February 2026

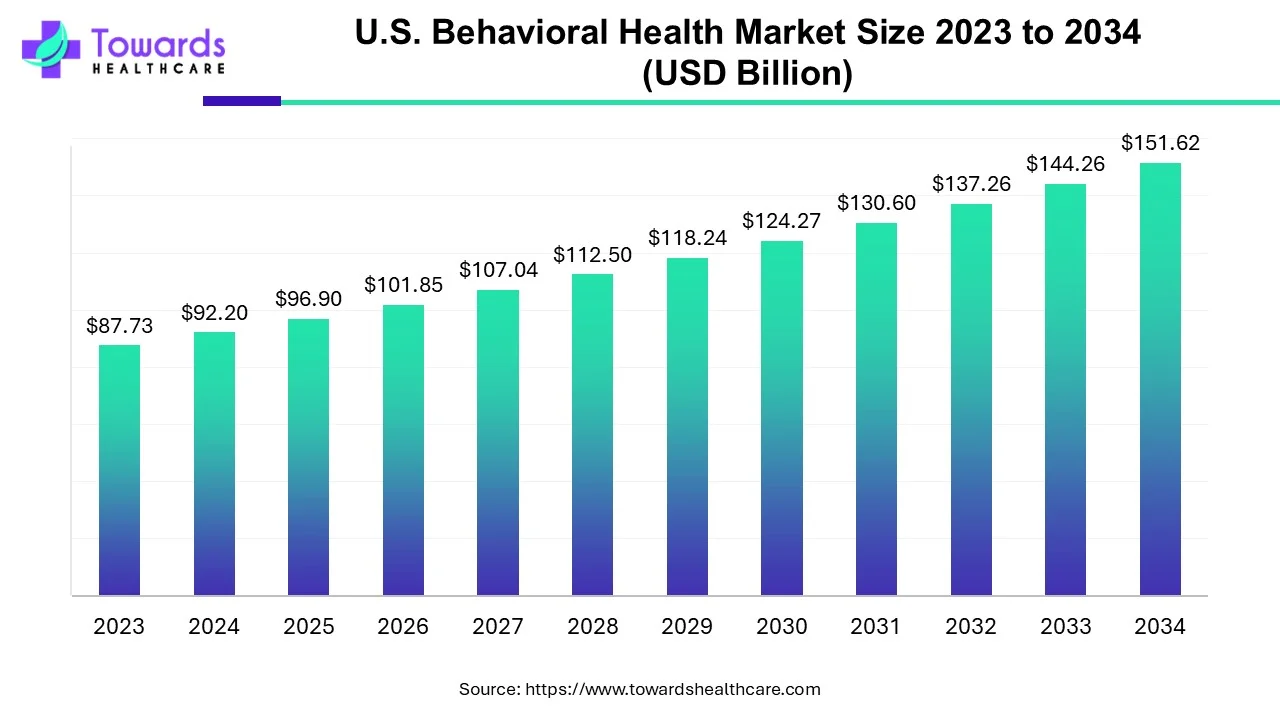

The U.S. behavioral health market size was calculated at USD 96.9 billion in 2025, to reach USD 101.84 billion in 2026 is expected to be worth USD 159.35 billion by 2035, expanding at a CAGR of 5.1% from 2024 to 2034.

| Key Elements | Scope |

| Market Size in 2025 | USD 96.9 Billion |

| Projected Market Size in 2035 | USD 159.35 Billion |

| CAGR (2026 - 2035) | 5.1% |

| Market Segmentation | By Service Type, By Disorder Type, By End-User |

| Top Key Players | Behavioral Health Group, Inc., Acadia Healthcare, Epic Health Services (Aveanna Healthcare), Universal Health Services, Ardent Health Services and CRC Health Group, IBH Population Health Solutions, CuraLinc Healthcare, North Range Behavioral Health, Promises Behavioral Health (Elements Behavioral Health) |

Behavioral health refers to a mental health condition leading to stress, anxiety, and depression. Destructive behavior is mainly caused due to eating disorders, substance abuse, self-injury, and addiction. Some behavioral health disorders are present from childhood, such as ADHD or autism. All these conditions require early detection, prevention, and treatment. These disorders are treated through rehabilitation programs, including psychotherapy along with medications. Psychotherapy includes cognitive behavioral therapy, exposure therapy, parent education, social skills training, and family support services. Additionally, alternative therapies are available, such as brain stimulation therapy.

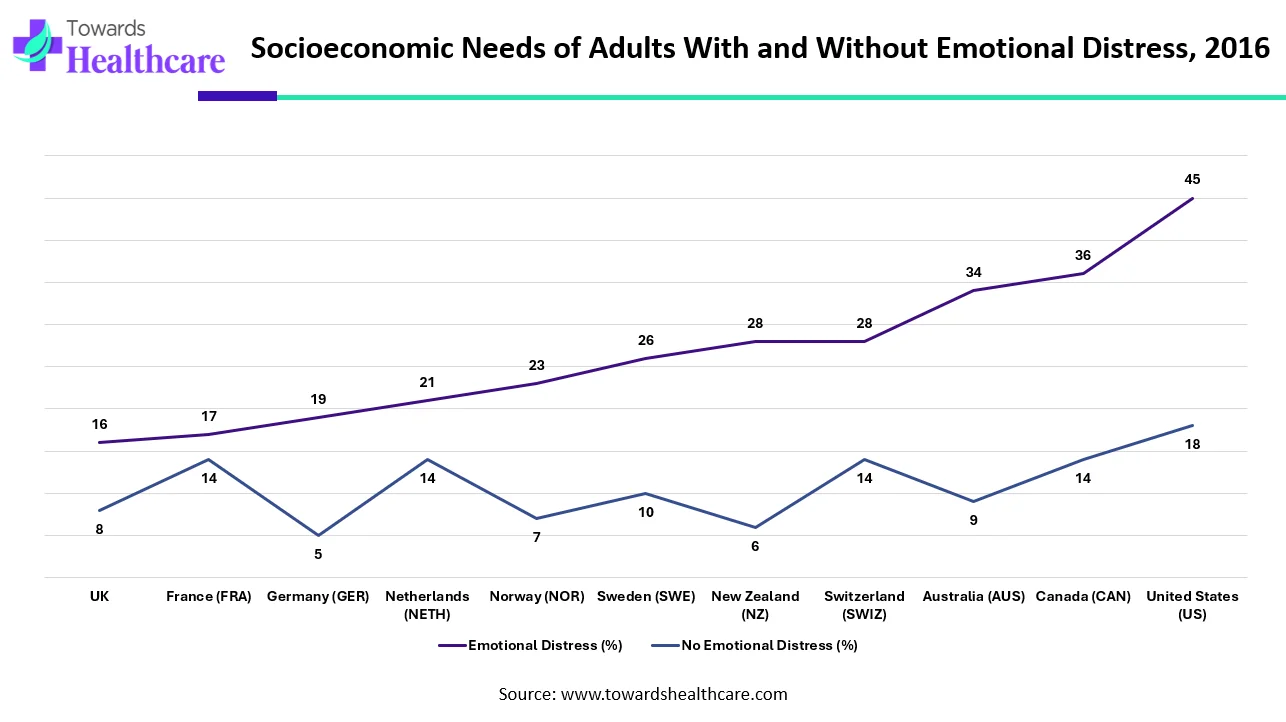

| Country | Emotional Distress (%) | No Emotional Distress (%) |

| UK | 16 | 8 |

| France (FRA) | 17 | 14 |

| Germany (GER) | 19 | 5 |

| Netherlands (NETH) | 21 | 14 |

| Norway (NOR) | 23 | 7 |

| Sweden (SWE) | 26 | 10 |

| New Zealand (NZ) | 28 | 6 |

| Switzerland (SWIZ) | 28 | 14 |

| Australia (AUS) | 34 | 9 |

| Canada (CAN) | 36 | 14 |

| United States (US) | 45 | 18 |

The data shows a strong link between emotional distress and people’s socioeconomic needs across different countries. In every country measured, adults who experience emotional distress report far more unmet needs than those who do not. The United States stands out the most. Nearly half of emotionally distressed adults in the U.S. said they “always” or “usually” faced socioeconomic challenges, which is more than double the rate of adults without distress. Canada and Australia also show large gaps, with distressed adults reporting significantly higher needs.

European countries such as the UK, France, Germany, and Switzerland show smaller but still notable differences. For example, in the UK, 16% of people with emotional distress struggled with socioeconomic needs, compared to only 8% of those without distress. Germany shows one of the lowest rates among people without distress, but the gap between distressed and non-distressed individuals remains clear.

Nordic countries, known for strong social support systems, still display elevated needs among emotionally distressed adults. In Sweden, Norway, and New Zealand, emotionally distressed individuals consistently report needs that are two to four times higher than those without distress. Overall, the data highlights a universal pattern: emotional distress strongly increases the likelihood of facing socioeconomic challenges, regardless of the country. Some countries show bigger gaps than others, but the trend remains the same people who struggle emotionally also tend to struggle more with basic economic and social needs.

| Mental Illness | Prevalence (%) |

| Anxiety disorders | 19.10% |

| Major depression | 8.30% |

| Post-traumatic stress disorder (PTSD) | 3.60% |

| Bipolar disorder | 2.80% |

| Borderline personality disorder (BPD) | 1.40% |

| Eating disorders | 1.20% |

| Obsessive-compulsive disorder (OCD) | 1.20% |

This chart highlights how common different mental health conditions are in the general population. Anxiety disorders stand out as the most widespread, affecting nearly one in five people. This shows how many individuals struggle daily with overwhelming worry, fear, or panic.

Major depression is the second most common condition, impacting more than 8% of people. It reflects how many individuals experience persistent sadness, loss of interest, or emotional exhaustion that affects their daily life. PTSD affects about 3.6% of people, often developing after traumatic events. Bipolar disorder, which involves extreme mood swings, impacts close to 3%. Though less common, these conditions can deeply shape the lives of those who experience them.

Borderline Personality Disorder affects around 1.4% of the population, while eating disorders and OCD each affect about 1.2%. Even though the percentages seem smaller, these conditions remain serious and require proper care and support. Overall, the data shows that mental health challenges are widespread, and many people quietly face struggles that deserve understanding, empathy, and access to proper treatment.

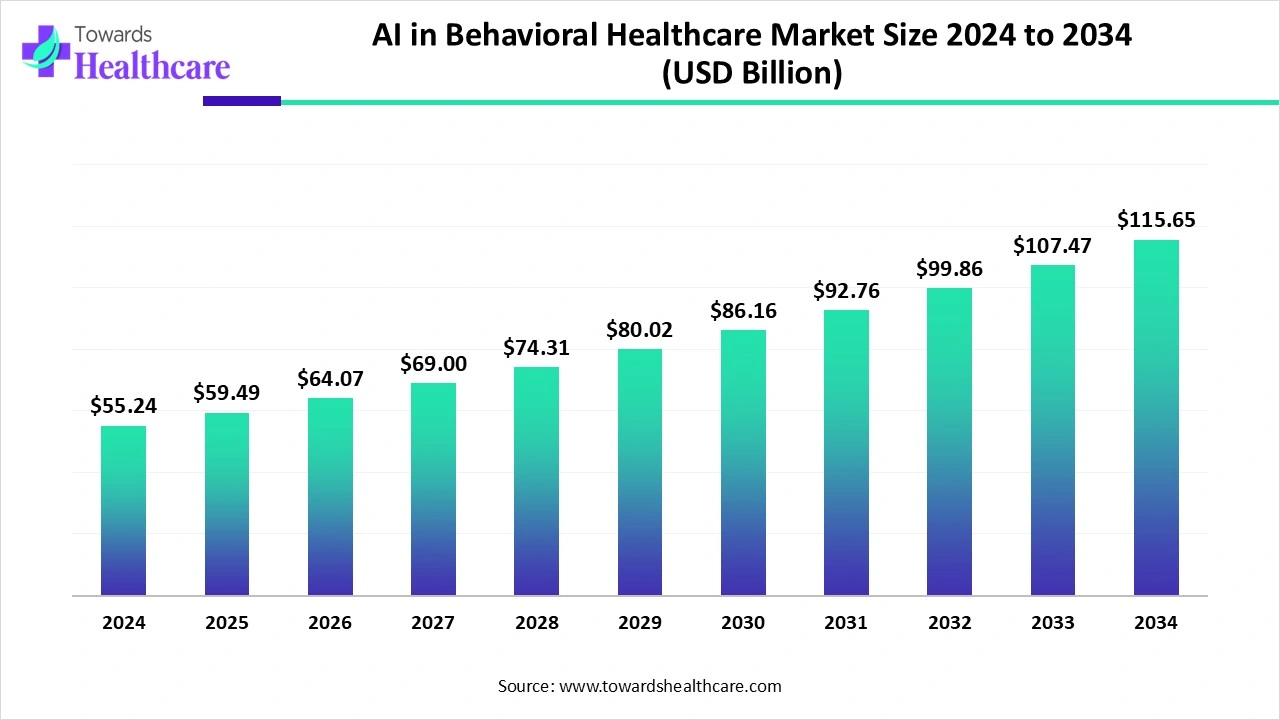

Artificial intelligence (AI) plays a vital role in transforming mental health services. AI and machine learning (ML) algorithms can screen large amounts of people to assess their mental health. This increases accuracy and precision, reducing manual errors. AI increases the accessibility of treatment care to patients by providing telehealth services. AI-based chatbots are utilized to offer advice and a line of communication for patients, helping them to cope with symptoms. AI-based sensors are integrated into wearables that can interpret body signals and provide real-time mental health status. AI and ML can also predict outcomes in patients receiving advanced rehabilitation therapy. AI can also be used to design personalized treatment for patients by monitoring their symptoms and reactions to treatment.

In 2024, the global AI in behavioral healthcare market stood at about US$ 55.24 billion. By 2025, it’s expected to rise to US$ 59.49 billion - and if trends continue, it could reach nearly US$ 115.65 billion by 2034, growing steadily at a 7.69% annual rate.

| Category | Sub-Category | Percent (%) |

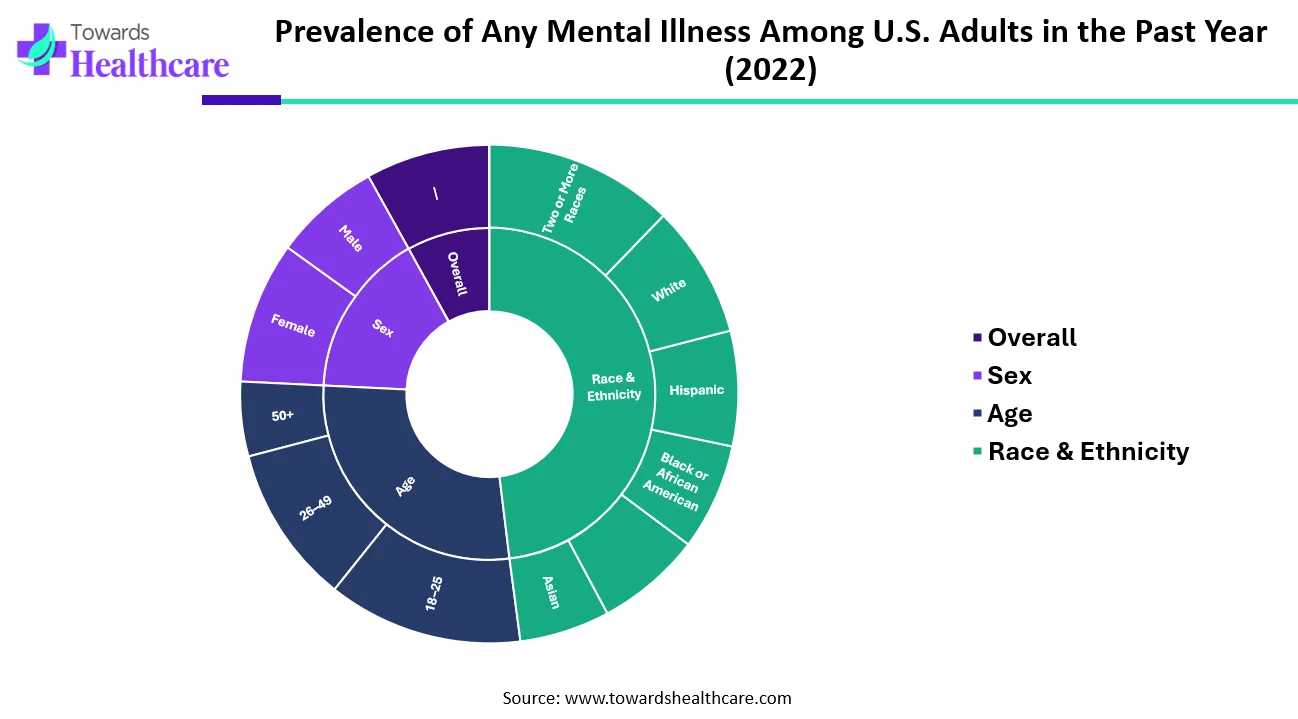

| Overall | — | 23.1 |

| Sex | Female | 26.4 |

| Male | 19.7 | |

| Age | 18–25 | 36.2 |

| 26–49 | 29.4 | |

| 50+ | 13.9 | |

| Race & Ethnicity | Hispanic | 21.4 |

| White | 24.6 | |

| Black or African American | 19.7 | |

| American Indian / Alaska Native (AI/AN) | 19.6 | |

| Asian | 16.8 | |

| Two or More Races | 35.2 |

The chart highlights how common mental illness was among U.S. adults in 2022, and it reveals some striking differences across gender, age groups, and racial or ethnic backgrounds. Overall, about 23.1% of adults experienced some form of mental illness in the past year. Women reported a noticeably higher rate (26.4%) compared to men (19.7%), showing that mental-health concerns affect women more frequently.

Age plays an even bigger role. Young adults between 18 and 25 years showed the highest prevalence at a significant 36.2%, meaning more than one in three young adults struggled with mental health challenges. The rate drops steadily with age 29.4% among those aged 26–49, and down to 13.9% for adults 50 and older, indicating that younger groups face more emotional and psychological pressures.

When looking at race and ethnicity, individuals who identify as two or more races reported the highest rate at 35.2%, while Asian adults had the lowest at 16.8%. White adults (24.6%) and Hispanic adults (21.4%) also showed notable prevalence, while Black adults and American Indian/Alaska Native adults reported similar levels around 19–20%.

Overall, the data paints a clear picture: mental-health challenges affect millions of adults, but younger people, women, and those identifying with more than one race tend to experience these issues at even higher levels.

Favorable Government Support

The major growth factor of the U.S. behavioral market is favorable government support to promote behavioral health treatment. The U.S. government formed “The Substance Abuse and Mental Health Services Administration (SAMHSA)” to look after behavioral health in the U.S. SAMHSA released an updated “National Behavioral Health Crisis Care Guidance” policy in 2025 for state, territory, tribal, and local governments and others to understand, implement, and sustain effective behavioral health crisis services and guide practitioners about the same. Additionally, The White House committed a national strategy for addressing mental illness and substance abuse disorders in 2024. The increasing public-private partnerships and collaborations to promote mental health care in the U.S. raise awareness among the general public.

Lack of Coverage and Inadequate Reimbursement

Even after the Mental Health Parity and Addiction Equity Act (MHPAEA) was passed in 2008, many Americans with insurance still do not have access to comparable behavioral health coverage. The Mental Health Parity and Addiction Equity Act (MHPAEA) requires health insurers and group health plans that cover behavioral health services to provide the same level of benefits for mental health and/or substance use treatment and services as they do for medical and surgical care, but it does not require that behavioral health treatments be covered. Furthermore, even though the Department of Health and Human Services (HHS) produced an action plan for the law's implementation in April 2018 as required by Congress, the provisions' strict enforcement has fallen short.

Access to mental health services may be restricted by the coverage restrictions and limitations in the Medicaid and Medicare programs. Even though Medicaid requires states to fund medically necessary mental health care, states have some discretion in determining medical necessity, which can result in inequities in coverage. States may also provide particular services as optional perks (e.g., rehabilitation, therapy, medication management, and peer support). State-by-state variations in these optional services' accessibility notwithstanding, many are essential for improved recovery and health. Even though IMDs can support adolescent recovery, treatment at institutes of mental illness (IMDs) is an optional service covering children and adolescents with behavioral health difficulties up to the age of 21. Medicare also restricts access to some behavioral health treatments by capping lifetime payments for inpatient mental health treatment at 190 days. This restricts recipients' access to life-saving care, especially for individuals with severe mental illnesses.

Historically, behavioral health treatment has been provided by state mental health organizations, which are chronically underfunded. Similar underpayments apply to providers in the continuum of mental health care under conventional fee-for-service payment models. Important features of behavioral health treatment, such as managing care remotely or coordinating care across clinicians and locations, are rarely covered by fee-for-service payment models (referrals, case management, etc.).

Poor reimbursement rates further impede access to behavioral health services. A recent study found that reimbursement for mental health doctors is still 20% lower than for primary care doctors. The reimbursement issues are a reflection of the undervaluing of mental health services, which usually require more investigation and effort than procedural procedures.

Payer-Based Strategy

The use of outcome measures is constrained despite a requirement for measurement-based behavioral healthcare on a national scale due to a lack of provider adoption and technological infrastructure to measure and report findings on a big scale. Thus, only about 50% of Americans who suffer from mental diseases obtain care. Even then, there is no measurement of quality, and when there is, there is cause for concern.

Not just policymakers and healthcare professionals, but new approaches are required to address these problems during and after the pandemic. Payers who have been criticized or questioned for their impact on behavioral healthcare access now have a chance to change the future. Payers have traditionally prioritized behavioral health cost reduction, typically working with carve-out mental health billing services companies, which has contributed to the existing system's fragmentation and accessibility issues.

To better the accessibility, effectiveness, and quality of mental health care, Blue Shield of North Carolina (Blue Cross NC) and Blue Cross are currently in the second year of a long-term strategy. The five activities mentioned in this essay include eliminating the integrating care, carve-out, quantifying effect, deploying point solutions at scale, and increasing value-based reimbursement. Although this plan was put in place before COVID-19, it provided a strong foundation that allowed us to quickly change course and accommodate the additional behavioral health aspects of the pandemic. This example shows how payment reform might encourage the development of an adaptable and responsive behavioral health system, especially during periods of high demand.

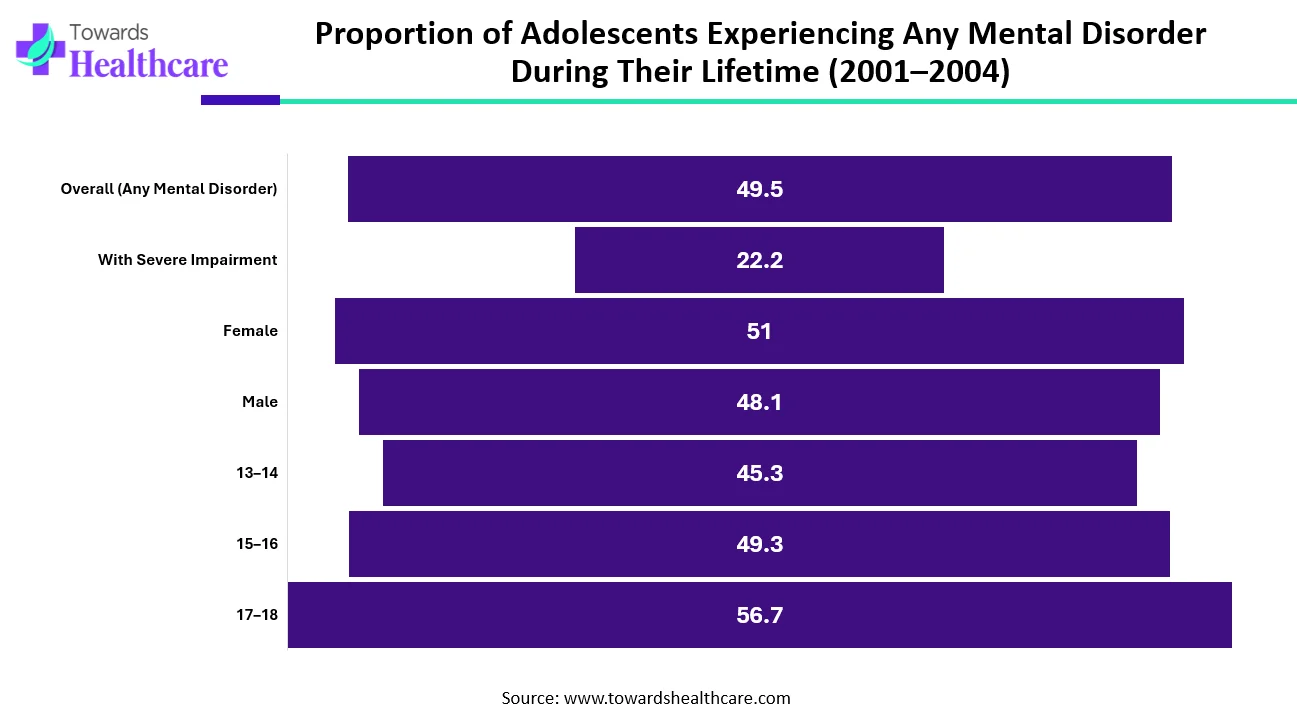

| Category | Sub-Category | Percent (%) |

| Overall Prevalence | Overall (Any Mental Disorder) | 49.5 |

| Severity | With Severe Impairment | 22.2 |

| Sex | Female | 51 |

| Sex | Male | 48.1 |

| Age Group | 13–14 | 45.3 |

| Age Group | 15–16 | 49.3 |

| Age Group | 17–18 | 56.7 |

The data shows that mental health challenges are very common among adolescents. Nearly one out of every two teenagers (49.5%) experiences some form of mental disorder at some point in their life. Even more concerning, about 22.2% face symptoms severe enough to significantly disrupt their daily life. When we look at differences between girls and boys, the numbers are fairly close. Girls report slightly higher rates (51%) compared to boys (48.1%), suggesting that mental health issues affect both groups at almost equal levels.

Age also plays an important role. Younger teens aged 13–14 show a prevalence of 45.3%, but the rate increases with age. Teens aged 15–16 experience a prevalence of 49.3%, and the highest rate appears among older adolescents aged 17–18, where 56.7% report having had a mental disorder at some point. Overall, the data emphasizes that mental health concerns are widespread among adolescents, and the need for early support and intervention grows stronger as teens get older.

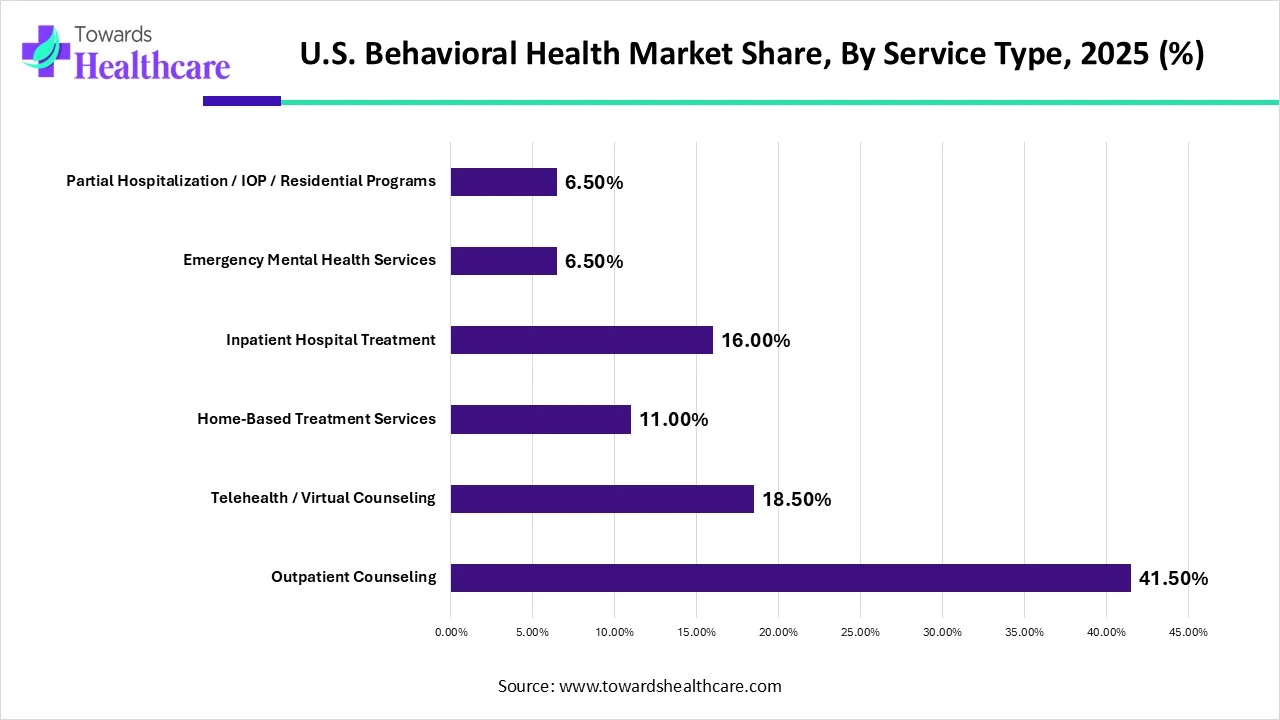

In, outpatient counseling held the biggest market share by 41.50%, and it is anticipated that this pattern will hold throughout the forecast period. The most common form of treatment for many mental health conditions is outpatient care since it is less expensive, more accommodating of patients' needs and schedules, and has a larger provider pool. Only when ongoing support is not necessary and it is healthy for the patient to remain in their environment to deal with stressors and learn to manage with professional aid can outpatient treatment be employed. This is typically the greatest option for persons who have eating disorders, depression, or anxiety.

The internet has created new opportunities for projects in rehabilitation. Technology has given people a new therapeutic alternative to help them overcome their addictions, although in-person counseling and treatment were formerly the only options to do so. Through group therapy sessions held over Zoom or Google Meet, individual online face-to-face chats, and online video chat, patients and their families have simple access to licensed addiction professionals and their network of supporters. Both the patient's quality of life and their chances of recovery are enhanced by this increased accessibility. If patients can obtain information online and avoid having to travel to and from an outpatient treatment facility, they will be more inclined to continue with therapy.

The demand for home-based treatment services is predicted to increase during the projection period, which will result in a decline in the percentage of inpatient hospital treatment, which was 22.0% in 2020. Before the implementation of COVID-19, the majority of payers (including the federal government) only provided coverage for home-based modalities (such as direct-to-consumer and mobile applications) for a small number of conditions that frequently required the coverage of physical comorbidities. In the case of a patient who also has a chronic ailment like diabetes, this may, for instance, just pay telemedicine treatment for substance use disorder. The phenomenal growth of home delivery of telehealth for virtually all diseases has significantly enhanced access to care in emergencies COVID-19 advice and payer policy.

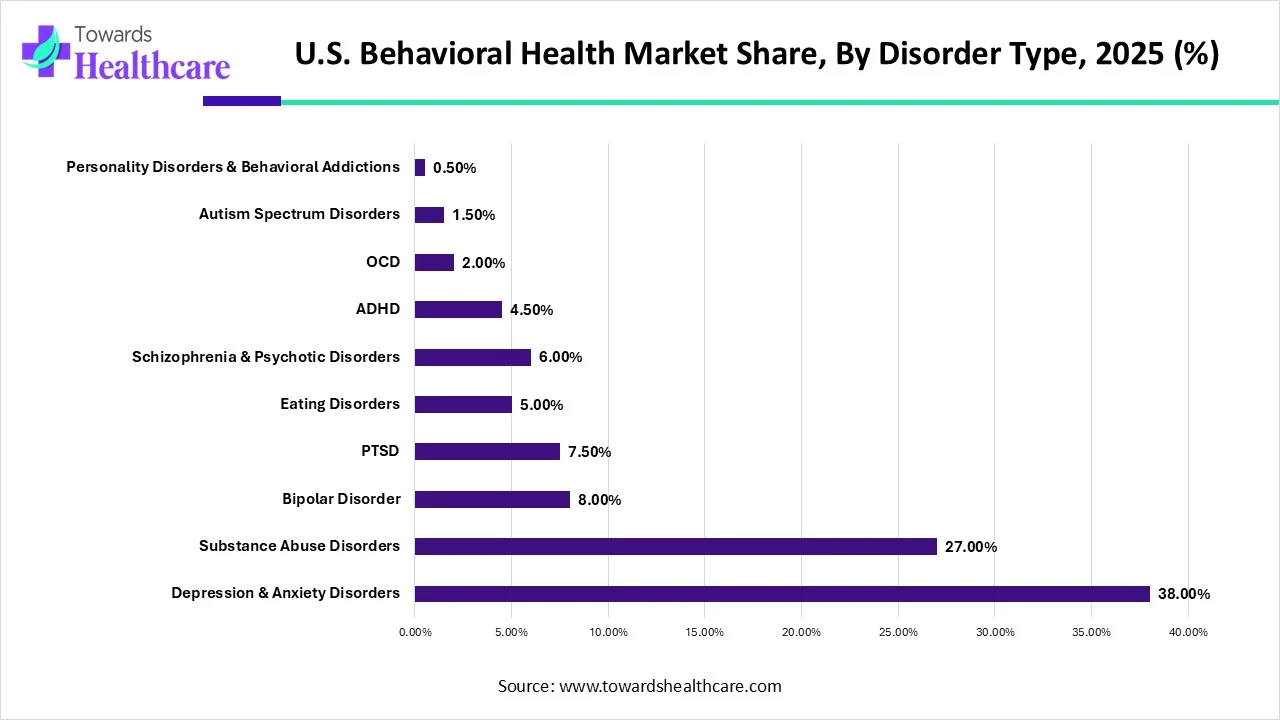

In, anxiety and depressive disorders held the highest market share by 38% because of the high incidence of COVID-19, which led to lockdowns and social withdrawal.

Other potential causes of anxiety and depression include negative life events, societal pressure, and lack of access to mental health resources. The increasing incidences of anxiety and depression and growing research and development activities for their treatment boost the segment’s growth. According to the American Psychiatry Association, around 43% of adults were reported to feel more anxious in 2024 compared to 37% in 2023. This rising trend potentiates the need for early detection and treatment.

By disorder type, the substance abuse disorder segment is projected to expand rapidly in the market in the coming years. Substance abuse disorder is mainly caused by over-consumption of alcohol, opioids, and marijuana. About 17.82% of adults, i.e. over 45 million people in the U.S. had a substance use disorder in 2024. The increasing incidences of substance abuse disorder augment the segment’s growth. The rise in rehabilitation centers and growing awareness also potentiate the segment’s growth.

| End-User | 2025 Share (%) |

| Outpatient Clinics | 37.50% |

| Hospitals | 24.00% |

| Rehabilitation Centers | 20.50% |

| Virtual / Telehealth Clinic Networks | 9.50% |

| Homecare Settings | 8.50% |

The largest market share held by outpatient clinics in 2020 was 37.50%. Since the majority of patients are diagnosed with mild to moderate symptoms and do not necessarily need to be admitted to hospitals, the sector is anticipated to continue to be the largest.

Mental health professionals have generally operated independently from primary care doctors in clinical care. A one-stop shop can assist ensure that patients obtain treatment sooner and, as a result, cut costs for both patients and providers. This is done by better integrating behavioral health and basic care. For instance, Genoa Healthcare integrates telepsychiatry, medical management, and outpatient mental health care. Psychiatrists now have access to more information that is necessary for accurate patient diagnosis and treatment. Genoa's telepsychiatry services created a patient-centered model and offered a solution for many adults and families who couldn't access mental healthcare.

Due to patient preference, it is anticipated that demand for homecare settings would increase during the projected period. Additionally, throughout the forecast period, the segment for homecare settings is anticipated to rise as more doctors and patients use telehealth solutions in this medical field.

The rise of home care is also being aided by the constantly developing technology that lets patients remain in their own homes. The effectiveness and security of home care can be increased with the aid of internet-based applications, software, and equipment. These technologies include but are not limited to, patient portals, online support groups, caregiver education, and training materials, mobile apps for appointment scheduling and reminders, improvements in telemedicine/telehealth, wearable sensors that remotely monitor patients, personal response systems that can be used to alert a call center when a patient falls, and automated medication dispensing systems. This segment's growth is anticipated to be accelerated by the growing adoption of telehealth.

One in four Medicare users suffers from a mental disorder. The prevalence of mental illness appears to be slightly higher among Medicare enrollees in traditional Medicare than in Medicare Advantage managed care plans, although comparisons are challenging due to varied data sources and measures used in different research. Traditional Medicare beneficiaries are more likely to suffer from a severe mental illness that leaves them significantly disabled, such as schizophrenia, bipolar disorder, or major depressive disorder.

Over 112 million Americans reside in areas with a dearth of mental healthcare providers, and by 2025, shortages of counselors, psychiatrists, mental health social workers, clinical & counseling psychologists, and other specialized professionals are expected to get worse, according to experts. Rural areas experience a particularly acute shortage of mental health providers, although the prevalence of mental disease among beneficiaries is comparable between rural and urban areas.

![]()

| Year | US (13.9) | FRA (13.1) | AUS (11.9) | CAN (11.8) | NOR (11.6) | NZ (11.5) | SWIZ (11.2) | SWE (11.1) | NETH (10.5) | GER (10.2) | UK (7.3) |

| 2001 | 11.1 | 17.5 | 12.8 | 11.7 | 12.4 | 13.5 | 18 | 13 | 9.1 | 12.8 | 7 |

| 2002 | 11.3 | 17.6 | 11.9 | 11.5 | 11 | 12.2 | 19 | 12.9 | 9.6 | 12.7 | 6.9 |

| 2003 | 11.1 | 17.8 | 10.9 | 11.7 | 11.1 | 13.3 | 16.6 | 12 | 9.2 | 12.6 | 6.6 |

| 2004 | 11.3 | 17.5 | 10.6 | 11 | 11.8 | 12.4 | 16.6 | 12.4 | 9.1 | 12 | 6.9 |

| 2005 | 11.2 | 17.1 | 11.2 | 11.6 | 12.7 | 16.6 | 13.1 | 9.4 | 11.4 | 6.7 | |

| 2006 | 11.3 | 16.5 | 10.5 | 10.8 | 11.5 | 12.7 | 16.5 | 12.7 | 9.1 | 10.7 | 6.7 |

| 2007 | 11.7 | 15.8 | 10.6 | 10.6 | 10.5 | 11.9 | 16.9 | 11.9 | 8 | 10.2 | 6.3 |

| 2008 | 12 | 16.1 | 10.9 | 10.7 | 10.6 | 12.3 | 16 | 12.2 | 8.4 | 10.3 | 6.9 |

| 2009 | 12.2 | 16.2 | 10.7 | 11.1 | 11.9 | 12 | 13.4 | 12.9 | 8.9 | 10.3 | 6.8 |

| 2010 | 12.5 | 15.9 | 10.9 | 11.1 | 11.2 | 12.4 | 11.9 | 11.7 | 9.2 | 10.8 | 6.7 |

| 2011 | 12.8 | 15.8 | 10.7 | 10.8 | 12.1 | 11.3 | 12.1 | 11.4 | 9.5 | 10.8 | 6.9 |

| 2012 | 13 | 14.6 | 11.4 | 10.8 | 10.2 | 12.5 | 12 | 11.6 | 10 | 10.5 | 6.9 |

| 2013 | 13.1 | 14.3 | 11.3 | 11.1 | 10.8 | 11.8 | 12.2 | 12.3 | 10.5 | 10.8 | 7.5 |

| 2014 | 13.5 | 13.1 | 12.5 | 11.5 | 10.5 | 11.5 | 11.4 | 11.4 | 10.4 | 10.8 | 7.4 |

| 2015 | 13.8 | 13.1 | 12.9 | 11.8 | 11.1 | 11.9 | 11.7 | 10.5 | 10.6 | 7.5 | |

| 2016 | 13.9 | 11.9 | 11.6 | 11.2 | 11.1 | 10.5 | 10.2 | 7.3 |

The table shows suicide rates per 100,000 people for 11 high-income countries over the years, from 1980 to 2016. The U.S. stands out as the country with the highest suicide rate among these nations, reaching 13.9 per 100,000 in 2016. Notably, the U.S. suicide rate has generally increased since 2000, reflecting a concerning upward trend.

Looking at the historical trends:

Overall, this data reveals that while some high-income countries have managed to reduce or stabilize suicide rates over the decades, the U.S. faces a persistent and growing challenge. The trend underscores the urgent need for targeted mental health interventions, awareness programs, and supportive social policies to address rising suicides.

The rising incidences of mental health disorders are the major growth factor of the market. Anxiety disorders are the most common type of mental health disorder in the U.S., accounting for 19.1% of all cases, followed by major depression, post-traumatic stress disorder, and bipolar disorder. The increasing number of behavioral health facilities in the U.S. contributes to market growth. There were around 15,424 Mental Health & Substance Abuse Clinics in the U.S., as of 2023. The growing awareness among the general public about behavioral health potentiates the market. Favorable government initiatives and increasing investments also augment the market. The U.S. government provided funding of $240 million to launch and expand mental health and substance use disorder services in more than 400 community health centers across the country.

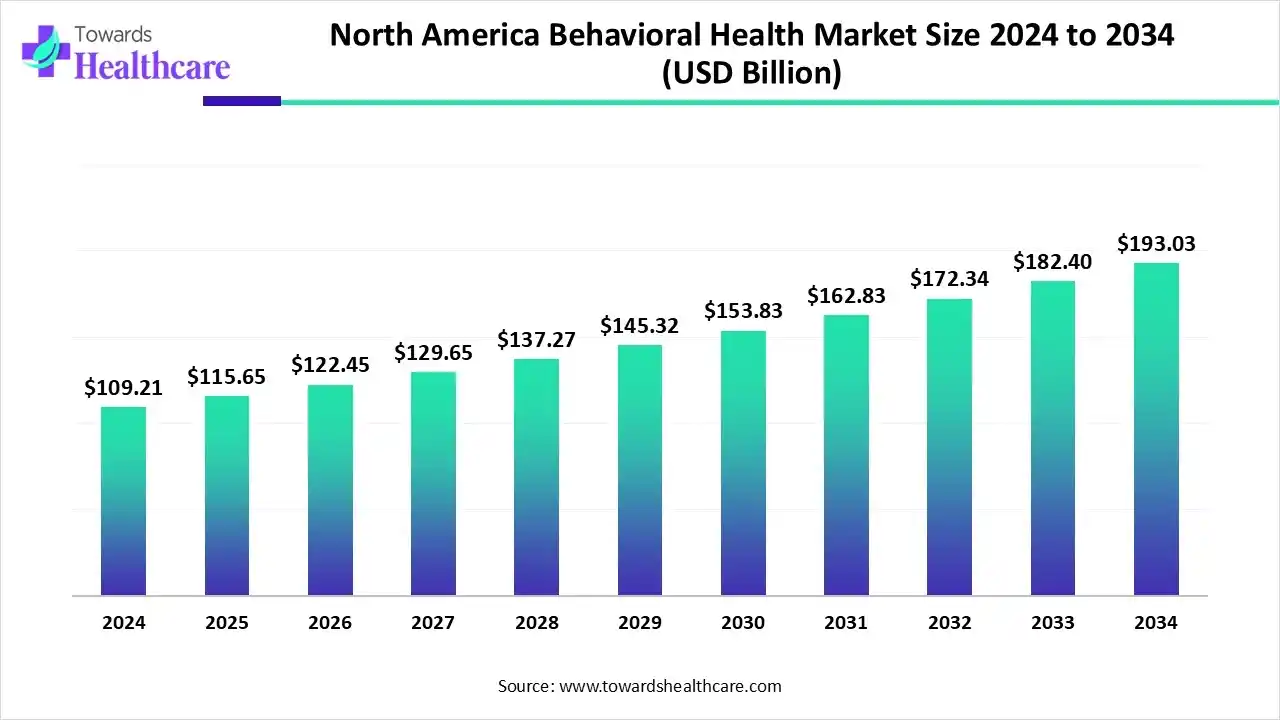

The North America behavioral health market size is calculated at US$ 109.21 billion in 2024, grew to US$ 115.65 billion in 2025, and is projected to reach around US$ 193.03 billion by 2034. The market is expanding at a CAGR of 5.86% between 2025 and 2034.

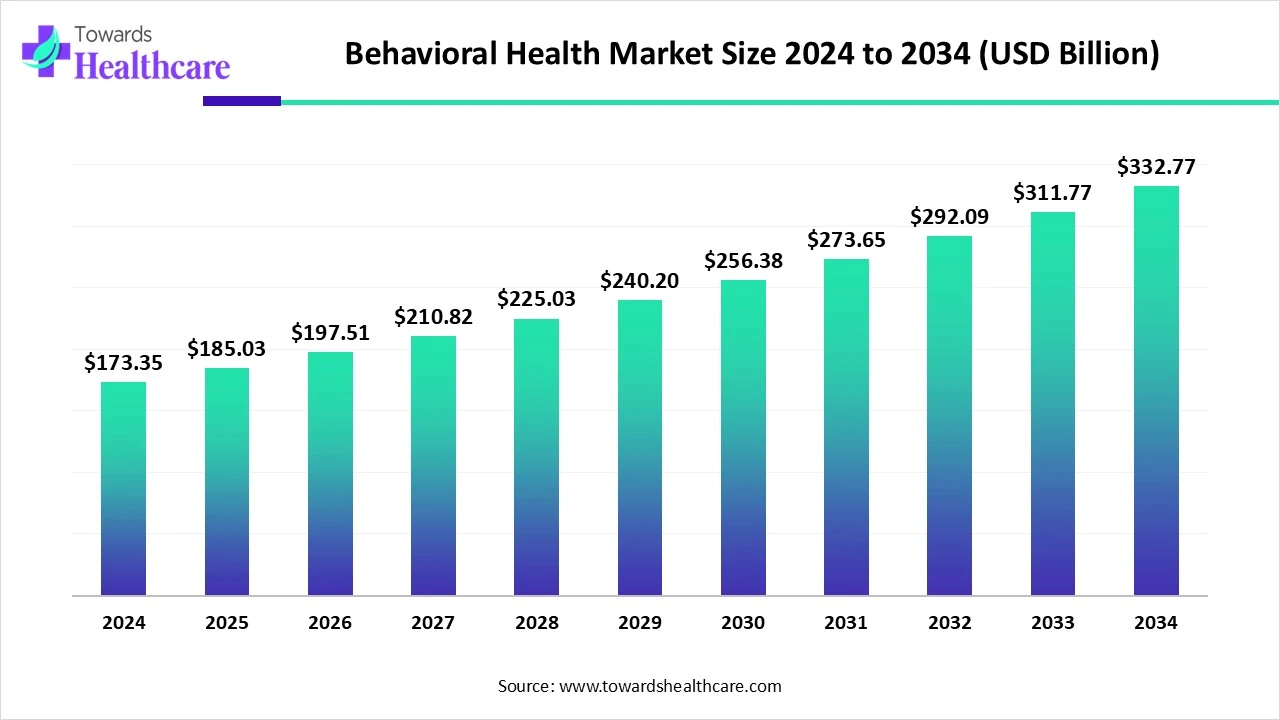

The global behavioral health market is valued at USD 173.35 billion in 2024 and is expected to rise to USD 185.03 billion in 2025. Looking ahead, it could reach about USD 332.77 billion by 2034, growing at a 6.74% CAGR from 2025 to 2034.

Marketa Wills, MD, MBA, CEO and Medical Director of the American Psychiatric Association, commented that telehealth services; collaboration between medical societies, physicians and patients, and organizations; as well as access to information are the major factors that can increase access to mental care. She added that insurers must abide by the laws to ensure patients receive benefits from mental health services.

By Service Type

By Disorder Type

By End-User

February 2026

February 2026

January 2026

January 2026