January 2026

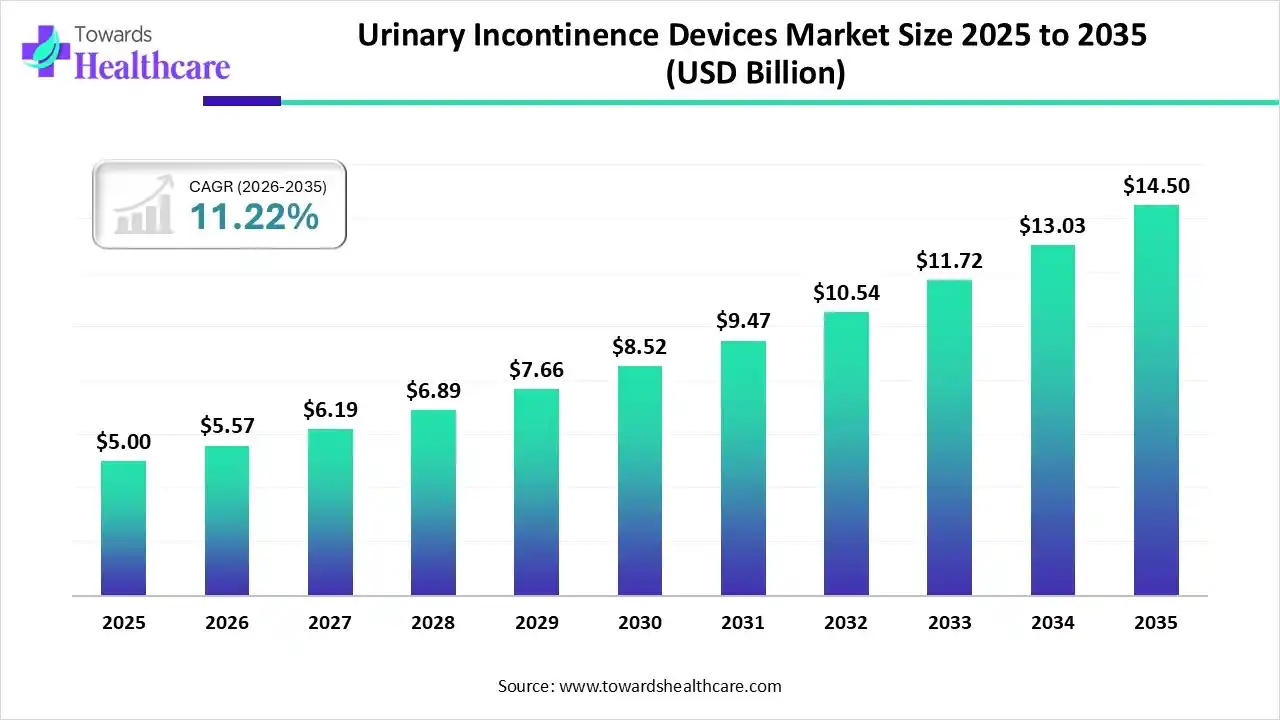

The global urinary incontinence devices market size was estimated at USD 5 billion in 2025 and is predicted to increase from USD 5.57 billion in 2026 to approximately USD 14.5 billion by 2035, expanding at a CAGR of 11.22% from 2026 to 2035.

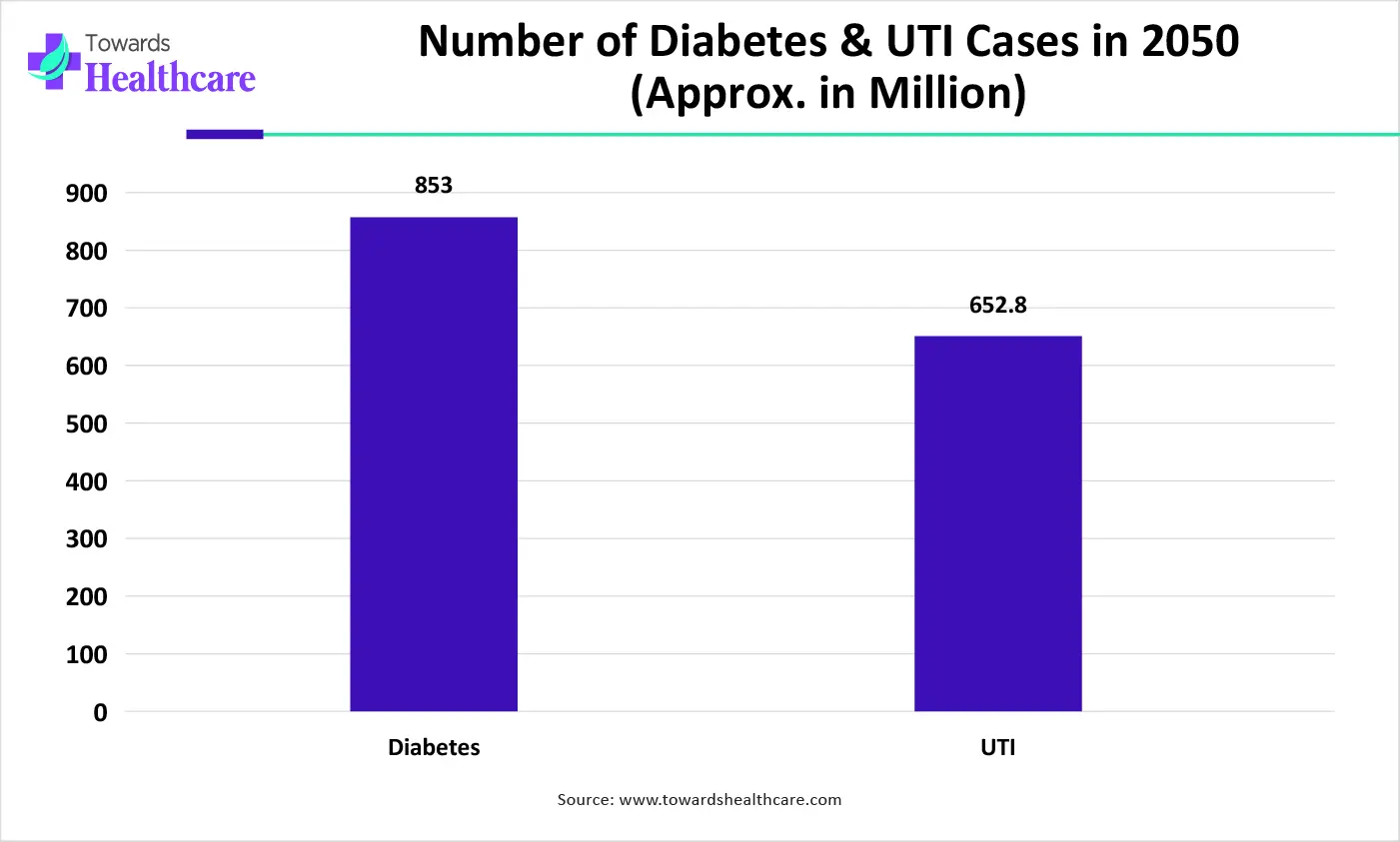

The globe is facing a huge rise in an ageing population having diabetes and neurological disorders, which are leading to urinary dysfunction, and this further fosters the advancements in the market. However, the elders are spurring the use of AI algorithms in wearable devices and other substantial implants. The widespread adoption of smaller, rechargeable, and MRI-compatible implants assists targeted neuromodulation.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.57 Billion |

| Projected Market Size in 2035 | USD 14.5 Billion |

| CAGR (2026 - 2035) | 11.22% |

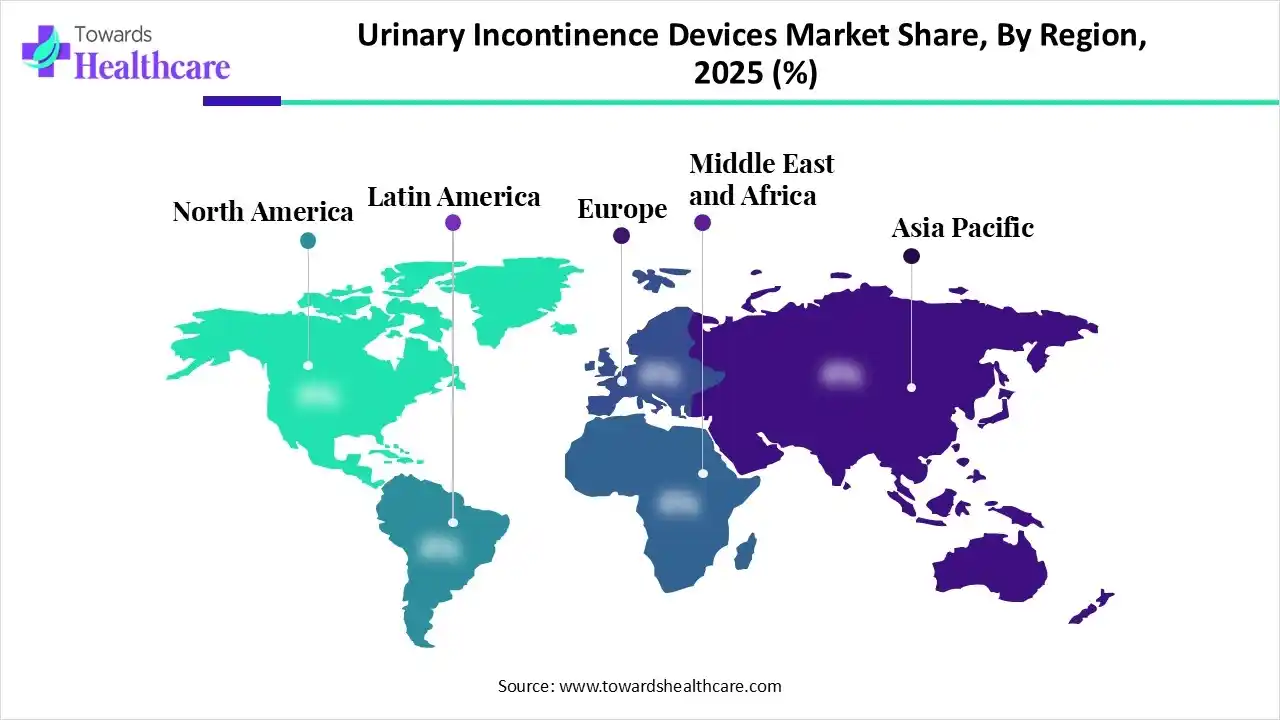

| Leading Region | North America |

| Market Segmentation | By Product, By Category, By Incontinence Type, By End User, By Region |

| Top Key Players | Coloplast, B. Braun, Boston Scientific, Medtronic, Convatec, Essity (TENA), Kimberly-Clark, Procter & Gamble, Teleflex Incorporated, Hollister Incorporated |

Mainly, the global urinary incontinence devices market is referred to as diverse absorbent pads, diapers, and waterproof underwear, coupled with more sophisticated external catheters, internal pessaries for women, and even implantable devices for critical instances. These varieties are propelled by a rising geriatric population, many chronic diseases, like diabetes, MS, stroke, prostate issues, with a raised demand for robust solutions. Recently, Medtronic received U.S. FDA approval for its Altaviva device, which is a minimally invasive, implantable tibial nerve stimulation (iTNM) device used to treat urge urinary incontinence (UUI) without the need for sedation or imaging for the procedure.

Primarily, for monitoring bladder filling and pressure, devices are utilizing non-invasive bioimpedance or optical sensors, and these solutions mainly use AI for further processing the sensor data, & sharing discreet notifications to the caregiver. Additionally, the wider adoption of AI models is involved in the analysis of urination sounds via a smartphone application to non-invasively detect flow rate, voided volume, and voiding time.

Many leading companies are fostering the integration of sensors in absorbent products for alerts, like Medline's tech and wearable stimulators, such as INNOVO, Axonics' systems for pelvic floor nourishing.

The market is stepping into more sophisticated, lower-profile slings and mesh products for stress incontinence, a recent example is the Caldera Medical acquisition.

In the coming era, the market will see major innovations in AI sphincters, including adaptive pressure regulation that automatically adjusts to a patient's movements and wireless control options via Bluetooth or an external remote.

Persistent breakthroughs in nerve stimulation, such as smaller, rechargeable, and MRI-compatible implants, will support targeting the sacral, tibial, and possibly pudendal nerves.

| Number of UTI Cases Globally each year | Approx. 400 million+ |

| Number of Health Service Visits Annually | Approx. 3 million |

| Women UTI % | 50-60% |

| Magcath | In April 2025, a company received an additional €535,000 (4 million Danish kroner) from its 36 existing Danish and Swiss business angel investors to assist in the prospective European launch of its female incontinence treatment device. |

| Uresta | In March 2025, it secured $3 million in funding to speed up the company’s U.S. launch and raise awareness of its innovative approach to bladder leakage. |

| Axena Health, Inc. | In February 2025, it collaborated with Mayo Clinic to unite the organization’s educational content on overactive bladder (OAB) into Axena Health’s clinically proven Leva Pelvic Health System. |

| Valencia Technologies | In February 2025, it secured a strategic investment of up to $35 million from Brooks Advisory Group to support the commercialization of its flagship eCoin system and establish minimally invasive treatments for urinary incontinence. |

Which Product Dominated the Urinary Incontinence Devices Market in 2025?

With the largest share, the urinary catheters segment led the market in 2025. The increasing cases of diabetes, obesity, spinal cord injuries, and Benign Prostatic Hyperplasia (BPH) are resulting in urinary dysfunction and further demand for this product. The current era is focusing on groundbreaking research in silver-coated and antimicrobial-impregnated catheters as well as Female External Catheters (FECs), like the Coloplast Luja and C.R. Bard Purewick systems.

Artificial Urinary Sphincters

Moreover, the artificial urinary sphincters segment is anticipated to witness rapid expansion. They prominently provide a definitive solution for patients with severe stress incontinence, especially men with sphincter damage post-prostatectomy, after medications and other therapies fail. Researchers are leveraging electronic, remote-controlled, and adaptive devices for boosting functionality and lowering complications, such as urethral erosion. E.g., VICTO and VICTO+ are adjustable hydraulic AUS that can be fine-tuned post-operatively in a clinical setting via an injection port.

Why did the External Urinary Incontinence Devices Segment Lead the Market in 2025?

In 2025, the external urinary incontinence devices segment captured a dominant share of the urinary incontinence devices market & estimated to sustain its dominance. A prominent catalyst is a rise in emphasis on comfort, with lowered infection risks (CAUTIs), optimised design with skin-friendly materials, and integration of digital health technologies. Specifically, the PureWick System (BD) employs gentle vacuum suction and a soft, wicking material placed externally at the vulva to draw urine away from the skin into a collection container.

Internal Urinary Incontinence Devices

In the coming era, the internal urinary incontinence devices segment will expand rapidly. They mainly encompass vaginal slings, artificial urinary sphincters (AUS), urethral inserts, and catheters. A growing effort into minimally invasive and technology integrations includes Bulkamid Urethral Bulking Agent, a water-based gel, delivered via minimally invasive injections into the urethral wall. It is also an easy, long-lasting treatment alternative for SUI in women.

Which Incontinence Type Led the Urinary Incontinence Devices Market in 2025?

The overflow urinary incontinence segment held the biggest share of the market in 2025. Mainly, aged people and those with diabetes or neurological conditions are more susceptible to overflow incontinence, which further needs advanced devices. Ongoing breakthroughs in neuromodulation devices, including Medtronic and Axonics, unveiled smaller, rechargeable, and full-body MRI-compatible implantable pulse generators (IPGs), like the AxonicsR15 and Medtronic InterStim Micro.

How did the Hospitals Segment Dominate the Market in 2025?

The hospitals segment captured the largest share of the urinary incontinence devices market in 2025. They primarily offer to maintain skin integrity, minimising the risk of incontinence-associated dermatitis (IAD) and pressure ulcers/injuries. By adopting these advanced devices, nurses and caregivers report satisfaction, with minimal workload connected with often pad changes and linen handling, clearing time for other vital care needs.

Clinics

In the upcoming years, the clinics segment is predicted to expand fastest. Substantial benefits of devices in clinics are immediate symptom relief, enhanced quality of life, and regained confidence for patients. Also, they provide tailored treatment, which enables fine-tuning of therapy. Top clinics like the Cleveland Clinic Glickman Urological & Kidney Institute and the Mayo Clinic, Rochester, are widely using these solutions.

In 2025, North America was dominant in the market due to the presence of robust healthcare systems, specialized clinics, and supportive reimbursement policies. Also, they are accelerating new FDA approvals for implantable neuromodulation systems and the progression of smart, home-use devices.

For instance,

According to the ADA, in the U.S., there are 1.2 million new diabetes cases per year, and other neurological disorder instances are encouraging the development of urinary incontinence devices.

For instance,

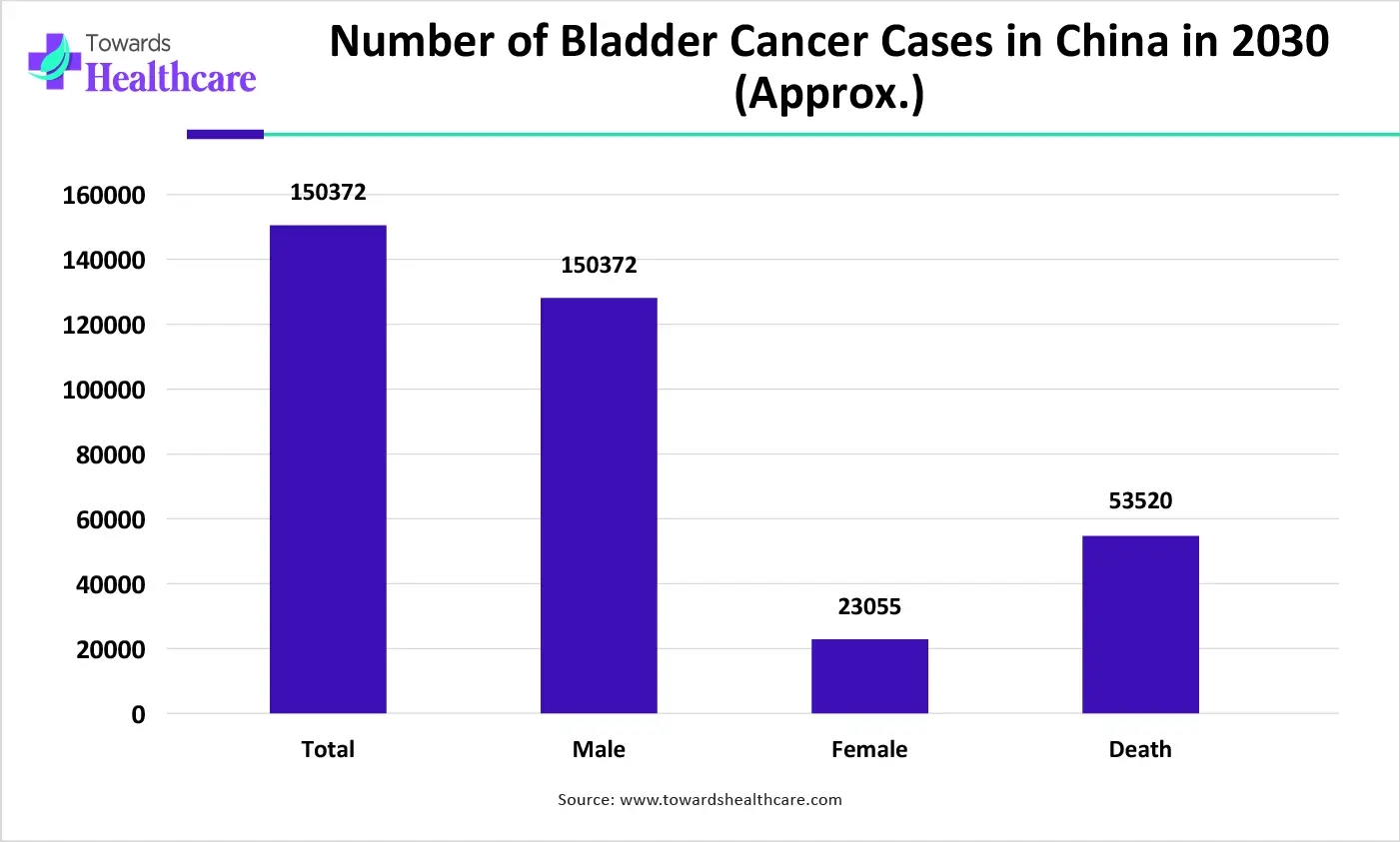

During 2026-2035, the Asia Pacific is predicted to expand fastest in the urinary incontinence devices market, with rising public understanding, due to 150 million UTI cases annually and minimal stigma, leveraging diagnosis and product adoption. However, they are pushing the development of more sustainable, reusable incontinence products, like washable pants with absorbent liners, to highlight environmental issues among consumers.

Whereas, China will expand at a rapid CAGR with increased study on evidence-based auriculotherapy (ear acupuncture points) as a complementary method for UI management in China, using techniques, especially ear plasters. China is a hub for developing a variety of smart wearables, apps for home rehab (WeChat), and advanced implants/stimulation.

With notable growth, Europe is exploring various advances in the urinary incontinence devices market. This covers the recently published amending Regulation (EU 2025/1234), which enables electronic Instructions For Use (eIFUs) for all professional-use medical devices, including specific types of incontinence devices.

For instance,

Germany is focusing on progressing eco-friendly, sustainable, and washable incontinence products. Like, inContAlert, a Bayern, Germany-based startup is contributing to designing a wearable device by using a patented sensor and AI technology to measure bladder filling levels.

| Coloplast | This usually provides intermittent and male external catheters, surgical implants, and nerve stimulation devices. |

| B. Braun | A vital firm specialises in urine collection systems, female devices, and related accessories. |

| Boston Scientific | It mainly offers treatment for male SUI (Stress Urinary Incontinence) with the gold-standard AMS 800 AUS, and the implantable AdVance XP Male Sling for mild-to-moderate SUI. |

| Medtronic | A company leverages the InterStim System for bladder/bowel control. And the recently FDA-approved Altaviva System for urge incontinence. |

| Convatec | This leader unveiled the GentleCath and Cure brands of intermittent catheters. |

| Essity (TENA) | Specifically facilitates a comprehensive portfolio of urinary incontinence products and services for men, women, and professional care settings. |

| Kimberly-Clark | It offers through the brands called Depend, Poise, and Plenitud. |

| Procter & Gamble | A player specialises in absorbent products for women under the Always Discreet brand. |

| Teleflex Incorporated | Its diverse products are offered through its Rüsch brand for bladder management solutions for urinary incontinence. |

| Hollister Incorporated | This explored VaPro intermittent catheters, the discreet Infyna Chic for women, different urine collection bags, external female pouches, and biofeedback probes for pelvic floor therapy. |

By Product

By Category

By Incontinence Type

By End User

By Region

January 2026

January 2026

December 2025

December 2025