February 2026

The global wound closure market size was estimated at USD 15.22 billion in 2025 and is predicted to increase from USD 16.3 billion in 2026 to approximately USD 30.35 billion by 2035, expanding at a CAGR of 7.15% from 2026 to 2035.

With a raised focus on prospective instances supporting innovations in wound closure solutions, such as hybrid/bioengineered materials, biodegradable sutures, and advanced sensors/devices. Along with this, many regions, especially South Korea, Japan, etc, are empowering effective wound closure measures in plastic & reconstructive surgery to meet the rising demand.

| Key Elements | Scope |

| Market Size in 2026 | USD 16.3 Billion |

| Projected Market Size in 2035 | USD 30.35 Billion |

| CAGR (2026 - 2035) | 7.15% |

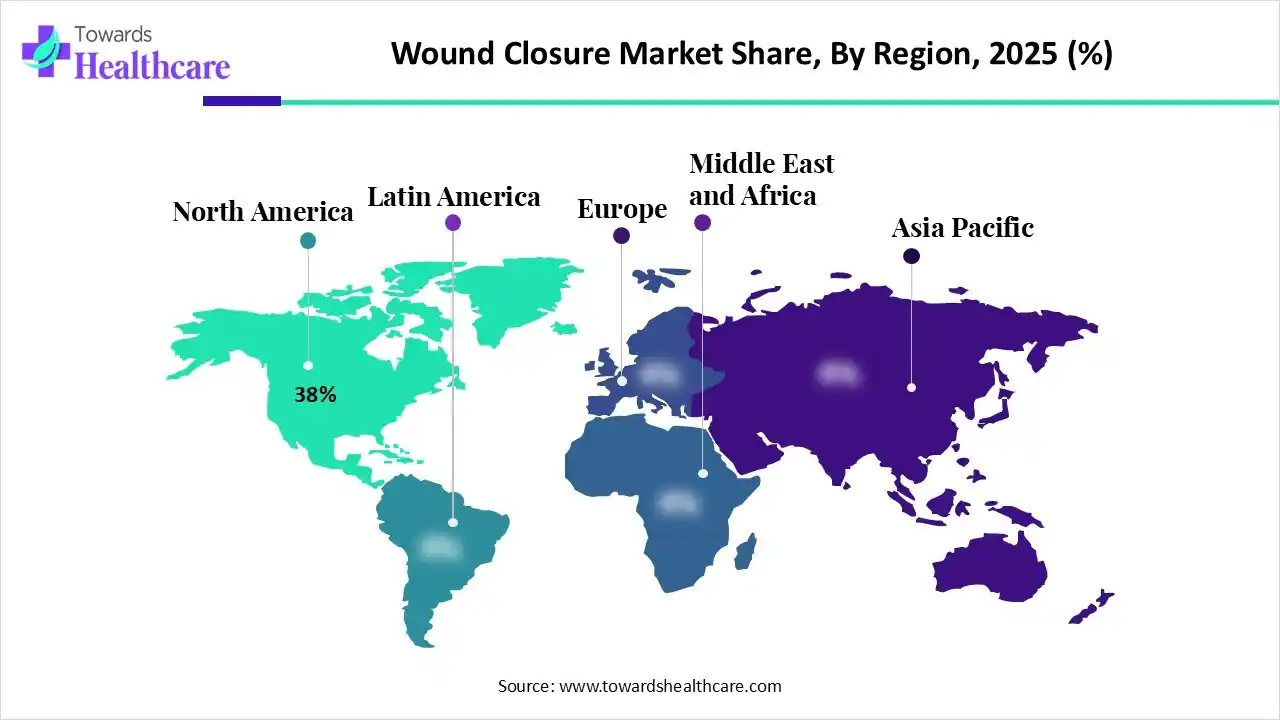

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Wound Type, By Material Type, By Application, By End-User, By Region |

| Top Key Players | Johnson & Johnson Services, Inc., Baxter, Smith+Nephew, Medtronic, 3M, Artivion, Inc., Boston Scientific Corporation, CooperSurgical Inc., Intuitive Surgical, MANI, INC. |

The global wound closure market comprises medical devices, materials, and technologies used to close surgical and traumatic wounds to promote healing, restore tissue integrity, and reduce infection risk. Market growth is driven by rising surgical volumes, increasing incidence of traumatic injuries, growing adoption of minimally invasive surgeries, advancements in bio-adhesives and absorbable materials, and an expanding geriatric population with higher wound care needs. The market includes sutures, staples, tissue adhesives, wound closure strips, sealants, and emerging closure technologies used across hospitals, ambulatory surgical centres, emergency care, and outpatient settings.

Firstly, the use of AI around the globe in the wound closure sector is leveraging multimodal AI models, especially the Deep Multimodal Wound Assessment Tool (DM-WAT), which unites image analysis with a patient's clinical data (comorbidities, medications, lab results) for the prediction of healing trajectories and recommends tailored treatment plans. Additionally, AI is assisting in RPM through various mobile applications, such as WoundAIssist, which enables automated segmentation and size calculation, along with remote monitoring of wound progression.

Currently, the market is driving the development of advanced dressings that can facilitate moisture balance, exudate absorption, and antimicrobial properties. Meanwhile, "smart" dressings with sensors monitor healing in real-time.

Nowadays, the worldwide rising use of biodegradable materials (e.g., PLA/PCL) for strips and scaffolds further encourages sustainability, supportive healing, whereas bioengineered composites act like natural tissue.

Ongoing extensive research activities are fostering the regenerative potential of stem cells, like adipose-derived stem cells, hair follicle stem cells, and recombinant growth factors to speed up tissue repair and lower scarring, with an emphasis on optimal delivery methods.

Researchers are putting efforts into the progression of 3D bioprinting technology to develop custom-tailored, multi-layered skin grafts using the patient's own living cells.

| Overview | Description |

| Zegenex (December 2025) | It received a $215,000 social-mission investment from the Richard King Mellon Foundation to assist formulation improvements and preclinical testing of Zegen-15, a small-molecule cream for treating chronic wounds, initiated with Diabetic Foot Ulcers (DFUs). |

| Plasmacure (July 2025) | Made a €6 million Series A investment to scale worldwide and expand the adoption of PLASOMA as a next-generation solution for complex wounds, like diabetic foot ulcers, venous leg ulcers, and pressure ulcers. |

| Venture Medical (July 2025) | Led a strategic investment in Plasmacure to bolster advanced cold plasma technology for chronic wound healing. |

Which Product Type Led the Wound Closure Market in 2025?

In 2025, the sutures segment captured an approximate 45% revenue share of the market. Globally rising demand for minimally invasive surgery and raised emphasis on infection prevention are driving the adoption of sutures. The latest developments comprise mecho-electrical sutures developed by China, and next-gen pressure-spun PLGA sutures. Immersive efforts include triclosan/silver coatings on sutures for the mitigation of bacterial adhesion and reducing surgical site infections (SSIs).

Tissue Adhesives & Sealants

The tissue adhesives & sealants segment will expand at approximately 9–11% CAGR. More effective adhesives offer rapid, less painful, scar-reducing options to staples/sutures, which fit MIS requirements. Researchers are studying designing bio-based adhesives (fibrin, collagen, mussel-inspired) for raised performance and adoption. Recently, MedTrade created marine collagen-infused adhesives, and other firms are leveraging alginate hydrogels to elevate tissue adhesion, carry drugs/cells, and support repair.

How did the Surgical Wounds Segment Dominate the Market in 2025?

The surgical wounds segment led with nearly 50% share of the wound closure market in 2025. Day by day, many regions are facing a huge burden of general, orthopedic, plastic, and cardiovascular surgeries, with the expanded popularity of plastic/reconstructive surgery and the desire for scar-free results, bolstering the adoption of innovative solutions. Companies are evolving nanofibrillar cellulose (FibDex) and biosynthetic cellulose (Epiprotect) dressings to boost healing and match natural collagen.

Traumatic Wounds

In the coming era, the traumatic wounds segment will expand at a nearly 8–10% CAGR. In the highly developed and developing cities, there are increasing cases of road accidents, industrial incidents, and falls resulting in severe cuts, fractures, and burns, which are widely demanding immediate, effective closure. For these cases, healthcare professionals are using devices like DermaClip and ClozeX, which facilitate needle-free, single-use options, without piercing or compressing the skin.

Which Material Type Led the Wound Closure Market in 2025?

In 2025, the synthetic materials segment captured an approximate 55% share of the market. They often induce minimal tissue reactions and carry a reduced risk of infection. Polyglycolic acid, polydioxanone, and poliglecaprone are broadly used to eliminate the need for suture or staple removal. Recently, the FDA cleared the NovoSorb Biodegradable Temporizing Matrix (BTM), a synthetic biodegradable polyurethane foam, which offers a scaffold for cellular infiltration and vascularization in complex wounds.

Hybrid/Bioengineered Materials

The hybrid/bioengineered materials segment will grow at approximately 10–12% CAGR. Their development provides the healing process by mimicking the skin's natural extracellular matrix (ECM), and assists cell progression, migration, and tissue regeneration. Currently, handheld bioprinters are in development, which could enable the in-situ application of cell-laden bioinks directly onto burn or large trauma wounds. Also, researchers are studying decellularized adipose matrix hydrogels pre-encapsulated with human adipose-derived stem cells.

What Made the General Surgery Segment Dominant in the Market in 2025?

In the wound closure market, the general surgery segment held an approximate 35% share in 2025. A prominent driver is a rise in cases of diabetes, obesity, and cardiovascular concerns, resulting in more surgical interventions and chronic wounds, such as diabetic ulcers and pressure sores, which are fostering demand for advanced closure. The era is exploring advanced bioabsorbable materials, antimicrobial solutions, smart monitoring systems, and novel applications for existing technologies, including negative pressure wound therapy (NPWT).

Plastic & Reconstructive Surgery

In the future, the plastic & reconstructive surgery segment is predicted to expand at a nearly 11–13% CAGR. The market has been transforming longer-chain cyanoacrylates, like Dermabond and LiquiBand, as alternatives or adjuncts to sutures for superficial closures, to facilitate rapid application times and enhanced cosmetic results. Ongoing groundbreakings in microvascular anastomosis, particularly coupling devices, have accelerated the effectiveness and reliability of free tissue transfer for complex reconstruction.

Why did the Hospitals Segment Lead the Wound Closure Market in 2025?

By capturing nearly 60% share, the hospitals segment registered dominance in the market in 2025. Hospitals commonly use sutures, staples, adhesives, and staples to adipose tissue, which further prevents infection, lowers scarring, with minimal dead space and controlled haemostasis. Additionally, using Negative Pressure Wound Therapy (NPWT), termed as vacuum-assisted closure (VAC), which uses controlled sub-atmospheric pressure to the wound bed via a foam dressing.

Ambulatory Surgical Centers (ASCs)

The ambulatory surgical centers (ASCs) segment will expand at approximately 9–11% CAGR. They mainly employ advanced sutures and sometimes zip-type closures in orthopedic cases, such as joint replacements, fracture fixations, and also handle emergency or minor trauma instances. In the case of blepharoplasty or other facial surgeries, ASCs highly favor techniques, specifically tissue adhesives and fine absorbable sutures.

How did the Conventional Suturing Segment Dominate the Market in 2025?

The conventional suturing segment captured nearly 48% revenue share of the wound closure market in 2025. Primarily includes the use of needle and thread (absorbable or non-absorbable) to stitch wounds, and provide accurate edge alignment, with common techniques, such as Simple Interrupted (individual stitches for strength) and Simple Running (continuous stitches for speed). Novelty extends to the needle itself, with developments, like specialized coatings (e.g., RediPass coating) to lower tissue drag and high-grade stainless steel.

Adhesive-Based Closure

The adhesive-based closure segment is estimated to grow at approximately 12–14% CAGR. An immersive development of these adhesives encompasses integrated biosensors, including in "smart bandages" for tracking physiological parameters like pH, temperature, and oxygen levels in real-time. Also, researchers are promoting the incorporation of silver or specific chemical compounds, especially polyhexamethylene biguanide (PHMB), for active inhibition of bacterial growth and reduction of the risk of infection in chronic or high-risk wounds.

With a nearly 38% share, North America dominated the market in 2025. The emergence of significant drivers is a rise in technological innovation (bio-engineered products, smart dressings, adhesives) for quicker healing, strong healthcare infrastructure, & favorable reimbursement. According to the American College of Surgeons, per year, around 4 million patients undergo emergency general surgery procedures, which demand advanced wound closure solutions.

The U.S. in the wound closure market is stepping towards reducing invasiveness, lowering infection risk, enhancing aesthetic outcomes, and integrating smart technologies for real-time monitoring and precision care.

In January 2025, the Suture-TOOL System received FDA approval and was established for automating and standardising abdominal wall closures using a robotic arm to ensure persistent, precise suturing.

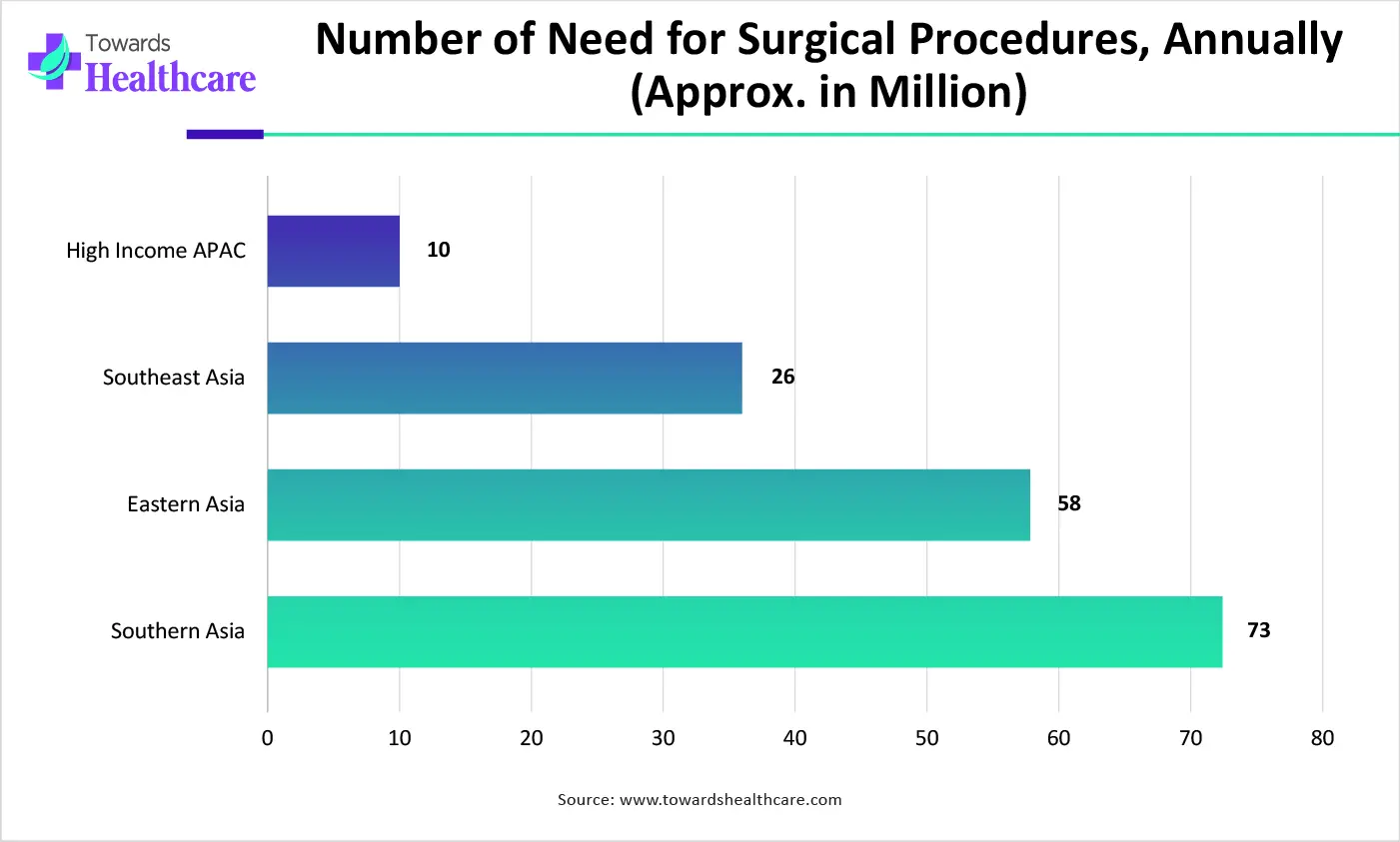

In the future, the Asia Pacific will expand with approximately 11-13% CAGR in the market, due to the growing cases of diabetes, cardiovascular issues, and pressure ulcers, which are demanding a huge need for efficient wound management. Alongside, China, India, and Japan are actively investing in hospitals, rural healthcare, and specialized wound centers, with optimized access.

Whereas China is consistently bolstering novelty in the wound closure market, such as they have developed a Chinese herb microneedle (CHMN) patch, by using extracts from Premna microphylla and Centella asiatica, in rat studies to support collagen deposition, angiogenesis, and tissue reconstruction, with other antibacterial properties.

With notable growth, the market in Latin America is promoting new research activities by using rich medicinal plants for wound healing. Recently, they have documented and assessed the effectiveness of different local plant extracts and formulations, especially those from the Piper and Asteraceae families, for probable integration of traditional knowledge with modern medicine.

Brazil has been leveraging regulatory breakthroughs and innovative collaborations to boost the treatment of chronic and acute wounds.

| Company | Description |

| Johnson & Johnson Services, Inc. | A company specializes in advanced sutures, knotless devices, and topical skin adhesives. |

| Baxter | This mainly explores adjunct hemostatic agents and surgical sealants used in operating rooms. |

| Smith+Nephew | It facilitated diverse advanced dressings, negative pressure wound therapy (NPWT) systems, and bioactive products. |

| Medtronic | A vital leader facilitates a comprehensive wound closure portfolio, such as advanced barbed sutures, different absorbable and non-absorbable sutures, topical skin adhesives, endoscopic suturing tools, and accessories. |

| 3M | A company provides everything from simple adhesive strips, such as Steri-Strip Reinforced Skin Closures, to advanced negative pressure wound therapies (NPWT), like Prevena Therapy, and Veraflo Therapy. |

| Artivion, Inc. | This primarily leverages surgical sealants and hemostatic agents, used as adjuncts to the standard surgical method. |

| Boston Scientific Corporation | It specifically facilitates a comprehensive portfolio of devices for endoscopic wound (defect) closure. |

| CooperSurgical Inc. | A company specialises in various devices for wound closure, such as the Carter-Thomason CloseSure System. |

| Intuitive Surgical | This emphasises instrumentation that allows precise suturing and stapling within minimally invasive robotic procedures. |

| MANI, INC. | It unveiled Manipler Disposable Skin Staplers, a variety of surgical sutures and specialized tools, including Vessel Knives. |

Mainly, the need for R&D expenditures for novel solutions (e.g., bioengineered skin substitutes, smart dressings) results in increased product costs, which can restrict adoption, particularly in emerging economies or budget-conscious healthcare systems.

By Product Type

By Wound Type

By Material Type

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026