February 2026

The liquid filtration for pharmaceutical market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

Across the globe, a rise in the burden of chronic diseases, like cancer and diabetes, is driving major demand for novel and advanced therapies, including biologics are fueling widespread adoption of advanced filtration systems to boost overall product quality and purity. Moreover, the global liquid filtration for pharmaceutical market is experiencing significant expansion with a rising focus on advancements in novel filter media, filter materials. Also, the liquid filtration systems are increasingly employed for sterile filtration, clarification, and biopharmaceutical purification processes in numerous pharmaceutical industries.

The liquid filtration for pharmaceutical market refers to the market for technologies and solutions used to separate solid impurities or microorganisms from liquid pharmaceutical products or intermediates during manufacturing processes. This filtration ensures purity, sterility, and compliance with regulatory standards, enabling the production of safe and effective pharmaceutical drugs. The filtration techniques include membrane filtration, depth filtration, and others, which are used in applications such as sterile filtration, clarification, and biopharmaceutical purification.

Due to the emerging greater demand for high-purity pharmaceuticals, the a need for more efficient and affordable manufacturing, and the potential of AI to simplify different stages of the filtration process, from material selection to real-time monitoring and control. Moreover, the adoption of AI algorithms assists in the analysis of large volumes of data sets of material characteristics and filtration performance to estimate the robust filter media for specific applications, improving pore size, material type, and other important parameters. In terms of quality control, AI helps in automating visual inspection of filters and filter media, detecting defects, ensuring consistent product quality, reducing the risk of contamination, and enhancing overall product safety.

Rising Emphasis on product Quality and Pharmaceutical Production

The global liquid filtration for pharmaceutical market is driven by expanding pharmaceutical companies with an increased need for liquid filtration approaches to purify liquids like water, buffers, and solvents used in drug production, ultimately accelerating the comprehensive product quality and safety. Besides this, various major regulatory bodies around the globe are imposing stringent guidelines on pharmaceutical manufacturing processes, especially related to purity and sterility, which necessitates advanced filtration technologies.

Escalating Spending and the Need for Trained Personnel

The contribution of advanced technologies, such as membrane filtration in numerous pharmaceutical filtration systems, is creating a major barrier for initial investment in different small-scale pharmaceutical industries and research institutions. Moreover, the global liquid filtration for pharmaceutical market is facing another hindrance, which is a greater need for specialized expertise and training for operating and maintaining these advanced approaches.

Technological Prospective Breakthroughs in Diverse Filtration Systems

In the coming era, diverse opportunities will arise in the global liquid filtration for pharmaceutical market, including immense advances in filtration technologies, such as in membrane filtration, single-use systems, and virus filtration. Moreover, the market is emphasizing aseptic processing in robust pharmaceutical manufacturing, which is evolving demand for sterilizing filtration and other technologies that prevent contamination. Also, currently, the growing major demand for precision medicine based on customizing treatments to individual patients is also creating another opportunity for the heavy use of these advanced filtration technologies for highly pure and safe product development.

In 2024, the membrane filtration segment was dominant in the market, due to accelerating instances of chronic diseases, like cancer and diabetes, which are fueling demand for novel therapies, particularly various biologics, which further boost the wider need for membrane filtration in their manufacturing. Also, expansion of the biopharmaceutical sector, comprising the production of biologics and biosimilars, depends increasingly on membrane filtration for purification and sterilization.

On the other hand, the ultrafiltration segment is estimated to grow rapidly because of a rise in demand for high-purity liquids. Moreover, the segment will expand due to growing demand for clean water, and the development of advanced UF membrane technologies is further contributing to its adoption. As well as consistent innovations in UF membrane materials, including ceramic-based membranes, are escalating their performance, durability, and resistance to fouling. This leads to the development of highly effective and affordable UF technology in the market with varied applications in the pharmaceutical industry.

The polyethersulfone (PES) segment dominated the global liquid filtration for pharmaceutical market in 2024. The contribution of several advantages of this media, such as it possesses low protein binding, which is vital for cell culture media filtration and blood product processing, reducing product loss and increasing yield. Along with this, it has high throughput and flow rates, with broad resistance to thermal degradation, and it can withstand different chemicals, making it suitable for widespread pharmaceutical uses.

Whereas, the polyvinylidene fluoride (PVDF) segment will expand fastest in the predicted timeframe. This media has versatile properties, which make it ideal for pharmaceutical filtration, including its best resistance to a broader acids, bases, and organic solvents. Also, it has strong and durable characteristics, with less product loss. In these superior properties, it also has inexpensiveness, with diverse applications in general filtration, sample preparation, and bead-based assays, further boosting the market growth.

Mainly, the sterile filtration segment held the dominating revenue share of the liquid filtration for pharmaceutical in 2024. Major factors incorporated in this segment’s expansion are the faster growth of the biopharmaceutical industry, primarily the development of newer biologics, which require reliable and robust sterile filtration processes. Furthermore, enhanced demand for customized medicine and sterile drug formulations is fueling the adoption of this kind of filtration. And, the most important property of this filtration is that it plays a vital role in ensuring the safety, efficacy, and quality of the final pharmaceutical product, adherence to regulatory standards, and patient expectations.

During 2025-2034, the clarification filtration segment is predicted to expand fastest in the market. A combination of factors is impacting the overall growth of this segment, such as enhancing demand for pharmaceuticals or various drugs, in which this kind of filtration is essential in their effective production processes. As well as nowadays, stringent regulations are helping to raise the high purity and quality standards for these products. Besides this, breakthroughs in filtration techniques are driving the development of novel filter material designs with accelerated efficiency and capacity.

In 2024, the pharmaceutical manufacturers segment held the largest share of the global liquid filtration for pharmaceutical market. Around the world, the rising burden of population and cases of chronic conditions is widely fueling demand for pharmaceutical, which needs more effective and high-quality filtration approaches in their production. Along with this, the expansion of the biopharmaceutical area, with an immense focus on biologics and other complex therapeutics, which are greatly dependent on advanced filtration technologies for purification and separation.

Moreover, the contract manufacturing organizations (CMOs) segment will expand fastest, due to the growing outsourcing trend and expansion of biopharma companies. Additionally, the complex pharmaceutical manufacturing requires highly trained expertise and advanced technologies, which are often offered by CMOs. As well as heavy investments in the R&D department by numerous pharmaceutical companies are resulting in a wider need for outsourcing production approaches, especially filtration.

The filter cartridges segment led the liquid filtration for pharmaceutical market in 2024. Currently, the emergence of stricter regulations by the EPA and WHO fuels the adoption of these advanced cartridges to remove contaminants and ensure the overall product purity. Also, this results in enhanced focus on environmental sustainability and water conservation. In addition, novel developments in filter materials, designs, and production processes are boosting the comprehensive performance and effectiveness of these liquid filter cartridges, with increasing demand.

The filter capsules segment is anticipated to register rapid growth in the coming years. This type of equipment has many advantages in various sectors, as it is easy to use and an effective measure for different liquid filtration essentials in pharmaceutical production, like water, buffers, and reagents. Also, it is increasingly employed in numerous stages of drug manufacturing, including prefiltration, clarification, and sterile filtration to discard impurities and ensure product quality. Moreover, its excellent compatibility in different filter housings and also provides ease of installation and replacement, are driving the ultimate segment and market expansion.

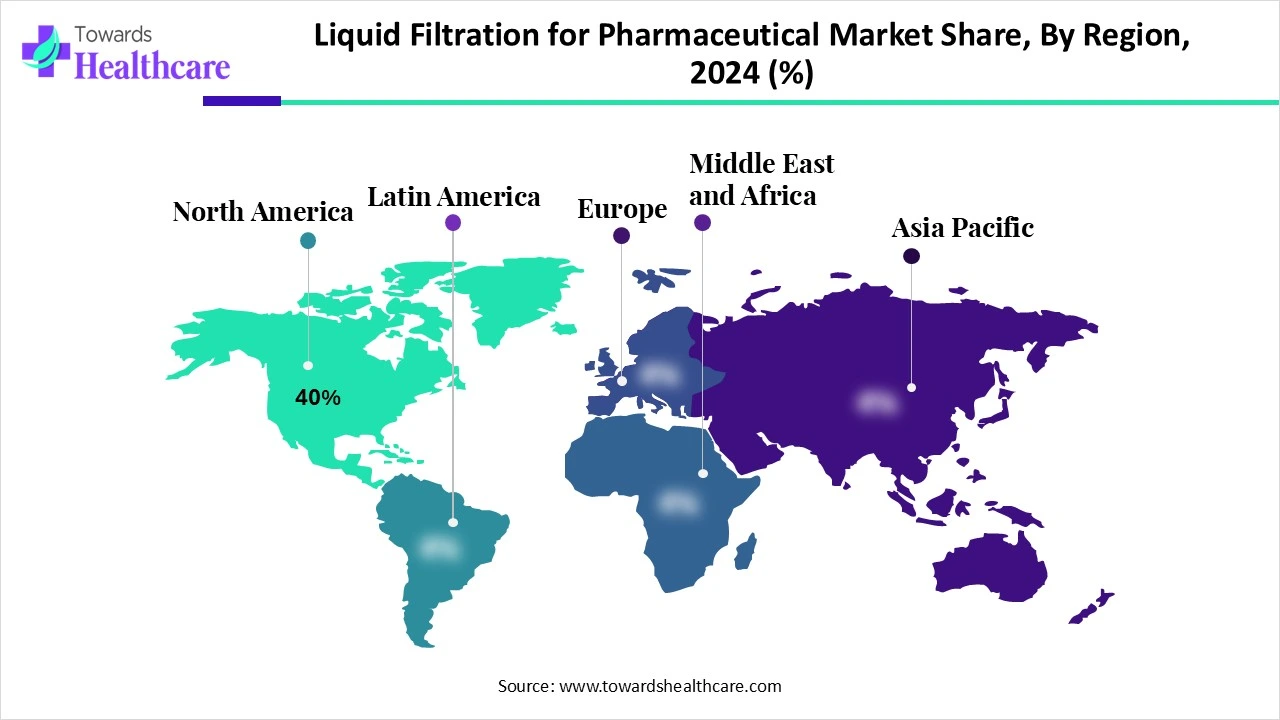

North America led the liquid filtration for pharmaceutical market by capturing a major revenue share by 40% in 2024. The expansion of the pharmaceutical industry, especially in the biologics and biosimilars area, is driving demand for innovative filtration technologies for drug production and quality boosters in this region. Along with this, major innovations in areas such as nanofiber technology and single-use technologies are accelerating the efficiency, scalability, and sustainability of pharmaceutical filtration processes.

Primarily, this country is experiencing crucial growth in the market, due to the participation of regulatory agencies, including the U.S. FDA and the European Union's Water Framework Directive are directly providing stringent rules on water quality and filtration in pharmaceutical manufacturing, pushing for the adoption of advanced filtration technologies.

For instance,

In Canada, rising investment in healthcare infrastructure and research & development is propelling innovation and growth in the pharmaceutical sector, subsequently accelerating the market. Moreover, boosting manufacturing and demand for biologics, vaccines, and gene therapies is acting as a major driver in the overall market expansion.

For this market,

Over the projected period, the Asia Pacific is estimated to be the fastest-growing region in the market. As this region is experiencing a surge in pharmaceutical production to meet the increasing demand for therapeutics, it is fueling the requirement for advanced and efficacious liquid filtration approaches. Ongoing focus on infection control in healthcare systems is resulting in a broad demand for high-quality filtration measures in hospitals and clinics, especially for sterile filtration.

In this region, escalating healthcare expenditure is assisting investments in infrastructure and pharmaceutical production, driving the overall market growth. As well as novel advancements in filtration technologies in this region, like smart filtration systems integrating IoT and AI for real-time monitoring and predictive maintenance, are optimizing effectiveness and minimizing downtime in pharma production.

For instance,

India is another key region, imposing faster industrialization and urbanization, which are fueling the demand for liquid filtration in numerous sectors, including pharmaceuticals. Furthermore, initiatives like the Production Linked Incentive (PLI) scheme and the development of "Pharma Parks" are fostering investments in new pharmaceutical infrastructure, including filtration systems.

For this market,

In the global liquid filtration for pharmaceutical market, Europe is facing a significant expansion, due to rising emphasis on pharmaceutical production, mainly on biologics, biosimilars, and advanced therapies. This expanding demand is driving the adoption of sophisticated filtration technologies to meet product quality and safety. Also, the European regulations, such as the Water Framework Directive and GMP guidelines, are fueling the adoption of advanced liquid filtration systems to meet quality and safety standards. The EU's sustainability goals are assisting market participants towards cleaner and stronger filtration solutions.

Novel developments in filtration technology, like membrane filtration and single-use systems, are supporting in accelerating of efficiency, decreasing expenses, and improving product quality in this region is widely impacting the overall market expansion. Besides this, a major focus on the development of sustainable and biodegradable filter media is influencing the expansion of many pharmaceutical sectors. Also, Germany is greatly adopting single-use systems to boost their product purity and quality.

The UK’s key innovation in microfiltration technique is employed for discarding microorganisms and particles, which is a crucial part in the development of pharmaceutical filtration approaches. Also, the emergence of polymeric filter media, having greater thermal resistance and low water absorption, is widely used and experiencing growth.

For this market,

In March 2025, Sartorius, a leading international partner of life sciences research and the biopharmaceutical industry, announced its ongoing investments in its Bangalore site to further accelerate manufacturing capacity and expand its global supply chain capabilities. Dr Joachim Kreuzburg, Chairman- Executive Board of Sartorius AG and Chairman- Board of Directors of Sartorius Stedim Biotech S.A. at the Bangalore site, commented that their focus is on the application of engineering capability to manufacture and test Resolute Flowdrive Chromatography systems for large-scale biopharmaceutical purification processes. (Source - Biospectrum India)

By Type of Filtration Technology

By Filter Media Type

By Application

By End-User

By Filtration Equipment Type

By Region

February 2026

January 2026

January 2026

January 2026