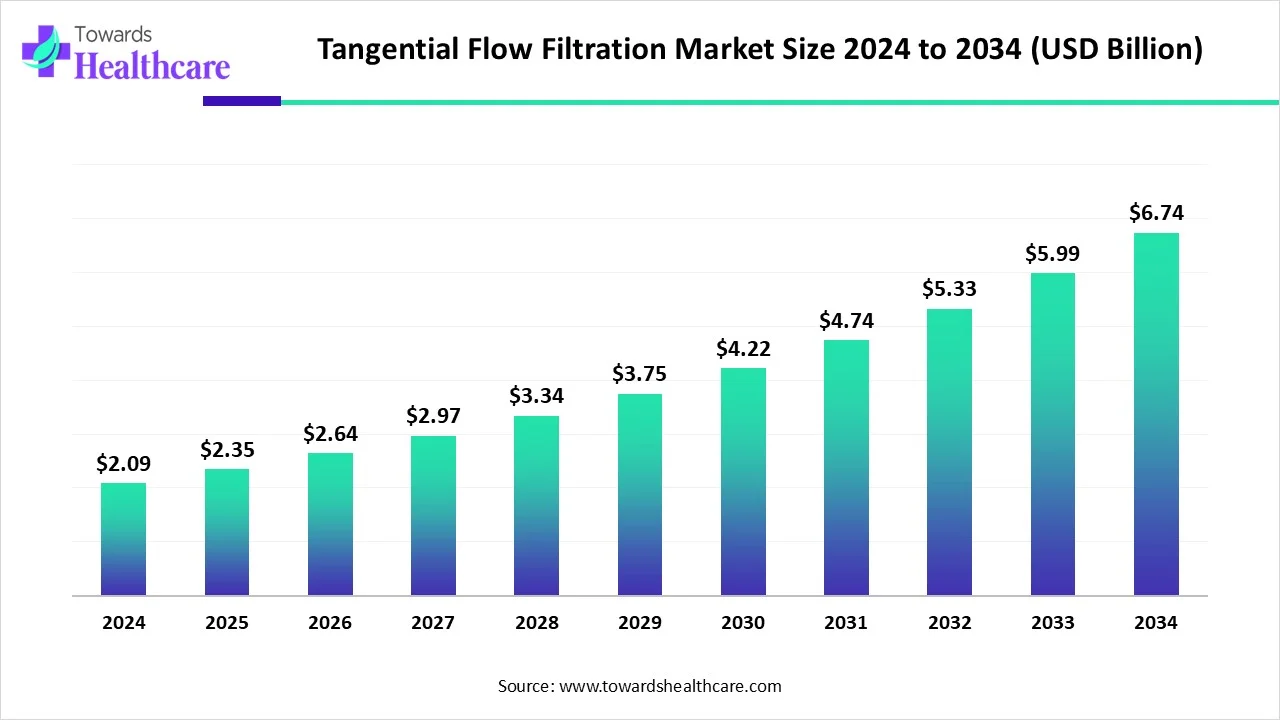

The global tangential flow filtration market size is calculated at USD 2.35 in 2025, grew to USD 2.64 billion in 2026, and is projected to reach around USD 7.59 billion by 2035. The market is expanding at a CAGR of 12.44% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 2.35 Billion |

| Projected Market Size in 2035 | USD 7.59 Billion |

| CAGR (2026 - 2035) | 12.44% |

| Leading Region | North America share by 42% |

| Market Segmentation | By Product, By Technology, By Application, By End-use, By Region |

| Top Key Players | Danaher Corporation, Sartorius AG, Parker-Hannifin Corporation, Alfa Laval AG, Merck KGaA, Repligen Corporation, FUJIFILM Wako Pure Chemical Corporation, Synder Filtration, Inc., Meissner Filtration Products, Inc., ABEC, Inc., Sterlitech Corporation |

Tangential flow filtration (TFF), also termed as cross-flow filtration, is one of the separation techniques, where liquid runs parallel to the surface of the membrane, instead of perpendicular to it as in conventional dead-end filtration. The tangential flow filtration market is fueled by the accelerating demand for biopharmaceuticals, growing chronic disease instances, and rising focus on reliable medicine. It is applied in various life science sectors, along with food and beverage companies, biopharmaceutical companies, also in cell harvesting, biomolecule purification, and the production of vaccines and monoclonal antibodies. It has a future extent in raised demand for biologics, single-use bioprocessing technologies, and technological advancements.

AI plays a vital role in tangential flow filtration as it can keep consistent monitoring of fundamental parameters such as pressure, flow rate, and transmembrane pressure, which enables automated adaptation and optimization. Over this, TFF can enhance system efficiency and minimize errors in bioproduction by managing the system process. Also, AI algorithms allow analysis of historical data to anticipate equipment breakdown and plan maintenance provident, reducing interruptions.

Elevating Demand for Biopharmaceuticals and Biologics

In the tangential flow filtration market, growth is driven by rising demand for biopharmaceuticals and biologics, technological advancements for membranes, and the need for high-throughput processing. It has a significant role in the pharmaceutical and biotechnology companies, employed in the separation and purification of biomolecules, including proteins, nucleic acids, and viruses, in which it provides prevention of blockage and highly effective separation.

Raised Capital Expenditure and Operational Difficulties

For the tangential flow filtration market, a growing challenge is the boosted capital investments needed for TFF systems, and regarding infrastructure can be major, which discourages small-scale and emerging industries and those having insufficient financial resources. Along with this, this system demands specialized knowledge and skilled personnel for operation, optimization, and troubleshooting.

Growing Acquisition of Single-Use Technologies and Tissue Engineering

The tangential flow filtration systems have a wide range of opportunities, such as single-use technology and tissue engineering. Single-use technologies foster rapid product changeovers, decreased system composition time, and ultimately minimize the production expenses. Applications of these technologies are for a one-time use and then dumped, reducing cleaning, sterilization, and validation necessities. Also, it raises flexibility and lowers the risk of cross-contamination. TFF system in tissue engineering is utilized for concentrating, purifying, and extracting biomolecules, including proteins and peptides, from cell culture supernatants or other biological fluids.

By product, the single-use tangential flow filtration (TFF) systems segment dominated the market by capturing the largest revenue share in 2024. This segment has several advantages, are minimization of cross-contamination, operational spending, and proposing flexibility. The tangential flow filtration market is impacted by rising preferences of this segment in biopharmaceutical production in the purification of proteins and virus filtrations, particularly as personalized medicine and biologics gain eminence.

By product, the filtration accessories segment is expected to grow fastest during the forecast period. Basically, pumps, pressure gauges, and cleaning solutions are used in TFF systems to ensure ideal performance and allow the uncomplicated integration of TFF systems. They are certainly vital in bioprocess applications, where they enhance reliable and effective protein purification, achieving high-throughput and rapid filtration frequencies.

By technology, the ultrafiltration technology segment held the largest revenue share in 2024. Ultrafiltration is a water treatment process that utilizes a semi-permeable membrane to exclude impurities from water. This segment's growth is propelled by broad applications in purification, separation, and concentration in bioprocessing and other uses like protein purification, viral clearance, etc, which fuel the growth of the tangential flow filtration market.

For instance,

By technology, the microfiltration technology segment is expected to grow at the fastest CAGR in the projected timeframe. This technique has a crucial role in the separation of suspended solids and microorganisms from solutions. As it has numerous advantages like minimizing faster clogging of the membrane, possessing lower pressures than other TFF techniques, it is employed in biopharmaceutical, food and beverage companies, water treatment, and oil-water separation.

By application, the raw material filtration segment dominated the market in 2024, with the largest revenue share. In the tangential flow filtration market, this segment plays a significant role in the purification and concentration of raw materials in the biopharmaceutical and pharmaceutical companies, especially in approaches including protein purification, antibody purification, and raw material filtration. It is also propelled by its use in the filtration of raw materials like cell lysates, tissue homogenates, and culture media, resulting in clarified liquid comprising the target biomolecules.

By application, the antibody purification applications segment is expected to grow at the fastest CAGR during the forecast period. This is one of the significant factors that fuels the overall growth of the tangential flow filtration market, by accelerating demand for monoclonal antibodies and the need for efficient large-scale production. Moreover, it is used in protein purification, virus and vector processing, and antibody purification itself in biopharmaceutical industries.

By end-use, the pharmaceutical and biotechnology companies segment led the market in 2024. Increasing demand for vaccine and viral vectors manufacturing, along with rising protein purification from cell culture and else biological sources, is boosting the extraction of therapeutic proteins for novel drug development, which is impacting the growth of the market. Although growing filtration of raw materials and feedstocks in bioprocessing, securing the quality and purity of downstream approaches in the pharmaceutical and biotechnology companies.

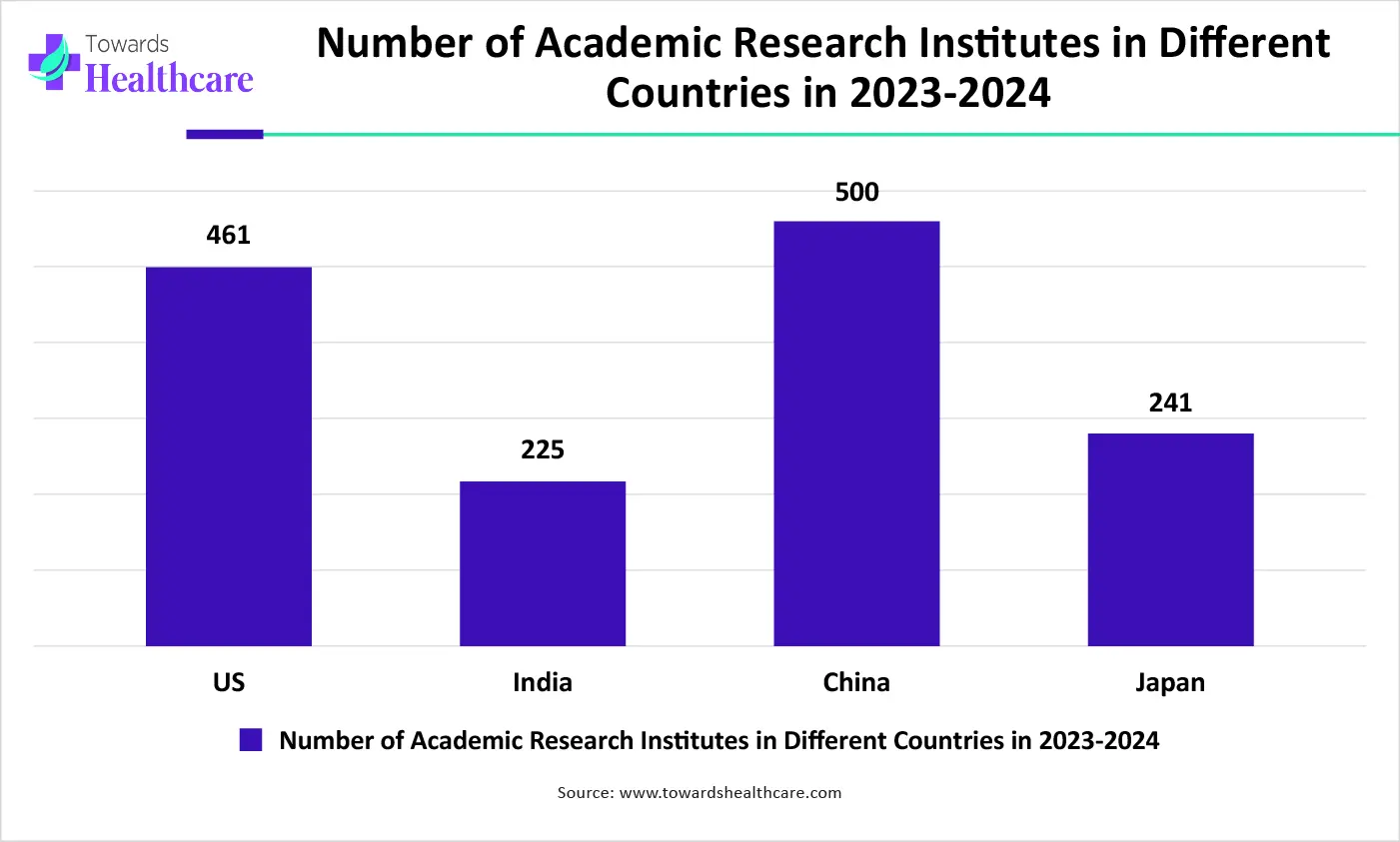

By end-use, the academic institutes and research laboratories segment is expected to grow at the fastest CAGR over the projected period. The academic institutes and research laboratories are introducing TFF systems in different bioprocessing and purification applications. Including separation and purification of biomolecules from complex mixtures, like cell lysates and fermentation broths, as well as enhancing the concentration of dilute biomolecule solutions, preparing them satisfactorily for downstream applications such as analysis and ahead processing.

In the projected period, academic institutes are expected to grow at the fastest CAGR in the tangential flow filtration market. AS they are introducing TFF systems in numerous bioprocessing and purification applications in research laboratories. Including separation and purification of biomolecules from complex mixtures, as well as increasing the concentration of biomolecule solutions.

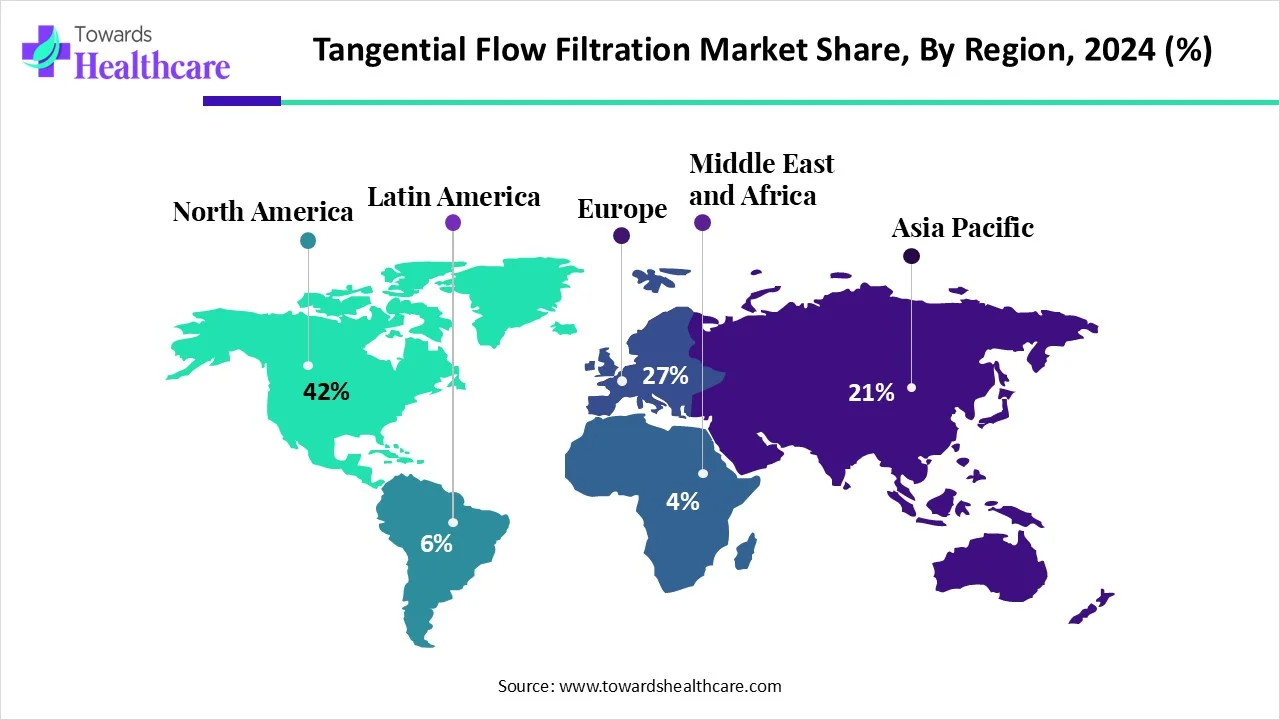

North America held the largest revenue share of the market share by 42% in 2024. The tangential flow filtration market is driven by a robust biopharmaceutical industry and major investments in research and development. In the biopharmaceutical sector, TFF is highly assisting in many downstream processing applications. Along with this, rising investments in R&D, especially in personalized medicine and biosimilars, are demanding advanced filtration techniques such as TFF.

For instance,

In the U.S., the market growth is fueled by the growing acquisition of single-use TFF systems, which enable the reduction of cross-contamination, increased flexibility, and rapid process times, resulting in transfer in biopharmaceutical production. Besides this, elevating consistent advancements in membrane technologies and bioprocessing filtration are anticipated prospective growth of the TFF market.

For instance,

In Canada, the accelerating growth in the biopharmaceutical sector is driven by the use of TFF systems for purification, concentration, and other critical steps in the production of complex biologics such as monoclonal antibodies, vaccines, and therapeutic proteins. Also, the growing investment in research and development, allied with technological advancements, is propelling demand for novel TFF solutions.

Asia Pacific is expected to grow at the fastest CAGR region in the upcoming years. In the Asia Pacific, the development of the biopharmaceutical industries, especially in countries including China, is a crucial driver. So, the raise demand for biopharmaceuticals, like biosimilars, propels the need for robust filtration and purification processes, resulting in TFF as a significant technology. Also, the encouraging government policies, innovation in bioprocessing, and infrastructure investments in healthcare and biotechnology are generating an adaptable environment for the acquisition of advanced filtration technologies like TFF.

In China, the bioprocessing industries are facing faster growth, resulting in enhanced demand for advanced filtration technologies like TFF. This growth is propelled by the growing need for biopharmaceuticals, like monoclonal antibodies, vaccines, and other biologics. Furthermore, China is majorly investing in life sciences and biopharmaceuticals to achieve domestic and global healthcare needs.

In Japan, the market growth is influenced by consistent novel creations in TFF systems, including new membrane materials and optimized process effectiveness. Other than this, accelerating demand for manufacturing of biologics and biosimilars requires strong and precise filtration approaches, and firm regulatory considerations in the pharmaceutical and biotechnology sectors, which motivates a validated and accurate TFF system.

Europe is expected to grow significantly in the upcoming years. The market growth is driven by the growing investments in bioprocessing from chief local and international companies are boosting the production of abilities, especially in biologics. Also, in Europe, a greater number of collaborations between academic institutions and industry leaders for research initiation are encouraging advancement in TFF technology and applications.

Germany has played its major role in innovations in membrane creation, and materials are increasing product output and efficiency, which is making TFF alluring for bioprocessing. These advancements provide efficient separation of targeted molecules and decrease the risk of filter blockage. As well as the escalating demand for biopharmaceuticals, such as biosimilars and biologics, is acting as a significant driver for the market growth.

For instance,

In the UK, raised regulatory considerations assist in developing high-quality standards in drug development, which require robust filtration solutions. Also, the rising investments from domestic and global companies in manufacturing capabilities in biologics are enhancing demand for TFF systems.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The rapidly expanding biotech sector, increasing investments and collaborations, and the presence of key players foster market growth. Government organizations launch initiatives and provide funding to support the indigenous manufacturing of biopharmaceutical products. The rising adoption of advanced technologies and stringent regulatory policies for contamination-free healthcare products contribute to market growth.

Mubadala Investment Company and Resilience have recently built Abu Dhabi’s first biopharmaceutical manufacturing facilities. In June 2025, the Department of Health – Abu Dhabi collaborated with multiple key players to accelerate global vaccine manufacturing. This will advance clinical research and development planning, optimize resource allocation, and establish terms for funding and access.

By Product

By Technology

By Application

By End-use

By Region

December 2025

November 2025

January 2026

November 2025