February 2026

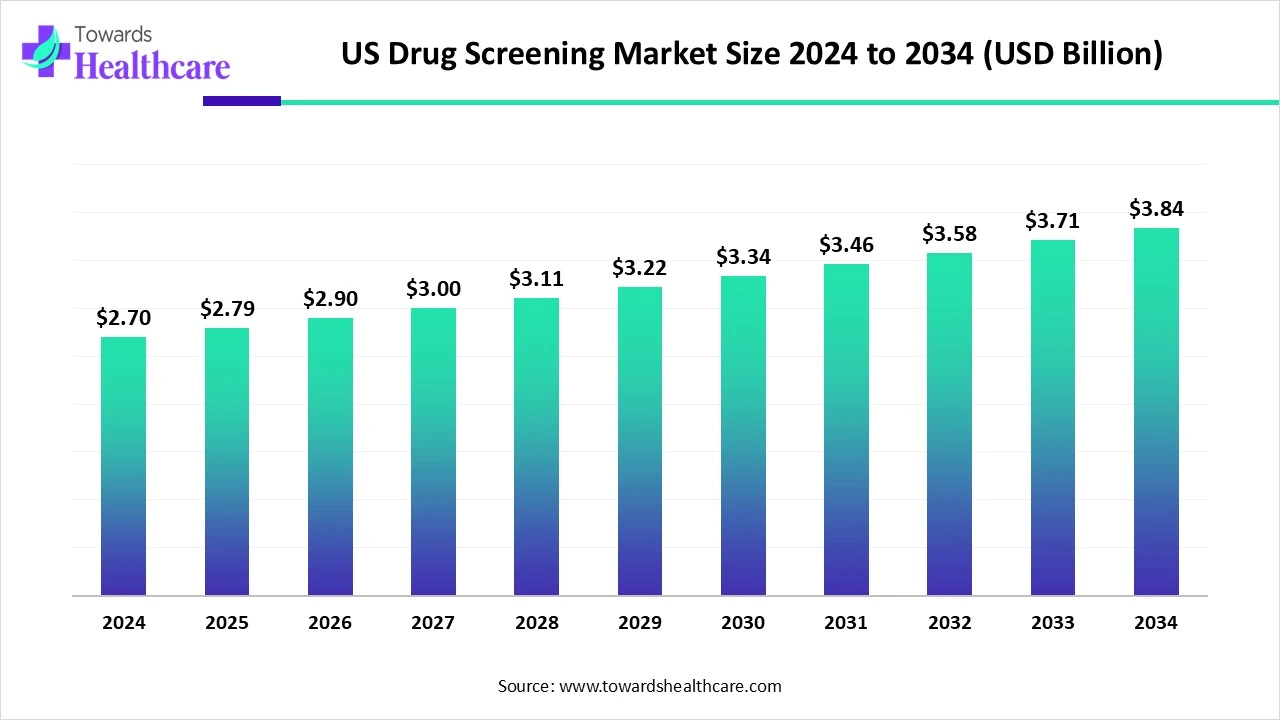

The U.S. drug screening market size is calculated at US$ 2.80 in 2025, grew to US$ 2.90 billion in 2026, and is projected to reach around US$ 4 billion by 2035. The market is expanding at a CAGR of 2.7% between 2026 and 2035.

The primary drivers of the market's growth include rising worries about substance abuse, advancements in drug abuse testing technologies, and more stringent laws in a number of sectors, such as healthcare, sports, and employment. Growing worries about substance addiction and the sharp increase in government initiatives to address the drug misuse issue have caused the industry to expand even more. Drug screening processes are now more precise due to modern technologies like liquid chromatography-mass spectrometry (LC-MS) and immunoassay techniques, which have increased accuracy and efficiency.

| Metric | Details |

| Market Size in 2026 | USD 2.9 Billion |

| Projected Market Size in 2035 | USD 4 Billion |

| CAGR (2026 - 2035) | 2.7% |

| Market Segmentation | By Product & Service, By Sample Type, By Drug Class Detected, By End User, By Technology |

| Top Key Players | Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), Abbott Laboratories (Abbott Toxicology), Alere Inc. (now part of Abbott), Thermo Fisher Scientific Inc., Orasure Technologies, Inc., Drägerwerk AG & Co. KGaA (U.S. arm), ForaCare, Inc., Psychemedics Corporation, Premier Biotech, Inc., Omega Laboratories, Inc., American Bio Medica Corporation, Redwood Toxicology Laboratory (Abbott subsidiary), Intoximeters, Inc., Bio-Rad Laboratories, Inc., TruDiagnostic, Millennium Health LLC, Cordant Health Solutions, CRL (Clinical Reference Laboratory), Randox Toxicology (U.S. presence) |

The U.S. drug screening market includes products, services, and technologies used to detect the presence of prescription drugs, illegal substances, alcohol, and other chemicals in biological samples such as urine, blood, hair, saliva, and breath. These tests are used for pre-employment screening, random workplace testing, post-accident investigations, legal and forensic purposes, and increasingly in clinical settings and home testing kits. The market is driven by rising substance abuse, evolving workplace policies, DOT mandates, and the opioid epidemic.

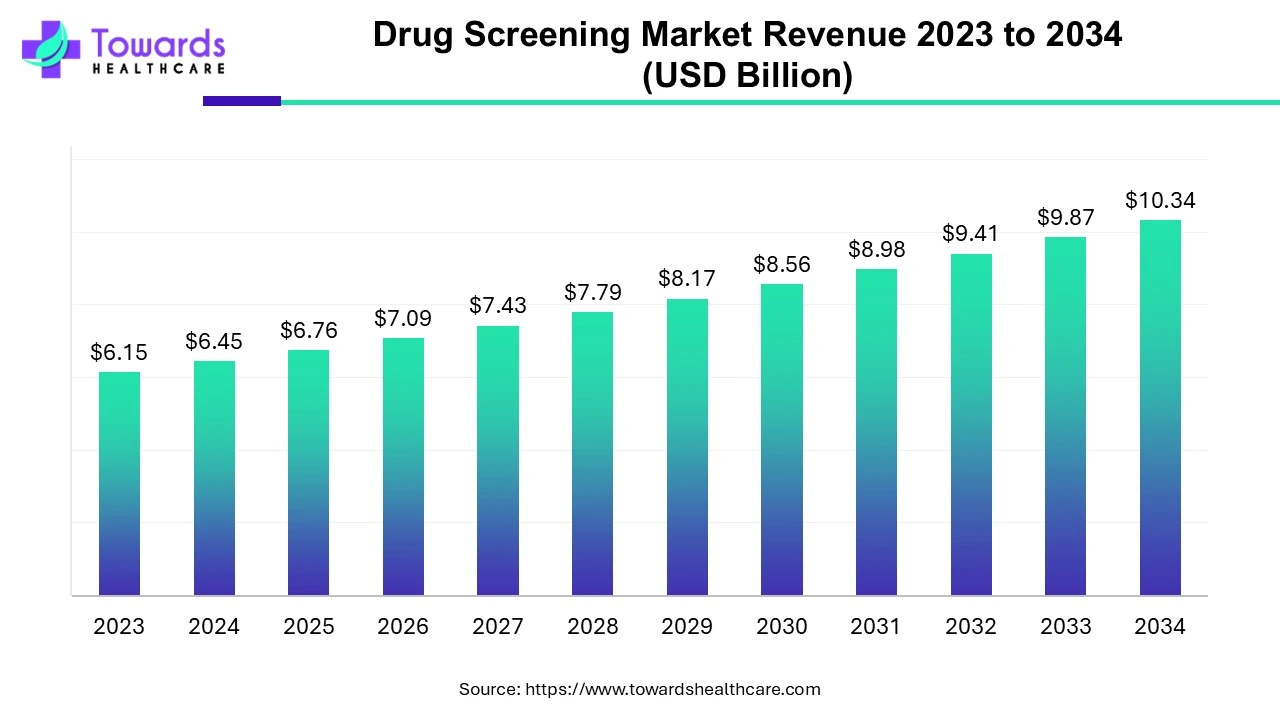

The global drug screening market was valued at $6.15 billion in 2023 and is expected to reach $10.34 billion by 2034, growing at an average annual rate of 4.84% from 2024 onward.

The advancements in AI and machine learning are transforming drug testing by enabling faster and more accurate patient diagnosis and research. One of AI and machine learning's greatest benefits for drug testing is its ability to quickly and accurately analyze massive amounts of data. It is possible to predict the toxicity of medications by using artificial intelligence (AI) to analyze the chemical structures and properties of substances. Toxicological datasets may be used to train machine learning algorithms to identify harmful structural characteristics and predict adverse outcomes.

Rising Demand for Rapid Drug Testing

The increasing need for quick and precise testing solutions is the main factor propelling the U.S. drug screening market. The demand for effective drug screening techniques is rising as a result of stricter laws and increased awareness of substance usage in a number of sectors, including healthcare, transportation, and sports. Businesses are taking advantage of this opportunity by providing cutting-edge, reasonably priced, and non-invasive testing solutions.

False Result Concerns

False-positive or false-negative findings may be reported by some drug screening tests. This might influence people's choices and undermine their faith in the system. Many at-home tests are thought to be inaccurate, producing erroneous findings.

How do Digital Health Platforms Influence the U.S. Drug Screening Market?

The integration of drug test results into digital platforms for health and well-being is one interesting possibility. The findings of drug screenings can provide valuable information for managing rehabilitation, treatment adherence, and preventative healthcare as telemedicine, wearable health monitoring, and electronic health records (EHR) become more widely used. Better pain management treatment customisation, workplace risk assessment, and seamless recovery monitoring in substance abuse programs are all made possible by digital integration. In an increasingly connected healthcare environment, companies that offer drug screening systems combined with cloud-based dashboards, analytics, and reporting tools stand to gain a competitive edge.

By product & service, the drug screening services dominated the U.S. drug screening market in 2024. Drug testing is a common and significant practice in legal, medical, sporting, and employment contexts. It is a versatile instrument that offers vital information on a person's behavior and health, with a range of testing methods accessible, including blood and hair analysis and urine tests.

By product & service, the drug screening products segment is estimated to grow at the fastest rate during the upcoming timeframe. As the prevalence of drug misuse in the US rises, businesses have created testing protocols to assist healthcare institutions in detecting drug abuse in patients so that treatment may begin as soon as feasible. The range of drug screening products makes it possible to test patients quickly and simply and to precisely identify increased levels of medications that are often misused.

Under the drug screening products segment, the rapid test kits & devices sub-segment is estimated to grow at the fastest rate during the forecast period. Confidence and high-quality, easy solutions are provided by rapid drug screening devices and kits, ensuring complete on-site drug testing. When combined with lab services, on-site screening equipment offers a convenient and all-inclusive drug testing option.

By sample type, the urine sample segment dominated the U.S. drug screening market in 2024, accounting for ~66%. Because urine drug screens are so easy to sample, they have been the most widely used technique for analysis. There is now more demand for the use of immunoassays due to their ease of use and quick findings. Longer detection durations are made possible by the higher concentrations of medicines and metabolites in urine as opposed to serum.

By sample type, the oral fluid (saliva) testing segment is anticipated to grow at the highest rate during 2025-2034. Lab-based results from oral fluid testing are private. The possibility of tampering or a donor challenge later in the drug screening process is decreased by utilizing oral fluid rather than urine, which allows donors to collect their own specimens on-site and in front of a monitor. The best way to identify recent drug usage is by oral fluid. For various testing scenarios, including pre-employment, reasonable suspicion, and post-accident testing, oral fluid testing is ideal.

By drug class detected, the opioids segment held the largest revenue share of the U.S. drug screening market in 2024. 3 million Americans and more than 16 million people globally fit the criteria for opioid use disorder (OUD). It is concerning to note that OUD causes more than 120,000 fatalities globally and 47,000 deaths in the U.S. annually. Opioids have killed more people in the U.S. than any other substance in history.

By drug class detected, the synthetic drugs segment is expected to be the fastest-growing during the predicted time period. The International Narcotics Control Board (INCB) states in its 2024 Annual Report that the rapid proliferation of illegal synthetic drugs is a fatal issue that poses a major risk to public health. The Global Coalition to Address Synthetic Drug Threats was established in 2023 as a new initiative to stop drug trafficking, break the supply chain for synthetic narcotics like fentanyl, and save lives both domestically and internationally.

By end-user, the workplace & employers segment captured the dominant share of the U.S. drug screening market in 2024. There are several reasons to implement drug or alcohol testing in the workplace, all of which support the upkeep of a secure, effective, and healthy working environment. Every worker is entitled to a safe workplace. Each business is required by law to establish a health and safety policy, which may include a policy on drugs and alcohol.

By end-user, the home care settings/OTC test kits segment is expected to witness the highest CAGR during 2025-2034. Prescription, over-the-counter, and illicit substances can all be detected using at-home drug testing. Most individuals find at-home drug tests to be handy since they don't require an appointment at a lab or testing facility to check for signs of a range of substances.

By technology, the chromatography techniques segment held the major share of the U.S. drug screening market in 2024. The identification and quantification of drugs of abuse have been transformed in recent years by the revolutionary development of liquid chromatography (LC). Because it improves the precision of drug tests and helps create more efficient preventive and treatment plans, this analytical method has been essential in the fight against drug misuse. In addition, gas chromatography-mass spectrometry (GC-MS) is the most significant and widely used method for screening and identifying solid-dosage medications.

By technology, the rapid test devices segment is anticipated to achieve the highest CAGR during the forecast period. Rapid tests, sometimes referred to as rapid diagnostic tests or RDTs, are simple, fast procedures that typically yield answers in 20 minutes or less. Volunteers and non-medical staff who have received the necessary training can administer them. In clinics and hospitals, these kits are the preferred option for physicians and nurses.

US drug screening market share by 45% in 2024. Because of the severe problem of drug misuse in the U.S., there is an increasing need for drug screening products and services. As of 2023, there were 47.7 million Americans aged 12 and older who currently used illicit drugs. Over the age of 12, 145.1 million individuals have taken narcotics illegally at some point in their lives. 38.6% of those who use illicit drugs suffer from a drug problem. At the March 2024 High-Level Segment of the UN Commission on Narcotic Drugs (CND), the U.S. also sparked fresh international action against the synthetic drug epidemic.

By region, the South & Midwest U.S. dominated the U.S. drug screening market with a combined share of ~45% in 2024. Ohio & Minnesota are among the top states to consume drugs. Ohio City's drug-related crime rate is 0.1050 per 1000 residents, placing it in the 97th percentile for safety. The Ohio State Highway Patrol detained 104,845 people for driving under the influence between 2018 and 2023. There were 4,452 unintentional drug overdose deaths in the state in 2023. Additionally, statistics indicate that while cannabis usage among adults has climbed in Minnesota, it has decreased among children and adolescents. Furthermore, data show that although cannabis use has increased among Minnesota's adults, it has down among kids and teenagers.

By region, the West Coast is expected to experience the fastest growth in the U.S. drug screening market during the forecast period. Drug abuse if most common in the Orgon and Arizona states of the West Coast of the U.S. In 2025, Oregon will implement new legislation to curb drug usage on public transit, lower prescription medicine costs, and control the cost of electronic gadget maintenance. Arizona is experiencing a severe opioid issue, just like many other places in the country. On the other hand, Arizona has around 14% more unintentional overdose deaths than the national average.

In June 2025, according to Tim Thoelecke, founder of InOut Labs, the workplace has undergone a significant transformation. Together with Novir, we are thrilled to present InstaCLEAR, a drug testing platform that meets people and employers where they are: at home, on the job, or anywhere in between. (Source - Cbs4indy)

By Product & Service

By Sample Type

By Drug Class Detected

By End User

By Technology

February 2026

February 2026

February 2026

February 2026