March 2026

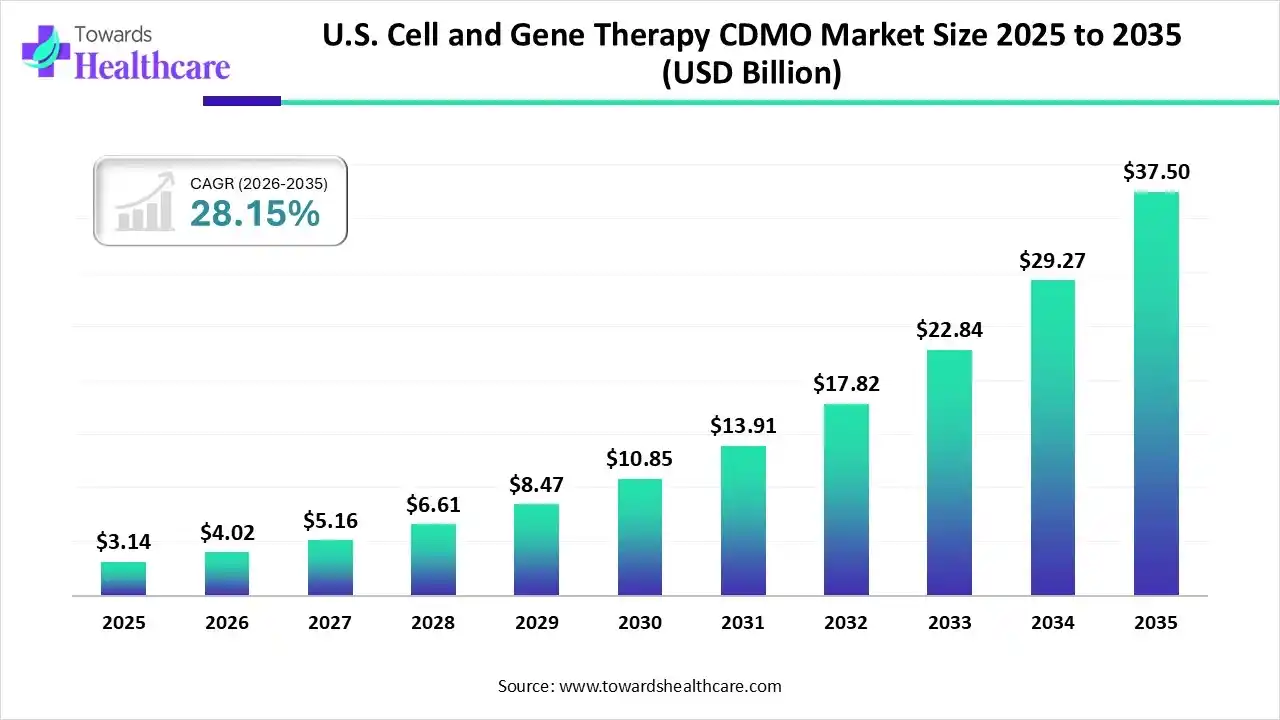

The U.S. cell and gene therapy CDMO market size was estimated at USD 3.14 billion in 2025 and is predicted to increase from USD 4.02 billion in 2026 to approximately USD 37.5 billion by 2035, expanding at a CAGR of 28.15% from 2026 to 2035.

The U.S. cell and gene therapy CDMO market is growing strongly, driven by rising clinical pipelines, complex manufacturing requirements, and increased outsourcing by biotech companies. Demand is supported by advances in viral vectors, CAR-T therapies, and regenerative medicine, along with regulatory support, strong funding activity, and expanding manufacturing infrastructure across the country.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.02 Billion |

| Projected Market Size in 2035 | USD 37.5 Billion |

| CAGR (2026 - 2035) | 28.15% |

| Leading Region | North America |

| Market Segmentation | By Phase, By Product, By Indication |

| Top Key Players | Lonza Group AG, Catalent, Inc., Cytiva, Samsung Biologics, Theramo Fisher Scientific, Inc., Novartis AG, WuXi AppTech / WuXi Biologics, AGC Biologics, OminiBio, Rentschler Biopharma SE |

A cell and gene therapy CDMO is an outsourced partner that develops and manufactures cell-and gene-based therapies for biotech and pharmaceutical companies. The U.S. cell and gene therapy CDMO market is growing due to rising biotech R&D investments, expanding clinical pipelines, and increasing approvals of advanced therapies. Companies lack in-house manufacturing capacity for complex viral vectors and cell products, so they outsource to specialized CDMOs. Strong funding, technological innovation, and regulatory support further boost demand.

AI is transforming the U.S. cell and gene therapy CDMO market by optimizing process development, improving vector design, and enhancing quality control through predictive analytics. AI-driven automation reduces manufacturing costs, shortens development timelines, and increases batch success rates, enabling CDMOs to scale complex therapies faster while meeting strict regulatory and commercialization requirements.

Growing demand for viral vectors and cell products is driving CDMOs to invest heavily in scalable facilities and advanced bioreactor systems, reducing bottlenecks and supporting commercial-scale production.

AI, machine learning, and automation enhance process optimization, predictive quality analytics, and supply chain efficiency, accelerating development timelines and lowering costs for complex therapy manufacturing.

Rising collaboration between biotech, pharma, and CDMOs, along with mergers/acquisitions, strengthens technical capabilities, broadens service offerings, and accelerates market entry for novel cell and gene therapies.

Why did the pre-clinical Segment Dominate in the Market in 2025?

The pre-clinical phase segment holds a strong share of the U.S. cell and gene therapy CDMO market due to a large volume of early-stage research programs and startups. Companies increasingly outsourced vector development, process optimization, and analytical testing to CDMOs to reduce costs, manage technical complexity, and accelerate progression toward clinical trials.

Clinical Phase

The clinical phase is expected to grow at the fastest CAGR as more cell and gene therapies advanced form early research into human trials. Rising numbers of phase I-III studies, complex GMO manufacturing needs, and limited in-house capabilities are driving sponsors to rely on specialized CDM for clinical-scale production, regulatory support, and quality compliance throughout trial progression.

How will the Cell Therapy Segment dominate the Market in 2025?

The cell therapy segment led the U.S. cell and gene therapy CDMO market due to the strong adoption of CAR-T, stem cell, and immune cell therapies across oncology and regenerative medicine. A large number of approved products and active clinical pipelines increased demand for specialized manufacturing cell processing and quality testing services, prompting companies to outsource complex production activities to experienced CDMOs.

Gene-Modified Cell Therapy

The gene-modified cell therapy segment is expected to grow at the fastest CAGR due to increasing development of CAR-T, TCR, and other engineered cell therapies. Rising clinical trials, strong investment in gene-editing technologies, and the need for specialized manufacturing and regulatory expertise drive outsourcing to CDMOs, enabling faster scale-up, efficient production, and accelerated time-to-market for advanced gene-modifying therapies.

How Does the Oncology Segment Dominate the Market in 2025?

The oncology segment dominated the U.S. cell and gene therapy CDMO market due to the high prevalence of cancer and the growing adoption of CAG-T, TCR, and personalized cell therapies. The increasing number of clinical trials, approvals of innovative oncology treatments, and the complex manufacturing requirements for cancer-targeted therapies have led companies to outsource production and development to specialized CDMOs, driving market leadership in this indication.

Rare Disease

The rare diseases segment is expected to grow at the fastest CAGR due to the rising development of gene and cell therapies targeting genetic and orphan disorders. Limited patient populations and complex, personalized manufacturing requirements encourage biotech companies to rely on CDMOs for scalable production, regulatory compliance, and quality assurance, accelerating clinical and commercial availability of therapies for rare conditions.

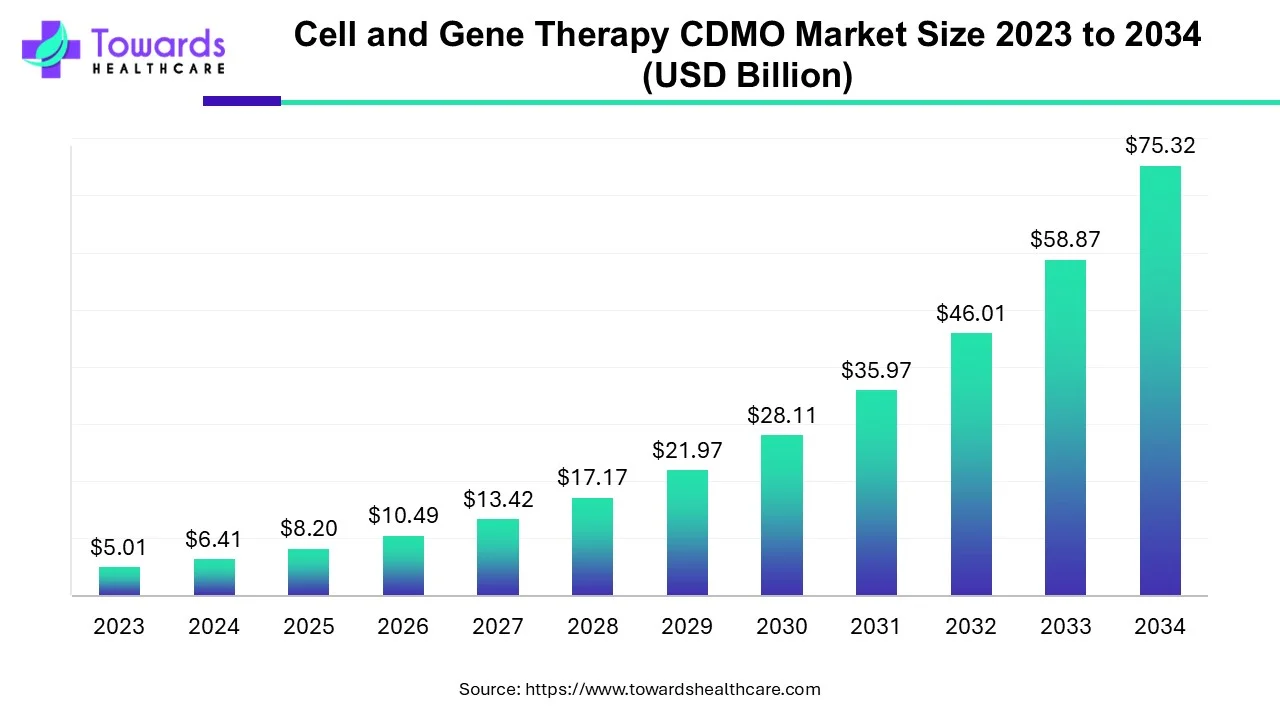

The global cell and gene therapy CDMO market size is calculated at US$ 6.41 in 2024, grew to US$ 8.2 billion in 2025, and is projected to reach around US$ 75.32 billion by 2034. The market is expanding at a CAGR of 27.94% between 2025 and 2034.

| Companies | Headquarters | Offerings |

| Lonza Group AG | Basel, Switzerland | Provides extensive biopharmaceutical development, custom manufacturing, and advanced therapy services, including cell and gene therapy manufacturing solutions globally. |

| Catalent, Inc. | Florida, U.S. | Offers drug formulation, process development, analytical testing, and manufacturing support. |

| Cytiva | Massachusetts, U.S. | Supplies bioprocessing technologies, tools, and services that support therapeutic discovery, development, and production, including cell and gene therapy workflows. |

| Samsung Biologics | Incheon, South Korea | Global CDMO providing discovery-to-commercial manufacturing with strong capabilities in biologics and expanding into complex therapies. |

| Theramo Fisher Scientific, Inc | Massachusetts, U.S. | Offers end-to-end CDMO services via Patheon, including clinical and commercial biologics and advanced therapy manufacturing. |

| Novartis AG | Basel, Switzerland | Major pharmaceutical company with internal cell/gene therapy manufacturing and contract work supporting advanced modalities. |

| WuXi AppTech / WuXi Biologics | Shanghai, China | Provides integrated research, development, and large-scale manufacturing services |

| AGC Biologics | Washington, U.S. | CDMO Specializing in the development and scalable manufacture of biologics and viral vectors for cell and gene therapy programs. |

| OminiBio | Ontario, Canada | Focused on process development, GMP manufacturing, analytical services, and scalable cell therapy solutions from preclinical to commercial stage |

| Rentschler Biopharma SE | Laupheim, Germany. | Biopharma CDMO providing custom development and GMP manufacturing services for biologics and complex therapeutics. |

By Phase

By Product

By Indication

March 2026

February 2026

February 2026

February 2026