February 2026

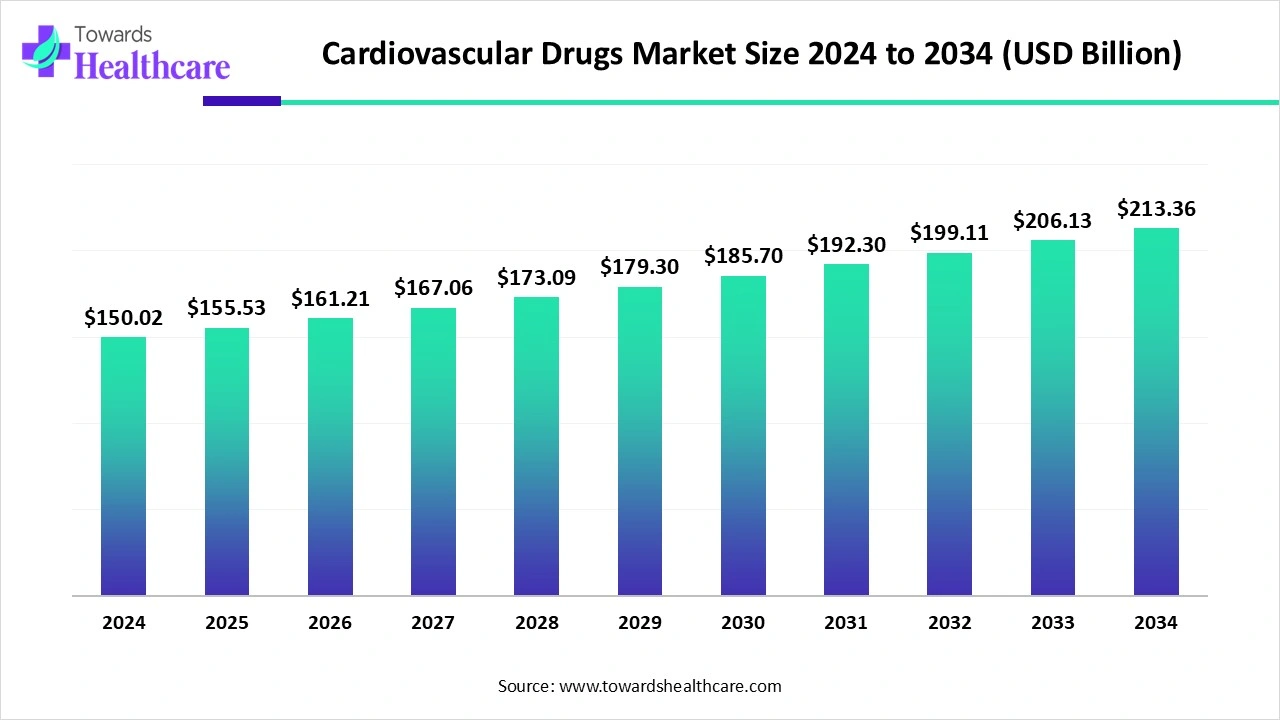

The global cardiovascular drugs market size is calculated at US$ 150.02 billion in 2024, grew to US$155.53 billion in 2025, and is projected to reach around US$ 213.36 billion by 2034. The market is expanding at a CAGR of 3.65% between 2025 and 2034.

There is a growth in the use of cardiovascular drugs globally due to the growing burden of cardiovascular diseases. This is increasing their R&D, acquisitions, and funding. AI is also being used in their discovery, development, optimization, and to enhance clinical trials. At the same time, the growing healthcare investments, their expansion, and growth in the development of biologics or generic drugs are increasing their use in various regions. Moreover, the companies are collaborating and launching new drugs. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2025 | USD 155.53 Billion |

| Projected Market Size in 2034 | USD 213.36 Billion |

| CAGR (2025 - 2034) | 3.65% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Route of Administration, By Disease Indication, By Distribution Channel, By Drug Type, By Region |

| Top Key Players | Amgen Inc., AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH, Bristol Myers Squibb, Daiichi Sankyo Company, Ltd., Eli Lilly and Company, GlaxoSmithKline plc (GSK), Johnson & Johnson (Janssen Pharmaceuticals), Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi S.A., Servier Laboratories, Viatris Inc. |

The Cardiovascular Drugs refer to pharmaceutical products used for the prevention, treatment, and management of cardiovascular diseases (CVDs), including hypertension, coronary artery disease, heart failure, arrhythmias, hyperlipidemia, and stroke. These drugs work by regulating blood pressure, cholesterol levels, clot formation, and cardiac function. These drugs are further classified depending on their actions, such as antihypertensive drugs, vasodilators, anticoagulants, etc. The market includes branded, generic, and novel therapies, and is driven by the high global burden of cardiovascular disorders and the demand for long-term medication.

Growth in cardiovascular diseases: There is a growth in cardiovascular diseases, which is increasing the demand for the use of safe and effective cardiovascular drugs. This, in turn, is increasing their research and development, leading to their new innovations. At the same time, to support these innovations, acquisitions and investments are being made by the companies.

For instance,

The use of AI in drug discovery and the development of cardiovascular drugs is increasing. It analyses the biological data and detects the targets, which in turn accelerates the drug development process. It predicts the drug efficacy and toxicity, which helps in minimizing the chances of drug failures. The use of machine learning helps in the development of new drug combinations. It is also being used in clinical trials for designing the trials, patient recruitment, and their monitoring. In the development of personalized treatments, as well as to promote the development of optimized dosage formulation use of AI is increasing.

Growing Awareness

Due to growing awareness among the population, the early diagnosis of cardiovascular diseases is increasing the demand for their effective treatment. This is increasing the use of various cardiovascular drugs depending on their condition and associated comorbidities. At the same time, the demand for preventive or targeted therapies is also increasing. This, in turn, is driving the development of novel therapies and biologics. Moreover, combination therapies are also being prescribed to reduce the chances of heart attacks or failures. Thus, this is driving the cardiovascular drugs market growth.

Safety Concerns

The side effects associated with the cardiovascular drugs are fatigue, muscle pain, bleeding, and dizziness. Their long-term use can worsen these side effects. This can lead to their recall, discouraging their use. Therefore, regulatory bodies strictly evaluate the safety of the drugs, delaying their approvals. This limits their innovations as well as their use by the patients.

Growing Advancements in Lipid-Lowering Drugs

Due to growing incidences of dyslipidemia and other cardiovascular diseases, the demand for lipid-lowering drugs is increasing. These drugs often have certain side effects and limited efficacy. Thus, this is increasing their innovations. Different types of lipid-lowering drugs, consisting of PCSK9 inhibitors, ANGPTL3 inhibitors, or CETP inhibitors, are being developed. Various RNA therapies or combination therapies are also being developed, as well as bempedoic acid is also being used to formulate new drugs. Moreover, they are also focusing on producing drugs with targeted action and minimal to no side effects. Thus, this is promoting the cardiovascular drugs market growth.

For instance,

By drug class type, the antihypertensive drugs segment held the largest share of the market in 2024, driven by increased incidences of hypertension. As it is a chronic condition, it has increased the use of hypertensive drugs. They were also used to minimize the chances of its complications. This increased the use of various types of hypertensive drugs.

By drug class type, the lipid-lowering drugs (statins, PCSK9 inhibitors, fibrates) segment is expected to show the fastest growth during the predicted time. The growing rates of dyslipidemia and other cardiovascular diseases are increasing the demand for these drugs. Moreover, growing lifestyle changes are also causing other lipid disorders. This, in turn, is increasing their use along with their combination therapies.

By route of administration type, the oral drugs segment led the market in 2024, as they enhance patient convenience. They were also used in the management of chronic diseases. Additionally, they were widely available and affordable. This, in turn, increased the acceptance rate and enhanced the patient outcomes and their adherence to the treatment.

By route of administration type, the injectable drugs segment is expected to show the fastest growth during the upcoming years. They are being preferred due to their rapid onset of action, driving their use in emergency situations. Novel biologics are also being developed, which are administered through this route. Similarly, the targeted therapeutics are also being administered as injectables.

By disease indication type, the hypertension segment held the dominating share of the market in 2024, due to its growing rates and associated risk factors. This, in turn, increases the demand for cardiovascular drugs for their management. Moreover, their growing early detection is also increasing the use of these drugs. Thus, this has enhanced the market growth.

By disease indication type, the heart failure segment is expected to show the highest growth during the predicted time. Due to the growing geriatric population and comorbidities, the chances of heart failure are increasing. This is increasing the use of various drugs depending on the condition of the patient. Moreover, the growing innovation are also enhancing their use.

By distribution channel type, the hospital pharmacies segment led the market in 2024, as the provided cardiovascular drugs for various heart conditions. They also provided biologics and other injectables. Moreover, their integration with hospitals increased their use in critical conditions. Thus, this in turn increased their purchasing volume.

By distribution channel type, the online pharmacies segment is expected to show the highest growth during the upcoming years. They provide a wide range of medications at an affordable price. Moreover, they also increase the accessibility and help in maintaining patient privacy. This increases their online orders in remote areas as well, enhancing patient convenience and comfort.

By drug type, the generic drugs segment held the largest share of the global market in 2024, due to their affordability. At the same time, they were widely available, which increased their use. This, in turn, is driving their prescriptions and manufacturing. Thus, this contributes to the market growth.

By drug type, the biologics/novel therapies segment is expected to show the highest growth during the predicted time. Due to the growing unmet needs of the patient, there is a rise in the development of these drugs. Moreover, their target-specific action is increasing their demand. Thus, they are being used in various cardiovascular diseases.

North America dominated the cardiovascular drugs market in 2024. North America consisted of an advanced healthcare sector, which was supported by healthcare investments. This increased the adoption of cardiovascular drugs to deal with their growing incidence. Moreover, the companies also contributed to their increased development and innovations. Thus, this enhanced the market growth.

Due to the growing patient volume with cardiovascular diseases in the U.S., the use of cardiovascular drugs is increasing. Moreover, various novel therapies and biologics are also being adopted using healthcare investments. Additionally, the growing early diagnosis and growth in the aging population are increasing their use. Furthermore, the insurance policies are attracting the patients.

The use of cardiovascular drugs in Canada is increasing due to rising hypertension and obesity rates, leading to an increased risk of cardiovascular disorders. Moreover, the growing screening and awareness programs for early diagnosis are leading to increased demand for safe and effective drugs. This is increasing the use of both generic and branded drugs. Additionally, the growing R&D is accelerating the development of innovative biologics.

Asia Pacific is expected to host the fastest-growing cardiovascular drugs market during the forecast period. Asia Pacific is experiencing a rise in cardiovascular diseases due to a growing population and lifestyle changes. The expanding healthcare is enhancing the utilization of various cardiovascular drugs. These adoptions are supported by the government and private sector investments. They are also supporting their growing innovations as well as their clinical trials. Moreover, various health awareness programs are also being conducted. Thus, this is promoting he market growth.

To enhance the existing therapies and to discover and develop new drug candidates to treat and prevent cardiovascular diseases is the main focus of the R&D of cardiovascular drugs.

Key Players: Novartis AG, Bayer AG, AstraZeneca plc, Sanofi S.A., Bristol Myers Squibb, Merck & Co., Inc.

The formulation and final dosage preparation of cardiovascular drugs consists of the development of safe, effective, stable, and patient-friendly dosage forms such as tablets, capsules, patches, and injectables.

Key Players: Novartis AG, AstraZeneca plc, Daiichi Sankyo Company, Ltd., Pfizer Inc.

The patient support and services of the cardiovascular diseases focus on providing medication education, counselling, and financial assistance programs.

Key Players: Novartis AG, Sanofi S.A., Lupin.

| Medicine Name | Core Benefits | Net Sales (USD millions, 2024) |

| Entresto | Oral medicine for heart failure and hypertension | 7,822 |

| Cosentyx | Injectable treatment for inflammatory and immune conditions | 6,141 |

| Kesimpta | Injectable treatment for relapsing multiple sclerosis | 3,224 |

| Kisqali | Oral treatment for a type of breast cancer | 3,033 |

| Promacta / Revolade | Oral treatment for certain blood disorders | 2,216 |

| Tafinlar + Mekinist | Oral combination targeted therapy for a certain type of cancer | 2,058 |

| Jakavi | Oral treatment for certain rare blood disorders | 1,936 |

| Tasigna | Oral treatment for a type of chronic myeloid leukemia | 1,671 |

| Xolair* | Injectable medicine for certain respiratory and immunological conditions (severe asthma) | 1,643 |

| Ilaris | Injectable medicine for certain rare autoinflammatory disorders | 1,509 |

In June 2025, after the launch of Biscado (Bisoprolol), the spokesperson at Cadila Pharmaceuticals Limited stated that, in the cardiovascular epidemic, India is the epicentre, with elevated heart rate as the modifiable risk factor. Thus, with these growing diseases, a clinically proven solution for patients and physicians is provided by the launch of Biscado.

By Drug Class

By Route of Administration

By Disease Indication

By Distribution Channel

By Drug Type

By Region

February 2026

February 2026

February 2026

February 2026