March 2026

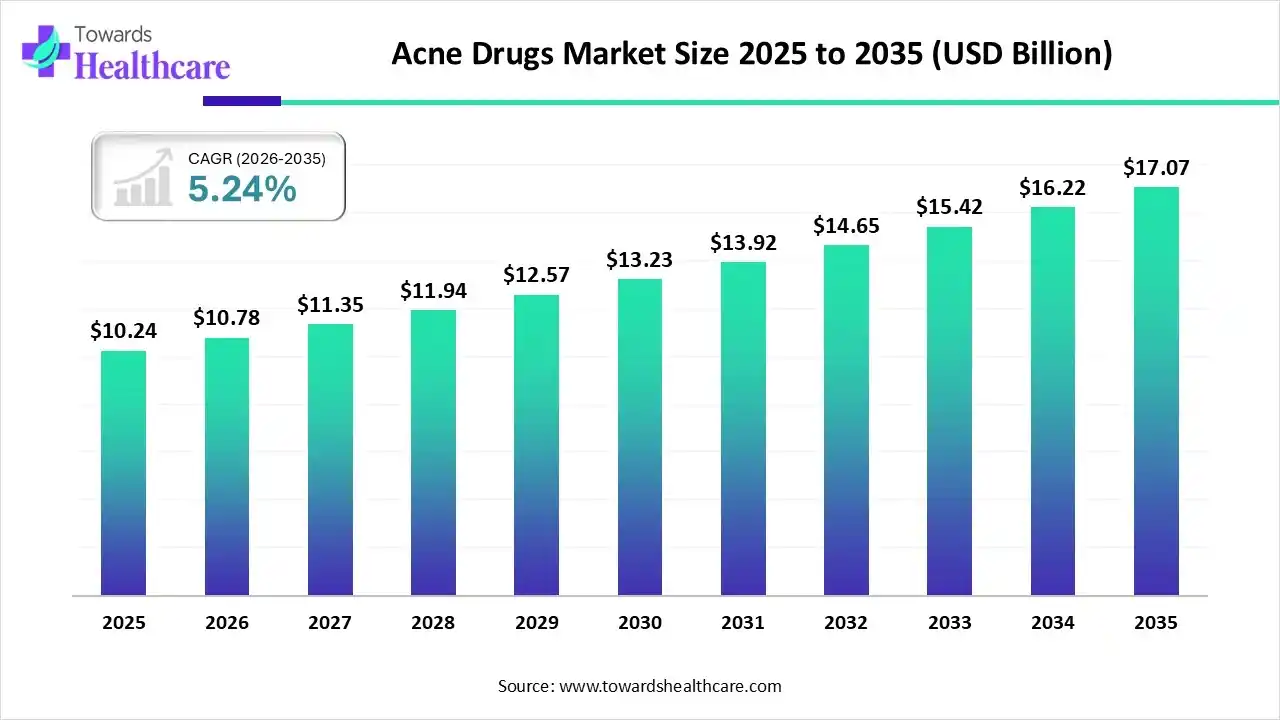

The global acne drugs market size was estimated at USD 10.24 billion in 2025 and is predicted to increase from USD 10.78 billion in 2026 to approximately USD 17.07 billion by 2035, expanding at a CAGR of 5.24% from 2026 to 2035.

The acne drugs market is growing due to the high and increasing prevalence of acne. Growing public awareness of skin care is driven by social media and lifestyle factors.

| Key Elements | Scope |

| Market Size in 2026 | USD 10.78 Billion |

| Projected Market Size in 2035 | USD 17.07 Billion |

| CAGR (2026 - 2035) | 5.24% |

| Leading Region | North America |

| Market Segmentation | By Type, By Therapeutic Class, Regional Outlook |

| Top Key Players | GALDERMA, Johnson & Johnson Services, Inc., GSK plc., Pfizer Inc., AbbVie Inc., Sun Pharmaceutical Industries Ltd., Bausch Health Companies Inc. |

The acne drugs market includes the pharmaceutical organizations, cosmetic brands, and customer giants developing diverse treatments. Acne constantly ranks in the top three most prevalent skin diseases in the population. Acne is a long-term disease in which both environmental and genetic factors cooperate. A significant goal of acne treatment is to efficiently manage and tackle present acne challenges, to prevent the development of permanent scars, limit the duration of the condition, and reduce the frequency of recurrence.

The integration of AI-driven technology into acne drugs drives the growth of the market, as AI-driven technology allows for early diagnosis and treatment of acne. AI-based technology in skincare recommendations driven by machine learning is a significant strategy in managing mild-to-moderate acne. AI-driven systems for acne categorization are expected to enhance dermatological care by providing standardized assessments, reducing inter-observer variability, and improving healthcare efficiency.

Personalized treatment helps in patient-centered acne management, which integrates priority and prognostic factors beyond conventional healthcare severity.

Topical formulation increased physical stability and improved protection from environmental factors, lowering adverse effects related to the topical antiacne agents, and it provides sustained release of the active agent, prolonging the drug activity.

Combination therapy with a topical retinoid and an antibiotic can regularize follicular epithelial desquamation and lower bacterial explosion.

Which Type Led the Acne Drugs Market in 2025?

In 2025, the inflammatory acne segment held the dominant market, as inflammatory acne is a skin condition that leads to red, swollen, and sore pimples. These pimples contain pus, dead skin cells, and excess oil. This type of acne commonly occurred back, face, chest, and shoulders. Various medicinal cleansers and creams supports to reduce inflammatory acne.

Non-inflammatory Acne

Whereas the non-inflammatory acne segment is the fastest-growing in the market, as non-inflammatory acne comes in two extremely recognizable key forms, open and closed comedones. Noninflammatory acne is the clogged pores that don't develop red, infected, or swollen. Salicylic acid is often used for acne in general; it usually works best on noninflammatory acne.

Why did the Over-the-Counter (OTC) Drugs Segment Dominate the Market in 2025?

The over-the-counter (OTC) drugs segment is dominant in the acne drugs market in 2025, as this medicine makes healthcare more accessible by allowing patients to purchase drugs without visiting a physician. Application of OTC drugs enhances access, service, convenience, health results, and patient satisfaction. OTC medicines manage a variety of illnesses and their symptoms, such as coughs, pain, and colds, diarrhoea, constipation, acne, and others.

Topical Retinoids

Whereas the topical retinoids segment is the fastest growing in the market, as topical retinol treatments supports to reduce the puffiness and inflammation associated with breakouts and supports to prevent further injury. Topical retinoids are valuable to treat post-inflammatory hyperpigmentation as they avoid melanosome transfer and simplify melanin dispersal.

Why did the Topical Segment Dominate the Market in 2025?

The topical segment is dominant in the acne drugs market in 2025, as topical drugs have been applied effectively to treat acne for decades. Topical treatment is well-known and mainstream strategies to treat acne, and there are a number of treatment selections. Benzoyl peroxide works as an antiseptic to reduce the number of bacteria on the surface of the skin.

Injectable

Whereas the injectable segment is the fastest growing in the market, as acne injections rapidly lessen inflammation and swelling in cystic acne and deep getaways, providing rapid relief and clearer skin in 24 to 48 hours. Acne Injections include administering a minor amount of a corticosteroid directly into an inflamed acne lesion, characteristically using a fine needle.

Why did the Retail Pharmacies Segment Dominate the Market in 2025?

The retail pharmacies segment is dominant in the acne drugs market in 2025, as it provides a wide collection of medicines and supplementary health products and addresses diverse medical care needs. With a comprehensive solution, including pharmacy and mail order selections, retail pharmacies modernize the drug access technology. Retail pharmacies are an important part of health systems and, in major countries, are accountable for dispensing a huge proportion of health products and related solutions.

Online Pharmacies

Whereas the online pharmacies segment is the fastest growing in the market, as online pharmacies aim to improve healthcare outcomes and reduce disparities in access to advanced treatments. Online pharmacies also offer a wide selection of products and drugs. It is a significant expense savings for the customer.

In 2025, North America led the acne drugs market, as development in the treatment of skin conditions and rising awareness of skin cancer led people to increasingly seek care. Major multidisciplinary clinics in dermatology result in enhanced patient results and satisfaction. The region is a hub of major industry players like Johnson & Johnson, Pfizer, Bausch Health, and Galderma, which continuously launch innovative drugs like Winlevi and Arazlo.

U.S. Market Trends

In the U.S. prevalence of chronic and lifestyle-related skin conditions, an ageing population, public awareness, and the rapid growth of the cosmetic industry. The number of U.S. medical spas increased from 1,600 in 2010 to 8,841 in 2022, projected to reach 11,553 by 2025, which drives the growth of the market.

Asia Pacific is set to experience rapid growth in the acne drugs market, as increasing daily stress has been related to skin problems, from blackheads and imperfections to acne and amplified oil production. Growing awareness, urbanization, and strong influence from social media and K-beauty movements have led to a rapidly growing market for both premium and personalized services.

India Market Trends

In India, a shifting trend toward adult-onset acne, specifically in women, is driven by increasing pollution, high-glycemic diets, and hormonal variations. Significant social media influencers and celebrities have a predominant impact on customer behavior in the cosmetic sector in this region. As the rising Indian middle class rises, and more people shift to urban areas, there is a greater willingness to invest in skincare treatments and products.

Europe is experiencing substantial growth in the acne drugs market, as in this region, acne was around 25% more common in young women than in young men. Well-developed healthcare facilities, dermatological hospitals, and specialized professionals ensure high-quality, targeted care and simple access to different prescription and OTC treatments.

UK Market Trends

In the UK Acne is the most common skin conditions in the foremost to 3.5 million visits to primary care each year. UK clinical strategies from the National Institute for Health and Care Excellence (NICE) help the applications of advanced treatments such as oral isotretinoin and particular combination therapies for persistent and simple cases of acne, which drives the growth of the market.

| Company | Headquarters | Latest Update |

| GALDERMA | Switzerland | Galderma intends to spend in its Therapeutic Dermatology portfolio, particularly Nemluvio, and in its mature brands, capitalizing on a foremost position in acne in International markets. |

| Johnson & Johnson Services, Inc. | United States | Johnson & Johnson is a worldwide healthcare corporation focused on Innovative Medicine and MedTech. |

| GSK plc. | United Kingdom | Novel GSK to deliver step-change in growth and performance over the next ten years, driven by a high-quality Vaccines and Specialty Medicines portfolio and late-stage pipeline. |

| Pfizer Inc. | United States | Pfizer completes early-stage acne trial, signalling quiet expansion in dermatology. |

| AbbVie Inc. | United States | AbbVie announced positive topline results from two replicate Phase 3 studies evaluating the safety and efficacy of upadacitinib. |

| Sun Pharmaceutical Industries Ltd. | India | In November 2025, Sun Pharma announced it acquired, at no cost, the commercial sales rights to LEVULAN KERASTICK in Canada from Clarion Medical Technologies. |

| Bausch Health Companies Inc. | Finland | In July 2025, Bausch Health, Canada Inc., announced that PrCABTREO™ gel 1.2% w/w, 0.15% w/w, and 3.1% w/w, for the treatment of acne vulgaris,1 is now available to beneficiaries of the public drug plans of Ontario and Nova Scotia, as well as through the federal government’s Non-Insured Health Benefits (NIHB) drug plan. |

By Type

By Therapeutic Class

Regional Outlook

March 2026

March 2026

March 2026

March 2026