February 2026

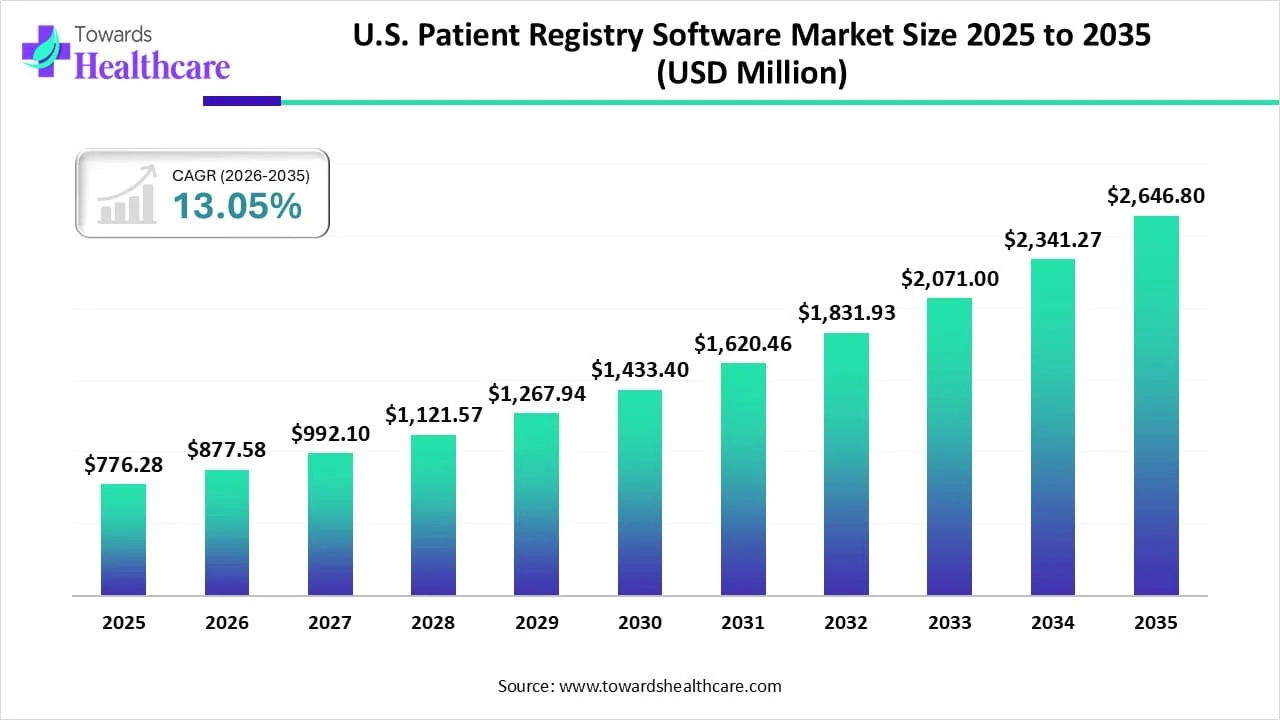

The U.S. patient registry software market size was reported at US$ 776.28 million in 2025 and is expected to rise to US$ 877.58 million in 2026. According to forecasts, it will grow at a CAGR of 13.05% to reach US$ 2646.8 million by 2035.

The U.S. patient registry software market is primarily driven by the rising adoption of electronic health records (EHRs). Healthcare providers mostly prefer software and platforms to manage patient data and provide personalized care. They collaborate to expand their services to a diverse patient population. Integrating artificial intelligence (AI) into patient registry software can automate data management. The future looks promising, with advancements in blockchain and cloud computing.

| Key Elements | Scope |

| Market Size in 2026 | USD 877.58 Million |

| Projected Market Size in 2035 | USD 2646.8 Million |

| CAGR (2025 - 2035) | 13.05% |

| Market Segmentation | By Registry Type, By Deployment Model, By Use Case/Application, By End-User, By Region |

| Top Key Players | IBM, IQVIA, McKesson Corporation, Health Catalyst, Oracle (Cerner), UnitedHealth Group, Conduent, Elekta, Dacima Software, Global Vision Technologies, ImageTrend, Syneos Health, Velos, Evado eClinical Solutions, Health Catalyst, FIGmd, Veeva Systems, ImageTrend |

The U.S. patient registry software market refers to digital platforms designed to collect, manage, and analyze structured patient data, typically organized around diseases, treatments, products, or health programs, within the United States. These solutions support healthcare providers, researchers, payers, and government agencies in tracking patient outcomes, managing chronic and rare conditions, powering clinical trials, and enhancing population health surveillance, often with integration into EHRs and support for real-world evidence (RWE).

AI plays a vital role in developing and functioning patient registry software by introducing automation. It can extract patient data from EHRs, lab systems, and other sources, eliminating the need for manual data entry. It can also provide real-time analytics of patient data, compare outcomes, and generate detailed reports. AI-based solutions can leverage natural language processing, predictive text, intelligent search, and other techniques to optimize administrative workflows. AI can also detect errors and fraud by cross-referencing information from various sources.

Increasing Hospital Admissions

The major growth factor for the U.S. patient registry software market is the increasing number of hospital admissions. The rising prevalence of chronic disorders and surgeries for acute disorders may lead to hospital admissions. Healthcare professionals aim to provide personalized care to patients. Patient registry software can reduce administrative burdens by simplifying patient data, enabling professionals to focus more on patient care. It can play a significant role in managing hospital admissions by centralizing patient information and providing tools for analysis and decision-making.

Limited EHR Usability

EHRs primarily focus on billing and avoiding legal issues, rather than on the clinical or research benefits of patient information sharing. This results in inflexible and difficult-to-use software, which can have negative consequences for patients and research studies.

What is the Future of the U.S. Patient Registry Software Market?

The market future is promising, driven by advancements in blockchain and cloud computing. The demand for blockchain in medical records is increasing, with the rising privacy concerns and the need to ensure patient data consistency. Blockchain technology helps maintain the security, integrity, and availability of patient data for healthcare providers. Additionally, cloud computing is an emerging technology that provides numerous benefits in patient registry software. It offers flexibility, cost-efficiency, and effective management of patients’ records. Patient and healthcare professionals can access medical data from anywhere and at any time.

By registry type, the disease registries segment held a dominant presence of the market in 2024. This is due to the rising prevalence of chronic disorders in the U.S. and the growing need to provide better treatment. The Alzheimer’s Prevention Registry, Cancer Genetics Network, and Fanconi Anemia Patient Registry are some national-level registries. These registries enable researchers to design clinical studies on a particular condition appropriately. Researchers and healthcare professionals also get a deeper understanding of the number of people with such a disease and their details.

By registry type, the product registries segment is expected to grow at the fastest CAGR in the market during the forecast period. Product registries provide information on drugs or medical devices involved in clinical research. Regulatory agencies use product registries to support regulatory decision-making about a drug’s safety and effectiveness. The U.S. Food and Drug Administration (FDA) has developed a framework for an RWE Program to support the approval of a new indication for a drug already approved.

By deployment model, the on-premises segment held the largest revenue share of the market in 2024. The on-premises system is widely preferred due to data privacy and the ability of healthcare professionals to personally use the system. Hospitals and other organizations have complete control over the registry software. The on-premises system eliminates the chances of data leakage and allows customization of data. Moreover, the system reduces monthly internet costs as it can be operated offline.

By deployment model, the cloud-based/SaaS segment is expected to grow with the highest CAGR in the market during the studied years. The cloud-based/SaaS platform provides superior benefits over the on-premises platform, as it can be operated and accessed from anywhere and at any time. It eliminates the need for any specialized infrastructure and can store a vast amount of patient data. It reduces IT staff’s responsibilities and capital expenses. Hence, it is suitable for small- and mid-sized organizations, enabling them to scale up within their budget.

By use case/application, the clinical research & trials segment contributed the biggest revenue share of the market in 2024. This is due to the increasing number of clinical trials in the U.S. The U.S. possesses favorable infrastructure for clinical trials, resulting in the highest number of trials in the world. As of 12th August 2025, a total of 184,452 studies were registered on the clinicaltrials.gov website. Patient registries help investigators to manage and analyze data and empower patient engagement.

By use case/application, the post-marketing surveillance segment is expected to expand rapidly in the market in the coming years. Post-marketing surveillance is essential to study the safety and effectiveness of drugs and medical devices. The increasing number of Phase 4 clinical trials boosts the segment’s growth. The U.S. FDA and other regulatory agencies emphasize the need for a post-marketing surveillance system that provides up-to-date insights. Patient registries can determine clinical effectiveness, adverse effects, and RWE of pharmaceuticals.

By end-user, the government agencies & public health authorities segment led the market in 2024. Government agencies & public health authorities manage complex patient data and provide access to researchers and patients. The National Institute of Health (NIH) governs patient registries in the U.S. This makes it easy for researchers to access diverse information from a single place. Additionally, patient registries assist government agencies in various functions like disease surveillance, research, and public health initiatives.

By end-user, the pharmaceutical/biotech companies segment is expected to witness the fastest growth in the market over the forecast period. The segmental growth is attributed to the presence of a favorable research infrastructure and skilled professionals. Patient registries provide relevant information to pharma & biotech companies, enabling them to develop novel drugs, biologics, and medical devices. The increasing number of startups potentiates the demand for patient registries.

Numerous factors influence the market, including the increasing number of clinical trials and favorable government support. The rising adoption of EHRs further potentiates the demand for patient registries. It is estimated that over 96% of the U.S. hospitals have adopted EHRs. The increasing investments by government and private organizations and the rising collaborations among key players contribute to market growth. The NIH is the largest federal funder of clinical trials in the U.S., accounting for approximately $3 billion in investment annually.

The South & Southeast region dominated the market in 2024. There are 828 and 6,595 not yet recruiting, recruiting, and active, not recruiting clinical trials in Mississippi and Florida, as of August 2025, respectively. There are about 30 critical access hospitals in Georgia. The region accounts for a total gross patient revenue of approximately $1.2 billion.

The West & Pacific region is expected to grow at the fastest CAGR in the market during the forecast period. The market growth in this region is mainly driven by the highest growth and the increasing adoption of advanced technology. The total gross patient revenue in the West & Pacific region was $848.9 million.

David Stefanich, CEO and Founder of Rymedi, commented that the partnership with Precision Genetics represents the company’s commitment to bringing Web3 and DeSci solutions to the global clinical trial and data management market. The collaboration was made to combine Precision Genetics’ PrecisionOp and Rymedi’s blockchain-enabled clinical trial and registry platform.

By Registry Type

By Deployment Model

By Use Case/Application

By End-User

By Region

February 2026

February 2026

January 2026

January 2026