February 2026

The global pain management drugs market size is calculated at USD 84.1 billion in 2024, grew to USD 87.58 billion in 2025, and is projected to reach around USD 126.17 billion by 2034. The market is expanding at a CAGR of 4.14% between 2025 and 2034.

The pain management drugs market is rapidly expanding due to growing research and development activities and the rise of over-the-counter (OTC) medications. Government and private bodies provide funding for conducting research activities. Prominent players collaborate to access advanced technologies and expand their product pipeline. Artificial intelligence (AI) assists researchers in designing and developing novel pain management drugs. The increasing demand for personalized medicines presents future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 87.58 Billion |

| Projected Market Size in 2034 | USD 126.17 Billion |

| CAGR (2025 - 2034) | 4.14% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Indication, By Route of Administration, By Distribution Channel, By End-User, By Region |

| Top Key Players | AbbVie Inc., Amgen Inc., AstraZeneca, Bayer AG, Boehringer Ingelheim, Bristol-Myers Squibb, Endo International plc, GlaxoSmithKline (GSK), Grünenthal GmbH, Johnson & Johnson (Janssen Pharmaceuticals), Mallinckrodt Pharmaceuticals, Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Viatris Inc. |

The pain management drugs market refers to the pharmaceutical segment that develops and commercializes medications aimed at reducing or managing acute and chronic pain, also known as analgesics. These drugs are prescribed across multiple indications such as cancer, musculoskeletal disorders, neuropathic pain, post-operative recovery, migraines, and other chronic illnesses. The market spans various drug classes, including opioids, NSAIDs, anticonvulsants, antidepressants, anesthetics, and other non-opioid agents, distributed via hospital, retail, and online pharmacy networks across regions.

FDA Approval: Regulatory agencies like the U.S. Food and Drug Administration (FDA) regulate the approval of pain management drugs.

Increasing Investments: Pharmaceutical startups raise funding to develop novel pain management drugs and expand their product pipeline.

AI can transform the market by designing and developing effective pain management drugs that are tailored to individual needs. It can save time and cost of the complex R&D process. AI and machine learning (ML) algorithms can analyze large datasets and predict pharmacokinetic and pharmacodynamic properties of novel drug candidates. AI can recommend treatment plans, predict treatment outcomes, and identify potential risks. Apart from research, AI and ML can streamline the manufacturing and supply chain process, delivering the right drug to the right patient.

Rising Prevalence of Pain Disorders

The major growth factor for the pain management drugs market is the rising prevalence of acute and chronic pain. This is due to increasing sports injuries, musculoskeletal disorders, or neuropathic pain. It is estimated that 1 in 5 adults suffer from pain globally, and another 1 in 10 adults are diagnosed with chronic pain annually. Acute and chronic pain lead to disability, loss of independence, and poor quality of life. It also poses an economic burden on individuals and healthcare systems, resulting in reduced productivity. These aspects necessitate the timely management of acute and chronic pain.

Side Effects

Pain management drugs cause potential side effects, such as constipation, nausea, drowsiness, and slow breathing. This limits the long-term use of pain management drugs, restricting market growth.

What is the Future of the Pain Management Drugs Market?

The market future is promising, driven by the increasing demand for personalized medicines. Scientists focus on developing novel biologics that could offer patients safer and more effective alternatives to currently available treatments. Biologics can be found effective against a wide range of disorders, including cancer, neuropathic pain, and inflammatory pain. Conventional small-molecule drugs have limited efficacy and are unable to penetrate the central nervous system. Biologics are designed based on patients’ conditions and genetic profiles.

By drug class, the opioids segment held a dominant presence in the market in 2024. This is due to the high efficacy of opioids against acute and chronic pain and faster relief. Opioids, such as oxycodone, hydrocodone, and morphine, block pain messages in the brain and boost the feelings of pleasure. Studies have demonstrated that patients with opioids report approximately a 30% decrease in pain from the baseline. Opioids are preferred for managing acute pain during and after surgery.

By drug class, the anticonvulsants segment is expected to grow at the fastest CAGR in the market during the forecast period. Researchers have found the significance of anticonvulsants in managing neuropathic pain caused by damaged nerves. Novel anticonvulsant drugs, such as gabapentin and pregabalin, are emerging as pain-relieving medications with fewer side effects. They are particularly effective in the treatment of post-herpetic neuralgia, diabetic neuropathy, and spinal cord injury.

By indication, the musculoskeletal disorders segment held the largest revenue share of the market in 2024. This is due to the rising prevalence of musculoskeletal disorders and the increasing sedentary lifestyles among individuals. Rheumatoid arthritis, low back pain, and osteoarthritis are the most common musculoskeletal disorders, affecting the quality of life of individuals. This is due to the growing geriatric population and post-menopausal women. According to a study published in The Lancet, 619 million people were suffering from low back pain in 2020, and it is projected to reach 843 million by 2050.

By indication, the neuropathic disorders segment is expected to grow with the highest CAGR in the market during the studied years. Neuropathic disorders are caused by nerve damage. Pain management drugs can specifically target and calm the dysfunctional nerves causing abnormal pain signals. Adjuvant pain medications, such as anticonvulsants and antidepressants, are commonly used to treat nerve pain. The increasing prevalence of chronic disorders, such as epilepsy and diabetes, boosts the segment’s growth.

By route of administration, the oral segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the ease of administration and the availability of OTC drugs. Oral drugs, such as tablets, capsules, and syrups, are taken by patients of all age groups. The growing demand for non-invasive drug delivery and fewer side effects make oral drugs a suitable choice. Novel delivery systems, including nanocarriers, micelles, cyclodextrins, and lipid-based carriers, alter the delivery of oral drugs.

By route of administration, the transdermal segment is expected to expand rapidly in the market in the coming years. The transdermal route offers targeted delivery of analgesics to the site of action. It is primarily used in conditions where an extended treatment period is required. Transdermal patches eliminate the first-pass metabolism pathway of conventional oral drugs. The drug delivered through these patches is directly circulated in the bloodstream, providing enhanced efficacy and bioavailability.

By distribution channel, the retail pharmacies & drug stores segment led the market in 2024. This is due to the availability of generic alternatives and OTC drugs. Patients mostly prefer purchasing painkillers from retail pharmacies due to the increasing number of drug stores and the presence of skilled professionals. Pharmacists can guide a patient about the type of analgesic based on conditions and the appropriate dosing regimen. Retail pharmacies offer numerous services, including 24/7 facilities and special discounts.

By distribution channel, the online pharmacies segment is expected to witness the fastest growth in the market over the forecast period. Online pharmacies enable patients to purchase a pain management drug in the comfort of their homes. The increasing geriatric population and the burgeoning e-commerce sector propel the segment’s growth. Online pharmacies offer free home delivery service, special discounts, and virtual consultations.

By end-user, the hospitals & clinics segment accounted for the highest revenue share of the market in 2024. This is due to the increasing number of hospital admissions and favorable infrastructure. Patients mostly prefer hospitals & clinics due to the presence of experts from multidisciplinary fields and favorable reimbursement policies. Hospitals are part of clinical trials, allowing patients to access novel medications before market approval.

By end-user, the specialty pain management centers segment is expected to show the fastest growth over the forecast period. Specialty clinics have suitable capital investment to adopt advanced drugs and devices for pain management. Skilled professionals provide personalized treatment and care to patients. They treat a disease from its root cause and help patients resume their normal lifestyle.

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and a robust healthcare infrastructure are the major growth factors in North America. The growing geriatric population and favorable government support boost the market. The increasing investments and collaborations among key players augment market growth.

Key players, such as AbbVie, Inc., Bristol Myers Squibb, and Pfizer, Inc., are the major contributors to the market in the U.S. According to the Vintage 2024 Population Estimates, approximately 18% of the total population in the U.S. is 65 years and above. The FDA recently approved a new guidance titled “Development of Non-Opioid Analgesics for Chronic Pain” to accelerate safe and effective non-opioid treatments and reduce prescription-related opioid misuse.

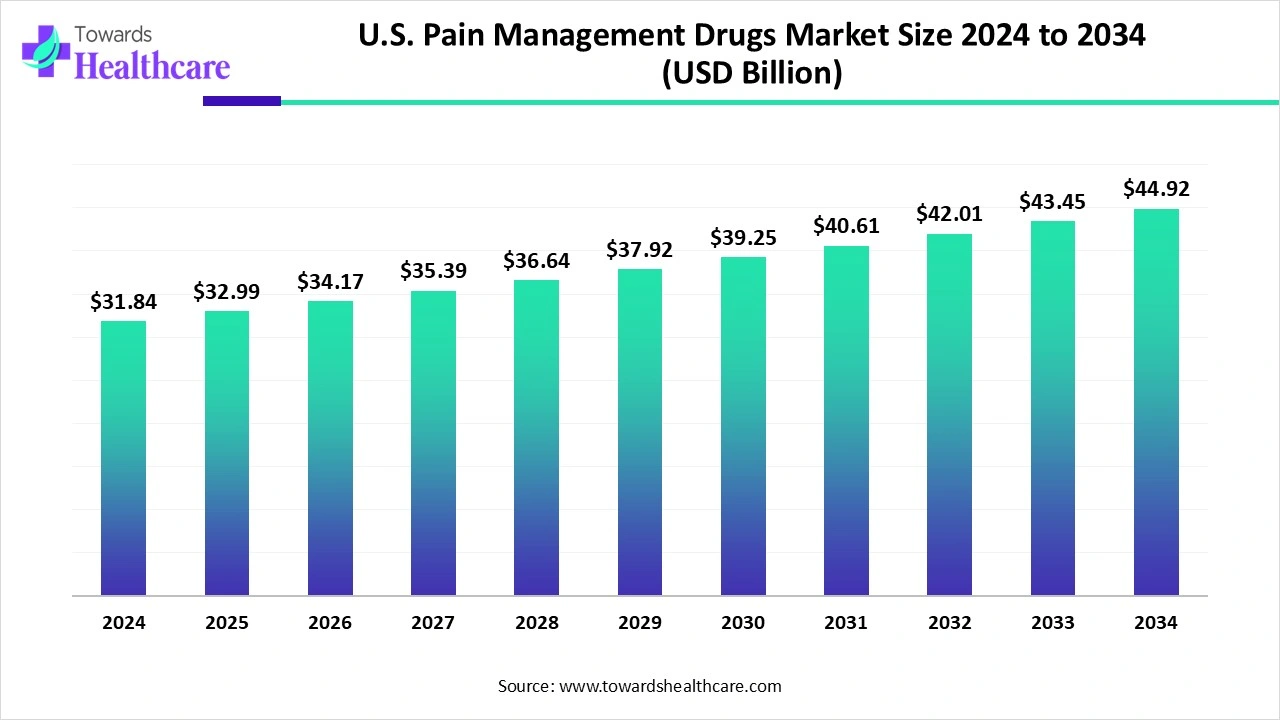

The U.S. pain management drugs market is valued at US$ 31.84 billion in 2024, rising to US$ 32.99 billion in 2025. Looking ahead, it is expected to reach around US$ 44.92 billion by 2034, growing at a steady CAGR of 3.64% from 2025 to 2034.

According to the National Initiative for the Care of the Elderly, around 18.9% of the total population was above 65 years in 2024, and is estimated to increase to 24% by 2040. More than 41% of the adult population in Canada uses some type of pain management drug.

Asia-Pacific is expected to grow at the fastest CAGR in the pain management drugs market during the forecast period. The rising prevalence of chronic pain, the burgeoning healthcare sector, and growing awareness bolster market growth. Government organizations provide funding to develop novel pain management drugs and launch initiatives for screening and early diagnosis of pain disorders. The increasing prevalence of chronic disorders, such as diabetes, epilepsy, and cancer, potentiates the risk of pain disorders.

The Health and Global Policy Institute (HGPI) reported that approximately 22.5% of the adult population is estimated to be living with chronic pain in Japan, accounting for 23.15 million people. Chronic pain imposes an economic burden of 2 trillion yen annually, due to loss of productivity among the working population.

Low back pain is a major public health concern among adults in India, affecting over 87.5 million people. The demand for pain management drugs is increasing in India, owing to growing awareness, ease of access to analgesics, and self-medication trends.

R&D activities for pain management drugs result in the development of personalized therapy and non-addictive prescription medicines. Researchers also develop new delivery systems to provide targeted treatment.

Key Players: Vertex Pharmaceuticals, Inc., Johnson & Johnson, and Novartis AG.

Clinical trials are conducted to assess the safety and efficacy of new drug candidates or to assess the therapeutic potential of licensed medicines for extended applications. Based on the clinical trials data, regulatory agencies provide marketing approval to the drug.

Key Players: Propella Therapeutics, Johnson & Johnson, Medidata

Patient support & services refers to providing tailored medications to patients and monitoring for their side effects. Healthcare professionals also explain the dose and delivery system to patients.

Reshma Kewalramani, M.D., CEO and President of Vertex, commented that the approval of JOURNAVX is a historic milestone for 80 million Americans who are prescribed a medicine for moderate-to-severe acute pain annually. The company has the opportunity to change the paradigm of acute pain management and establish a new standard of care.

By Drug Class

By Indication

By Route of Administration

By Distribution Channel

By End-User

By Region

February 2026

February 2026

January 2026

January 2026