February 2026

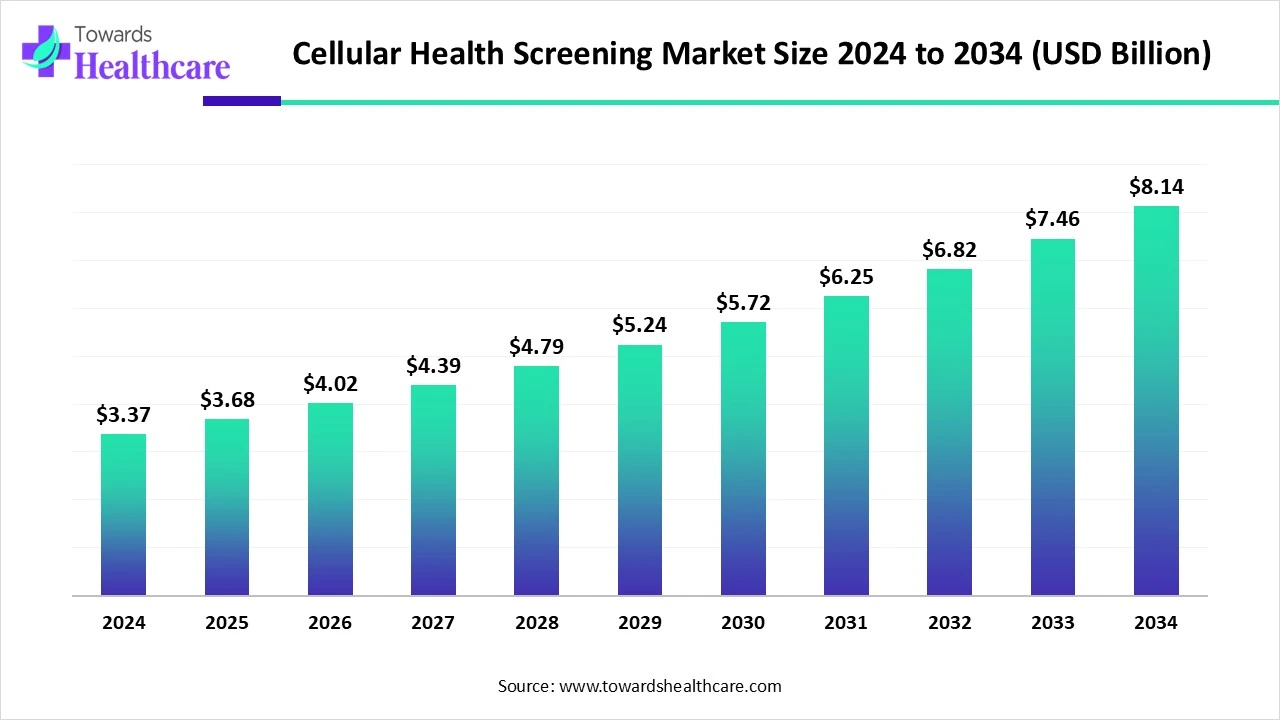

The global cellular health screening market size is calculated at USD 3.37 billion in 2024, grew to USD 3.68 billion in 2025, and is projected to reach around USD 8.14 billion by 2034. The market is expanding at a CAGR of 9.24% between 2025 and 2034.

The cellular health screening market is primarily driven by the increasing prevalence of chronic diseases and the need for early disease detection. The growing demand for personalized medicines also potentiates the need for cellular health screening. This enables healthcare professionals to provide the right treatment at the right time. The growing research and development activities encourage researchers to develop novel screening techniques. The future looks promising, with technological advancements in screening tools and advances in genomics.

| Metric | Details |

| Market Size in 2025 | USD 3.68 Billion |

| Projected Market Size in 2034 | USD 8.14 Billion |

| CAGR (2025 - 2034) | 9.24% |

| Leading Region | North America |

| Market Segmentation | By Test Type, By Sample Type, By Collection Site, By Application, By End-Use, By Region |

| Top Key Players | SpectraCell Laboratories, Telomere Diagnostics Inc., Genova Diagnostics, Life Length, RepeatDx, Quest Diagnostics, Labcorp, OPKO Health, Cell Science Systems, Immundiagnostik AG, Segterra Inc., OmegaQuant, DNA Labs India, Cleveland HeartLab, Innovatics Laboratories, BioReference Laboratories, Atomo Diagnostics, GRAIL Inc., Guardant Health, Arivale |

The cellular health screening market refers to diagnostic and wellness testing focused on evaluating the health, function, and integrity of cells using biomarkers such as telomere length, oxidative stress, inflammatory markers, and mitochondrial function. These screenings are used in preventive care, longevity programs, clinical diagnostics, and R&D. They provide a brief idea about irritation levels, metabolic performance, and toxin accumulation within the body. Apart from diagnosing a chronic condition, cellular health screening also aids in monitoring a treatment response.

Numerous factors influence market growth, including the rising prevalence of chronic disorders and the growing demand for personalized medicines. Cellular health screening is used to diagnose a range of illnesses, including cardiovascular diseases, diabetes, neurological diseases, inflammatory conditions, and digestive problems. The growing research activities facilitate the development of novel tools and techniques for cellular health. Several business organizations are modifying their employee wellness programs by integrating cellular health screening.

Integrating artificial intelligence (AI) into cellular health screening can automate the screening process and enhance the efficiency and accuracy of testing. AI and machine learning (ML) algorithms ensure the precision of testing large datasets in real-time. They can accelerate the speed of testing and improve the accuracy and precision. AI and ML can suggest potential treatment outcomes for chronic diseases. They can also enable real-time monitoring of medicines, enabling healthcare professionals to make proactive decisions. AI can simplify the task of researchers and even detect minor changes in cellular health.

Personalized Medicines

The major growth factor of the cellular health screening market is the growing demand for personalized medicines. Personalized medicines are widely preferred due to rapidly changing demographics and the rising geriatric population. Cellular health screenings enable personalized treatment by early disease detection, taking into account custom-designed treatment techniques. The screening outcomes enable healthcare professionals to provide tailored treatments. Pharmaceutical companies use cellular health screening data to expand targeted drug therapies. These efforts manage the root cause of a disease, instead of treating signs and symptoms.

Lack of Skilled Professionals

Several underdeveloped and developing countries do not have sufficient skilled professionals to perform complex screening procedures. The increasing population also poses a significant challenge to screening a large patient population. Thus, insufficient skilled professionals restrict market growth.

What is the Future of the Cellular Health Screening Market?

The future of the market is promising, driven by advances in genomic technologies. Cellular health screening refers to the use of genetic and epigenetic testing tools to identify chronic disorders. These techniques examine DNA and gene expression modifications that affect cellular fitness. Advanced genomic technologies increase the specificity and selectivity of health screening. The growing genomics research and increasing investments in biotech present future market opportunities. Moreover, the advent of liquid biopsy tests aids in the non-invasive examination of cancer. This leads to the identification of early sickness due to circulating tumor cells.

By test type, the telomere length testing segment held a dominant presence in the market in 2024. This segment dominated because of the ability to measure cellular aging, disease susceptibility, and overall well-being. Telomere length testing can identify the increased risks of age-related conditions, such as cardiovascular disease, cancer, and neurodegenerative disease. Different techniques used for telomere length testing such as PCR, terminal restriction fragment (TRF), and single telomere length analysis (STELA).

By test type, the multi-panel cellular health tests segment is expected to grow at the fastest rate in the market during the forecast period. Multi-panel cellular health tests detect multiple biomarkers or genes involved in disease progression. These tests are widely used for detecting different types of cancer and neurological disorders. They identify any abnormalities in cellular health. This genetic information allows a doctor to administer more effective precision medicines.

By sample type, the blood segment held the largest revenue share of the market in 2024. This is due to easy sample collection and the presence of suitable biomarkers. Numerous disorders release their biomarkers in the blood and circulate throughout the body. Blood tests can help detect diseases early or provide warnings about potential illnesses in the future. RBCs, WBCs, and platelets are cells present in blood.

For instance,

By sample type, the saliva segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for non-invasive diagnostic tests boosts the segment’s growth. Sample collection is easy for saliva and does not require a needle stick. Saliva can be used to detect a wide range of disorders, such as HIV, hepatitis, TB, and periodontal disease. It has also been studied to detect changes linked to diabetes, Parkinson’s, heart disease, and some cancer types.

By collection site, the hospitals & clinics segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the increasing number of patients in hospitals and the availability of favorable infrastructure. Hospitals and clinics have skilled professionals to collect samples accurately and test for potential disease risks. Samples can be collected and analyzed at the same place, eliminating the need to transfer samples from one place to another.

By collection site, the at-home sample collection segment is expected to expand rapidly in the market in the coming years. The increasing geriatric population and sedentary lifestyles potentiate the demand for at-home sample collection. Healthcare professionals can visit a patient’s home and collect samples. Patients can receive test results in the comfort of their homes without visiting a hospital or clinic. At-home sample collection offers numerous advantages, including increased privacy and reduced exposure to infections.

By application, the disease risk assessment segment led the global market in 2024. This is due to the growing need for timely treatment and personalized medicines. Cellular health screening provides insights into potential disease risks, allowing providers to make proactive decisions. Healthcare professionals can provide targeted treatment based on patients’ conditions and implement strategies to mitigate those risks. The World Health Organization (WHO) supports countries in developing, strengthening, and maintaining their capacity to conduct risk assessment.

By application, the preventive healthcare segment is expected to witness the fastest growth in the market over the forecast period. Screening tests help providers take preventive measures against a disease. They can reduce the overall disease burden by understanding risks. Several government organizations collaborate to conduct screening tests and prevent major diseases, improving people’s lifestyles. Preventing diseases can also benefit the healthcare sector economically.

By end-use, the hospitals & clinical labs segment held a major revenue share of the market in 2024. The presence of favorable infrastructure and suitable capital investment augments the segment’s growth. Hospitals and clinical labs have skilled professionals to conduct screening tests. Patients mostly prefer hospitals and clinical labs, as they can receive test results and consult healthcare professionals in the same place.

By end-use, the wellness & anti-aging clinics segment is expected to show the fastest growth in the market in the upcoming years. The increasing number of wellness and anti-aging clinics and the growing awareness of anti-aging treatments propel the segment’s growth. These clinics adopt advanced cellular health screening techniques to provide effective treatment regimens. They help individuals to enhance their vitality and extend their health span. Cellular health screening tests enable professionals to provide personalized treatment.

North America dominated the global market in 2024. The presence of a robust healthcare infrastructure, increasing R&D investments, and technological advancements are the major growth factors of the market in North America. Research institutions have state-of-the-art research and development facilities to develop novel cellular health screening tools. The presence of key players also augments market growth.

The Centers for Disease Control and Prevention (CDC) reported that one person dies every 33 seconds in the U.S. due to cardiovascular disease. (Source - Centers for Disease Control) Additionally, the CDC supports screening for different cancer types as recommended by the U.S. Preventive Services Task Force. Key players, such as SpectraCell Laboratories, LabCorp, and Guardant Health, are the major contributors to the market in the U.S.

It is estimated that approximately 44% of adults in Canada have at least one chronic disorder. (Source - Cpha) Canada’s total healthcare expenditure in 2023 was $344 billion, representing 12.1% of the total GDP. The federal government spends around 30% to 40% of provincial and territorial budgets on healthcare, and these costs are expected to increase by 5.4% over the next decade. (Source - Cma)

Asia-Pacific is expected to grow at the fastest CAGR in the cellular health screening market during the forecast period. The growing awareness among the general public about health screening tests and favorable government support boost the market. The burgeoning healthcare sector and increasing investments also contribute to market growth. The rising geriatric population and the increasing prevalence of chronic disorders necessitate the use of cellular health screening.

Over 180 million elderly people are estimated to have at least one chronic disorder in China. The Chinese government, along with the National Health Commission and the National Development and Reform Commission, aims to have a sweeping action plan for dementia by 2030. The action plan involves early diagnosis, treatment, rehabilitation, and care. The authorities will also conduct functional screenings for the elderly. (Source - Scmp)

A recent study report stated that approximately 21% of the total elderly Indian population suffers from at least one chronic condition. (Source - Times of India) In March 2025, World Trade Center Pune announced a collaboration with The Anti-Aging Centre to bring the transformative concept of longevity and wellness to India. The Anti-Aging Centre uses cutting-edge research to unlock the secrets of cellular health and slow the aging process. (Source - Wtca)

Europe is expected to grow at a considerable rate in the cellular health screening market in the upcoming period. Government organizations launch initiatives and provide funding for encouraging people to screen for and detect diseases. The growing demand for personalized medicines, the rising adoption of advanced technologies, and the increasing emphasis on preventive healthcare foster market growth.

The German government highlighted the significance of early detection and prevention of cardiovascular diseases. The Bavarian government has launched several initiatives to prevent cardiovascular diseases. Approximately 46% of the adult population has at least one chronic disorder.

NHS England offers national screening for different conditions, such as pregnancy, newborn babies, diabetic eye screening, cervical screening, and breast screening through the NHS Screening Committee (UK NSC). The UK government announced an investment of £600 million ($764 million) to create a new Health Data Research Service (Source - Clinicaltrialsarena)

Some government initiatives for cellular health screening include:

Mahyer Salek, Co-founder, President, and Chief Technology Officer at DeepCell, commented on collaborating with NVIDIA that there are many possibilities for incorporating multimodal and generative AI into the company’s platform to leverage their proprietary database of billions of cell images to train additional AI models. (Source - Pharma times)

By Test Type

By Sample Type

By Collection Site

By Application

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026