January 2026

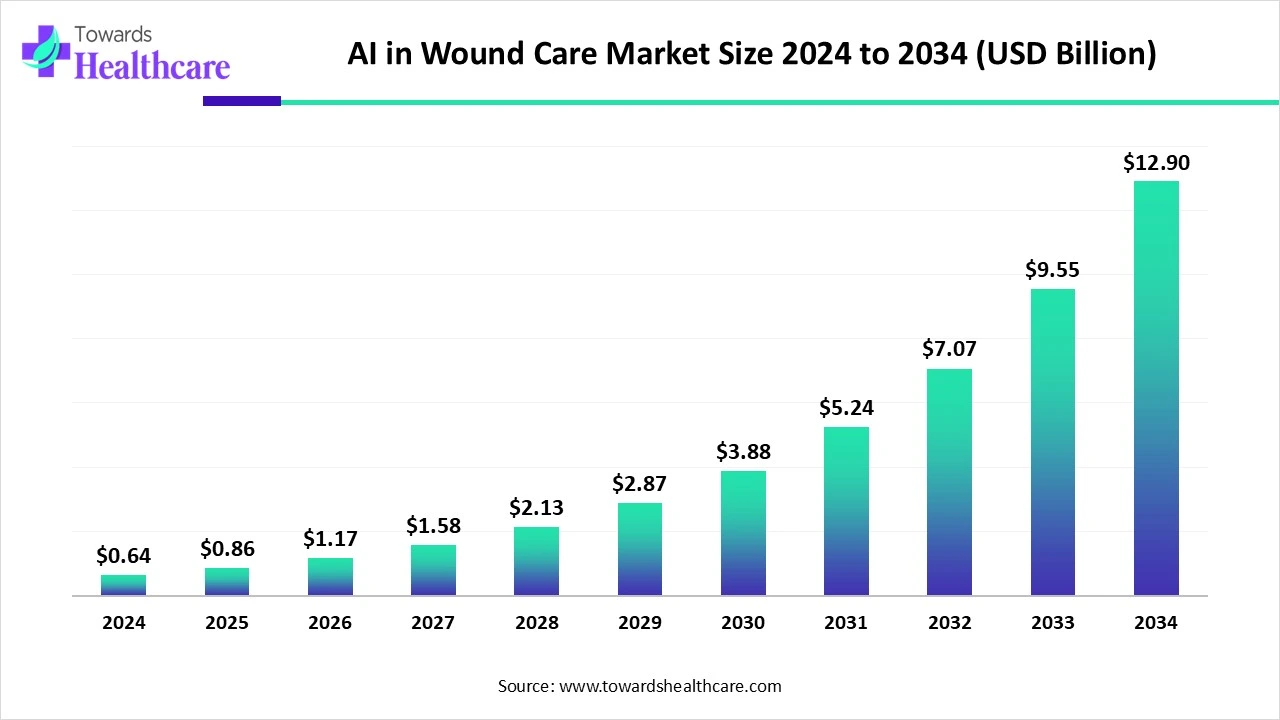

The global AI in wound care market size is calculated at USD 0.64 in 2024, grew to USD 0.86 billion in 2025, and is projected to reach around USD 12.9 billion by 2034. The market is expanding at a CAGR of 35.03% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 0.86 Billion |

| Projected Market Size in 2034 | USD 12.9 billion |

| CAGR (2025 - 2034) | 35.03% |

| Leading Region | North America |

| Market Segmentation | By Wound Type, By Type of Acute Wound, By Type of Chronic Wound, By Technology, By End-User, By Region |

| Top Key Players | Aldevron, eKare, Healthy.io, Kronikare, Intellicure, Perceptive Solutions, Spectral AI, Swift Medical, The Wound Pros, Tissue Analytics, Wound Vision |

Complicated procedures for high-risk multimorbid patients and wounds that are difficult to heal have become more common as the population ages and chronic diseases increase. AI has great potential to transform wound care and management, improving hospitalized patient care and allowing better time management for healthcare professionals. In the last three years, machine learning (ML) and deep learning (DL) have been at the forefront of current advances in artificial intelligence. With the use of sophisticated algorithms and large databases, artificial intelligence (AI) makes it possible to quickly analyze enormous collections of wound photos in order to precisely identify, categorize, and forecast the properties of wound tissue. Crucially, the continuous learning of AI can increase accuracy.

Rising Chronic Wounds due to Diabetes

The AI in wound care market is expected to expand quickly due to the rising incidence of diabetes. High blood glucose levels are a hallmark of diabetes, a chronic illness that can cause serious side effects like heart disease, renal failure, neuropathy, and visual loss. Ageing populations, as the risk of type 2 diabetes rises with age, and growing obesity rates, which raise the disease's risk, are the main factors of the rise in diabetes incidence. By offering accurate wound evaluations and individualized treatment plans, AI in wound care helps control diabetes and enhances the efficacy and efficiency of diabetic ulcer care.

Cost Constraints

Advanced wound care software and technology can be expensive, which can significantly limit market expansion. Because these items frequently use pricey materials and technology, individuals and healthcare facilities with little funding may find them more difficult to obtain. Cost factors, particularly in areas with limited healthcare resources, may influence uptake and restrict market growth.

Support due to Government Regulations

Furthermore, government policies and regulatory actions encouraging the use of digital health technologies are significantly contributing to the market expansion for AI-based wound care software. As the importance of AI technology in healthcare is recognized more and more, regulatory bodies like the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) are offering precise guidelines on the regulatory paths for medical devices that use AI. The development and commercialization of novel products and services to meet unmet clinical requirements is encouraged by this regulatory backing, which also encourages innovation and investment in AI-based wound care solutions.

By wound type, the chronic wounds segment dominated the AI in wound care market in 2024 and is anticipated to witness the fastest growth rate during the forecast period. Two million of the almost 7 million Americans who suffer from chronic sores have diabetic foot ulcers. One member of every four households has a chronic wound. Healthcare systems are heavily burdened by chronic ulcers, which need accurate monitoring and evaluation in order to be effectively treated. AI is emerging as a viable tool in healthcare, especially in wound care, as more and more mobile apps are being created to assist doctors and nurses. These smartphone applications seem to have a lot of promise and can be useful resources for industry experts.

By type of acute wound, the surgical site infections segment led the AI in wound care market in 2024. The advancement of healthcare has been significantly influenced by surgical site infections (SSIs). Artificial intelligence (AI) was developed in response to the shortcomings of traditional methods for addressing the problems that SSIs face. Artificial intelligence could be able to assist with SSI decision detection and assistance. In addition to potentially improving the scalability and cost of remote surgical wound assessment, machine learning (ML)-based approaches have recently been used to address aspects of the postoperative wound healing process.

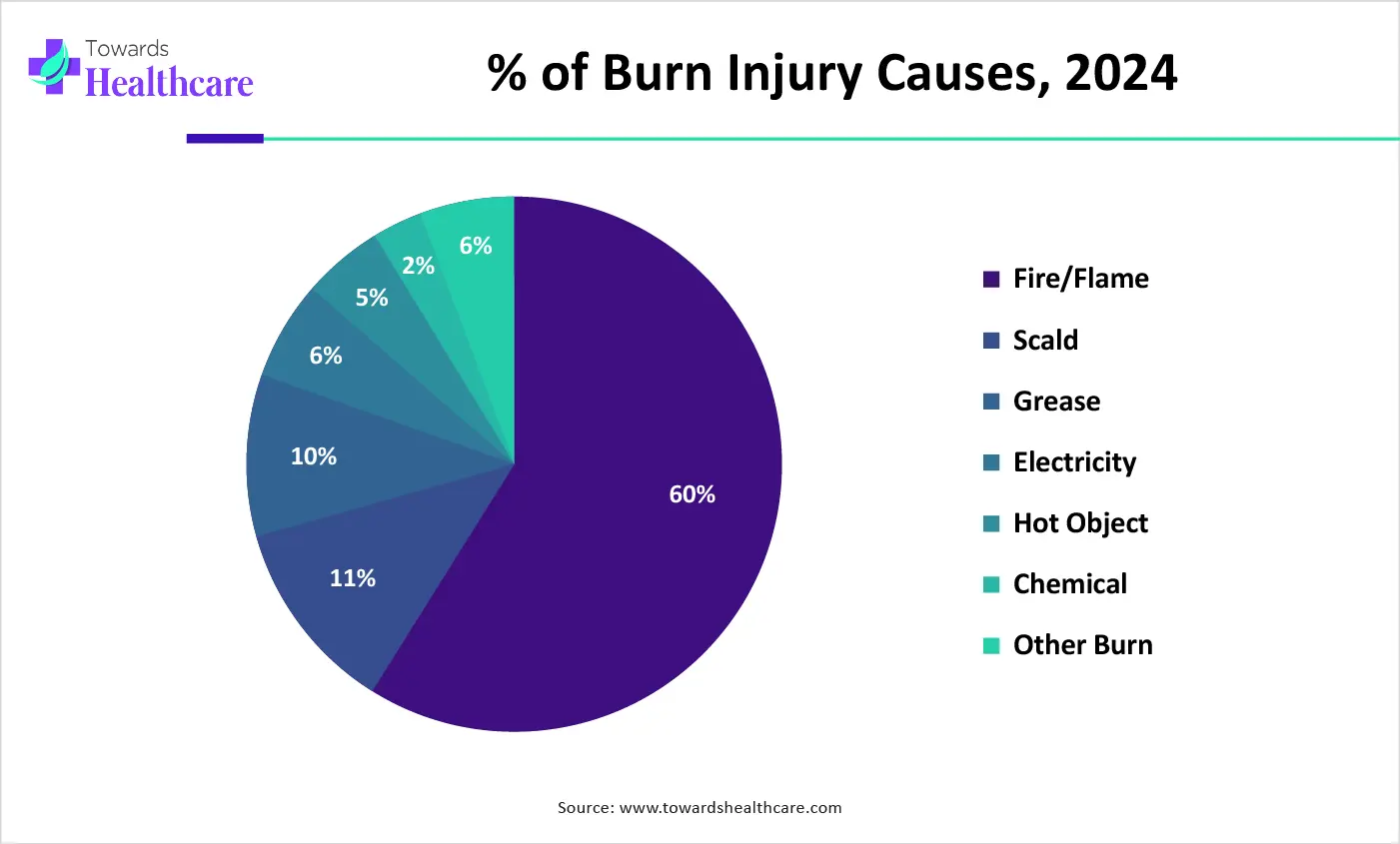

By type of acute wound, the burns segment is estimated to be the fastest-growing in the AI in wound care market during the forecast period. The World Health Organization estimates that each year, 300,000 people die from burn injuries. The immediate and long-term consequences of large burns are associated with significant morbidity. Machine learning (ML), a subset of artificial intelligence (AI), focuses on algorithms that can quickly spot patterns in data, a task that is typically outside the purview of human intellect or traditional statistical methods. Medical professionals are starting to apply machine learning-based methods in the field of burns. These algorithms have been shown to properly measure burn depths and survival, and to forecast patients who may be at risk of sepsis or acute renal impairment more rapidly and reliably than current standards and technologies.

By type of chronic wound, the venous ulcers segment led the AI in wound care AI in wound care market in 2024 and is expected to grow at the fastest CAGR during 2025-2034. Venous leg ulcers (VLUs) are the most prevalent kind of CLU, accounting for about 70% of all occurrences. CLU affects 0.6–3% of adults over 60 and over 5% of those over 80. AI-based automated techniques may be used to identify the clinical class and detect the existence of chronic venous disease.

By technology, the machine learning segment led the AI in wound care market in 2024. Hard-to-heal wounds are becoming more common as the population ages and chronic illnesses increase, making it increasingly challenging for healthcare professionals to treat every patient simultaneously in a safe and efficient manner. One potential method to improve the wound care given to hospitalized patients while allowing medical personnel to better arrange their working hours is to use machine learning (ML) algorithms to detect and treat wounds that are difficult to heal.

By technology, the deep learning segment is anticipated to grow at the fastest CAGR in the AI in wound care market during the forecast period. Deep learning has gained popularity and yielded revolutionary results in wound care. There are no set guidelines that need to be adhered to. Deep learning-based image-based wound categorization has been a recent emphasis area. The promise of deep learning in image processing has become widely acknowledged since the convolutional neural network (CNN)-based AlexNet architecture produces outstanding results in the ImageNet competition. The CNN model is the most often used model in deep learning.

By end-use, the hospitals segment led the AI in wound care market in 2024. A wound care center located in a hospital is a crucial component of the multidisciplinary approach to wound therapy. Experts working together produce the ideal working environment for providing high-quality care for complex wounds through frequent communication and pooled resources. The approach is especially well-suited to treating serious wounds because it incorporates inpatient and outpatient post-operative care, easily accessible auxiliary services, specially trained personnel, and continuity of care from the outpatient clinic to admission to surgery.

By end-use, the home health agencies segment is estimated to be the fastest-growing in the AI in wound care market during 2025-2034. Home care allows patients to obtain professional nursing services in the convenience of their own homes, while also avoiding illness, encouraging health, and making public healthcare resources easily accessible. These days, home care services are increasingly being provided to patients who have chronic wounds. The increased prevalence of chronic diseases and the unmet out-of-hospital medical needs of the older population are driving up demand for home care services.

North America dominated the AI in wound care market in 2024. North America boasts a highly developed healthcare system that includes state-of-the-art research facilities, clinics, and hospitals. The adoption and integration of AI-based wound care technologies into current healthcare systems are made easier by this architecture. North American healthcare professionals are among the first to embrace digital health technologies because they see how they may improve patient care and expedite the delivery of healthcare. The quick adoption of AI-based wound care software is fueled by this proactive strategy.

For patients with chronic or non-healing wounds, US Wound Care & Hyperbaric Centers are committed to provide top-notch care and cutting-edge treatment alternatives. We assist patients in maintaining their independence and improving their quality of life, with a special emphasis on limb salvage. In the United States, a variety of events are organized to encourage wound care. For example, the 4th Advanced Woundcare Summit USA 2025 is the only event devoted to the woundcare industry, making it more than simply another industry meeting. Here, inventors, payers, regulators, and global leaders collaborate to transform ground-breaking science into affordable, accessible treatments from conception to commercialization.

An estimated $3.9 billion is spent on direct wound treatment expenses each year in Canada, where wounds account for 30 to 50% of all medical procedures. As the premier knowledge mobilization organization for wounds in Canada, Wounds Care (formerly CAWC) is a non-profit organization committed to improving wound management and prevention. Wounds Canada's primary publication is called Wound Care Canada. It is still the greatest resource for medical professionals looking for reliable information about wound treatment and prevention in clinical practice, and it is the only journal in Canada dedicated solely to wound care.

Asia Pacific is estimated to host the fastest-growing AI in wound care market during the forecast period. Rapidly emerging economies like China, India, Japan, and South Korea are included in the Asia Pacific area, where there is a growing emphasis on enhancing healthcare infrastructure and raising awareness of the significance of wound care. The region's need for cutting-edge wound care solutions is fueled by factors including the aging population, the increase in chronic disease prevalence, and growing healthcare costs.

The fast urbanization and economic transformation in China have led to an increase in the prevalence of diabetes, which is starting to put a strain on the healthcare system. Numerous individuals who are impacted are at a high risk of experiencing complications, such as foot issues. This initial initiative, which focuses on diabetic foot ulcers, is being carried out in China by the Chinese Tissue Repair Society (CTRS) with assistance from the World Diabetes Foundation and cooperation from Coloplast A/S. As a nationwide wound care program, the project aims to cover every region of China.

Diabetic foot ulcers are more common in India at the onset than they are globally. Amputations for diabetic foot ulcers are more common in India than is generally acknowledged. In 2024, India will face a severe diabetes issue since one-fourth of the world's diabetics reside there. The country most affected worldwide is India, where an estimated 21.2 crore (212 million) people have diabetes.

Europe is expected to grow significantly in the AI in wound care market during the forecast period due to its aging population and high prevalence of long-term conditions, including diabetes and heart disease. Germany, France, the UK, and other countries are putting national standards for wound care into effect, as well as investing in the education and training of care workers. Along with growing regulatory support for innovative wound-dressing technologies and the growing adoption of evidence-based treatment techniques, these developments are improving the quality of care and driving market expansion in healthcare settings. An increasing number of outpatient wound care services are sprouting as the market grows.

With its state-of-the-art diagnostic tools, skilled practitioners, and innovative treatments, Germany has emerged as a world leader in wound care. In Germany, the annual cost of treating chronic wounds is eight billion euros. German consumers have been searching for innovative wound care products and technologies. Both a higher awareness of the need for proper wound care and the desire for faster and more effective healing are driving forces behind this. Additionally, consumers are looking for products with long-lasting advantages and ease of use. Additionally, the need for environmentally friendly and sustainable wound care products is rising.

In April 2025, according to the study's corresponding author, Wenyao Xu, a professor of computer science and engineering, wound monitoring puts a burden on hospitals and other healthcare facilities. Our method has the potential to decrease secondary infections, lower the expenses of treating such infections, and free up time for nurses and other healthcare professionals to focus on other responsibilities.

By Wound Type

By Type of Acute Wound

By Type of Chronic Wound

By Technology

By End-User

By Region

January 2026

January 2026

January 2026

January 2026