January 2026

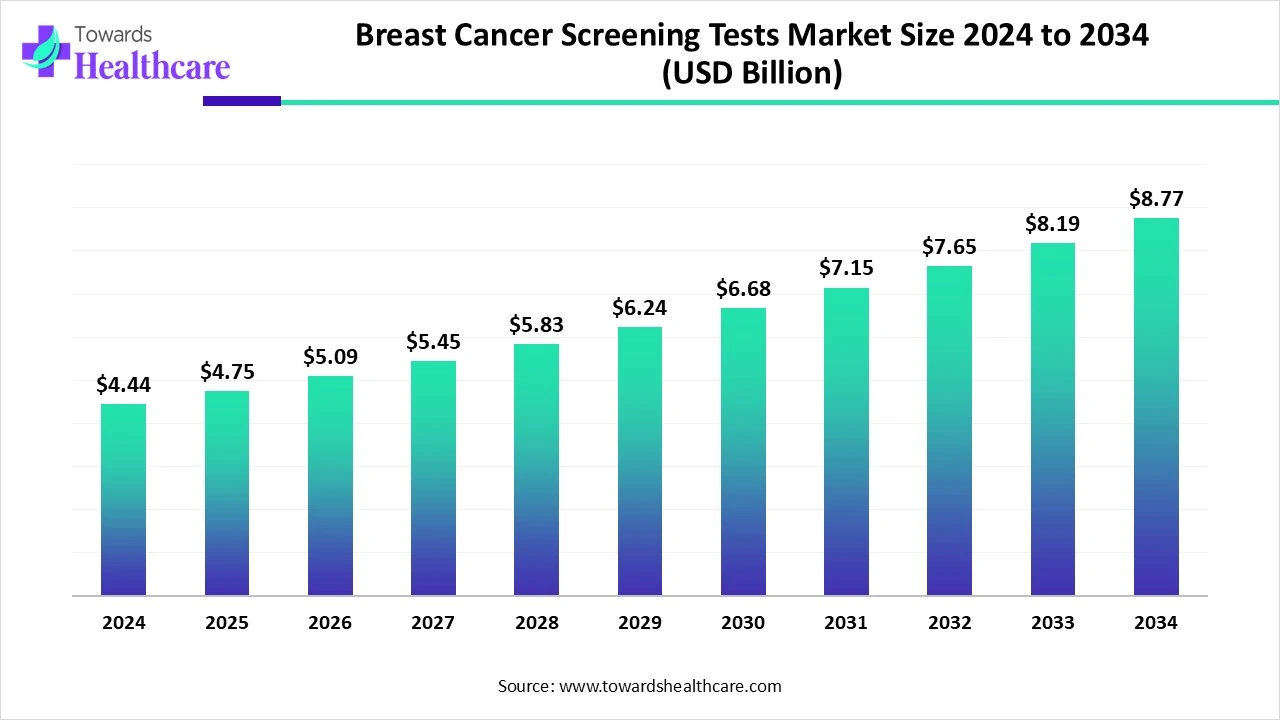

The global breast cancer screening tests market size is calculated at US$ 4.44 in 2024, grew to US$ 4.75 billion in 2025, and is projected to reach around US$ 8.77 billion by 2034. The market is projected to expand at a CAGR of 7.04% between 2025 and 2034.

The breast cancer screening tests market is expanding due to the increasing demand, awareness, and prevalence of breast cancer, as well as growing government initiatives promoting early detection. North America is dominated due to technological advancements like MRI, ultrasound, and 3D mammography are enhancing diagnostic accuracy. Asia Pacific is fastest fastest-growing due to increasing cases of breast cancer and rapid growth due to enhanced medical care access.

| Metric | Details |

| Market Size in 2025 | USD 4.75 Billion |

| Projected Market Size in 2034 | USD 8.77 Billion |

| CAGR (2025 - 2034) | 7.04% |

| Leading Region | North America |

| Market Segmentation | By Test Type, By Sample Type, By Application, By End User, By Region |

| Top Key Players | Hologic Inc., Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Corporation, Toshiba Medical Systems Corporation, Samsung Medison Co., Ltd., Mindray Medical International Limited, Varian Medical Systems, Exact Sciences Corporation, Guardant Health, Natera Inc., Biocept Inc., Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Illumina Inc., Color Health |

The breast cancer screening tests market covers diagnostic methods and technologies used to detect breast cancer in asymptomatic individuals. These tests enable early detection and risk assessment to improve treatment outcomes and survival rates. Breast cancer screening is the medical screening of asymptomatic, seemingly healthy women for breast cancer in an attempt to attain an earlier diagnosis. The assumption is that early detection will improve results.

AI Integration in the breast cancer screening tests is driving the growth of the market as AI techniques are developed and validated with promising applications in mammography screening, which help computer-assisted detection (CAD) identify suspicious findings depending on the challenges of malignancy. AI trained to scan imaging such as MRIs to detect and flag potential tumor-like structures in patients' scans with high efficiency. This supports radiologists and oncologists in a deeper examination of these flagged regions. AI integrated into the workflow of 2D breast screening under different scenarios. These involve using AI as a significant system to replace a human reader, and simultaneous reading with AI-CAD or AI for triaging regular cases.

For Instance,

Is Breast Cancer Diagnosis Increasing?

The diagnosis of breast cancer has steadily risen among women under age 50 over the past years, with more rapid increases in recent years. Several factors elevate the risk of developing breast cancer, such as advancing age, obesity, excessive alcohol consumption, family history, previous radiation exposure, reproductive history, tobacco use, and postmenopausal hormone therapy. These factors contribute to the growth of the breast cancer screening test market.

Major Challenges of Breast Cancer Screening Test

Several factors act as barriers to breast screening, such as stigma, religious beliefs, low risk perceptions, and distrust in health professionals. These barriers hinder the growth of the breast cancer screening market.

Recent Advances in Positron Emission Mammography (PEM)?

Positron emission mammography (PEM) is an advanced imaging technique for the breast that combines elements of PET scans and mammograms. It uses the same radioactive tracer injected into the bloodstream as a PET scan. During the procedure, the breast is gently compressed while images are captured, similar to a mammogram. PEM is a promising new technology that enhances the pretherapeutic evaluation of invasive lobular carcinoma (ILC) and benefits patients with renal impairment. This development presents opportunities for growth in the breast cancer screening market.

By test type, the imaging tests segment led the breast cancer screening tests market, due to it plays a significant role in breast cancer screening, for categorising and for defining the extent of breast cancer locally, loco-regionally, and at distant sites. Most breast cancers are identified by X-ray mammography, generally as part of nationwide screening programmes. It provides numerous advantages, with monitoring capability in real time, no need for tissue destruction, a minimally invasive procedure, and usability over wide periods and size ranges that are generally required in pathological and biological processes.

On the other hand, the blood marker tests segment is projected to experience the fastest CAGR from 2025 to 2035 as it supports doctors in figuring out whether likely early-stage breast cancer is to come back and make decisions about whether treatments after surgery would provide benefits. Blood markers help doctors detect how likely the cancer is to respond to various treatments. It also helps diagnose the origin of cancer in patients presenting with advanced, extensive disease. In breast cancer, blood markers are most often used to test response to cancer treatment or to watch for recurrence.

By sample type, tissue biopsy segment dominated the breast cancer screening tests market in 2024, because it is done to detect whether cancer or other abnormal cells are present. Breast biopsy is done by the doctor to determine whether a mass detected on mammography, ultrasound, or MRI is cancerous or not. A breast biopsy is a technique to remove a sample of breast tissue for testing. The tissue sample is directed to a lab, where a physician who specializes in analysing blood and body tissue examines the tissue sample and provides a diagnosis.

The blood segment is projected to grow at the highest CAGR from 2025 to 2035, as blood tests offer evidence of breast cancer and are applied as aids in diagnosing breast cancer or noticing recurrence, for example, the CEA and CA 27.29 blood tests for breast cancer. Blood-based tests in the circulation complement existing diagnostic devices to enhance the performance of breast cancer screening and identification. A blood test could lower false positives and offer a less stressful, profitable way for consumers to diagnose breast cancer earlier, without the requirement for biopsies.

By collection site, the hospitals segment led the market in 2024, due to hospital staff supporting those patients who have been diagnosed with breast cancer, and also other people appreciate how much of a challenge breast cancer is, supervisory them to take action. This screening is finding cancer early, when it's easier to treat.

The home-based testing segment is projected to experience the fastest CAGR from 2025 to 2035, as it is easy and cost-effective, such as Blue Box is a healthcare device for pain-free, non-irradiating, low-cost, in-home breast cancer testing, through introducing a urine sample in a box. Home-based testing comprises both visual inspection and manual breast self-exams.

By application, the early detection segment dominated in the breast cancer screening tests market in 2024, as early detection of cancer or a precursor results in less radical treatment and enhanced prognosis for various types of cancers. Early detection and screening are some of the most significant tools to help prevent the risks of cancer. Regular screenings identify cancer early, often before symptoms appear.

On the other hand, the post-treatment monitoring segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as essential follow-up care is significant for enhancing health results in breast cancer survivors (BCSs) and it needs determination of the optimal intensity of clinical examination and surveillance, valuation of models of follow-up care like primary care-based follow-up.

By end user, the healthcare providers segment dominated in the Breast Cancer Screening Tests Market in 2024, as screening tests assist healthcare providers in finding breast cancers at an early stage, when they’re easier to treat and perhaps cure. By these screening tests, healthcare providers predict the risk of breast cancer coming back in various areas of the body. Early detection lowers the chance of dying from breast cancer and which leads to a wide range of treatment options and reduces healthcare expenses.

On the other hand, the home users segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as breast cancer screening tests, with self-exams, support home users by allowing early detection of potential challenges, enabling timely medical intervention.

North America dominated the breast cancer screening tests market in 2024, as the increasing incidence of breast cancer is due to many people getting less physical activity, consuming alcohol, and having fewer kids in North America. In 2025, investigators expected that 16% of women with breast cancer would be younger than 50 years of age. The flow is driven largely by the growing number of women diagnosed with estrogen-receptor positive tumors, tumorous growths increased by estrogen, which drives the growth of the market.

For Instance,

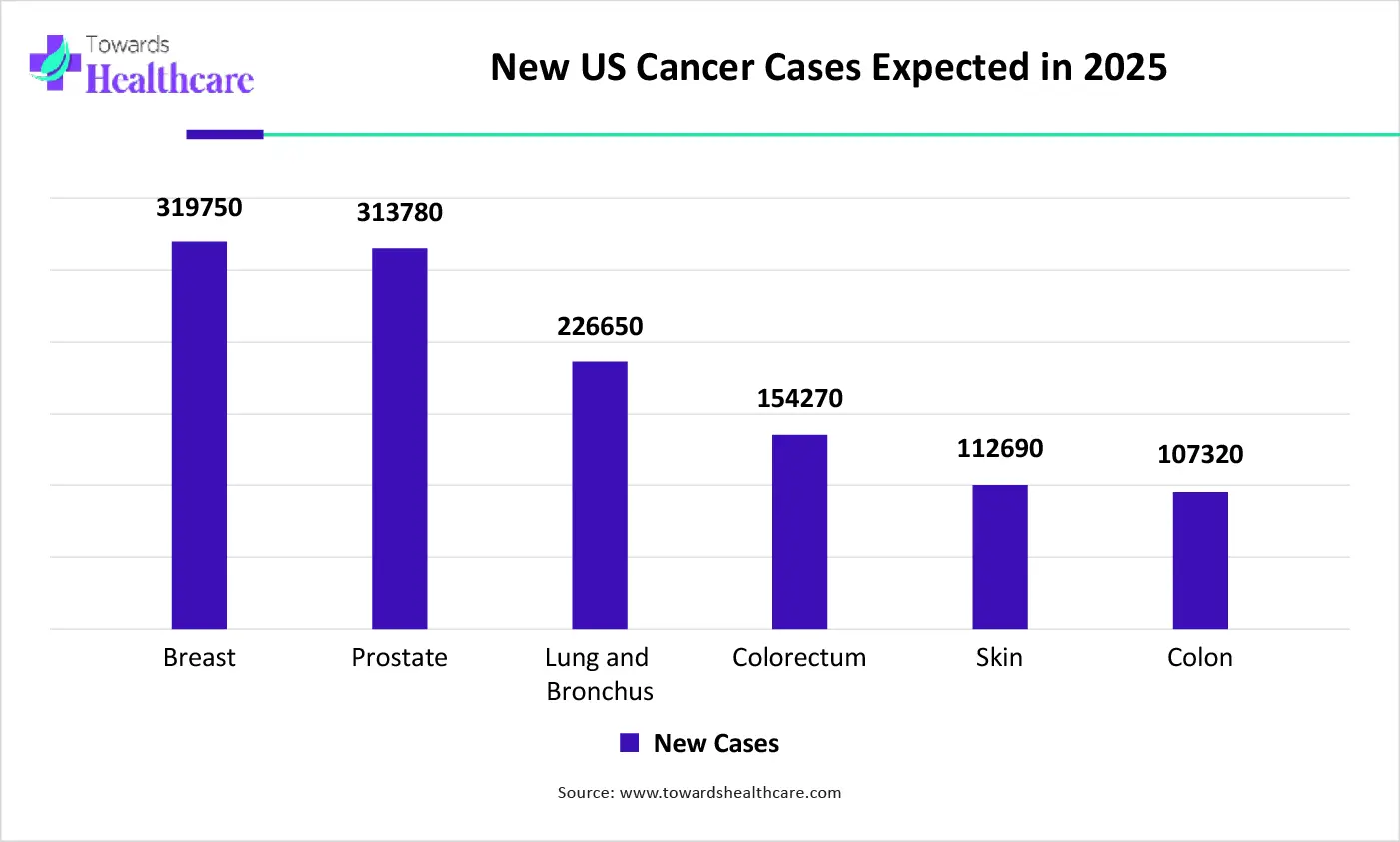

In the U.S., breast cancer is the most common type of cancer, with 319,750 recent cases expected in the United States in 2025. The novel combination therapy, in which two targeted drugs, inavolisib and palbociclib, along with hormone therapy, fulvestrant, was shown to have enhanced overall survival through an average of seven months, as compared with the patients in the control group, which drives the growth of the market. (Source - Medium)

In Canada, growing public funding allows the government to regulate costs and prevent for-profit motives from increasing healthcare prices. The presence of various healthcare organizations, such as the Canadian Institute for Health Information (CIHI), drives the growth of the market. The number of recent diagnoses and deaths by cancer is likely to constantly increase because of growing and aging populations, contributing to the growth of the market.

Asia Pacific is estimated to be the fastest-growing breast cancer screening tests market during the forecast period, as breast cancer research in Asia Pacific is necessary in entirely domains of healthcare research, It is felt that for Asia Pacific breast cancer patients, the requirement is highest, an increasing demand for the breast cancer screening test market. Asia Pacific countries are becoming an aging or aged society, with growing westernized lifestyle-related cancers, which contribute to the growth of the market.

For Instance,

China has sped up the pace of introducing novel drugs, which has advanced in clinical research and treatment of breast cancer, driving the growth of the market. Breast cancer has a great economic and social burden for China, but there is still quite a long way to enhance the prevention, which increases the demand for breast cancer screening tests.

Growing cancer awareness leads to greater demand for breast cancer services, encouraging healthcare workers to expand access to screening, treatment, and diagnosis facilities. Rising collaboration among the Government and non-governmental organizations to launch public health campaigns using different media channels to disseminate data related to breast cancer, its symptoms, and the importance of early detection, which increases the growth of the market.

Europe is expected to grow significantly in the breast cancer screening tests market during the forecast period, as in Europe, breast cancer civil society organizations have arisen to increase awareness related to cancer as a survivable disease and offer huge patient support. Increasing government initiatives, such as the European Commission Initiative on Breast Cancer (ECIBC) is a patient-focused projects established by the European Commission, goal of enhancing and harmonizing breast cancer care in Europe, providing significant levels of quality care that are equally available in Europe, which drives the growth of the market.

German Cancer Aid is the main source of private funding for efforts to fight cancer, including cancer research, in Germany. The country is increasing its leading healthcare talent worldwide and keeps active partnerships with important institutions like MD Anderson Cancer Center and Memorial Sloan Kettering, supports to adoption of breast cancer screening tests, which contributes to the growth of the market.

The UK Cancer advocacy groups in established countries have been confirmed to be significant forces for the progression of cancer control and offer considerable leadership in the establishment of national cancer priorities. Increasing aging and growing population, rising awareness and screening cases leading to more diagnoses, and a huge prevalence of risk factors of breast cancer, which contribute to the growth of the market.

The Middle East & Africa are considered to be a significantly growing area in the market, due to the rising prevalence of breast cancer and favorable government support. Government organizations launch initiatives to raise awareness of breast cancer and its screening and early diagnosis. The burgeoning healthcare sector and rising investments contribute to market growth. According to a recent health survey, the increased screening participation for breast cancer in Jordan was correlated with advanced age, larger home affluence, higher parity, previous STDs, and exposure to radio communications.

The prevalence rate of breast cancer in the UAE is 94 cases per 100,000 women. The Breast Interventional Imaging Specialist at the Emirates Health Services (EHS) reported that 66% of all breast cancer cases in the UAE are diagnosed at early stages, contributing to a 98% survival and recovery rate. This is driven by government initiatives like the National Guideline for Breast Cancer Screening and Diagnosis.

In April 2025, Dr. Howard Berger, President and Chief Executive Officer of RadNet, Stated, “Every 14 seconds, a woman is diagnosed with breast cancer globally, and in the United States alone, over 42,000 women are expected to die from breast cancer during 2025. iCAD’s ProFound Breast Health Suite and RadNet’s DeepHealth AI-powered breast screening solutions, together, have the power to materially expand and improve patient diagnosis and outcomes on a global basis through further enabling accuracy and early detection.”

By Test Type

By Sample Type

By Collection Site

By Application

By End User

By Region

January 2026

December 2025

December 2025

December 2025