February 2026

The CDMO services for pharma and biotech market is experiencing substantial growth from 2024 to 2034, driven by increasing outsourcing trends among pharmaceutical and biotech companies. The demand for end-to-end drug development, manufacturing efficiency, and regulatory compliance support is accelerating market expansion. Innovations in biologics, personalized medicine, and complex therapeutics are prompting firms to seek specialized CDMO partnerships. Emerging economies are also contributing significantly, offering cost-effective manufacturing hubs and expanding healthcare infrastructure.

The use of CDMO services in pharma and biotech companies is increasing due to growing innovative treatment approaches and diseases. This, in turn, is leading to new collaborations as well as the launch of new CDMOs and the products developed. At the same time, the use of AI in CDMO is enhancing its workflow. Its use in different regions is also increasing due to increasing innovations, industries, and expanding healthcare. Thus, all these developments are promoting the market growth.

The CDMO services for pharma and biotech market encompasses third-party organizations that provide comprehensive drug development and manufacturing services to pharmaceutical and biotechnology companies. CDMOs assist from early-stage development (R&D, formulation) to large-scale commercial manufacturing across small-molecule drugs, biologics, vaccines, and advanced therapies (e.g., cell & gene therapies). Moreover, it also provides advanced synthesis techniques and expertise to enhance the production. At the same time, the product quality, tech transfer process, and regulatory compliance are also provided by CDMO, facilitating the entry of the products into the market.

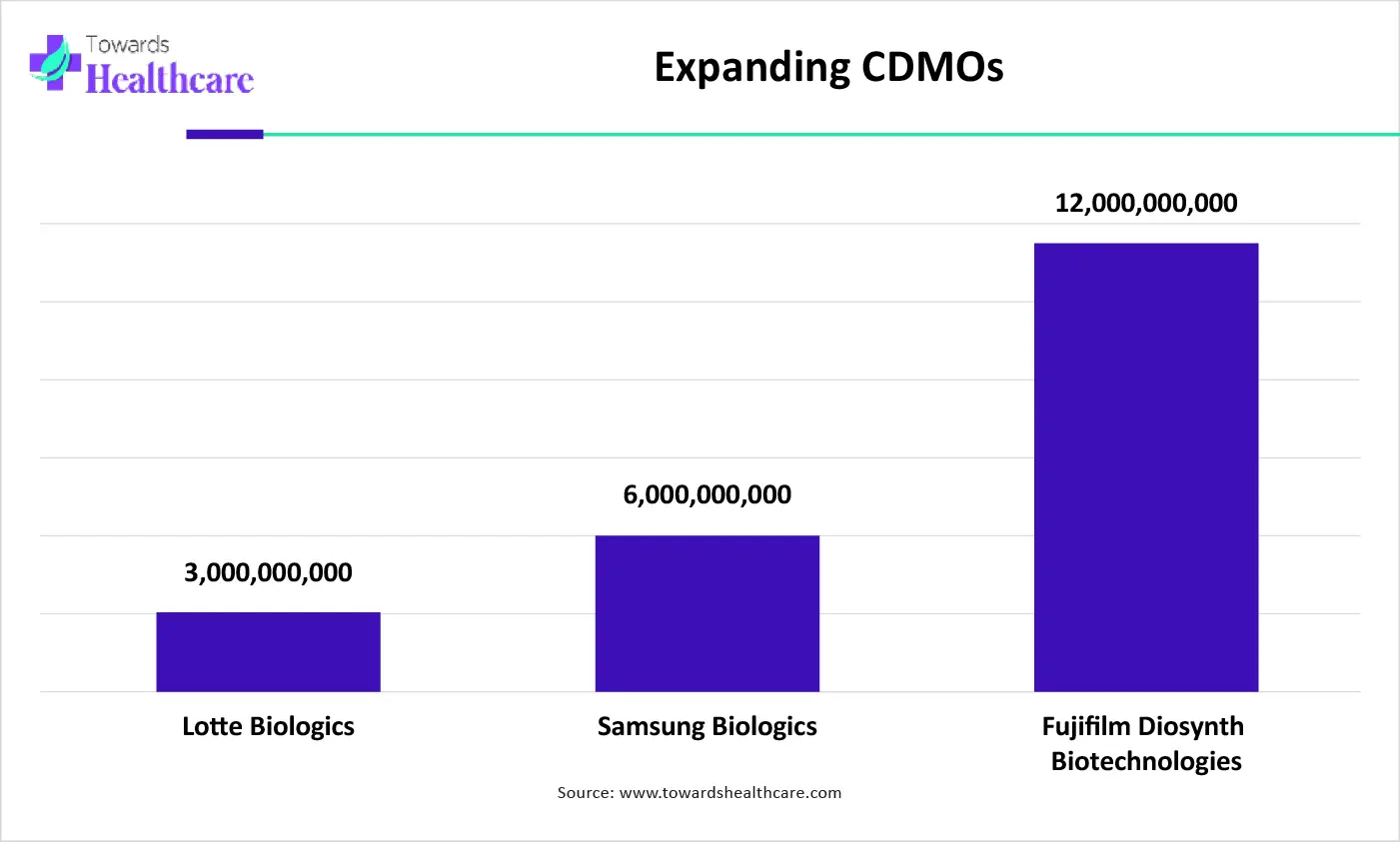

The graph represents the total investment plans of CDMOs for their expansion. It indicates that there is a rise in the expansion of CDMO services. Hence, they will enhance the biomanufacturing of the products from pharma and biotech companies. Thus, this in turn will ultimately promote the market growth.

The use of AI is increasing in the CDMOs as it enhances the quality and efficiency, along with minimizing the time-to-market, improving the drug development and manufacturing. Moreover, the conditions for drug development and production can be optimized with the help of AI, predictive analytics, and machine learning algorithms. Thus, it minimizes downtime and waste, resulting in cost efficiency. Hence, the use of AI in CDMO serves as a critical tool in improving drug development, its effectiveness, and efficiency, and is anticipated to provide more such applications in upcoming years.

Growing Outsourcing

The increasing outsourcing of products is increasing the demand for CDMO services. The CDMO helps to decrease the risk involved in the production or during the scaling up of the product. Moreover, it also provides expertise during the development process and is in compliance with the regulations laid by regulatory bodies. At the same time, to accelerate the clinical trials, the pharma and biotech companies are collaborating with CDMOs. Thus, this promotes the CDMO services for pharma and biotech market growth.

Lack of infrastructure

The lack of infrastructure in CDMO can affect the outsourcing, as well production of the companies. At the same time, advanced therapies may require a specialized environment and equipment, which may be difficult to provide by the CDMO. Thus, due to limited infrastructure, the services provided by CDMO may be restricted, affecting the market growth.

Increasing cancer treatment approaches

The growing advancements in the development of novel treatment approaches for cancer are increasing the use of CDMO services by the pharma and biotech companies. The growing therapies require sterile conditions and specialized equipment, which are offered by CDMOs. Moreover, it also helps in enhancing the production of these treatment approaches. Additionally, it also helps in clinical trials and the commercialization of them as they comply with the regulatory standards. Thus, this promotes the CDMO services for pharma and biotech market growth.

For instance,

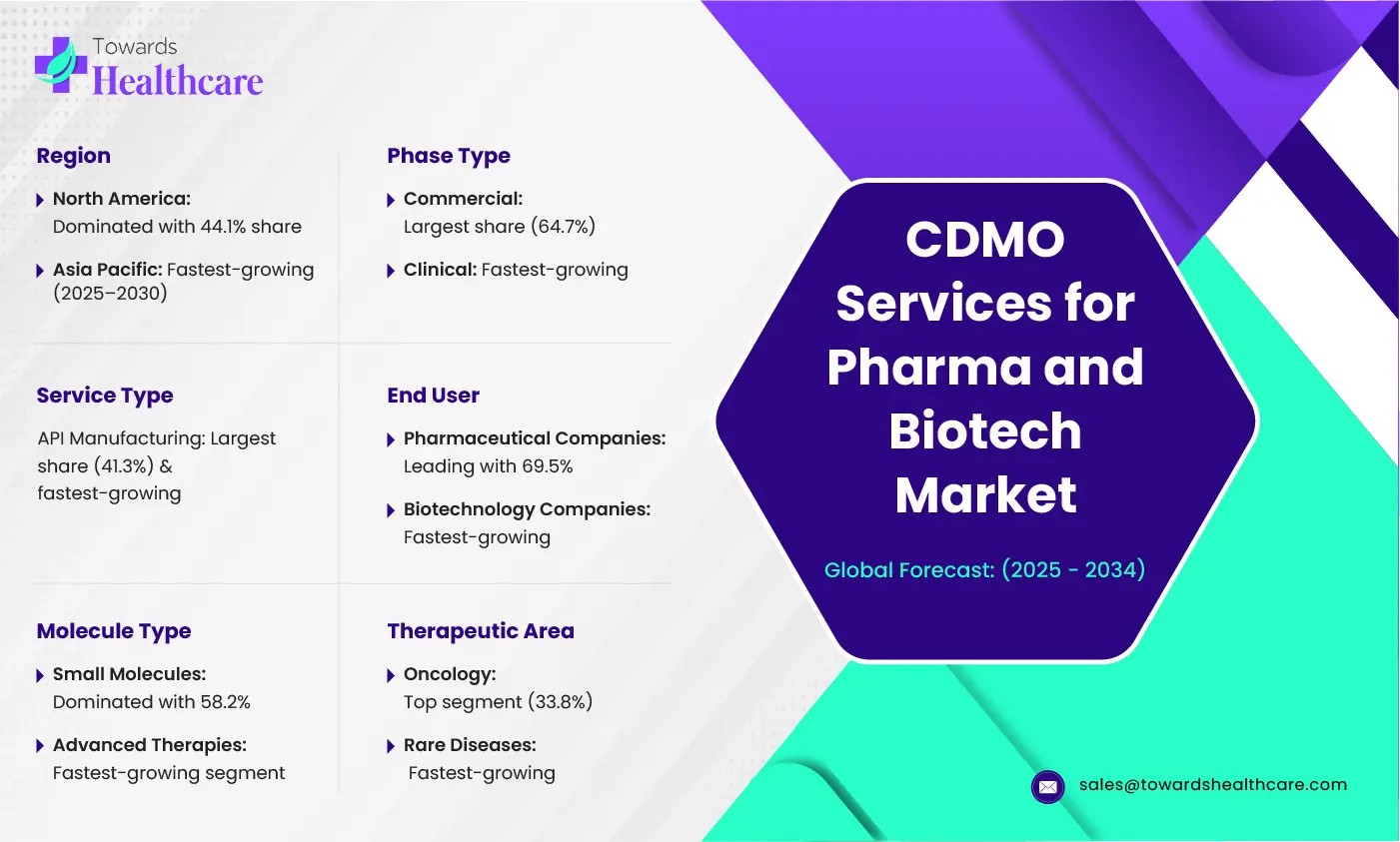

By service type, the API manufacturing segment led the market in 2024 with 41.3% and is expected to sustain the position during the predicted time. The use of API is crucial in the development of all medicines. Thus, their manufacturing, production, and outsourcing were efficiently conducted with the help of CDMO. Moreover, it also helps in reducing the cost associated with it.

By molecule type, the small molecules segment held the largest share of the market with 58.2% in 2024. The growing development of small molecules has increased the demand for CDMO services. At the same time, it provided various facilities to enhance their quality and production. Thus, this contributed to the market growth.

By molecule type, the advanced therapies segment is expected to show the highest growth during the upcoming years. The growing incidence of chronic diseases is increasing the development of advanced therapies. Therefore, the collaborations with CDMOs are also increasing.

By phase type, the commercial segment held the dominating share of the market with 64.7% in 2024. The large-scale manufacturing and outsourcing services were provided by the CDMO during the commercial phase, along with enhanced quality and regulatory standards. This enhanced the market growth.

By phase type, the clinical segment is expected to show the fastest growth rate during the forthcoming years. The growing clinical trials is increasing the demand for CDMO services. They help in reducing the time as well as cost, and also offer regulatory guidance from experts, enhancing the approval rates.

By end user, the pharmaceutical companies segment led the global market with 69.5% in 2024. The pharmaceutical companies showed continuous drug development and production, which in turn increased the demand for the use of CDMO services. Thus, the scale-up of the products, approval, and commercialization were supported by them, increasing their use.

By end user, the biotechnology companies segment is expected to show the highest growth during the predicted time. The increasing development of biologics, gene therapies, etc, in biotechnology companies is increasing the demand for CDMOs. Thus, they are offering a favourable environment and facilities to enhance their development.

By therapeutic area type, the oncology segment held the largest share of the market with 33.8% in 2024. Various cancer treatment options are being developed, which require specialized manufacturing facilities and expertise. Thus, the use of CDMO services increased. They helped in their manufacturing as well as in clinical trials, promoting the market growth.

By therapeutic area type, the rare diseases segment is expected to show the fastest growth rate during the upcoming years. Increasing incidences of rare diseases are driving the development of treatment approaches. Thus, this leads to growing collaboration with CDMO to enhance their production, clinical trials, approvals, and commercialization.

North America dominated the CDMO services for pharma and biotech market in 2024. North America consisted of well-developed industries, which in turn, enhanced the production of various products along with outsourcing, leading to a rise in CDMO services. Thus, this contributed to the market growth.

The industries in the U.S. are focusing on the development of various traditional approaches. This, in turn, is increasing the demand for CDMO for advanced infrastructure to enhance the manufacturing and development process. At the same time, growing investments are also contributing to the same.

The growing interest in the development of cancer treatment approaches, such as gene therapies, CAR-T, etc., is increasing in Canada. This, in turn, increases the collaboration of companies with CDMO to utilize the services for their development. Thus, they provide companies with well-suited infrastructure.

Asia Pacific is expected to host the fastest-growing CDMO services for the pharma and biotech market during the forecast period. The healthcare sector in Asia Pacific is advancing with the growing adoption of advanced technologies, research, and development. This, in turn, increases the demand for CDMO by the pharma and biotech companies, enhancing the market growth.

With the growing research and development in China, there is a rise in various diagnostic and treatment approaches. Thus, to enhance production, approval, and commercialization, the adoption of CDMO services is increasing. Moreover, to support them, the investments are also provided by the government.

The growing production rates, as well as the biologics and generic drugs development, are increasing in India, promoting the use of CDMO services by the pharma and biotech companies. Moreover, the increasing clinical trials and investments by companies are also contributing to the same.

Europe is expected to grow significantly in the CDMO services for the pharma and biotech market during the forecast period. To deal with the growing incidence of diseases, the pharma and biotech companies in Europe are increasing the development of various treatment approaches. Thus, this promotes the market growth.

The industries as well as the institutes in Germany are focused on developing innovative approaches for the diagnosis and treatment of rising diseases. Thus, to support this development, the adoption of CDMO is growing. Furthermore, to accelerate their clinical trials and approval, their adoption is increasing.

To deal with the rising outsourcing and development of products in the UK, the demand for CDMO services is increasing. At the same time, they are also supporting the research and development for rare diseases and cancer. Furthermore, the guidance by the experts is promoting the formulation and development process.

By Service Type

By Molecule Type

By Phase

By End User

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

February 2026