February 2026

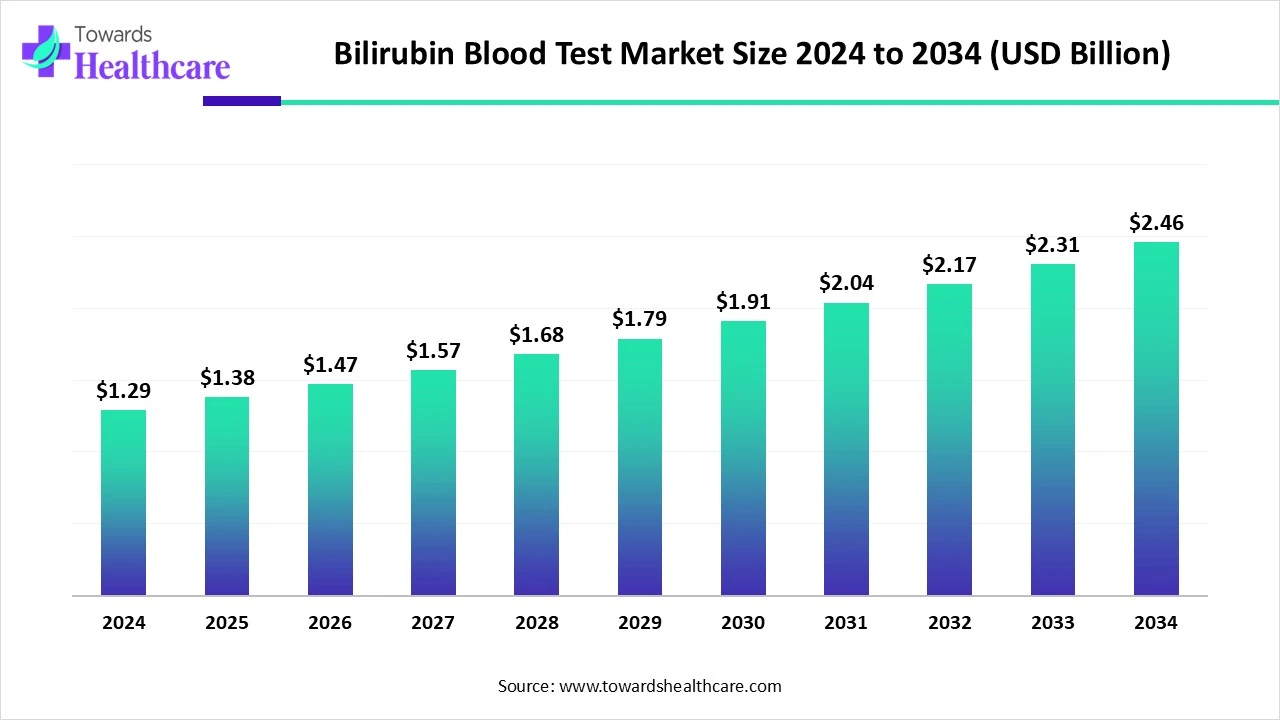

The global bilirubin blood test market size is calculated at USD 1.38 billion in 2025, grows to USD 1.47 billion in 2026, and is projected to reach around USD 2.62 billion by 2035. The market is expanding at a CAGR of 6.67% between 2026 and 2035.

The bilirubin blood test market is expanding due to the rising prevalence of liver diseases and neonatal jaundice, necessitating early and accurate diagnosis. Technological advancements, such as point-of-care devices and non-invasive testing methods, have enhanced diagnostic efficiency and accessibility. Additionally, increased public awareness about liver health and preventive healthcare measures is driving demand for these tests globally.

| Metric | Details |

| Market Size in 2026 | USD 1.47 Billion |

| Projected Market Size in 2035 | USD 2.62 Billion |

| CAGR (2025 - 2034) | 6.67% |

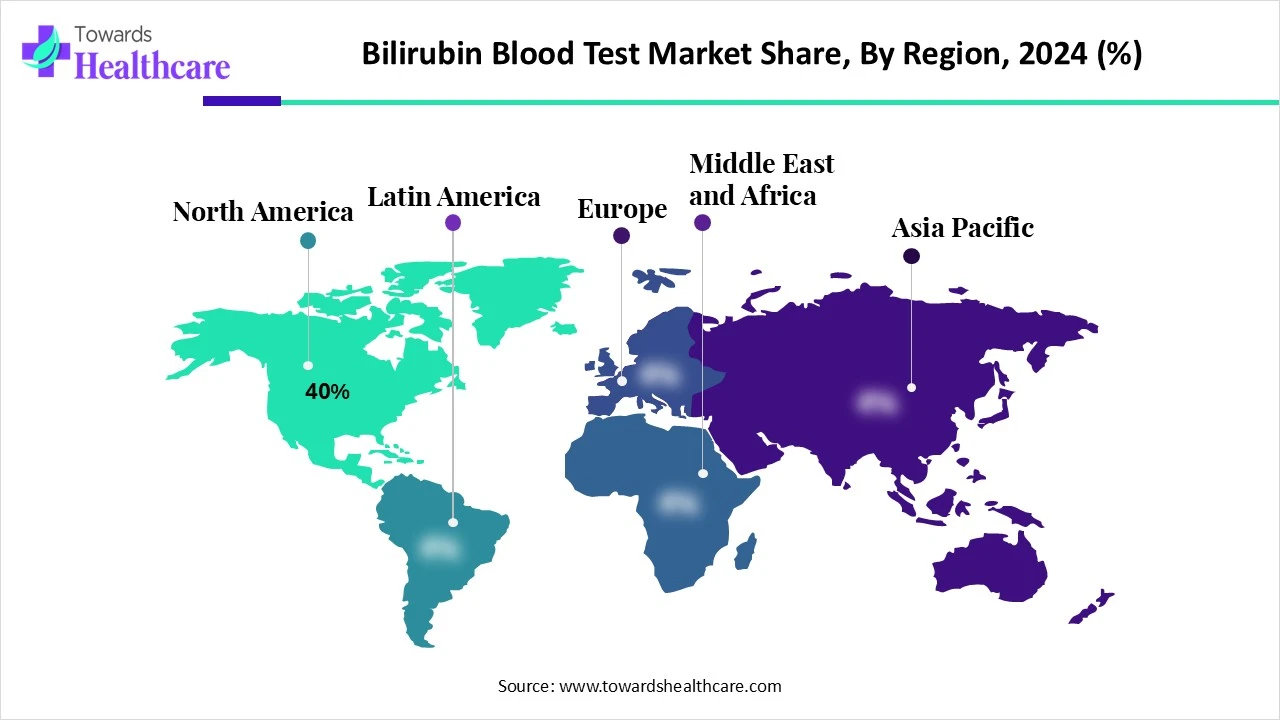

| Leading Region | North America share by 40% |

| Market Segmentation | By Test Type, By Application, By Technology, By End User, By Regions |

| Top Key Players | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Beckman Coulter, Thermo Fisher Scientific Inc., Radiometer Medical, Philips Healthcare, Drägerwerk AG & Co. KGaA, Nova Biomedical, Bayer AG, Arkray Inc., A&T Corporation, Gesan Production Srl, Sekisui Diagnostics, Mindray Bio-Medical Electronics Co., Ltd., EKF Diagnostics, Ortho Clinical Diagnostics, HORIBA Medical, SFRI Medical Diagnostics, TransLite, LLC |

The bilirubin blood test market involves diagnostic tests that measure the levels of bilirubin, a yellow compound produced during the breakdown of red blood cells in the blood. Elevated bilirubin levels can indicate liver dysfunction, hemolytic anemia, neonatal jaundice, or bile duct obstruction. These tests are routinely used in clinical diagnostics, neonatal care, liver disease monitoring, and pre-operative assessments. The market is driven by the growing burden of liver-related conditions, increasing neonatal screening, and automation in clinical laboratories. The bilirubin test market is evolving with the growing need for early detection of liver disorders and neonatal conditions. Innovations such as portable, point-of-care testing devices and non-invasive methods are making diagnostics faster and more accessible. Increasing healthcare awareness and focus on preventive screening, especially in developing countries, are further shaping the market’s expansion.

AI can significantly impact the market by enhancing diagnostic accuracy, enabling faster test result analysis, and reducing human error. AI-powered imaging and predictive tools can assist in the early detection of liver conditions by analyzing patterns in patient data. Additionally, integration with digital health platforms can support remote monitoring and personalized treatment. These advancements improve efficiency, accessibility, and decision-making in clinical settings, ultimately boosting the overall demand and effectiveness of bilirubin testing.

Rising Prevalence of Liver Diseases and Neonatal Jaundice

The increasing cases of liver disorders and neonatal jaundice are propelling the blood test market, as both conditions demand continuous monitoring of bilirubin concentration. In infants, early testing helps prevent complications like kernicterus, while in adults, it supports timely intervention in hepatic diseases. Growing hospital admissions for such conditions and greater clinical emphasis on early, accurate diagnostics are further fueling the need for these tests in routine and emergency care settings.

For Instance,

High Costs of Advanced Diagnostic Equipment

The expensive nature of modern bilirubin testing equipment poses a challenge for widespread use, particularly in rural and underfunded healthcare settings. Many hospitals and clinics may lack the financial resources to invest in or upgrade advanced diagnostic tools. As a result, patients in these areas face delays in testing or receive less precise results, which can impact timely treatment and overall patient outcomes, thereby slowing market expansion in cost-sensitive regions.

For Instance,

Rising Demand in Emerging Economies

The growing demand in emerging economies is unlocking new avenues for the global bilirubin blood test market. With rising disposable incomes and a shift towards modern lifestyles, populations in these regions are experiencing a higher incidence of lifestyle-related conditions such as diabetes, cardiovascular diseases, and liver disorders. This trend is prompting individuals to seek regular health screenings, including to seek regular health screenings including blood tests. In addition, test increasing presence of private healthcare providers and diagnostic chains is making these services more accessible, further supporting market growth in developing nations

The dominance of the total bilirubin test segment in the market is largely due to its role in routine health check-ups and pre-surgical evaluations. Unlike specialized tests, total bilirubin measurements are often part of standard liver panels, making it more commonly prescribed. Additionally, its ability to indicate early liver dysfunction, even before symptoms appear, has led to its increased demand across both preventive and diagnostic healthcare settings, particularly in primary care and emergency departments.

The point-of-care bilirubin measurement segment is projected to grow rapidly due to rising preference for immediate clinical decisions and shorter hospital stays, especially in neonatal wards. These devices minimize the need for repeated blood draws, making them ideal for infants and sensitive patients. Additionally, growing investment in compact diagnostic tools and increasing use of home-based monitoring are fueling demand. Their convenience, faster turnaround, and expanding application in outpatient and ambulatory care settings contribute to the market's growth.

The liver disease diagnosis & monitoring segment dominated the bilirubin blood test market as it plays a vital role in the ongoing clinical management of patients with suspected or confirmed hepatic conditions. With the growing use of hepatotoxic drugs and alcohol-related complications, routine bilirubin assessment has become essential for tracking liver response and avoiding complications. Moreover, the rise in specialized liver clinics and focus on chronic disease follow-up care has reinforced the high demand for bilirubin testing in this application area.

The neonatal jaundice detection segment is expected to witness the fastest CAGR as the healthcare system prioritizes preventive neonatal screening to reduce hospitalization and treatment costs. The growing demand for early discharge of newborns has increased reliance on quick bilirubin assessments before leaving maternity care. Moreover, technological improvements in potable testing devices have enabled more widespread use in community clinics and home visits. These shifts in clinical practices and care models are fueling the market's accelerated growth during the forecast period.

The photometric assay/spectrophotometry segment dominated the market as it offers standardized testing protocols and is well-established in diagnostic workflows. Its long-standing integration into hospital lab systems ensures consistency and ease of use for technicians. Additionally, the method requires minimal maintenance and is compatible with various reagents and sample types, making it a practical choice for high-throughput environments. These operational advantages have reinforced its leadership among available testing technologies.

The transcutaneous bilirubinometers segment is projected to grow at the fastest CAGR due to the increasing shift toward minimally handled neonatal care and reduced reliance on lab-based diagnostics. These devices streamline routine screening processes, saving time for healthcare staff while ensuring newborns are monitored without stress or risk of infection. Growing emphasis on early discharge programs in hospitals and the integration of digital monitoring features in newer model further support their expanding role in modern neonatal healthcare practices.

The hospitals segment led the bilirubin blood test market in 2024, due to its growing number of surgical procedures and pre-operative assessment, where bilirubin testing is essential. Hospitals also serve as referral centers for complex liver and neonatal conditions, increasing the frequency of diagnostic evaluations. Moreover, advancements in hospital-based diagnostic systems and integration of automated analyzers have streamlined the testing process, making hospitals a preferred choice for accurate and timely bilirubin assessment, thus securing their dominant market position.

The neonatal & pediatric clinics segment is anticipated to grow at the fastest CAGR due to the growing trend of outpatient based newborn management and follow-up care. These clinics are increasingly preferred for postnatal bilirubin monitoring because they offer targeted age-specific care in less crowded, more accessible environments compared to hospitals. Moreover, the rise of pediatric specialty centers and the integration of quick, non-invasive diagnostic tools have enhanced their capability to deliver timely bilirubin assessments, supporting their accelerated market growth.

North America dominated the bilirubin blood test market share by 40% due to its well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong awareness of liver and neonatal health. The region has a high rate of routine health screenings, supported by favorable reimbursement policies and the presence of key industry players. Additionally, the prevalence of liver-related disorders and widespread use of point-of-care testing in both hospital and outpatient settings have contributed to North America's leading market position

The U.S. market is growing due to the rising incidence of liver disorders, increased focus on preventive health checkups, and the widespread adoption of advanced diagnostic technologies. Supportive healthcare policies, high awareness levels, and the availability of both laboratory and point-of-care testing solutions further boost the market's expansion across hospitals and clinics nationwide.

For Instance,

The Canadian market is expanding due to a growing elderly population, increased prevalence of liver-related conditions, and rising public awareness of preventive health. Enhanced accessibility to healthcare services, especially in remote areas, along with the adoption of modern diagnostic technologies, is further accelerating the demand for efficient and routine bilirubin testing across the country.

Asia-Pacific is expected to grow at the fastest CAGR in the market due to the increasing shift toward decentralized diagnostics and the expansion of private healthcare services. Growing urbanization has led to higher demand for early disease detection, while medical tourism is fueling investments in diagnostic capabilities. Additionally, rising awareness of liver health through public health campaigns and the penetration of low-cost testing technologies are driving stronger market momentum across emerging economies in the region.

China's market is expanding due to the country having a large neonatal population, leading to increased demand for jaundice screening. Government initiatives like the Healthy China 2030 plan aim to enhance healthcare access and quality. Additionally, rising awareness of liver health and the adoption of advanced diagnostic technologies contribute to market growth.

India's market is expanding due to rising neonatal jaundice cases and increased awareness of early detection. Government programs like Ayushman Bharat enhance access to affordable diagnostics. The adoption of portable, non-invasive devices in rural areas, coupled with growing healthcare infrastructure and public-private partnerships, is further driving demand for bilirubin testing across the country.

In 2024, Europe is advancing its market through the integration of digital health solutions and point-of-care (POC) testing. Countries like Germany and the UK are leading in adopting automated analyzers and non-invasive devices, enhancing diagnostic accuracy and patient comfort. The rise of telemedicine and home-based testing is also contributing to market growth, particularly in neonatal care. Furthermore, strategic partnerships and investments in healthcare infrastructure are supporting the expansion of bilirubin testing services across the region.

The UK market is expanding due to increased focus on early disease detection, rising cases of liver-related conditions, and widespread use of routine neonatal screening. Government support for improved diagnostic services and growing adoption of non-invasive testing methods in both public and private healthcare settings are further driving the market’s steady growth.

Germany's market is expanding due to the integration of non-invasive testing methods and digital health solutions, including telemedicine platforms that incorporate bilirubin testing data. The country's emphasis on research and development has led to innovations in test accuracy and efficiency. Additionally, Germany's aging population and the implementation of universal healthcare systems ensure widespread access to bilirubin testing, further solidifying its market presence.

MEA is expected to grow significantly in the bilirubin blood test market during the forecast period, due to growing incidences of neonatal jaundice and other liver diseases. The growing healthcare infrastructure, government initiatives, and investments are also increasing their use. Furthermore, the growing health awareness and medical tourism are also promoting the market growth.

The presence of advanced healthcare in Saudi Arabia is increasing the use of the bilirubin blood test for the detection of growing liver diseases and neonatal jaundice cases. The increasing government initiatives are also driving their demand, where the companies are investing and developing various point-of-care bilirubin testing devices.

South America is expected to grow significantly in the bilirubin blood test market during the forecast period, due to growing healthcare infrastructure. The expanding diagnostic centres, health awareness, and government support are also increasing their adoption rates. Additionally, growing liver diseases and neonatal disorders are also increasing their use, which is enhancing the market growth.

The growing incidence of liver disease in Brazil is increasing the demand for bilirubin blood tests. The growing birth rates are also increasing their use for the early detection of any neonatal disorders. Moreover, the expanding healthcare and its investments are also promoting their adoption and innovations.

In 2024, Karius Inc., a Redwood City-based blood-testing company, secured $100 million in funding led by Khosla Ventures, along with 5AM Ventures and Gilde Healthcare. The company aims to expand hospital use of its AI-driven test, which detects infections by comparing microbial DNA fragments to a database of 20,000 references, producing results in just 26 hours. CEO Alec Ford noted the importance of faster diagnostics, especially for cancer and immunocompromised patients who often face delayed treatment. Khosla’s Alex Morgan described Karius' approach as a breakthrough, comparing it to using DNA at a crime scene rather than outdated methods. The test is already in use at 400 hospitals, including MD Anderson and Memorial Sloan Kettering. (Source - Bloomberg)

By Test Type

By Application

By Technology

By End User

By Region

February 2026

February 2026

February 2026

January 2026