March 2026

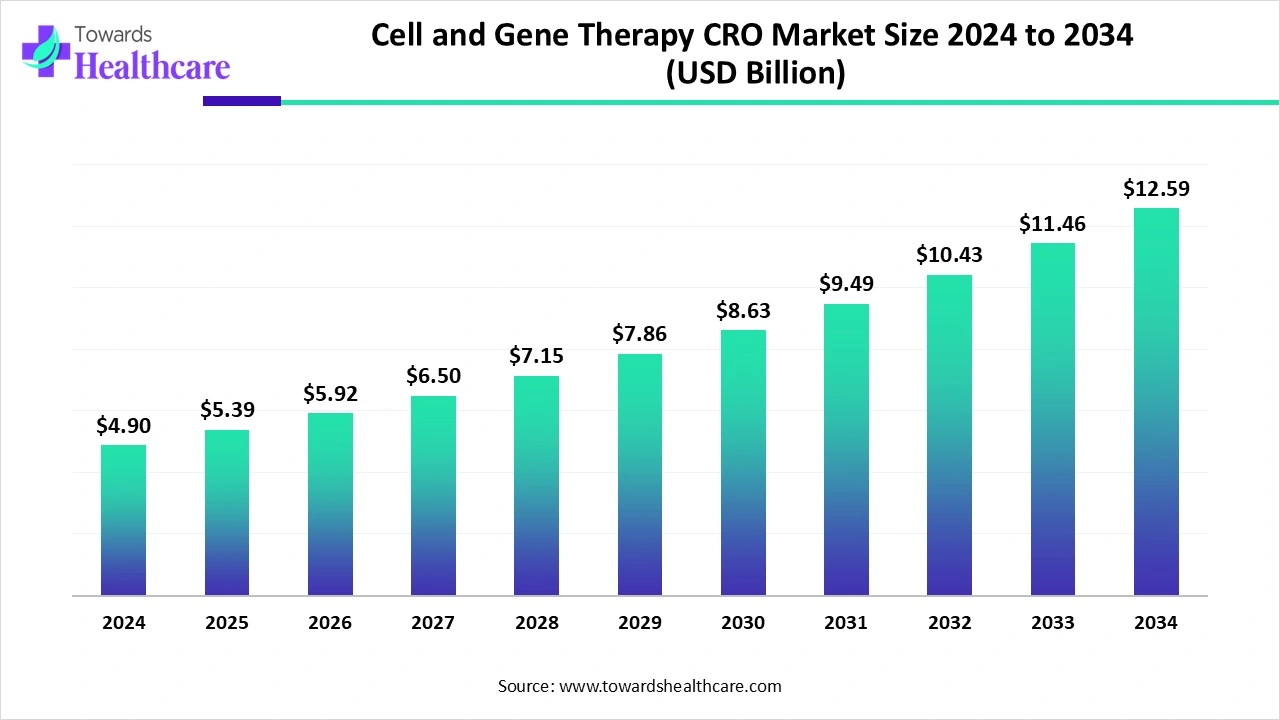

The global cell and gene therapy CRO market size is estimated at US$ 4.90 billion in 2024, is projected to grow to US$ 5.39 billion in 2025, and is expected to reach around US$ 12.59 billion by 2034. The market is projected to expand at a CAGR of 9.9% between 2025 and 2034.

The cell and gene therapy CRO market is expanding rapidly due to increasing expenses, complexity, and government challenges for developing advanced therapies. Outsourcing to CRO is important for effective and compliant development pathways. North America is dominant in the market, with increasing clinical research services and growing outsourcing activities to CRO. Asia Pacific is the fastest-growing region, as increasing government support and a massive patient base.

| Table | Scope |

| Market Size in 2025 | USD 5.39 Billion |

| Projected Market Size in 2034 | USD 12.59 Billion |

| CAGR (2025 - 2034) | 9.9% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Therapy Modality Supported, By Sponsor Type / End User, By Trial Phase / Activity, By Region |

| Top Key Players | Charles River Laboratories, Labcorp / Covance, ICON plc, IQVIA, Parexel, Syneos Health, Medpace, PPD, Novotech, Precision for Medicine, QPS, CMIC Group, Altasciences, Aixial, WuXi AppTec, Catalent, Thermo Fisher Scientific / Patheon, Cryoport / Clinical logistics specialists, TrakCel / Vineti, Specialist boutique CROs |

The cell and gene therapy CRO market covers specialized contract research organizations that provide outsourced R&D and clinical-trial services tailored to advanced therapies (in-vivo gene therapy, ex-vivo gene-modified cell therapies such as CAR-T, viral/vector analytics, bioanalytics/immunogenicity assays, PK/PD modelling, patient-matching/site logistics, and ATMP-specific regulatory support). These CROs supply protocol design, IND-enabling studies, GLP preclinical work, GMP translational analytics (bioassays, potency), clinical operations for complex multicenter and single-site autologous trials, long-term safety follow-up, and specialty services (cell processing oversight, decentralized trial logistics, chain-of-identity). Demand is driven by rising CGT pipelines, regulatory complexity, manufacturing/logistics constraints, and sponsor preference to outsource specialized, high-risk capabilities.

Increasing government programmes that support to design of cell-based therapies to treat human disease and for the repair of damaged or destroyed tissues.

For instance,

Increasing demand for medical disposables due to increasing healthcare demands, improving hygiene, lowering infection challenges, and enhancing efficiency drives the growth of the market.

For Instance,

Integration of AI cell and gene therapy CRO drives the growth of the market as AI is transforming cell and gene therapy advancement by investigating large sets of genomic and clinical information to recognize biomarkers and identify patient responses, enhancing trial achievement and outcomes. In modified medicine, AI-driven technology tailors treatments such as CAR-T to individual patients and improves gene therapy production, improving safety and lowering expenses. This speeds up research, making therapies accessible. AI and other advanced technologies are expected to progress, and they are predicted to accelerate growth in this field. With rapidly growing proof of AI tech feasibility and its innovative potential, pharma companies and CRO are eager to partner with AI companies, which drives the growth of the cell and gene therapy CRO market.

For instance,

Increasing Cell and Gene Therapies in Genetic Diseases

Cell and gene therapy (CGT) is a cutting-edge approach in tackling severe diseases such as rare genetic conditions and certain cancers. As the regulatory environment often changes quickly, with new approval routes and designations for CGTs, it’s essential to stay informed about country, state, and site-specific requirements and licensing rules. CROs are progressively offering virtual clinical trials, with remote site monitoring, eConsent, and telemedicine. Because these therapies demand highly specialized expertise and an experienced team, this need is fueling the growth of the cell and gene therapy CRO market.

Major Challenges of Cell and Gene Therapy

CGTs are expensive to produce, with regional regulations adding complexity, and sourcing top-tier materials often challenging throughout early and later clinical development stages. The significant expenses involved also pose a barrier. Since investments tend to focus on the most profitable therapy areas, research on less common diseases’ challenges is severely underfunded, thereby restricting growth in the cell and gene therapy CRO market.

Recent Advancements in Gene Editing and Cell Therapy

Advances in gene editing and cell therapy, such as autologous CAR T cell therapy, CRISPR-Cas9, and viral vector engineering, have driven rapid growth in CGTs. These tools allow precise genetic modifications with minimal off-target effects, boosting therapeutic success. Developments in non-viral delivery methods provide safer alternatives to viral vectors, broadening gene therapy options. Additionally, increased investment and funding have fueled CGT production, creating opportunities for growth in the cell and gene therapy CRO market.

By service type, the clinical operations & site management segment led the cell and gene therapy CRO market, as it enhances development approach, government compliance, operational efficacy, quality assurance, and cost-effectiveness, eventually speeding up the development and commercialization of innovative cell therapies. Clinical trial site management contains the organization and oversight of numerous activities at the site, wherever the trial is conducted. This includes tasks like data management, patient recruitment, regulatory compliance, and confirming the devotion to ethical considerations.

On the other hand, the bioanalytics & assay development segment is projected to experience the fastest CAGR from 2025 to 2034, as collaborating with a bioanalytical CRO that provides combined bioanalytical services abilities to help the full development of a product offers some advantages, from unified transitions among development phases to improve efficiency, regulatory support, and expertise. A CRO the whole product lifecycle offers a seamless transition between diverse development phases. From early-stage research to preclinical and clinical trials, consistent bioanalytical laboratory solutions support continuity and consistency in data generation, lowering potential delays, miscommunications, and compatibility challenges.

By therapy modality supported, the gene-modified cell therapies segment is dominant in the cell and gene therapy CRO market in 2024, as genetic therapies may be used to prevent, treat, or cure certain hereditary disorders, like cystic fibrosis, alpha-1 antitrypsin deficiency, beta thalassemia, haemophilia, and sickle cell disease. They are also used to manage cancers or infections, including HIV. Gene modification significantly improves the survival and functionality of stem cells used in replacement.

The in-vivo gene therapy segment is projected to grow at the fastest CAGR from 2025 to 2034, as it involves directly introducing therapeutic genes into the patient’s body. Novel hereditary material is initially created in a lab and then delivered to the patient’s cells directly, typically by permeating it into the blood or, in some cases, injecting it directly into a body organ.

By sponsor type/end user, the biotech & VC-backed innovators segment led the cell and gene therapy CRO market in 2024, as this therapy offers novel treatments for diseases that presently do not have other options. Many cell and gene therapies are single treatments, rather than continuing medication that consumers have to take. VC investors are betting that organizations connecting cell and gene therapy and complex logic to control cell therapies will enhance their security profiles.

The large pharma segment is projected to experience the fastest CAGR from 2025 to 2034, as CROs support large biotech companies in understanding dynamics, target the accurate patient populations, and position their products for prime entry into the marketplace rapidly. Healthcare organizations are harnessing cell & gene therapy to address untreatable healthcare conditions and advance therapeutic choices.

By trial phase/activity, the phase I/I–II segment led the cell and gene therapy CRO market in 2024, as well-designed phase I trials interpretation for therapy-specific factors, as well as general safety metrics to provide a complete safety and side-effect profile. The primary focus is to find out efficacy and adverse effects; these studies offer initial insights into the therapy's behaviour in the body, helping researchers understand its lasting activity and confirm gene expression, all while finding a clear path for future development and potential governing approval.

On the other hand, the phase II & pivotal segment is projected to experience the fastest CAGR from 2025 to 2034, as this study is important for pivotal trials of cell and gene therapies and how the exclusive features of progressive therapy clinical trials affect preparations for pivotal trials. Estimate solutions that streamline and enhance preparations for pivotal trials in cell and gene therapies.

North America is dominant in the market in 2024, as this region is a hub of 85 % of the global small, research-intensive biotech companies. Increasing cell and gene therapy-driven start-ups are significant to drug development and medical care competitiveness. Research and development (R&D) in the biopharmaceutical region is significant for developing novel drugs that treat and manage diseases, which increases the demand for cell and gene therapy.

For Instance,

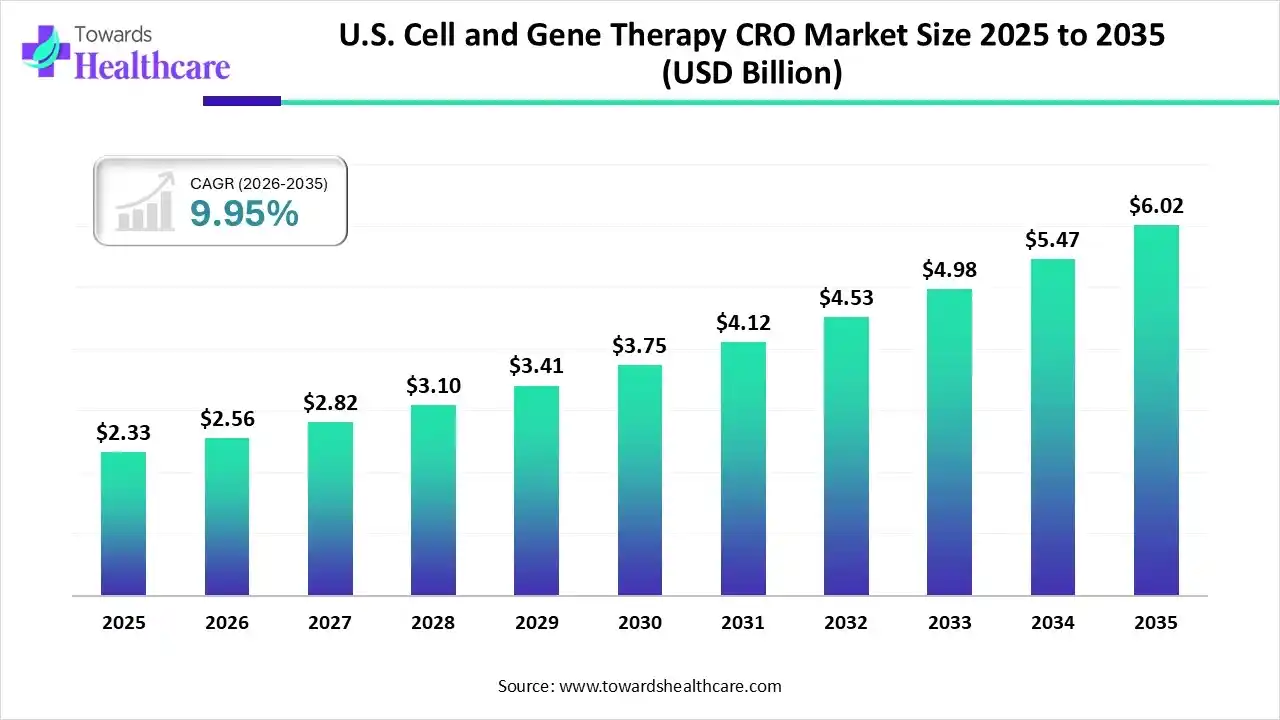

In the U.S., government spending on Medicare, Medicaid, and other programmes, and the US medical care industry are the fastest-growing sectors of the nation's economy, which drives the growth of the market. The United States has long-lasting, substantial savings in clinical research of cell and gene therapies to improve the health and well-being of the regions, which contributes to the growth of the market.

U.S. Cell and Gene Therapy CRO Market Growth

The U.S. cell and gene therapy CRO market size was estimated at USD 2.33 billion in 2025 and is predicted to increase from USD 2.56 billion in 2026 to approximately USD 6.02 billion by 2035, expanding at a CAGR of 9.95% from 2026 to 2035.

In Canada, increasing approval of cell and gene therapy, for instance, 10 gene therapy products are approved. Cell and gene therapies are presently at the forefront of scientific invention. They hold huge promise for patients suffering from a range of severe diseases. Canada is looking to support healthcare innovation by establishing a pathway for Advanced Therapeutic Products (ATPs), which contributes to the growth of the market.

Asia Pacific is the fastest-growing region in the medical disposable market in the forecast period, as the APAC government bodies encourage a high standard of care and medical research that meets worldwide expectations for moral protocols. For instance, China alone holds around 60% of the global CAR-T therapy clinical trials. Cell and gene therapies are gaining traction in the Asia-Pacific region, driven by increasing patient demand and an increasing ecosystem of healthcare innovation, which contributes to the growth of the market.

R&D of cell and gene therapies involves many steps, including cell harvesting, transportation, expansion, gene transduction, and infusion into the patient, each of which demands to be reliable and reproducible.

Key Players: uniQure and Oxford Biomedica

Clinical trials of gene and cell therapy are often organised as a phase I / II study, where a small group of participants with the disease are registered and both efficacy and safety tests are conducted. Significant activities involve gene introduction or cell reprogramming, vector manufacturing and testing, cell extension and quality control, and delivery to patients, and rigorous monitoring.

Key Players: Novartis and Sarepta Therapeutics, Beam Therapeutics, and Intellia Therapeutics

Cell and gene therapies support the patient by involving the transfer of cells with the appropriate function to the patient. Approximately protocols use both gene therapy and cell therapy. The patient journey includes some steps, from early diagnosis and pre-treatment testing to the actual administration and succeeding monitoring.

Key Players: Biostate.ai and Kite Pharma

In April 2025, Artis CEO Brian Neel stated, “Advanced therapies continue to be a driving force of invention in the biopharma ecosystem, and we believe the industry is at an inflection point in advancing and developing the significant processes and the manufacturing of these therapies.”

By Service Type

By Therapy Modality Supported

By Sponsor Type / End User

By Trial Phase / Activity

By Region

March 2026

March 2026

March 2026

March 2026