January 2026

The U.S. digital mental health market size was estimated at USD 7.46 billion in 2025 and is predicted to increase from USD 8.97 billion in 2026 to approximately USD 47.13 billion by 2035, expanding at a CAGR of 20.25% from 2026 to 2035.

The U.S. digital mental health market is expanding rapidly, driven by rising mental health awareness, growing acceptance of virtual therapy, and increasing adoption of AI-enabled diagnostic and support tools. Strong employer-led wellness programs, integration of telepsychiatry into healthcare systems, and demand for accessible, affordable care further accelerate growth. Advancements in mobile apps and remote monitoring strengthen its overall market momentum.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.97 Billion |

| Projected Market Size in 2035 | USD 47.13 Billion |

| CAGR (2026 - 2035) | 20.25% |

| Market Segmentation | By Component, By Age Group, By End User, By Disorder Type |

| Top Key Players | BioTelemetry, Inc., eClinicalWorks, Allscripts Healthcare Solutions, Inc., iHealth Lab, Inc., AT&T, Honeywell International Inc., Cisco Systems, McKesson Corporation, Cerebral, Inc. (added) |

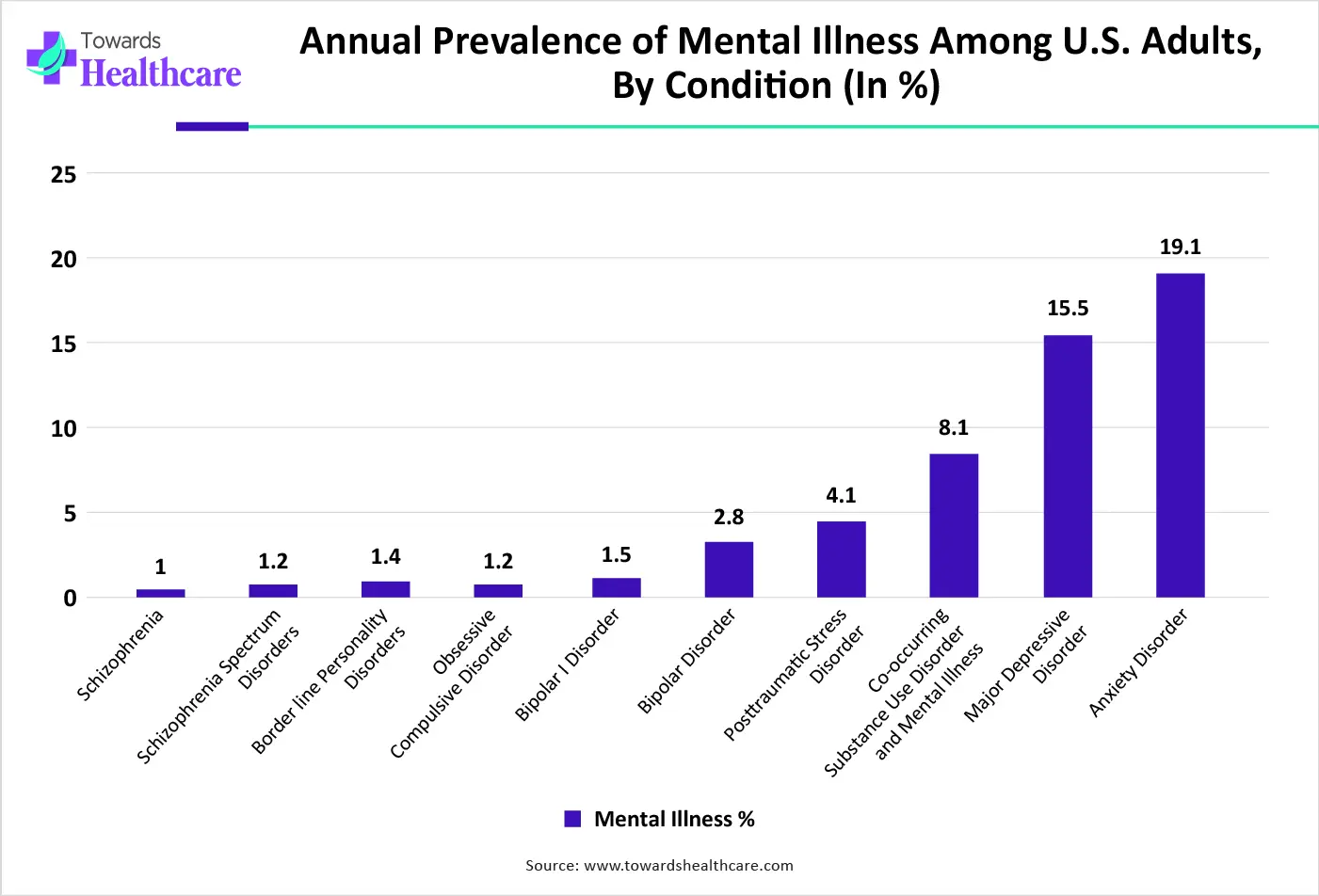

The U.S. digital mental health market is driven by rising anxiety and depression rates, increased acceptance of virtual therapy, and strong demand for accessible care. Innovations in AI-powered assessments, employer-sponsored mental wellness programs, and expanded insurance coverage further accelerate adoption, strengthening digital platforms as mainstream mental health solutions.

The digital mental health market refers to technology-enabled solutions designed to support, monitor, and improve mental well-being through digital platforms. It includes teletherapy services, mental health apps, AI-based assessment tools, online cognitive-behavioral therapy programs, remote monitoring systems, and virtual care platforms. These solutions aim to increase accessibility, reduce stigma, and deliver timely mental health support regardless of location. The market serves individuals, healthcare providers, employers, and insurers, offering personalized care pathways and scalable interventions.

AI integration can significantly enhance the U.S. digital mental health market by enabling personalized, data-driven care. Machine learning algorithms can analyze user behavior, speech patterns, and physiological data to detect early signs of mental health issues, allowing timely interventions. AI-powered chatbots and virtual therapists provide 24/7 support, reducing barriers to care and improving accessibility. Predictive analytics help clinicians tailor treatment plans and remotely monitor progress.

Which Component Segment Dominated the U.S. Digital Mental Health Market?

The software segment dominates the market due to the widespread adoption of teletherapy, virtual counseling, and online psychiatric services. Increased demand for professional guidance, personalized treatment plans, and real-time support drives growth. Employer wellness programs, insurance reimbursements, and integration with healthcare systems further strengthen service offerings, making them the primary choice for accessible and effective mental health care.

Services

The services segment is anticipated to be the fastest-growing in the U.S. digital mental health market due to digital mental health services offer a wide range of solutions like teletherapy, AI chatbots (Woebot, Wysa), wellness apps (Calm, Headspace), VR therapy, and wearables for tracking, growing rapidly to bridge mental healthcare gaps via accessible, scalable, and personalized tools, driven by increased awareness and tech adoption post-pandemic, though facing challenges in data privacy and long-term efficacy proof.

Why Did adult (20 to 65) Dominant Segment in the U.S. Digital Mental Health Market?

The adult (20 to 65) segment dominates the market due to the higher prevalence of stress, anxiety, and depression among working-age populations. Greater awareness, willingness to seek virtual therapy, integration with workplace wellness programs, and widespread smartphone usage drive adoption, making adults the primary users of digital mental health services.

Children & Adolescents

The children & adolescents (10 to 19) segment is anticipated to be the fastest-growing age group in the U.S. digital mental health market due to increasing awareness of youth mental health issues, rising school-based programs, and parental demand for accessible support. Gamified apps, virtual counseling, and early intervention tools cater to younger users, promoting engagement, prevention, and timely management of stress, anxiety, and behavioral challenges.

Which End User Segment Led the U.S. Digital Mental Health Market?

The patients segment dominates the market due to direct demand for accessible, personalized, and convenient mental health solutions. Growing awareness, increased acceptance of teletherapy, and the availability of mobile apps and virtual counseling platforms drive patient adoption, making them the primary end-users of digital mental health services.

Providers

The providers segment is estimated to be the fastest-growing end-user in the U.S. digital mental health market due to increasing adoption of teletherapy platforms, digital tools for patient monitoring, and integration with electronic health records. Growing demand for efficient care delivery, remote patient management, and streamlined clinical workflows drives rapid provider engagement.

Why is Mental Disorder Dominant Segment in the U.S. Digital Mental Health Market?

The mental disorder segment dominates the market due to the high prevalence of conditions such as depression, anxiety, and stress-related disorders. Rising awareness, early diagnosis initiatives, and demand for accessible therapy and monitoring solutions drive adoption. Digital platforms provide continuous support, personalized care, and integration with healthcare services, strengthening their prominence in managing mental disorders.

Behavioral Disorder

The behavioral disorder segment is the fastest-growing disorder-type segment in the U.S. digital mental health market due to increasing recognition of ADHD, autism spectrum disorders, and other behavioral conditions. Rising demand for remote monitoring, digital therapy programs, and early intervention tools, combined with parental and clinical support, drives adoption. Mobile apps and telehealth platforms enhance engagement and continuous management for affected individuals.

The U.S. digital mental health market is witnessing strong growth across all regions. North U.S. shows significant adoption due to higher awareness, robust healthcare infrastructure, and widespread telehealth integration. The East U.S. benefits from major technology hubs and leading research institutions, driving innovation in AI-powered mental health tools. West U.S. sees rapid growth fueled by tech-savvy populations, early adoption of digital therapeutics, and strong venture capital investments. Nationwide, rising mental health concerns, increased acceptance of virtual care, employer wellness programs, and insurance reimbursements are key drivers. Regional variations reflect infrastructure, technology adoption, and investment levels, collectively supporting overall market expansion.

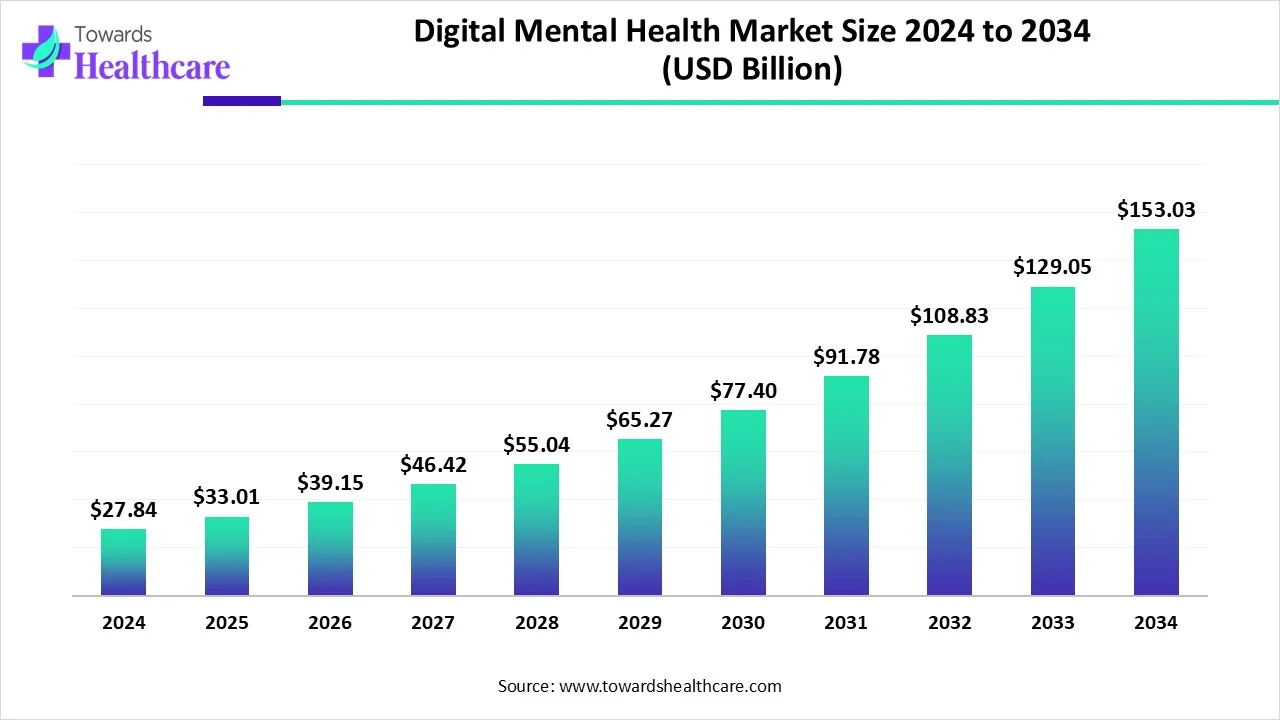

The global digital mental health market size is calculated at US$ 27.84 in 2024, grew to US$ 33.01 billion in 2025, and is projected to reach around US$ 153.03 billion by 2034. The market is expanding at a CAGR of 18.58% between 2025 and 2034.

| Company | Digital Mental Health / Digital Health Offering (U.S.) |

| BioTelemetry, Inc. | Remote health monitoring technologies (connected health & remote patient monitoring); not specific mental health care. |

| eClinicalWorks | EHR and healthcare IT, including telehealth support, enabling digital care delivery (not a dedicated digital mental health platform). |

| Allscripts Healthcare Solutions, Inc. | EHR, practice management & patient engagement platforms with telehealth workflows; supports digital care but not a core mental health product. |

| iHealth Lab, Inc. | Consumer mobile health devices and mHealth peripherals; does not offer direct mental health services. |

| AT&T | Connectivity/telecom infrastructure supporting digital health ecosystems; not a direct mental health provider. |

| Honeywell International Inc. | IoT and facility tech supporting healthcare operations; not focused on mental health care. |

| Cisco Systems | Networking/telehealth infrastructure used by healthcare providers, including telemedicine; not a mental health service provider |

| McKesson Corporation | Healthcare distribution & IT support services enabling care delivery; not a core mental health provider. |

| Clarity Health / Klarity Health | Digital care marketplace connecting patients with licensed providers, including mental health services, via online consultations. |

| Cerebral, Inc. (added) | U.S. telehealth company offering online mental health care, including therapy, counseling, and medication management for mental health conditions. |

By Component

By Age Group

By End User

By Disorder Type

January 2026

January 2026

January 2026

January 2026