February 2026

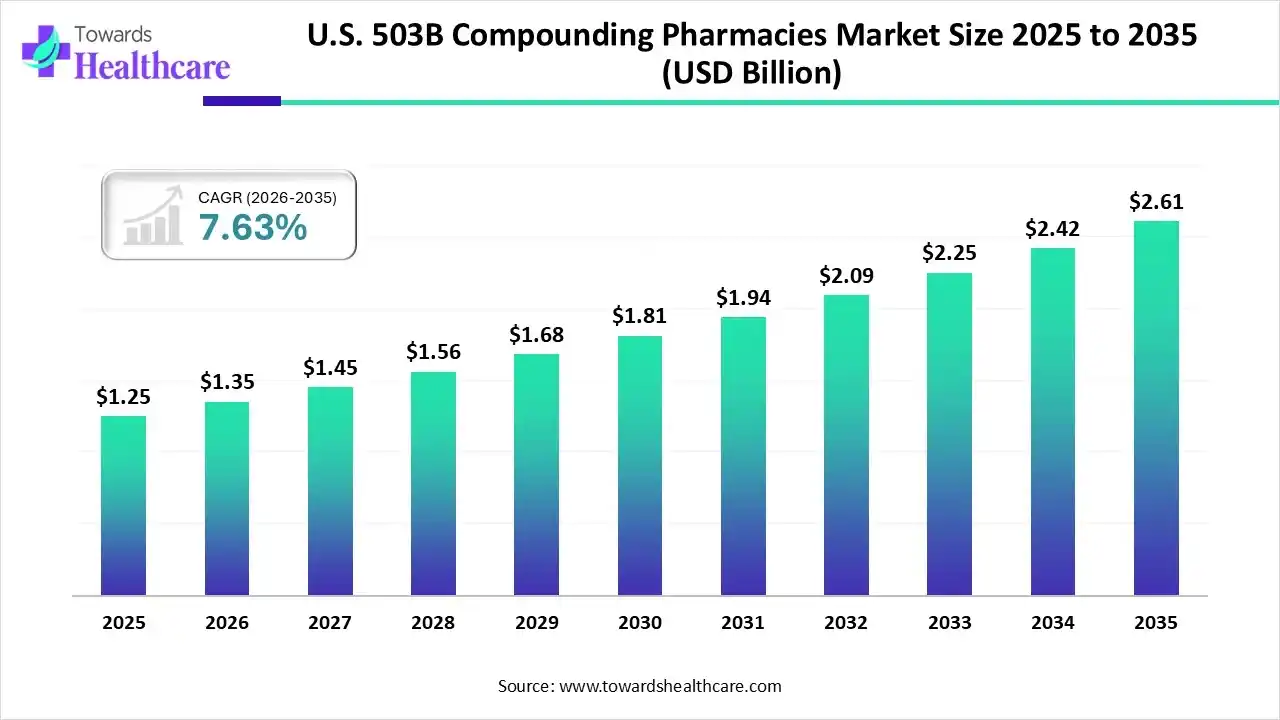

The U.S. 503B compounding pharmacies market size was valued at US$ 1.25 billion in 2025 and is projected to grow to 1.35 billion in 2026. Forecasts suggest it will reach approximately US$ 2.61 billion by 2035, registering a CAGR of 7.63% during the period.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.35 Billion |

| Projected Market Size in 2035 | USD 2.61 Billion |

| CAGR (2026 - 2035) | 7.63% |

| Market Segmentation | By Product Type, By Formulation Type, By Therapeutic Application, By Compounding Type, By Region |

| Top Key Players | SCA Pharma, Nephron Pharmaceuticals Corporation, Athenex, Inc., Wells Pharma of Houston LLC, Olympia Pharmacy, Fagron Compounding Pharmacies |

The FDA directly regulates 503B pharmacies through the use of CGMP regulations, which are the subject of the 503B compounding pharmacies market. Pharmaceutical firms also adhere to the same set of CGMP rules. As a result, a 503B pharmacy is a compounding pharmacy that follows the strict CGMP regulations.

The only pharmacies authorized to provide compounded pharmaceuticals for use in doctor's offices, clinics, and hospitals are these 503B outsourcing facilities. In recent times, the 503B U.S. compounding pharmacy market has undergone significant changes due to a number of key developments that will likely affect 503B outsourcing facilities in 2024 and beyond.

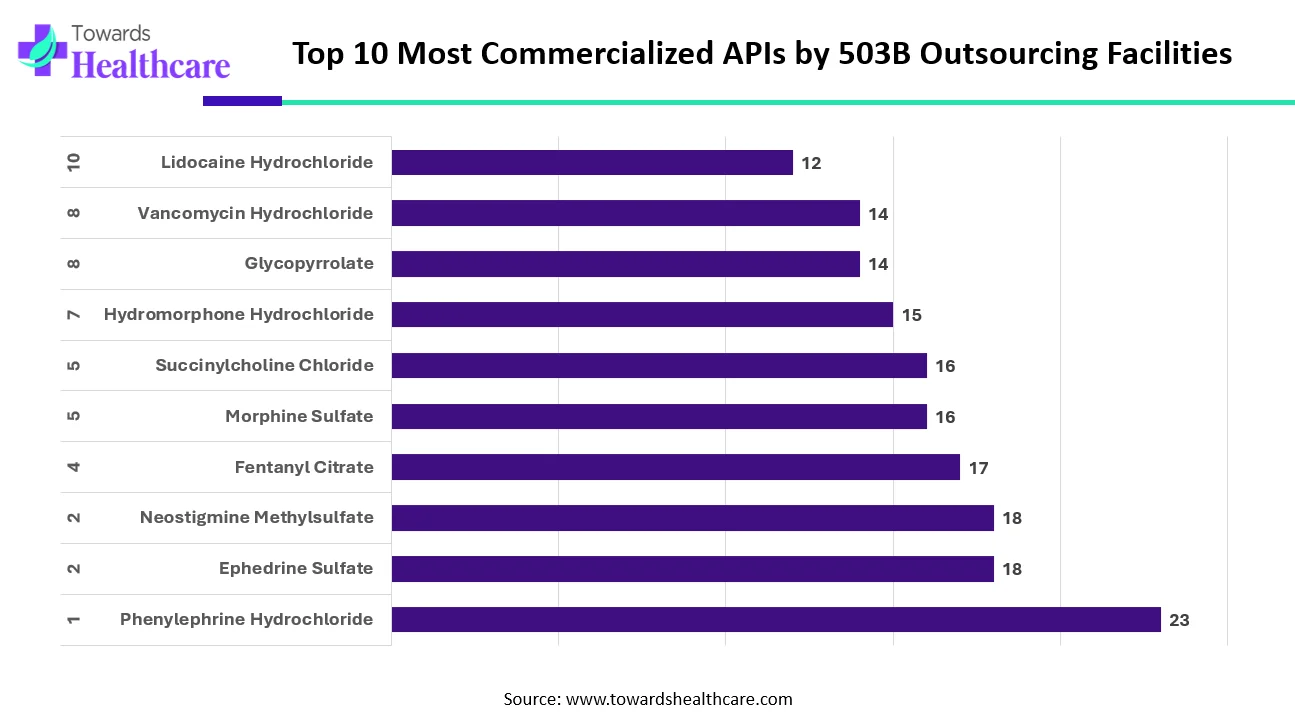

The data highlights which active pharmaceutical ingredients (APIs) are most commonly commercialized by 503B outsourcing facilities. Phenylephrine Hydrochloride leads the list, with the highest number of facilities producing products that contain it. This strong demand reflects its widespread use in emergency and critical care settings.

Ephedrine Sulfate and Neostigmine Methylsulfate follow closely, showing equal levels of commercial interest. Their high usage indicates their importance in anesthesia and perioperative care. Fentanyl Citrate and Morphine Sulfate also appear prominently because healthcare providers rely heavily on these analgesics to manage severe pain.

Succinylcholine Chloride and Hydromorphone Hydrochloride remain key products as well, demonstrating the consistent need for neuromuscular blockers and strong opioids in hospital environments. Meanwhile, Glycopyrrolate and Vancomycin Hydrochloride rank slightly lower but still show strong commercialization due to their essential roles in infection control and surgical preparation.

Lidocaine Hydrochloride closes the list but remains a widely used local anesthetic across multiple clinical procedures. Overall, the ranking reflects real-world clinical demand and the continuing reliance of healthcare systems on these critical medications.

The integration of artificial intelligence (AI) into the 503B compounding pharmacies is poised to significantly enhance market growth. AI's ability to analyze vast datasets quickly and accurately improves quality control and ensures consistent, high-quality compounded medications. By automating routine tasks, AI reduces human error, streamlines operations, and increases efficiency, allowing pharmacists to focus on more complex aspects of compounding.

Predictive analytics powered by AI can forecast demand trends, optimize inventory management, and minimize waste, leading to cost savings and better resource allocation. Moreover, AI-driven systems can assist in regulatory compliance by maintaining meticulous records and ensuring adherence to stringent standards set by the FDA. AI also plays a crucial role in personalized medicine by analyzing patient data to customize formulations, thereby improving patient outcomes.

The integration of AI not only accelerates the compounding process but also enhances the overall safety and effectiveness of medications. As the healthcare industry increasingly embraces technological advancements, AI's role in 503B compounding pharmacies is expected to expand, driving market growth and setting new standards for precision and efficiency in pharmaceutical compounding.

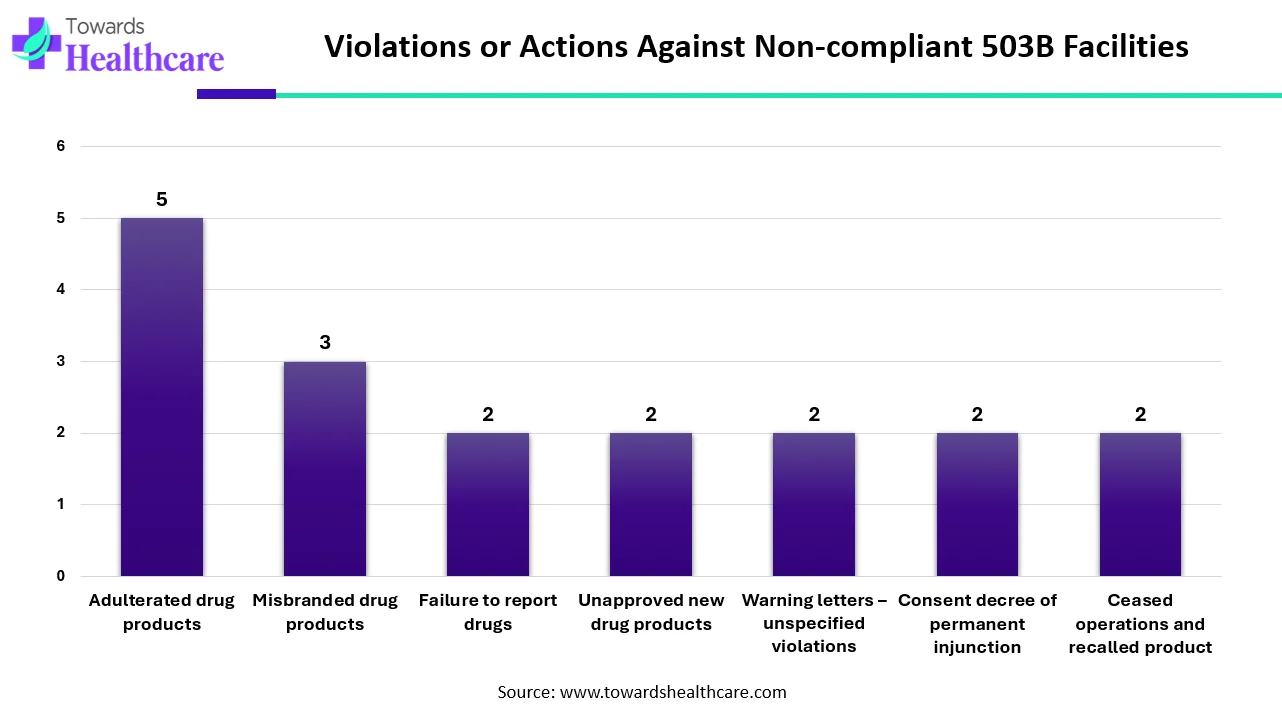

The data shows the types of violations or enforcement actions that 503B outsourcing facilities faced during their most recent FDA inspection. The most common issue was adulterated drug products, with five recorded cases. This indicates that several facilities produced drugs that did not meet quality or safety standards, which can pose serious risks to patients.

The FDA also found three cases of misbranded drug products, meaning some facilities did not label their products correctly or provided misleading information. In addition, two facilities failed to report their drugs, which is a basic requirement for maintaining regulatory transparency.

There were also two instances each of facilities producing unapproved new drug products, receiving warning letters for unspecified violations, being placed under a permanent injunction through a consent decree, and ceasing operations due to product recalls. These repeated two-count categories show that several facilities struggled with compliance across multiple areas, from product approval to operational safety.

Overall, the pattern reflects ongoing quality and compliance challenges within certain 503B facilities, highlighting the need for stronger oversight, better operational controls, and consistent adherence to FDA standards.

By decreasing waste and driving down prescription prices, the hospital can actually lower organizational risk through greater regulatory compliance and minimize waste by choosing the right outsourcing pharmacy partner. Furthermore, 503Bs are better suited to comply with the increasingly strict FDA regulations and cGMPs, which benefit the hospital in ways such as extended beyond-use-date of products (beyond that of in-hospital compounded products), which minimize waste, aid in inventory management, and permit the shipment of goods to hospitals located further within the health system than is currently permitted by federal regulations. Even while these benefits come at a higher cost per unit when compared to the cost of buying a sterile vial of medication, the hospital still pays less for these medications.

Manufacturing specialized pharmaceuticals is a compounding pharmacy's primary duty. For the purpose of creating pharmaceuticals that are specifically tailored to each patient's needs, they collaborate closely with patients and healthcare professionals. A 50 mg dose or a 100 mg dose, for example, or the actual components can be customized, as can the dosage forms (such as a capsule or syringe) and strength. Compounding pharmacies have a strong position to address the growing demand for specially formulated pharmaceuticals.

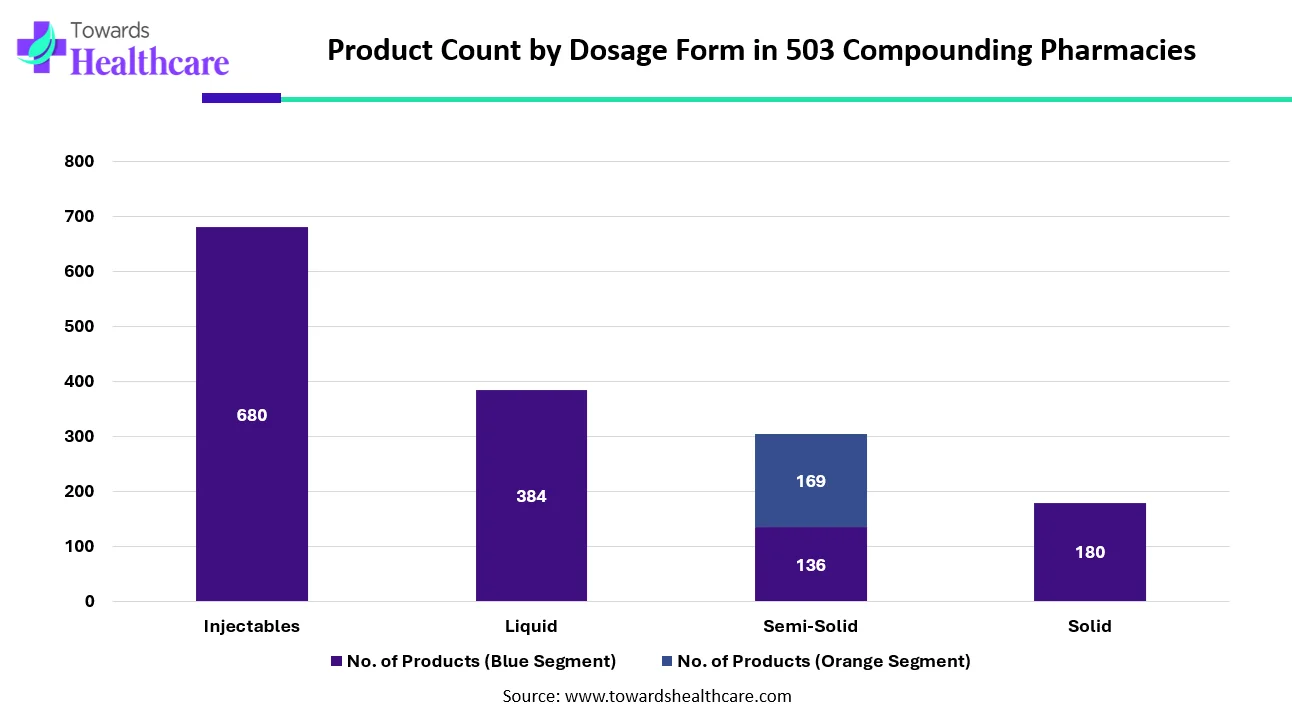

The chart highlights how pharmaceutical products are distributed across different dosage forms. Injectables lead by a wide margin, with 680 products, showing the industry’s strong focus on therapies that require direct administration into the body. Liquid formulations follow with 384 products, reflecting their common use in oral and topical treatments. Semi-solid products show an interesting split 136 products in the base category and another 169 likely representing an additional classification or formulation type, bringing the total to 305. Solid dosage forms, such as tablets and capsules, account for 180 products, indicating moderate diversification in this category. Overall, the data shows that injectables and liquids dominate product development, while semi-solid and solid forms continue to play important supporting roles in the pharmaceutical landscape.

| Product Type | Share (%) |

| Sterile Compounded Drugs | 68% |

| Non-sterile Compounded Drugs | 32% |

Which Product Type Segment Dominated the U.S. 503B Compounding Pharmacies Market?

By product type, the sterile compounded drugs segment held a dominant presence by 68% in the market in 2024, due to the need for contamination-free formulations. Sterile compounding ensures the preparation of drug formulations in a clean-room environment using aseptic techniques. It is required for patients suffering from chronic disorders, such as cancer, neurological disorders, and musculoskeletal disorders. The growing demand for administering drugs through the parenteral route boosts the segment’s growth.

By product type, the non-sterile compounded drugs segment is expected to grow at the fastest CAGR in the market during the forecast period. Oral and topical medications, such as tablets, capsules, creams, and syrups, do not require sterile compounding. In non-sterile compounding, formulations are prepared in a clean environment but without aseptic techniques. Oral and topical formulations are widely preferred due to their low cost and easy administration.

Why Did the Injections & Infusions Segment Dominate the U.S. 503B Compounding Pharmacies Market?

By formulation type, the injections & infusions segment held the largest revenue share of the market in 2024, due to high bioavailability and reduced systemic side effects. Injections & infusions are beneficial for treating a wide range of chronic and genetic disorders. Drug substances are directly administered into the bloodstream, providing a rapid onset of action. Advancements in aseptic techniques for manufacturing injectable formulations also augment the segment’s growth.

By formulation type, the capsules & tablets segment is expected to grow with the highest CAGR in the market during the studied years. Capsules & tablets are highly preferred due to their ease of administration and cost-effectiveness. They can be taken by patients of all age groups and can be easily customized based on a patient’s therapeutic response. Compounding tablets & capsules does not require specialized equipment and an aseptic environment.

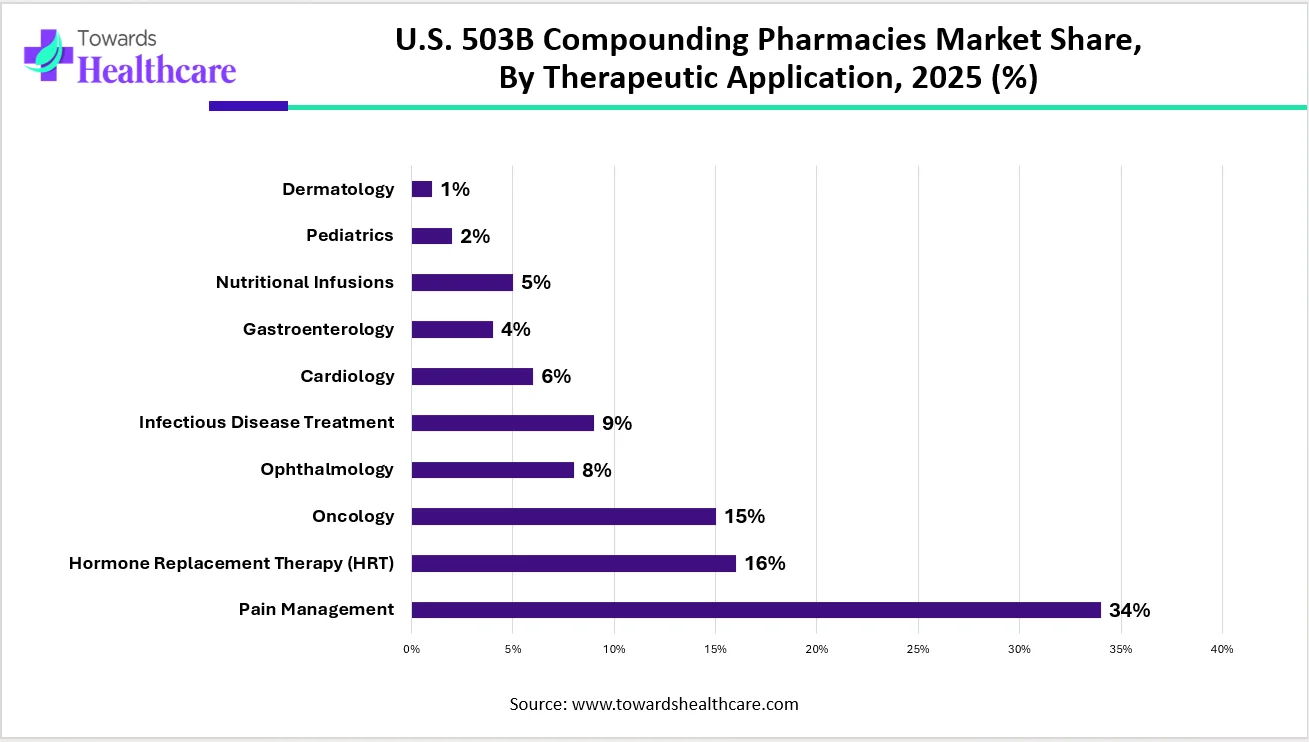

How the Pain Management Segment Dominated the U.S. 503B Compounding Pharmacies Market?

By therapeutic application, the pain management segment contributed the biggest revenue share of the market in 2024, due to the rising prevalence of chronic pain. The Centers for Disease Control and Prevention (CDC) reported that approximately 24.3% of adults were suffering from chronic pain in 2023. Of these, around 8.5% of adults had severe chronic pain, limiting their daily life activities. The increasing demand leads to analgesic shortages. According to the Annual Drug Shortages Report, fentanyl citrate, leucovorin calcium, and lidocaine hydrochloride are some of the most common drugs that have been in shortage for over 3 years.

By therapeutic application, the oncology segment is projected to expand significantly in the market in the coming years. The increasing prevalence of cancer and its complexities potentiate the demand for compounding. Compounding facilitates the delivery of personalized medicines based on a patient’s conditions. It can be a very effective way to provide the needed medications and supplements for cancer treatment.

Which Compounding Type Segment Led the U.S. 503B Compounding Pharmacies Market?

By compounding type, the batch compounding segment led the market in 2024, due to the increasing demand for critical medications. Batch compounding enables the preparation of bulk medications for multiple patients. This saves time and cost, as well as ensures uniformity in formulation preparation. It also allows pharmacists to prepare drugs for a single patient. Drugs are produced in small to large batches for sale to physicians, healthcare facilities, and other pharmacies.

By compounding type, the patient-specific compounding segment is expected to show the fastest growth in the forecast period. Patient-specific compounding allows pharmacists to provide personalized medicines. Pharmacists can assess a patient’s response and the adverse effects of certain medications on patients. They mix ingredients to meet the unique needs of an individual patient.

The U.S. 503B compounding pharmacies market is experiencing robust growth, driven by the rising prevalence of chronic disorders and growing demand for personalized medicines. The Centers for Disease Control and Prevention (CDC) reported that an estimated 129 million Americans suffer from at least 1 chronic disorder. The Food and Drug Administration (FDA) regulates the approval of compounding outsourcing facilities under Section 503B. There are a total of 93 outsourcing compounding facilities as of September 2025.

The Northeast region dominated the market in 2024. This is favored by the strong presence of 503B compounding facilities and the growing need for compounded medications. Cities like New York, Philadelphia, Albany, and Manchester are at the forefront of developing compounding drugs. Key players, such as ProRx Pharma and Stokes Pharma, are major players located in the Northeast region.

The South region is expected to expand rapidly, due to the increasing number of hospitals and outpatient centers. South Valley Compounding Pharmacy and the U.S. Compounding Factory are the major players in 503B compounding pharmacy. The growing geriatric population in the region also contributes to market growth. The median age of people in the South region is 38.8.

Unites States, being is a center of innovation, home to top pharmaceutical and biopharma businesses as well as medication inventors, holds a great potential for the industry. The industry has a promising future as patients with rare diseases benefit greatly from advancements made possible by technologies like artificial intelligence, biotech, mRNA, and the cell and gene space.

Growth is explained by the existence of major international chains, including Rite Aid Corp., Boots, Walgreens, CVS Health, UnitedHealth Group, Cigna, and Walmart. To increase their dominance and presence, these players are utilizing a variety of techniques and cutting-edge technologies.

The Federal Food, Drug, and Cosmetic Act's Section 503A or 503B applies to drug products or categories of drug products that provide demonstrable difficulties for compounding. This proposed rule was released by the U.S. Food and Drug Administration (FDA) on March 20, 2024.

By Product Type

By Formulation Type

By Therapeutic Application

By Compounding Type

By Country

February 2026

February 2026

February 2026

January 2026