February 2026

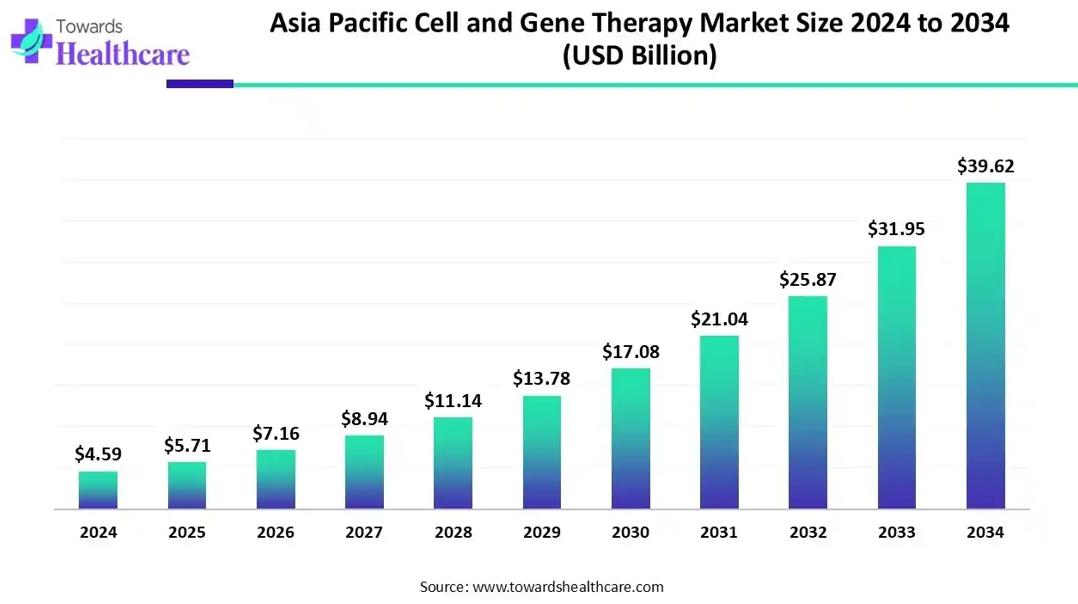

The APAC cell and gene therapy market size is calculated at US$ 4.59 billion in 2024, grew to US$ 5.71 billion in 2025, and is projected to reach around US$ 39.62 billion by 2034. The market is expanding at a CAGR of 24.04% between 2025 and 2034.

China, India, Japan, and South Korea are facing a huge burden of patient population having diverse cancers and rare diseases, which are further boosting demand for advanced and novel cell & gene therapies. The APAC cell and gene therapy market is further putting efforts into gene editing solutions, non-viral vector products, and allogenic developments. These approaches are exploring the widespread capacity of numerous pharmaceutical & biotechnology companies in ASAP.

| Table | Scope |

| Market Size in 2025 | USD 5.71 Billion |

| Projected Market Size in 2034 | USD 39.62 Billion |

| CAGR (2025 - 2034) | 24.04% |

| Market Segmentation | By Therapy Type, By Therapeutic Area, By Vector Type, By Cell Source, By End User, By Country |

| Top Key Players | Fujifilm Cellular Dynamics (Japan), Astellas Pharma (Japan), Medipost (South Korea), GC Cell (Green Cross Cell) (South Korea), Kolon TissueGene (South Korea), Samsung Biologics (South Korea), CHA Biotech (South Korea), Cipla (India), Dr. Reddy’s Laboratories (India), Biocon Biologics (India), CSL Behring (Australia), Mesoblast Limited (Australia), Pharmicell (South Korea), Innovent Biologics (China), BeiGene (China) |

The Asia Pacific (APAC) cell and gene therapy market refers to the rapidly growing ecosystem of advanced regenerative and genetic medicine solutions across key countries such as China, Japan, South Korea, India, Australia, and ASEAN nations. Cell therapy involves the transplantation or modification of cells, such as stem cells, immune cells, or engineered cell types, while gene therapy delivers genetic material to correct or modify defective genes. APAC has become a hub for clinical trials, manufacturing hubs, and collaborations, driven by supportive government policies, rising investment in biotechnology, and a strong patient base for rare diseases, cancer, and chronic conditions. Japan and China remain leaders due to regulatory acceleration and high R&D intensity, with India and ASEAN markets emerging.

| Country | Notable Steps |

| China | In March 2025, the government leveraged over RMB 5 billion (around $765 million) specifically for stem cell research projects. |

| Japan | In September 2025, Japan External Trade Organization (JETRO) launched its "Regenerative Medicine/Cell and Gene Therapy Startups for Japan Entry Acceleration Program." |

| South Korea | In January 2025, South Korea increased its 2025 biomedical research and development (R&D) budget to ₩2.14 trillion ($1.56 billion USD), a nearly 15% rise from the previous year. |

A prominent use of AI in the respective market is emphasizing the acceleration of accuracy, manufacturing effectiveness, and clinical decision-making. This primarily empowers AI-enabled drug discovery, sophisticated quality control systems for CAR-T cell therapies in Japan and China. Alongside, machine learning is used in the prediction of cell harvest times and the detection of anomalies in manufacturing processes. Whereas, Takara Bio in Japan has been adopting AI to leverage its vector-specific PCR kits, in ensuring the safety and regulatory approval of cell and gene therapies.

In 2024, the cell therapy segment held approximately 60% share of the APAC cell and gene therapy market. The rising investment, supportive government initiatives, a huge patient population, and enhanced clinical trials are fueling the expansion of cell therapy. The ASAP is leveraging novel autologous and allogeneic cell therapies for cancer and regenerative medicine, with nine CAR-T therapies approved. Approved clinical trials by Osaka University to transplant human iPSC-derived heart cell sheets onto patients with heart disease are impacting complete growth.

However, the gene therapy segment is predicted to expand rapidly during 2025-2034. A rise in various cancers, genetic disorders, and age-related concerns is supporting the transformation of gene therapies. The leading companies, like Pfizer, Novartis, and Roche, are increasingly investing in AAV gene therapy development in the region, mainly in Japan, South Korea, and Taiwan.

Under this segment, the gene editing sub-segment will expand at a rapid CAGR in the coming era. Recently, Thailand and the Philippines have merged with new regulations to encourage precision medicine and advanced trials for cancer and rare diseases, boosting the adoption of gene editing. Moreover, China is stepping into the progress of gene editing solutions for deafness by targeting the OTOF gene.

The oncology segment captured a dominant share of nearly 50% of the market in 2024. The segment is mainly driven by a huge burden of cancer, specifically solid tumors and blood cancers, the breakthroughs in cell therapy, such as CAR-T cell therapies, and a robust government support for clinical trials and commercialization in China, Japan, and South Korea. In the last few days, India's APAC Biotech has established and received approval for APCEDEN, a customized dendritic cell-based immunotherapy to fight against specific cancer cells.

Although the rare genetic disorders segment will witness the fastest expansion in the upcoming years. The emergence of neuromuscular disorders, blood-related concerns, and metabolic disorders is fostering the revolution and growth of diverse kinds of therapies for the same. Recently, the All India Institute of Medical Sciences (AIIMS) researchers have established an innovative AI-based diagnostic tool for precise & rapid detection of ciliary disorders, which can affect the respiratory system, kidneys, and eyes.

By capturing nearly 70% share, the viral vectors segment led the APAC cell and gene therapy market in 2024. Expanded investments in healthcare and R&D, the growth of gene and cell therapy clinical trials for diseases, especially cancer and rare genetic disorders, are leveraging the innovations in viral vector approaches.

Under this segment, the adeno-associated virus (AAV) & lentivirus sub-segment held a major share of the market. In June 2025, Cytiva and EurekaBio partnered for manufacturing lentiviral vectors (LVV) in China, which further focuses on advancing gene and cell therapy by expanding the development and manufacturing.

On the other hand, the non-viral vectors segment is anticipated to witness rapid expansion in the APAC cell and gene therapy market during 2025-2034. These types of vectors encompass enhanced safety, scalability, and cost-effectiveness during production is fostering their widespread application. Researchers are boosting the development of inorganic-organic hybrid vectors and peptide-lipid vectors to expand transfection effectiveness while reducing toxicity.

Under this segment, the lipid nanoparticles sub-segment will expand at a rapid CAGR. The latest development comprises the application of a "virus-inspired" nanostructure that leverages an mRNA-encapsulating cationic polymer core surrounded by a lipid nanoparticle (LNP) shell. These LNPs are widely incorporated to transfer CRISPR/Cas9 mRNA and single-guide RNA (sgRNA).

In 2024, the autologous segment held an approximate 65% revenue share of the market. ASAP is increasingly using this source in the escalating prevalence of leukemia, lymphoma, and degenerative disorders. Besides this, ongoing developments in immunotherapy (particularly CAR-T cells), mesenchymal stem cells (MSCs), and induced pluripotent stem cells (iPSCs) are propelling a greater demand for this type of cell source. The bone marrow is a major source of autologous cells, which are further used in hematopoietic stem cell transplantation (HSCT) to treat blood disorders.

On the other hand, the allogeneic segment is predicted to expand rapidly in the APAC cell and gene therapy market during the forecast period. Certain significant sources like hematopoietic stem cells (HSCs), mesenchymal stem cells (MSCs), natural killer (NK) cells, and donor T-cells, derived from sources like peripheral blood, bone marrow, umbilical cord, and adipose tissue, are bolstering the segment expansion. Various companies are contributing to the progress of cell engineering, with accelerated investments and a strong clinical trial pipeline. A prominent catalyst is its affordability, and off-the-shelf therapies with boosted scalability over autologous treatments are influencing the overall market growth.

In 2024, the biopharma & biotechnology companies segment accounted for approximately 48% share of the APAC cell and gene therapy market. The leading players in China, Japan, and South Korea are highly fostering innovations in cell and gene therapy with streamlined approval processes. In October 2025, Made Scientific, a leading CDMO, and Syenex, a synthetic biology company, partnered to advance the scalability and efficiency of their UltraCell and RapidCell.

Whereas, the hospitals & specialty clinics segment is anticipated to register rapid growth. Primarily, these facilities are conducting clinical trials for novel cell and gene therapies, with innovative hubs in China, Japan, and South Korea, and are expanding a large number of these trials. A significant player in India is Tata Memorial Hospital, which partnered with IIT Bombay for the transformation and launch of India's foremost indigenously produced, inexpensive CAR-T cell therapy for cancer.

China, with a nearly 35% revenue share, led the APAC cell and gene therapy market in 2024. China’s growing patient population, encouraging government provisions, and maturing clinical research infrastructure are assisting its comprehensive development in a variety of cell and gene therapies. Especially, China's GenScript Biotech has employed an AI-assisted qPCR assay to offer therapeutic integrity, from lab to clinic, supporting CAR-T developers. Recently, the approval of China's first hemophilia B gene therapy in Q2 2025 and several CAR-T therapies for cancer have enhanced the overall country-level progression.

India is estimated to register the fastest growth in the APAC cell and gene therapy market during 2025-2034. Day by day, India is facing a rise in concerns regarding heart diseases, cancers, and genetic disorders, which are further accelerating the demand for advanced cell and gene therapies. This demand is supporting to expansion of both public & private investments in R&D and clinical trials. Whereas several biotech startups are promoting alliances among large pharmaceutical companies and academic institutions.

For instance,

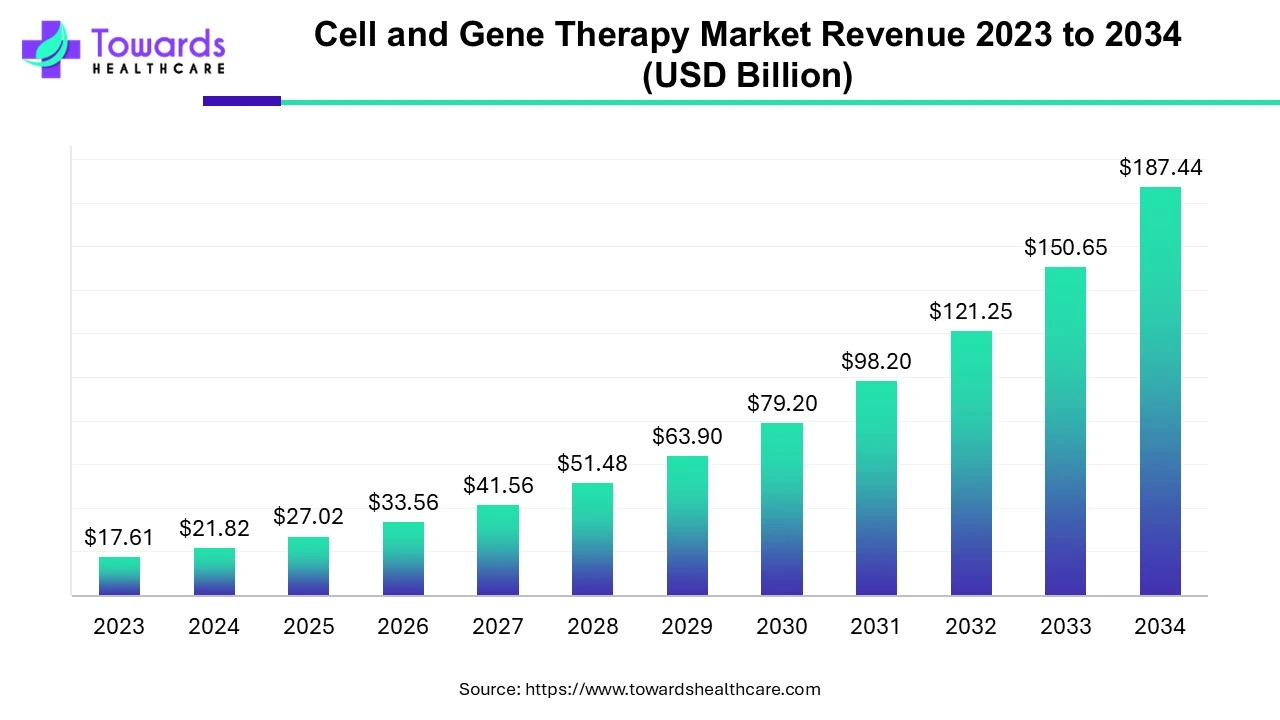

The global cell and gene therapy market is valued at USD 21.82 billion in 2024 and is projected to reach USD 187.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 24% from 2024 to 2034, driven by a surge in clinical trials and a rising number of product approvals.

Commonly involved discovery, preclinical studies, clinical studies, and post-marketing surveillance are contributing to the overall R&D sector of these therapies.

Key Player: ImmunoACT (India), Kolon TissueGene and JCR Pharmaceuticals (South Korea), etc.

It encompasses several stages of preclinical, clinical studies, with the IND application process, and finally regulatory approval & review by BLA or other respective bodies.

Key Players: Alpha Biopharma (Jiangsu) Co., Ltd., AstraZeneca, Genexine, Inc., etc.

It basically comprises regulatory navigation with tools like the ISCT APAC Industry Committee's regulatory roadmaps, case management for personalized, robust support, and advanced patient engagement strategies.

Key Players: IQVIA, Novotech, ProPharma, etc.

By Therapy Type

By Therapeutic Area

By Vector Type

By Cell Source

By End User

By Country

February 2026

February 2026

February 2026

February 2026