February 2026

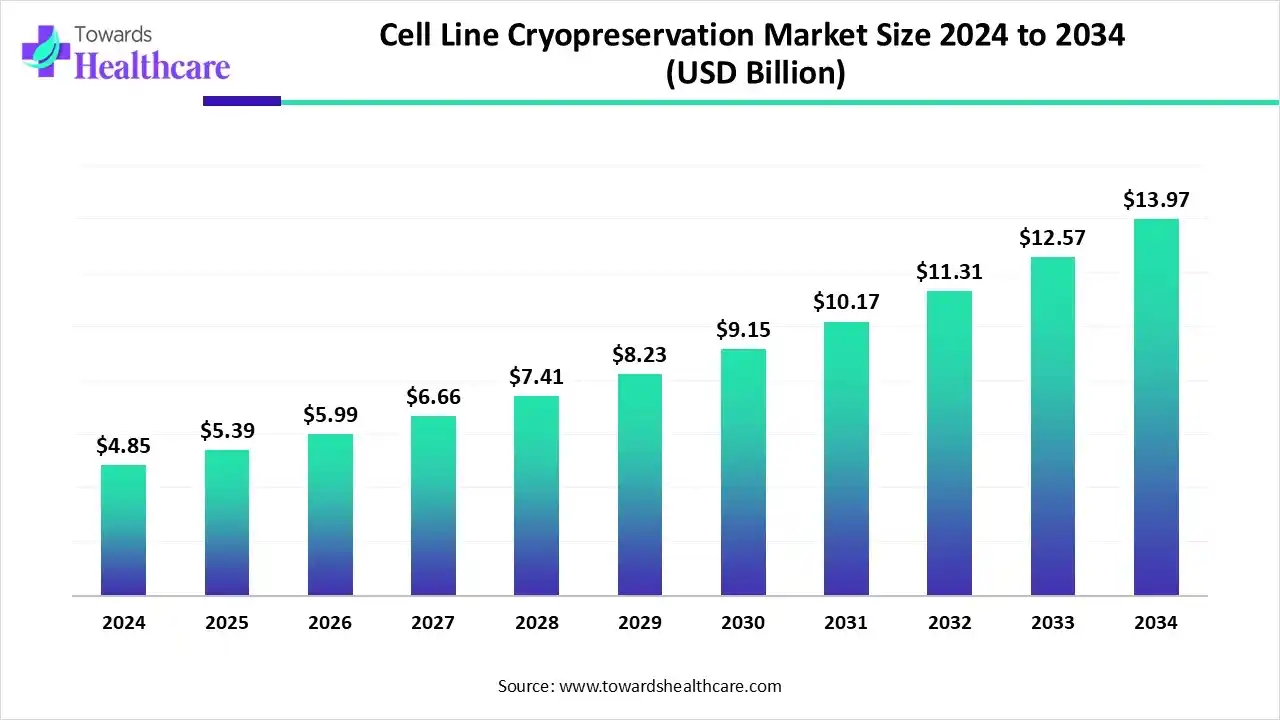

The global cell line cryopreservation market size is estimated at US$ 5.39 billion in 2025, is projected to grow to US$ 5.99 billion in 2026, and is expected to reach around US$ 13.97 billion by 2034. The market is projected to expand at a CAGR of 11.16% between 2024 and 2034.

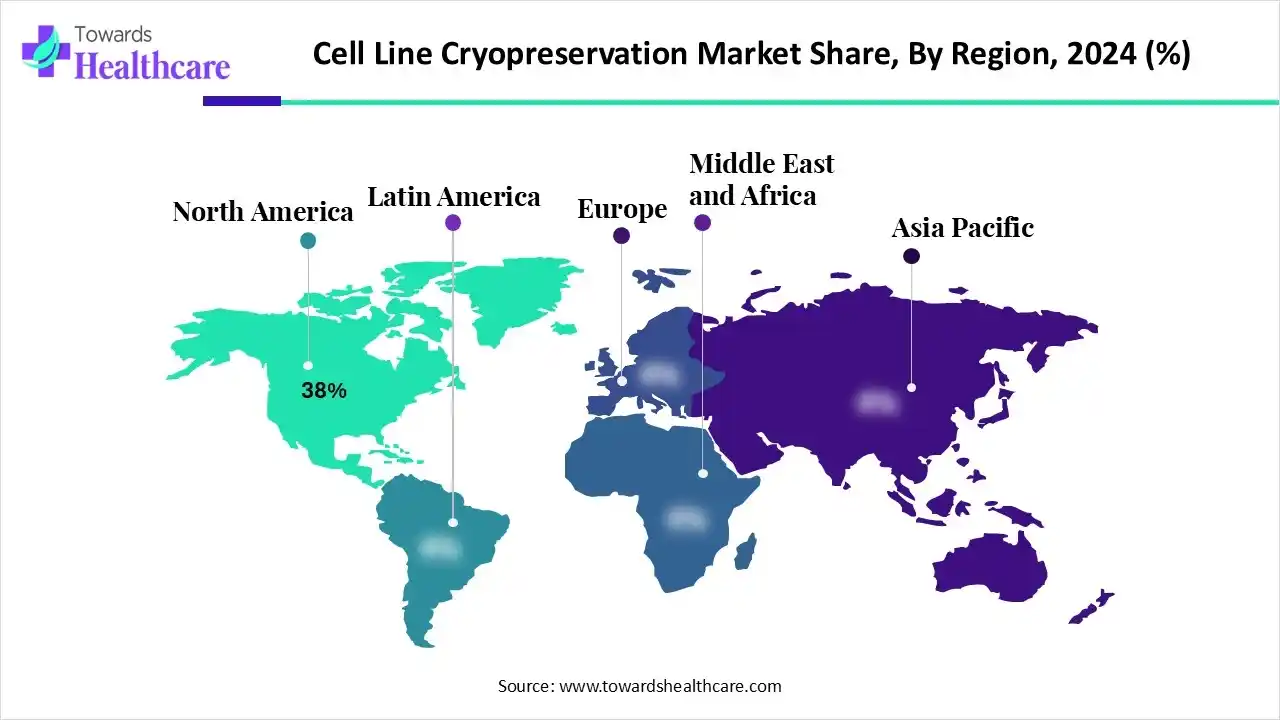

The cell line cryopreservation market is growing due to the rising demand for cell-based therapies, the expanding use in drug discovery, and the broader applications in regenerative medicine and fertility treatments. North America is dominant in the market due to advances in reproductive technology and technological innovation, while the Asia Pacific is the fastest growing as the increasing prevalence of chronic diseases and rising biobanking services.

| Table | Scope |

| Market Size in 2025 | USD 5.39 Billion |

| Projected Market Size in 2034 | USD 13.97 Billion |

| CAGR (2024 - 2034) | 11.16% |

| Leading Region | North America by 38% |

| Market Segmentation | By Product / Offering, By Preservation Method / Technology, By Service Model / Provider Type, By End-User / Customer Segment, By Application, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Merck KGaA, BioLife Solutions, Inc., Corning Incorporated, Lonza Group Ltd., Sartorius AG, PromoCell GmbH, HiMedia Laboratories Pvt. Ltd., STEMCELL Technologies Canada Inc., Cryoport, Inc., Creative Biolabs, GE Healthcare Technologies Inc., Eppendorf Corporate, Takara Bio Inc., Planer PLC, Brooks Life Sciences (part of Azenta), Acorn Biolabs Inc., Pluristyx Inc., PanTHERA CryoSolutions, CryoCrate LLC |

The cell line cryopreservation market covers technologies, media, equipment and services dedicated to the long-term storage (at ultra-low temperatures, often below 130 °C) of cell lines, stem cells, primary cells, gametes/embryos, and other biological samples for future use in research, biobanking, drug discovery, cell & gene therapy manufacturing, fertility preservation, and related clinical applications. It includes cryoprotectant media, freezing & storage equipment (freezers, liquid nitrogen tanks), consumables, monitoring/quality systems, and associated cryostorage logistics and services. Growth is driven by the expansion of cell-based therapies, increasing biobanking and fertility preservation demand, and rising R&D in biopharma and academic settings.

Integration of an AI-driven system in cell line cryopreservation54 drives the growth of the cell line cryopreservation market, as AI-driven cryopreservation monitoring technology presents a lower in damage by a massive margin than outdated processes. AI-based monitoring in such services ensures that every single sample. AI-driven monitoring contributes to better government compliance and administration of information. This type of system robotically logs all applicable data, so it offers a full audit trail in real-time, which streamlines compliance and lowers the risk of penalties. AI-driven technology becomes ever more integrally positioned in cryopreservation, leading toward an era of unprecedented security and efficacy for biobanking.

Which Product Dominated the Market in 2024?

Cell freezing media & cryoprotectants: the cell freezing media & cryoprotectants segment led the cell line cryopreservation market with a 35% share, as it enables lasting storage of cell lines by protecting them from ice crystal injury, which keeps their viability, genetic integrity, and functionality.

Automated cryogenic biobanking/robotic storage solutions segment: this segment is expected to experience the fastest CAGR from 2025 to 2034, as automating biobanking procedures, sample integrity and security are protected, biobanking events are streamlined, and space and energy are effectively utilized. An automated biobank enhances the biobank workflow in quantitative and qualitative ways.

Cryo-storage services segment: Cryogenic storage provides various benefits for the pharmaceutical industry, confirming the integrity and longevity of complex materials. It confirms safe storage of blood plasma and other blood material, offering vital support for blood transfusion and healthcare emergencies.

How did Slow-Freezing Dominated the Market in 2024?

Slow-freezing segment: this segment is dominant in the cell line cryopreservation market in 2024, with a 50% share, as it is much more desirable for eggs, as these have an advanced intracellular content. Slow freezing helps preserve the flavor better than rapid freezing. It helps retain the nourishing value of the produce, making it a greater method for long-term storage.

Vitrification/ultra-rapid freezing segment: this segment is expected to experience the fastest growth from 2025 to 2034, as it offers faster procedures, improved results, and a smoother family planning journey. This ground-breaking process redefines success rates in in vitro fertilization (IVF) by enhancing both embryo survival and implantation rates.

Dry ice / short-term cryo-transport protocols segment: This offers logistical flexibility while reducing the challenges of degradation and exploiting feasibility upon arrival. It reduces cellular damage caused by temperature variations, which is specifically significant for delicate materials such as stem cells and immune cells.

What Made In-House Dominant in the Market in 2024?

In-house segment: this segment led the cell line cryopreservation market in 2024, with approximately 42% share, as in-house cryopreservation increases the effectiveness of assisted reproductive treatments by enabling all extracted and fertilized cells to be preserved for future use. This process is particularly significant for research laboratories, fertility clinics, and biobanks that require preserving and managing sensitive cells, tissues, or genetic material over a long time.

Outsourced biobanking & CRO cryo-services segment: this segment is projected to experience the fastest CAGR in the cell line cryopreservation market from 2025 to 2034, as outsourcing removes the requirement for spending on infrastructure, apparatus, and employees required for in-house sample storage, resulting in expense savings for scientists. It permits researchers to focus on their essential research activities without the load of managing sample storage logistics.

Academic/public biobanks & repositories segment: these types of biobanks play a vital role in biomarker research and contribute to the advancement of this novel targeted medicine. It offers advanced quality genetic material and is a significant tool in the elucidation of the molecular mechanisms that promote rheumatic illnesses.

How Biopharmaceutical & Cell-Therapy Developers Dominated in 2024?

Biopharmaceutical & cell-therapy developers segment: this type of segment is the fastest growing in the cell line cryopreservation market in 2024, with approximately 30% share, as it is a significant tool for handling variability related to starting material stability, locking in feasibility, and potency. Cryopreservation strives to exploit the biofunctionality and viability of cells and tissues by cooling them to a sub-zero temperature to simplify delivery and storage.

CROs & Contract Cell-line Developers segment: this segment is expected to experience the fastest growth from 2025 to 2034, as cryopreservation boosts the effectiveness of assisted reproductive treatments by enabling all extracted and fertilized cells to be saved for future use. CROs act as strategic partners that provide end-to-end support for research projects. With on-site biobanks, organizations offer a broad ecosystem that integrates different characteristics of research.

Research Institutes & Academia segment: In research institutes, cryopreservation enables the banking of a huge cells and tissues which are utilized for scientific research and healthcare applications, including hepatocyte and pancreatic islet transplantation, bone marrow transplantation, blood transfusion, in vitro fertilization, and artificial insemination.

Which Application Segment Dominated the Market in 2024?

R&D/drug discovery segment: this segment led the cell line cryopreservation market in 2024 with approximately 30% share, as cryopreservation is a better-established process for the long-term storage of cells and living samples, lowering expenses and simplifying the storage and transport of encapsulated cells from research laboratories to healthcare facilities.

Cell therapy & regenerative medicine segment: this segment is expected to experience the fastest CAGR from 2025 to 2034, as cryopreservation is a complex procedure in regenerative medicine. It enables the preservation of stem cells for future use, lowers the challenges of contamination, extends the shelf life of stem cells, permits the transportation of stem cells, and allows multiple treatment choices.

Biomanufacturing/production-cell line banks segment: Cell banking predominantly accelerates the cell line development procedure, resulting in time and cost savings for scientists and biotechnological organizations. Cell banks serve as significant resources that drive the growth of research and clinical trials.

North America is dominant in the cell line cryopreservation market in 2024, with a 38% share, due to the huge presence of a well-developed network of research institutions and biotech organizations. Growing infertility rates and the increasing adoption of assisted reproductive technologies (ART), like in vitro fertilization (IVF). Well-developed supply networks and the presence of major cryopreservation device manufacturers contribute to the growth of the market.

For Instance,

In the U.S., the increasing prevalence of chronic diseases and the resultant demand for cell-driven therapies, including regenerative medicine and targeted medicine. Cryopreservation is significant for the storage of biological samples such as DNA, RNA, and proteins, and the growth of biobanking networks and sources is a major market growth factor.

For instance,

In South America, increasing government spending across the region in biotechnology research and development, goal to technological leadership in the region. The growing biotechnology and biopharmaceutical organizations are driving the demand for contract manufacturing services (CDMOs), which depend on cryopreservation, and this contributes to the growth of the market.

For Instance,

Asia Pacific is the fastest-growing region in the cell line cryopreservation market in the forecast period, as the massive expansion of the biotechnology and biopharmaceutical fields, the increasing occurrence of chronic diseases, and supportive government policies. The biopharma and biotechnology sectors are quickly expanding in the Asia Pacific, with a noteworthy focus on research and development. Considerable government funding and private sector investments are driving the growth of the cell and gene therapy sector in the region. In February 2025, Singapore Budget 2025: S$3 billion National Productivity Fund boost for efforts to drive tech and innovation.

In China growing aging population leads to a higher rate of chronic conditions and infertility, increasing the requirement for organ transplantation processes and fertility treatments such as IVF, which drives the demand for cryopreservation solutions. The number of biobanks and research organizations that use cryopreservation technology for long-term sample storage, for instance, Hong Kong proposes axing the 10-year storage limit for frozen eggs and embryos amid declining fertility in the city.

Europe is a notably growing market region due to the presence of robust medical care infrastructure, significant advancement in biotechnology and research, and helpful government frameworks. European Union initiatives, such as Horizon Europe, assign billions of euros toward research and invention, including biotechnology. Increased research in Europe's biopharmaceutical and biotechnology organizations is driving demand for high-quality cryopreservation services.

For Instance,

In Germany, growing biotechnology research and massive investments in healthcare. A rising interest in targeted medicine and cell culture processes is driving demand for cell cryopreservation.

For Instance,

Growing demand for biobanking, regenerative medicine, and fertility solutions, along with modern advancements in expertise. Growth of bio-services and fertility clinics, and the modernization of healthcare infrastructure the major drivers of the market. Developing local AI-based analytics and adopting advanced media preparations offers a modest edge.

For instance,

The Middle East & Africa a notably growing, with increasing government spending, the rising prevalence of long-term diseases, and a wealthy biotech and regenerative healthcare sector. This region is experiencing a rise in cases of NCDs such as cancer and diabetes. Recent development in regenerative therapies, which uses stem cells for the restoration of injured tissue, are creating a massive demand for cryopreservation.

For instance,

In South Africa, rising cases of chronic disorders, like cancer and CVD diseases, are driving the requirement for cryopreserved cells and tissues for beneficial applications. South Africa has major academic and research organizations that are driving invention in biotechnology and cell-driven therapies, which is growing the requirement for cryopreservation.

For Instance,

The research and development (R&D) processes for cell line cryopreservation include fundamental cryobiology research, protocol development and optimization, characterization and quality control (QC), and government compliance and scale-up

Key Players: BioLife Solutions and Thermo Fisher Scientific

Clinical trials involving cell line cryopreservation are the pre-cryopreservation quality control (QC) and preparation, cryopreservation procedure, traceability and documentation, thawing and post-thaw recovery and storage, and transportation

Key Players: Merck KGaA and Lonza Group

Major patient services involve patient education and counseling, consent, sample collection, and post-storage communication.

Key Players: Stemcell Technologies and FUJIFILM Irvine Scientific

Company Overview

History and Background

Created via the 2006 merger of Thermo Electron Corporation and Fisher Scientific International. Over subsequent years built scale through major acquisitions and expansion into bioprocessing and sample-management services.

Key Milestones / Timeline

Business Overview

Operates across multiple segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, Laboratory Products & Services.

Business Segments / Divisions

Key divisions include Life Sciences, Clinical Genomics, Bioprocessing, Diagnostics, and Lab Services.

Geographic Presence

Global operations across the Americas, Europe/Middle East/Africa, and Asia-Pacific with manufacturing, R&D, and sales offices worldwide.

Key Offerings

Cryopreservation media, controlled-rate freezers, liquid nitrogen storage systems, vials, sample management software, consumables for cell line preservation and biobanking.

End-Use Industries Served

Pharmaceuticals & biotech, academic research institutions, clinical diagnostics labs, cell & gene therapy manufacturing, biobanks.

Key Developments and Strategic Initiatives

Strategic push into digital and AI-enabled workflows: in October 2025, announced collaboration with OpenAI to embed AI across product development, service delivery, and customer engagement.

Mergers & Acquisitions

Partnerships & Collaborations

Collaboration with OpenAI announced in October 2025; partnerships with academic and biotech customers to enhance biopreservation, automation and digital workflows.

Product Launches / Innovations

Continuously upgrading cryopreservation media, sample-management software, and automation platforms (specific product names not publicly detailed in 2025 news).

Capacity Expansions / Investments

Investments announced to ramp U.S. manufacturing, expand bioprocessing capability, and reinforce sample-storage/service infrastructure.

Regulatory Approvals

Holds global regulatory clearances for diagnostics, lab instruments and bioprocessing systems (no specific new approvals disclosed in 2025 news).

Distribution Channel Strategy

Multi-channel model: direct enterprise sales, distributors, e-commerce platforms, OEM partnerships for integrated systems.

Technological Capabilities / R&D Focus

R&D prioritized on cryoprotective formulations, automation of freezing/storage workflows, digital traceability, and integration of AI into life-sciences operations.

Core Technologies / Patents

Portfolio of proprietary technologies in controlled-rate freezing, cryoprotectant media, and sample tracking instrumentation.

Research & Development Infrastructure

Global R&D hubs and application-laboratories supporting customers worldwide in cell preservation and bioprocessing.

Innovation Focus Areas

Biopreservation media improvement, sample-integrity tracking, cold-chain and storage automation, AI-enabled analytics of cell-therapy workflows.

Competitive Positioning

Positioned as a market leader in life sciences with broad product breadth, deep channel reach, and integrated services from reagents through instrumentation to data.

Strengths & Differentiators

Scale, brand recognition, comprehensive portfolio, global support network, service offering across the research-to-manufacture continuum.

Market presence & ecosystem role

A primary supplier to biobanks, biotechnology firms, clinical-research organizations, and cell‐therapy manufacturers globally.

SWOT Analysis

Recent News and Updates

Press Releases

Major releases cover the acquisition announcements, collaboration with OpenAI, and Q3 earnings.

Industry Recognitions / Awards

Recognized in prior years for innovation in life sciences solutions and sustainability; no major new awards publicly disclosed in 2025 news.

Company Overview

Merck KGaA is a German science and technology company, through its Life Science business (MilliporeSigma in the U.S./Canada), providing reagents, consumables, equipment, and services for biomanufacturing, cell culture, cryopreservation, filtration, and purification.

Corporate Information (Headquarters, Year Founded, Ownership Type)

Headquarters: Darmstadt, Germany. Founded: 1668. Public company (Frankfurt: MRK); majority-owned by family holding E. Merck KG.

History and Background

With over three-and-a-half centuries of history, Merck evolved from a chemical/pharma business into a diversified life-science and technology group. The Life Science business draws on a deep heritage in reagents, cell-culture media, and bioprocessing tools.

Key Milestones/Timeline

Business Overview

Operates through three core sectors: Life Science (MilliporeSigma), Healthcare, and Electronics. Life Science is the key segment for cell-line preservation, bioprocessing, and cryopreservation consumables.

Business Segments / Divisions

Life Science (including Process Solutions, Science & Lab Solutions), Healthcare, Performance Materials.

Geographic Presence

Global presence across Europe, Americas and Asia-Pacific; manufacturing, R&D and sales in 60+ countries.

Key Offerings

Cryopreservation media and reagents, cell-culture consumables, filtration and chromatography systems, storage containers, and bioprocess purification tools.

End-Use Industries Served

Biopharma (cell & gene therapy, monoclonal antibodies), fertility clinics, research & academic labs, diagnostics, biomanufacturing.

Key Developments and Strategic Initiatives

Focus on digital transformation via AI and partnerships, strengthening purification/filtration portfolio, improving operating model for Life Science business.

Mergers & Acquisitions

Partnerships & Collaborations

MoU with Siemens AG (September 2025) to integrate AI, software, and automation across the life-science value chain.

Product Launches / Innovations

New offerings in advanced filtration and chromatography (via acquisition); focus on next-gen biology tools (organoids, cell-culture tech) though specific product names not detailed.

Capacity Expansions / Investments

Investment and operational restructuring announced at Capital Markets Day 2025; emphasis on building a leading position in high-growth technologies while maintaining financial discipline.

Regulatory Approvals

Maintains global regulatory compliance across life-science consumables and bioprocessing equipment; no new major approvals publicly highlighted in 2025.

Distribution Channel Strategy

Multi-channel: direct enterprise, regional distributors, digital platforms; tailored go-to-market model for Life Science customers from Jan 2026 onward.

Technological Capabilities / R&D Focus

Expertise in cryopreservation chemistry, cell-culture reagents, filtration and chromatography systems, analytics, and digital workflows.

Core Technologies/Patents

Patent portfolios in preservation media, protein-A chromatography resins (e.g., Amsphere™ from JSR deal), filtration membranes, and process-control software.

Research & Development Infrastructure

Global R&D hubs and manufacturing/test sites (>55 globally) supporting the Life Science business.

Innovation Focus Areas

Cell-and-gene-therapy support, biologics purification, next-gen cell-culture models (organoids), digital/AI-enabled workflows.

Competitive Positioning

Major contender in life-science reagents and bioprocessing with integrated offerings across cell-culture, preservation, and purification – positioned for the expanding cell-therapy era.

Strengths & Differentiators

Long scientific heritage, breadth of reagents and equipment, global footprint, strong partnerships, and acquisition strategy.

Market Presence & Ecosystem Role

Key supplier to biotech, pharma, reproductive medicine, and research solution providers; part of core supply chains for cryopreservation and bioprocessing.

SWOT Analysis

Recent News and Updates

Press Releases

Released Q1 & Q2 results for 2025; published Capital Markets Day announcements and strategic acquisition news.

Industry Recognitions / Awards

Known for awards in chemistry and science (e.g., Heinrich Emmanuel Merck Award) and sustainability initiatives; no new major awards publicly reported in 2025.

Top Vendors and their Offering

By Product / Offering

By Preservation Method / Technology

By Service Model / Provider Type

By End-User / Customer Segment

By Application

By Region

February 2026

January 2026

January 2026

January 2026