February 2026

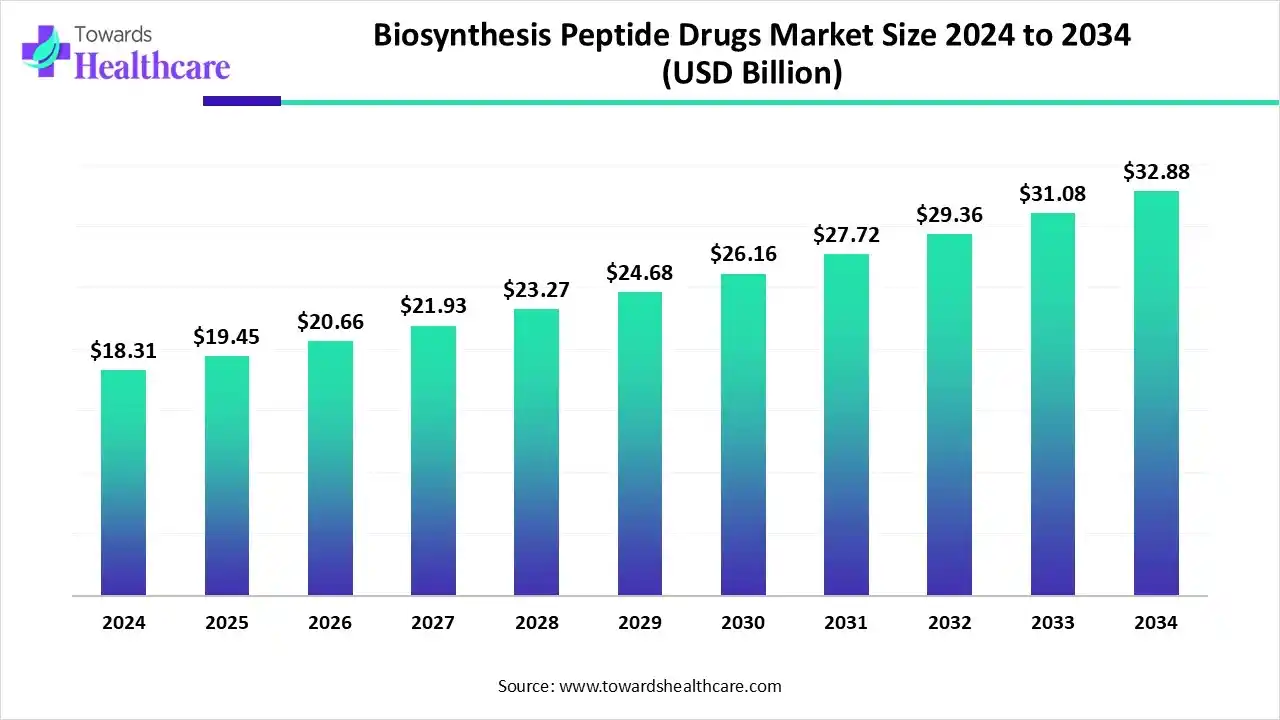

The global biosynthesis peptide drugs market size is estimated at US$ 18.31 billion in 2024, is projected to grow to US$ 19.45 billion in 2025, and is expected to reach around US$ 32.88 billion by 2034. The market is projected to expand at a CAGR of 6.26% between 2025 and 2034.

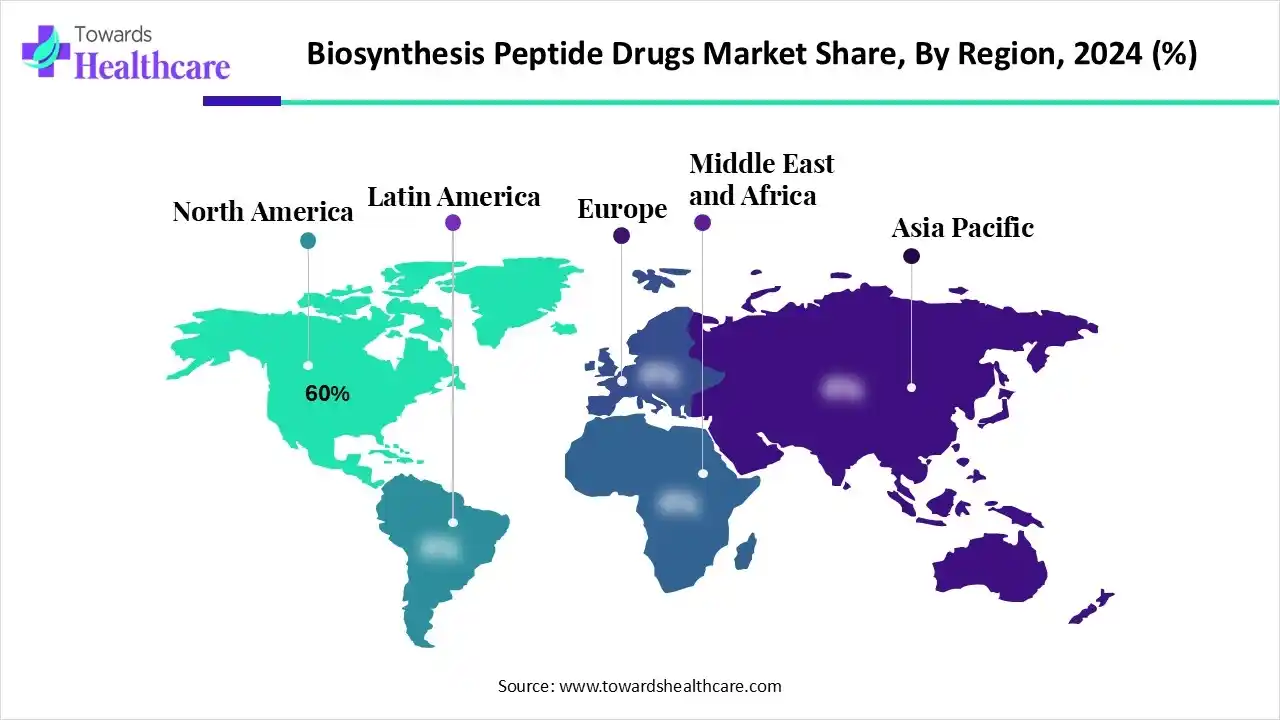

The biosynthesis peptide drugs market is growing because researchers have recently utilized peptide applications for the production of advanced drug molecules for therapeutic purposes, such as cancer treatment, diagnosis, epitope mapping, antibiotic drug manufacturing, vaccine design, and antibody sequencing solutions. North America is dominant in the market as it is a hub of attention for many pharmaceutical companies and research institutions, while Asia Pacific is fastest growing the fastest-growing market due to increasing investment in biotechnology and R&D.

| Table | Scope |

| Market Size in 2025 | USD 19.45 Billion |

| Projected Market Size in 2034 | USD 32.88 Billion |

| CAGR (2025 - 2034) | 6.26% |

| Leading Region | North America by 60% |

| Market Segmentation | By Drug Type, By Synthesis Technology, By Application/Therapeutic Area, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players | Novo Nordisk, Eli Lilly and Company, Pfizer Inc., Novartis AG, Sanofi S.A., Amgen Inc., AstraZeneca PLC, GlaxoSmithKline plc (GSK), Merck & Co., Inc., Takeda Pharmaceutical Company Limited, Bachem Holding AG, PolyPeptide Group, AmbioPharm, Inc., CPC Scientific Co., Ltd., CordenPharma (part of Longrun Group), PeptiDream Inc., Zealand Pharma A/S, Peptide Institute, Inc., CSBio, Inc., BCN Peptides (Peptides & Biochemicals S.L.) |

The biosynthesis peptide drugs market covers the global industry involved in the discovery, chemical or biological synthesis, development, manufacturing, and commercialization of peptide-based therapeutics. Peptide drugs are short chains of amino acids that bridge small-molecule and biologic medicines they offer high target specificity, predictable metabolism, and modifiable pharmacokinetics, and are used across indications such as metabolic diseases, oncology, infectious disease, endocrinology, and rare disorders.

The market includes activities from early-stage peptide design and optimization, through solid-phase and liquid-phase peptide synthesis, formulation and delivery, all the way to GMP manufacture, regulatory support, and commercialization. Key value-chain participants include large pharmaceutical companies developing peptide therapeutics, specialist peptide biotechnology firms, and dedicated peptide CDMOs/CMOs that provide synthesis, scale-up, and GMP manufacturing services.

Integration of AI significantly promotes the growth of the biosynthesis peptide drugs market , as the artificial intelligence-driven technology has further sped up the discovery of peptides, enabling the swift identification of bioactive sequences and structural optimization to improve their efficacy, stability, and target specificity. AI-driven technology offers a range of computational tools and algorithms that allow scientists to accelerate therapeutic peptide manufacturing.

AI-based strategies have started to renovate the field of peptide design and optimization by leveraging computational algorithms and predictive models to guide the discovery of new peptide therapeutics. Using AI in peptide development, encompassing classifier methods, predictive systems, and the avant-garde design simplified by deep generative models such as variational autoencoders and generative adversarial networks.

For Instance,

By drug type, the branded peptide drugs segment led the Biosynthesis Peptide Drugs Market with a 70% share, as branded peptide drugs use short chains of amino acids to manage diseases, which are approved and are sold under a detailed brand name. They are often used for chronic health conditions such as diabetes, cancer, and CVD, and are valued for their high specificity, minor toxicity, and potential for lower production expenses compared to other drugs.

On the other hand, the generic peptide drugs segment is projected to experience the fastest CAGR from 2025 to 2034, as generic peptides replicate existing peptide drugs. These drugs are generally composed of amino acids connected by peptide bonds and are applied to manage different types of diseases, such as cancer, immune disorders, and diabetes. Developing these generics needs inclusive research in the synthesis processes, quality control, formulation technologies, and bioequivalence to ensure they match the quality and efficacy of the brand drugs.

By synthesis technology type, the solid-phase peptide synthesis segment is dominant in the biosynthesis peptide drugs market in 2024, with approximately 60% share, as solid-phase peptide synthesis is better suited to automation using batch peptide synthesizers. Robotic systems perform repetitive deprotection and coupling cycles with accurate timing and delivery of reagents. This phase synthesis accommodates a broad variety of sequences, including challenging or highly functionalized peptides. It is relatively simple to incorporate non-natural amino acids, labels, or modifications at intended positions; each residue is added separately.

The liquid-phase peptide synthesis segment is expected to experience the fastest growth from 2025 to 2034, as LPPS, peptides are offered bit-by-bit in services using soluble tags. These tags, like the solid supports in SPPS, streamline the process after every step by making it simple to separate the product. In terms of product transparency, liquid-phase peptide synthesis attains high standards. For short and less complex peptides, liquid-phase synthesis proceeds rapidly.

By application, the metabolic disorders segment led the Biosynthesis Peptide Drugs Market in 2024, with a 25% share, as peptide-based activities transformed the management of conditions such as type 2 diabetes and obesity. Peptide drugs have greater biocompatibility and excellent specificity, making them a reliable choice in healthcare treatment. They provide significant roles in disease-related metabolic reprogramming and immune modulation through activating cell signaling pathways, managing metabolic processes, and immune cell functions.

The neurological disorders segment is projected to experience the fastest CAGR from 2025 to 2034, as peptides have benefits than conventional small-molecule drugs, with high specificity, reduced toxicity, and the ability to target many disease pathways simultaneously. Peptide-based therapies are gaining attention in neurology, predominantly in the context of aging-related cognitive diseases.

By route of administration, the parenteral segment led the biosynthesis peptide drugs market in 2024, with a 80% share, as parenteral delivery is the leading route for peptide-based medications because it overcomes the many challenges of oral administration, such as poor stability and low bioavailability in the gastrointestinal (GI) tract.

The oral segment is projected to experience the fastest CAGR from 2025 to 2034, as oral administration of therapeutic peptides reaches the blood circulation, these drugs have to overcome several challenges, including the enzymatic, mucus, sulfhydryl, and epithelial barrier. Oral administration of peptides for systemic delivery offers suitability for patients and encourages better adherence to dosing regimens than injections.

By distribution channel, the hospital pharmacies segment led the biosynthesis peptide drugs market in 2024 with a 50% share, as this type of pharmacies are capable of purchasing, handling, storing, pricing, and distributing medications. Additionally, it provides proper drug data to all healthcare professionals and the public. Hospital pharmacists offer specifications for buying drugs, chemicals, and biological medications.

The online pharmacies segment is projected to experience the fastest CAGR from 2025 to 2034, as online pharmacies are a link between patients and essential medications, particularly for those living in underserved or remote areas. Online platforms confirm that patients obtain the medication services they need without having to travel larger distances. Major online pharmacies source medications from trustworthy suppliers, confirming authenticity and quality.

North America is dominant in the biosynthetic peptide drugs market in 2024, with a revenue of 60% due to its strong presence of many pharmaceutical and biotechnology organizations, significant and consistent spending in research and development, and an advanced healthcare infrastructure, as well as growing government investment in healthcare technology. For Instance, in October 2024, clinical researchers will receive approximately $17.2 million over the next four years, which contributes to the growth of the market.

For Instance,

In the U.S., an increase in demand for peptide drug biosynthesis for targeted therapies, technological advances in healthcare production, and increased investment. Adopting innovative technology in peptide biosynthesis has made manufacturing processes more effective, scalable, and affordable. The demand for modified and targeted treatments is growing, and peptides are well-suited to this approach because of their customization strength.

For Instance,

Asia Pacific is the fastest-growing region in the market in the forecast period, as this region is experiencing a rise in the prevalence of long-term health conditions such as cancer, diabetes, and metabolic disorders, which are significant targets for peptide-based therapies. Revolutions in peptide synthesis, drug delivery technology, and the integration of AI and automation are enhancing effectiveness and lowering expenses, which drives the growth of the market.

For Instance,

In China growing burden of chronic diseases like diabetes and cancer, which increases the demand for peptide drugs, for instance, China has the world's largest diabetes population, with more than 118 million people suffering from diabetes. Also, rising government policies associated with medical care services, like China, have applied the priority review (PR) program and flexible registration needs for novel drugs with significant clinical value, which drives the growth of the market.

Europe is a notably growing region in the market due to the increase in biosimilars is a major trend in Europe, providing affordable versions of branded drugs as their patents expire. The presence of supportive government regulations, such as the European Medicines Agency (EMA), provides comprehensive, peptide-specific regulation for manufacturing, characterization, and control, which fosters stability and innovation.

In Germany, robust pharmaceutical and biotech sectors and growing applications in chronic disease treatment, targeted medicine, and diagnostics. Recently, Germany has adopted "Industry 4.0" practices in its biomanufacturing technology, which improves quality control and operational effectiveness. The German government has implemented approaches such as "Pharma Strategy 2030," which offers incentives and funding to drive biopharmaceutical research and development.

For Instance,

The research and development (R&D) processes for biosynthetic peptide drugs mainly include peptide discovery and lead identification, synthesis and optimization, downstream processing, and preclinical and clinical development.

Key Players: Novo Nordisk A/S and Eli Lilly and Company

Clinical trials of biosynthetic peptide drugs involve discovery, preclinical testing, three phases of human trials, and a review for government approval.

Key Players: Pfizer Inc. and Merck & Co., Inc.

The patient services process for biosynthetic peptide drugs involves a patient's journey from initial consultation to chronic disease monitoring, contributing diagnosis, treatment planning, administration, and ongoing support.

Key Players: AstraZeneca and Amgen Inc.

By Drug Type

By Synthesis Technology

By Application/Therapeutic Area

By Route of Administration

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026