February 2026

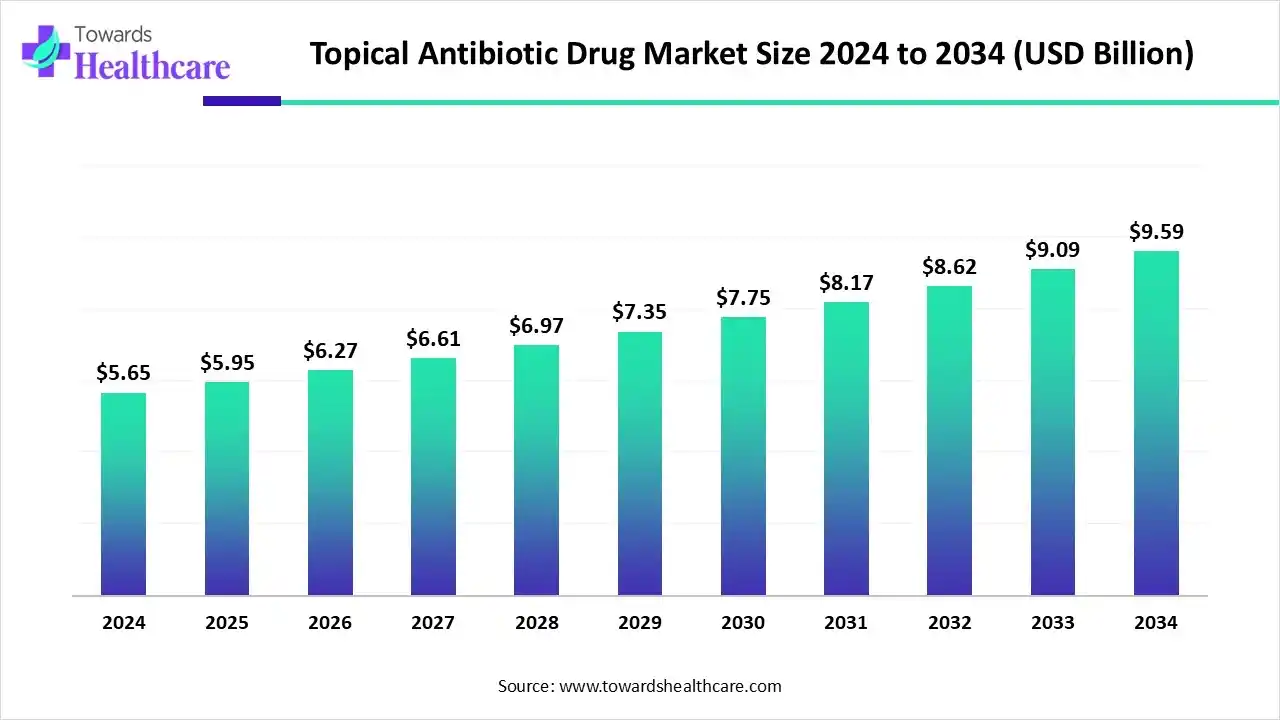

The topical antibiotic drug market size touched US$ 5.65 billion in 2024, with expectations of climbing to US$ 5.95 billion in 2025 and hitting US$ 9.59 billion by 2034, driven by a CAGR of 5.45% over the forecast period.

The topical antibiotic drug market is experiencing steady growth, driven by the increasing prevalence of bacterial skin infections, expanding geriatric populations, and rising demand for over-the-counter treatments. Advances in formulation technologies and improved wound care management are further boosting market expansion. North America leads due to high healthcare spending, while Asia-Pacific shows rapid growth with increasing awareness and expanding access to dermatological care.

| Table | Scope |

| Market Size in 2025 | USD 5.95 Billion |

| Projected Market Size in 2034 | USD 9.59 Billion |

| CAGR (2025 - 2034) | 5.45% |

| Leading Region | North America by 38% |

| Market Segmentation | By Product Formulation, By Active Ingredient / Drug Type, By Indication / Therapeutic Use, By Distribution Channel, By End User, By Region |

| Top Key Players | Johnson & Johnson (Neutrogena / Aveeno), Leo Pharma, Mylan (Viatris), Sandoz (Novartis division), Hikma Pharmaceuticals, Fresenius Kabi, Almirall, Dr. Reddy’s Laboratories, Cipla, Torrent Pharmaceuticals, Abbott Laboratories, AstraZeneca, Galderma, Bionpharma / Regional manufacturers |

The topical antibiotic drug market is growing due to the increasing incidence of minor wounds and burns, coupled with rising demand for fast-acting, localized infection treatments. According to WHO, Skin disorders are among the most widespread health issues globally, impacting nearly 900 million people at any given time, with just five major conditions responsible for over 80% of all cases.

Topical antibiotic drug are formulations applied directly to the skin, mucous membranes, or wounds to prevent or treat localized bacterial infections. They include creams, ointments, gels, sprays, and powders. Indications range from minor cuts, burns, abrasions, and surgical site prophylaxis to acne, dermatological infections, and chronic wound management. Advantages include targeted delivery, reduced systemic exposure, lower risk of systemic side effects, and faster onset at the infection site. Market growth is driven by rising skin infection prevalence, increasing surgical procedures, growing dermatology patient awareness, and the rise of antimicrobial stewardship programs focusing on localized treatment.

AI is transforming the topical antibiotic drug market by accelerating drug discovery, predicting bacterial resistance patterns, and optimizing formulation design for enhanced skin absorption. It enables personalized treatment approaches, improves clinical trial efficiency, and reduces development costs. Through predictive analytics, AI helps identify novel antimicrobial compounds, supporting faster innovation and improved therapeutic outcomes.

| Company Name | Headquarters | Major investments |

| Novartis | Basel, Switzerland | 50 million for European topical antibiotic production |

| Sanofi | Paris, France | $13 billion off its market value for an experimental inflammatory disease drug |

| Johnson & Johnson | New Brunswick, New Jersey, United States | Invested $850 million to acquire Proteologix, Inc. it is biotech company that mainly focuses immune immune-related diseases and dermatitis |

| Sun Pharma | Mumbai |

In 2024, the creams & ointments segment accounted for nearly 42% of topical antibiotic prescriptions, leading the market due to their easy application and effective localized delivery. Studies show that over 70% of patients preferred creams for skin infections, burns, and wounds because of faster absorption and better tolerability. High stability, longer shelf life, and wide over-the-counter availability further fueled adoption, making this formulation the most prescribed and recommended by dermatologists globally.

The combination topical antibiotic segment is projected to grow at the fastest CAGR due to its enhanced therapeutic efficacy. Combining multiple active ingredients helps target a broader spectrum of bacterial infections and reduces resistance development. Around 6000 surgical cases occurred with combination therapy. Clinical data indicate that over 65% of complicated skin infections respond better to combination therapies than single-agent formulations. Increasing dermatologist recommendations, rising prevalence of mixed bacterial infections, and patient preference for multifunctional treatments are driving rapid adoption globally.

In 2024, the mupirocin segment led the market with the revenue share of approximately 28%. Over 13 million prescriptions were written for mupirocin in the United States, making it the most prescribed topical antibiotic across all specialties. This widespread use is attributed to mupirocin's proven efficacy in treating skin infections like impetigo and its role in managing methicillin-resistant Staphylococcus aureus (MRSA) colonization. Its availability in both prescription and over-the-counter formulations, coupled with a favorable safety profile, has reinforced its position as a preferred choice among healthcare providers and patients.

The combination formulations segment is anticipated to experience the fastest growth in the market during the forecast period due to its enhanced efficacy against a broad spectrum of pathogens. Clinical studies have demonstrated that combination therapies, such as those combining mupirocin with other agents, can achieve higher cure rates and reduced resistance development. For instance, a study published in the Journal of Clinical Microbiology found that combination therapy resulted in a 25% higher clinical cure rate compared to monotherapy. Additionally, the U.S. Centers for Disease Control and Prevention (CDC) has highlighted the importance of combination therapies in combating antibiotic-resistant infections, further driving their adoption in clinical practice.

The acne/dermatological infection segment held the largest share of approximately 35% in the topical antibiotic market due to the high prevalence of acne vulgaris among adolescents and young adults. Topical antibiotics like clindamycin and tetracycline are widely prescribed for this indication, improving treatment outcomes and patient compliance. According to the U.S. CDC, appropriate antibiotic use is essential to prevent resistance. The segment’s dominance is further supported by its role in reducing inflammation and bacterial colonization in over 50% of acne cases globally.

The other/emerging indications segment in the topical antibiotic market is projected to grow at the fastest CAGR during the forecast period. This growth is driven by expanding therapeutic applications beyond traditional uses. For instance, the development of novel formulations targeting chronic wounds, ophthalmic infections, and burn care is gaining momentum.

In 2024, the retail pharmacies segment led the topical antibiotic market with a revenue share of approximately 55% due to high accessibility and convenience for patients. Globally, retail outlets accounted for over 60% of outpatient antibiotic dispensing, according to WHO reports on essential medicines distribution. Easy over-the-counter availability, proximity to communities, and patient preference for self-managed skin treatments reinforced the dominance of retail pharmacies as the primary distribution channel for topical antibiotics

The online pharmacies/e-commerce segment is expected to grow at the fastest CAGR in the topical antibiotic market due to rising consumer preference for convenience and home delivery. In 2024, over 40% of prescription medications in the U.S. were ordered online, reflecting the shift toward digital healthcare. India’s free National Telemedicine Service, eSanjeevani, has conducted over 276 million consultations, averaging around 300,000 daily. The platform improves nationwide healthcare access by offering remote medical services and bridging care gaps.

In 2024, the outpatients/home users segment led India's healthcare market with a revenue share of nearly 60% due to increased demand for accessible, cost-effective services. Government initiatives like the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) expanded coverage, with over 79.75 crore Ayushman Bharat Health Accounts (ABHA) created by August 2025. Additionally, the eSanjeevani platform facilitated over 21.6 crore teleconsultations by March 2024. These efforts improved healthcare access, especially in rural areas, driving the growth of outpatient and home healthcare services.

The Other Institutional/Specialized Programs segment is projected to exhibit the fastest CAGR during the forecast period due to the Indian government's strategic focus on specialized healthcare initiatives. Programs such as the National Tuberculosis Elimination Program (NTEP) and the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY) have significantly expanded access to specialized care. For instance, PM-JAY authorized over 7.79 crore hospital admissions by September 2024, covering specialized treatments like heart surgeries, cancer care, and dialysis. These targeted interventions are enhancing institutional capacity and driving growth in specialized healthcare services.

In 2024, North America dominated the market with a revenue share of approximately 38% due to well-established healthcare infrastructure, high per capita healthcare spending, and widespread access to prescription medications. Government data shows that the U.S. FDA approved multiple topical antibiotics in 2024 to address bacterial infections, while CDC reports indicate rising cases of skin infections and antibiotic-resistant bacteria, increasing demand for topical treatments. Rising demand for non-invasive cosmetic treatments is driving growth, as more than 60% of North American patients prefer topical therapies due to their convenience and simplicity. These factors collectively supported market leadership.

The U.S. undertook several initiatives to strengthen the market. The FDA approved multiple new topical antibiotics, such as Zevtera, to treat bacterial skin infections and bloodstream infections. The CDC allocated significant funding to all 50 states and territories to support antimicrobial resistance research and programs. Additionally, CDC stewardship programs promoted optimized antibiotic use in healthcare facilities, reducing resistance. The American Academy of Dermatology reports that skin conditions like acne, eczema, and psoriasis impact around 50 million people in the U.S. each year. These measures collectively enhanced regulatory, clinical, and research frameworks for topical antibiotics.

In 2024, Canada took significant steps to address antimicrobial resistance (AMR) in the topical antibiotic market. Health Canada approved several new topical antibiotics, enhancing treatment options for skin infections. The Public Health Agency of Canada released the Pan-Canadian Action Plan on Antimicrobial Resistance Year 1 Progress Report, highlighting collaborative efforts with federal, provincial, and territorial partners to combat AMR. Additionally, Health Canada's guidance documents provided updated information on antimicrobial medications, supporting informed decision-making in healthcare.

For Instance,

Asia-Pacific is accelerating the market through strengthened healthcare initiatives and antimicrobial resistance (AMR) programs. In India, around 41.7 out of every 1,000 people experience skin problems, with allergies being the most prevalent condition. In 2024, countries like India, China, and Japan implemented national action plans to combat AMR, supported by the WHO’s South-East Asia and Western Pacific offices. These efforts include improved access to essential antibiotics, clinician training, and public awareness campaigns, which are expanding the use of topical antibiotics and promoting safer, more effective treatment across the region.

For Instance,

By Product Formulation

By Active Ingredient / Drug Type

By Indication / Therapeutic Use

By Distribution Channel

By End User

By Region

February 2026

February 2026

February 2026

February 2026