February 2026

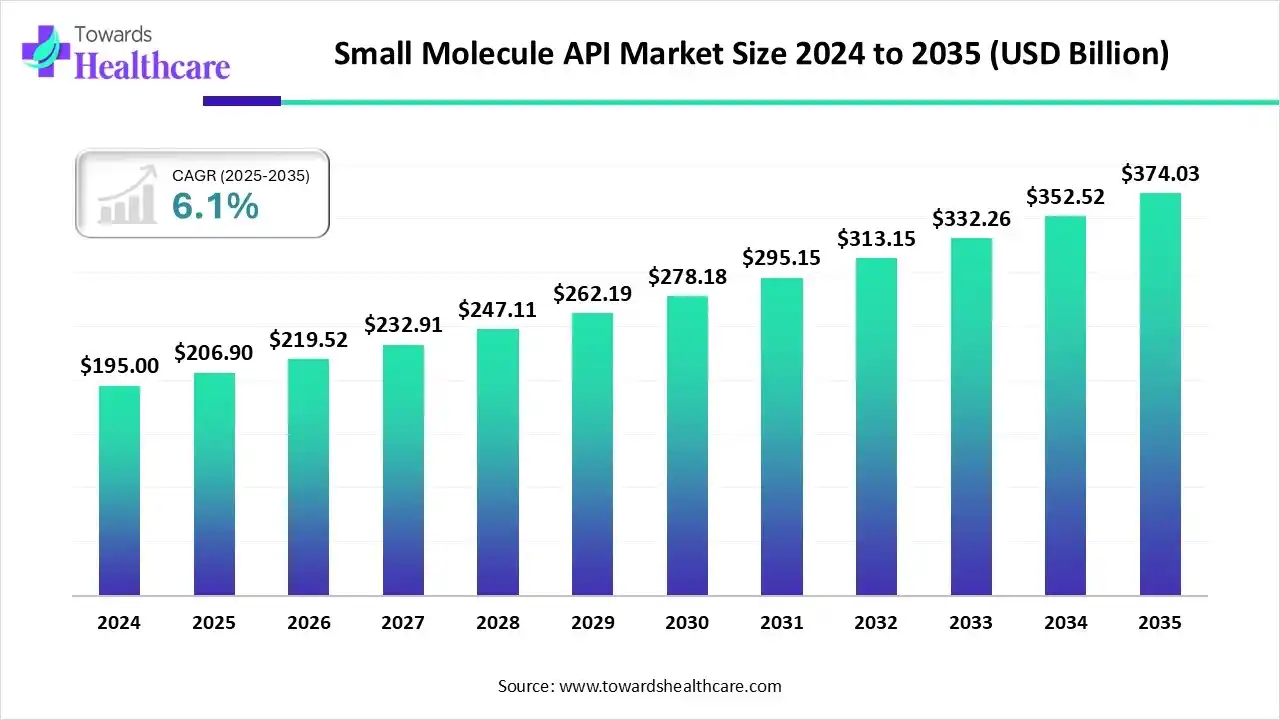

The global small molecule API market size is calculated at US$ 206.9 billion in 2025, grew to US$ 219.52 billion in 2026, and is projected to reach around US$ 374.03 billion by 2035. The market is expanding at a CAGR of 6.1% between 2026 and 2035.

The increasing demand for small-molecule medications across a range of therapeutic areas, particularly in oncology, cardiovascular diseases, and diabetes management, supports this growth. Pharmaceutical giants' growing investments to improve internal production capabilities and reduce reliance on external API suppliers are also driving growth in the small molecule API market.

| Key Elements | Scope |

| Market Size in 2025 | USD 206.9 Billion |

| Projected Market Size in 2035 | USD 374.03 Billion |

| CAGR (2026 - 2035) | 6.1% |

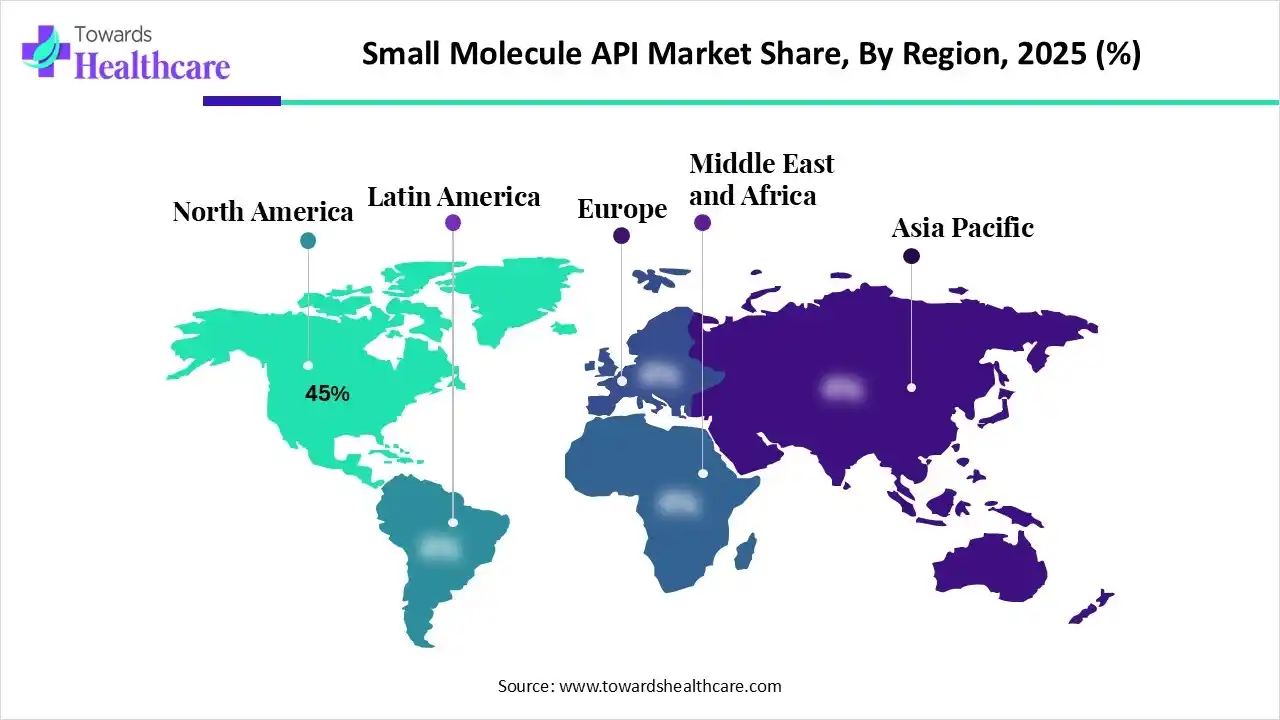

| Leading Region | North America by 45% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Molecule/Chemistry Type, By Dosage/Formulation, By End User, By Region |

| Top Key Players | Lonza Group, Catalent Inc., Cambrex Corporation, Bachem, Siegfried Group, Divi’s Laboratories, Aurobindo Pharma, Dr. Reddy’s Laboratories, Sun Pharmaceutical Industries, Granules India, Jubilant LifeSciences, Teva Pharmaceuticals, Pfizer, Merck KGaA, Novartis, Sandoz, WuXi AppTec, Piramal Pharma Solutions, Hikal Ltd., Famar, Fareva, EuroAPI, Lupin, Glenmark, Cipla |

The small molecule API market comprises production, trade, and supply of low-molecular-weight chemical compounds that are the active ingredients in most conventional pharmaceuticals. It includes innovator APIs (patent-protected) and generic/merchant APIs (off-patent), produced in dedicated API manufacturing facilities or by CDMOs. The market covers synthetic chemistry, process R&D, scale-up, regulatory compliance (cGMP), and specialty services such as controlled-substance handling, high-potency APIs (HPAPIs), and sterile small-molecule injectables. Global demand is driven by rising chronic disease burden, outsourcing to CDMOs, reshoring investments, and growth in novel small-molecule therapeutic launches.

A major change in the way the industry approaches production processes is represented by the incorporation of AI into the manufacturing of small molecule APIs. Manufacturers can more successfully negotiate the growing complexity of small-molecule production by utilizing AI's capabilities, leading to increased productivity, enhanced consistency, and eventually better patient outcomes. With artificial intelligence (AI) at the forefront and driving the sector toward a more streamlined, efficient production paradigm, the future of small-molecule manufacturing appears bright as technology advances.

Which Product Dominated the Market in 2024?

The branded/innovator small-molecule APIs segment led the small molecule API market, accounting for approximately 55% of revenue in 2024. After extensive research, a single company develops and markets these medications, maintaining the patent for a predetermined amount of time. Their small molecular weight, chemical synthesis process, oral administration potential, and cellular penetration are their defining characteristics.

Generic/Merchant APIs

The generic/merchant APIs segment is expected to be the fastest-growing in the small molecule API market during the forecast period. Because generic drug applicants do not need to repeat animal and clinical (human) studies that were necessary for brand-name medications to demonstrate safety and effectiveness, generic drugs typically have lower prices than their brand-name counterparts. When more than one generic company is authorized to sell a single product, the market becomes more competitive, which usually means that patients will pay less.

High-Potency APIs (HPAPIs) & Cytotoxics

The high-potency APIs (HPAPIs) & cytotoxics segment is growing at a lucrative rate during the forecast period. Even at low dosages, HPAPIs, pharmacologically active drug substances, are known to be highly effective and highly specific. Compared to conventional APIs, they offer several advantages. As a result, they are now widely produced and used. Nearly 145 businesses currently possess the necessary skills to provide cytotoxic drug and HPAPI manufacturing services at various operational scales.

Why Oncology Dominated the Small Molecule API Market in 2024?

The oncology segment led the market with approximately 32% revenue in 2024 and is expected to be the fastest-growing segment during the forecast period. Targeted therapy has advantages over traditional therapies in terms of selectivity, efficacy, and tolerability. One of the main targeted treatments for cancer is small-molecule inhibitors. A lot of work has gone into developing more small-molecule inhibitors because of their benefits, including their ability to target a variety of targets, their ease of administration, and their capacity to enter the central nervous system.

Cardiovascular & Metabolic

The cardiovascular & metabolic segment is growing with a lucrative rate during the forecast period. Because of their capacity to specifically target important signaling pathways, small-molecule medications have become a crucial class of therapeutic options for the treatment of CVDs. Additionally, the main ways that small-molecule medications for type 2 diabetes regulate blood sugar levels are by enhancing insulin sensitivity, boosting insulin secretion, or decreasing the production of liver glycogen. Numerous new medications with unique targets and modes of action have been found as a result of increased research into the pathophysiology of diabetes.

Why Small-Molecule Organic APIs Dominated the Market in 2024?

The small-molecule organic APIs segment led the small molecule API market, accounting for approximately 82% of revenue in 2024. Pharmaceuticals use synthetic compounds called small-molecule organic APIs. Their benefits include simple synthesis, oral bioavailability, good cell permeability, and ease of formulation; they can be used to treat diseases.

Peptidomimetics & Small Peptides

The peptidomimetics & small peptides segment is expected to be the fastest-growing in the small molecule API market during the forecast period. With organic chemistry and biotechnology emerging as key tools for creating peptidomimetics that have better stability, specificity, and bioavailability than traditional peptides, peptide drug discovery has seen a remarkable renaissance over the past 20 years.

Heterocyclic & Specialty Scaffolds

The heterocyclic & specialty scaffolds segment is growing with a lucrative rate during the forecast period. A lot of work is being done to find lead molecules related to the biological potential of different heterocyclic scaffolds because medicinal chemists are particularly interested in this. They improve the effectiveness of drug delivery and allow the available drug-associated chemical space to expand.

How Oral Solid-Dose APIs Dominated the Market in 2024?

The oral solid-dose APIs segment led the small molecule API market, accounting for approximately 60% of revenue in 2024. Many patients view oral administration as a significant benefit. The goal of current research is to create oral therapies that are safer and more effective than the alternatives currently on the market.

Injectables

The injectables segment is expected to be the fastest-growing in the small molecule API market during the forecast period. The rapid bloodstream absorption of small molecule injectables allows for targeted delivery to particular cells, increasing efficacy and reducing systemic side effects. This also enables prompt action in emergency situations.

Topicals

The topicals segment is growing significantly during the forecast period. Topical small molecules have many uses, such as reducing itching, accelerating wound healing, and treating inflammatory skin conditions like psoriasis and atopic dermatitis.

Which End-User Dominated the Market in 2024?

The pharmaceutical innovator companies & MNCs segment led the small molecule API market, accounting for approximately 50% of revenue in 2024. The active ingredients in many drugs are chemically synthesized and produced by companies such as Pfizer, Merck, Dr. Reddy's Laboratories, Cipla, Sun Pharmaceutical, and Novartis. These companies frequently distinguish between innovator products and those made using large-scale generic manufacturing.

Generic Drug Manufacturers

The generic drug manufacturers segment is expected to be the fastest-growing in the small molecule API market during the forecast period. After patents expire, generic drug manufacturers concentrate on copying existing molecules rather than creating new ones. Millions of people who might not otherwise be able to afford life-saving drugs now have access to them thanks to this seemingly straightforward act.

CDMOs/Contract Manufacturers

The CDMOs/contract manufacturers segment is growing at a lucrative rate during the forecast period. Leading pharmaceutical manufacturing companies, CDMOs are influencing the expansion of the sector by satisfying the rising demand for pharmaceutical goods worldwide. For preclinical and clinical outsourcing services, CDMOs/CMOs offer a strong network of businesses that offer complete, end-to-end solutions.

North America dominated the small molecule API market share by 45% in 2024. Over the course of the forecast period, the region is expected to dominate the market. Growing rates of chronic illness and more government efforts to create novel therapeutic medications are the main drivers of the expansion. The North American market is expanding as a result of patients' quick adoption of small-molecule medications for the treatment of various chronic illnesses.

Drug discovery remains a highly productive field in 2024. This year, 50 new molecular entities (NMEs) received FDA approval. A sizeable percentage of the FDA-designated breakthrough therapies and small-molecule medications with distinct mechanisms of action make up the approved market, underscoring the continuous innovation in this area.

Asia Pacific is estimated to host the fastest-growing small molecule API market during the forecast period fueled by large investments in the pharmaceutical manufacturing industry, a supportive regulatory framework, and robust government programs to support the development of generic drugs and healthcare access.

The department's efforts support the Make in India campaign, which aims to make India the world's largest supplier of high-quality medications at affordable costs. The Indian pharmaceutical industry, distinguished by its dominance in branded generic medications, competitive pricing, and a strong network of domestic brands, continues to play a critical role in producing high-quality, reasonably priced medications for both domestic and international markets. The PLI Scheme for KSMs, DIs, and APIs was introduced on March 20, 2020, and it required ₹6,940 crore in funding for the fiscal years 2020–21–2029–2030.

Europe is expected to grow at a significant CAGR in the small molecule API market during the forecast period because of a firmly established pharmaceutical sector, sophisticated manufacturing facilities, and strict regulations. Along with rising R&D expenditures, the growing need for sustainable and high-quality APIs is also anticipated to accelerate market expansion.

A significant piece of legislation, Germany's Medical Research Act, went into effect on October 30, 2024, with the goal of enhancing the country's appeal as a location for pharmaceutical and medical innovation. The act streamlines clinical trial approval procedures, offers incentives for local clinical trials, harmonizes ethics committee procedures, and permits confidential negotiated drug pricing.

South America’s small molecule API market is gaining momentum through local manufacturing boosts and pharma-friendly regulations. Brazil’s leadership attracts investments in CDMOs, improving supply chains and regional self-sufficiency, signaling a shift from dependency to innovation-led pharmaceutical growth.

Brazil is transforming into a small molecule API powerhouse. Global collaborations, GMP upgrades, and supportive government policies are fueling domestic manufacturing and innovation, helping Brazil strengthen its pharma independence and regional leadership.

The MEA region is nurturing a growing small molecule API market through rising healthcare investments and regulatory reforms. Expanding local manufacturing and strategic partnerships are shaping its transformation from importer to contributor in the global API network.

GCC nations are scaling up small molecule API capacity with strong backing from Saudi Arabia and the UAE. Strategic investments, advanced facilities, and innovation incentives are turning the region into a pharmaceutical manufacturing and export hub.

Through improved molecular design for therapeutic efficacy, new synthesis pathways, and sophisticated chemistry, research and development propel innovation in small molecule APIs.

Key Companies: Pfizer, Novartis, AstraZeneca, Merck & Co., Johnson & Johnson, Bristol Myers Squibb, and Sanofi drive R&D innovation.

Before APIs are used in the manufacturing of commercial pharmaceuticals, extensive clinical testing and rigorous regulatory reviews guarantee safety, efficacy, and compliance.

Key Companies: Roche, GlaxoSmithKline, Eli Lilly, Bayer, Amgen, AbbVie, Takeda, etc

To satisfy therapeutic and commercial requirements, APIs are transformed into final dosage forms via quality control, stability optimization, and precise formulation.

Key Companies: Catalent, Lonza, Thermo Fisher Scientific, Siegfried Holding AG, Piramal Pharma Solutions, Cambrex Corporation, Recipharm AB, etc.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview

Business Segments/Divisions:

Geographic Presence:

Global presence with major manufacturing and R&D sites across North America, Europe (Germany, Switzerland, UK), and Asia-Pacific (China, India, Japan).

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

The company's current structure is largely due to the 2015 acquisition of Sigma-Aldrich, which is foundational to the current Life Science portfolio.

Focus on long-term CDMO partnerships with pharmaceutical clients, leveraging its end-to-end capabilities from clinical to commercial scale.

Continued high investment in the Life Science sector. Example: Ongoing investments (over $300 million announced in recent years) to expand HPAPI and small molecule manufacturing capacity in Europe and North America to meet growing global demand.

Research & Development Infrastructure:

Extensive R&D facilities focused on process chemistry, analytical development, and formulation sciences within the Life Science business.

Strengths & Differentiators:

Market Presence & Ecosystem Role:

Dominant supplier in the research chemicals and lab materials sector, providing a direct pipeline into CDMO services. One of the top global CDMOs for small molecule and biopharma services.

SWOT Analysis (Life Science Segment):

Recent News and Updates

Industry Recognitions/Awards:

Frequently recognized for supply chain excellence, quality, and sustainability initiatives in the pharmaceutical manufacturing sector.

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview

Geographic Presence:

Extensive global manufacturing network, including major API facilities in the U.S., Europe (e.g., Ireland, Italy), and Asia.

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives

Mergers & Acquisitions:

Focus in 2024/2025 is primarily on integrating major past acquisitions (e.g., Seagen) to bolster its pipeline, which drives demand for small molecule APIs, particularly HPAPIs for oncology.

Partnerships & Collaborations:

Product Launches/Innovations:

The small molecule API business is driven by the internal launch of new small molecule drugs from Pfizer's pipeline (e.g., new oncology or internal medicine drugs) which requires large-scale API production.

Capacity Expansions/Investments:

Ongoing investments in its global manufacturing network to ensure supply chain resilience and to support its growing pipeline, especially in specialized areas like HPAPI production.

Technological Capabilities/R&D Focus

Core Technologies/Patents:

Research & Development Infrastructure:

Massive global R&D infrastructure supporting medicinal chemistry and process development for thousands of small molecule compounds in its history.

Innovation Focus Areas:

Strengths & Differentiators:

Market Presence & Ecosystem Role:

Dominant player in the finished dose market, and a significant, high-quality, and specialized supplier in the API and CDMO segment, acting as a "secure source" for specialty APIs.

SWOT Analysis (Pfizer CentreOne):

Recent News and Updates

Industry Recognitions/Awards:

Often receives awards for its overall supply chain performance and manufacturing excellence within the pharma industry.

| Company | Headquarters & Type | Core Expertise | Key Offerings | Market Contribution |

| Lonza Group | Switzerland, CDMO | Small-molecule APIs and biologics | Custom synthesis, process development | Global leader in CDMO services with advanced technology platforms enhancing drug manufacturing efficiency. |

| Catalent Inc. | USA, CDMO | API and drug delivery solutions | Formulation, scale-up, manufacturing | Drives innovation in small-molecule APIs through integrated development and commercial supply services. |

| Cambrex Corporation | USA, API Specialist | Small-molecule CDMO services | Process chemistry, manufacturing | Focused on API development and commercial supply with expertise in complex molecules. |

| Bachem | Switzerland, Manufacturer | Peptide and small-molecule APIs | Peptide synthesis, GMP production | Offers high-quality APIs with a global presence in contract manufacturing. |

| Siegfried Group | Switzerland, CDMO | Small-molecule and API production | Development, manufacturing, packaging | Provides end-to-end API and finished product solutions across regulated markets. |

Checkout how top players are redefining the Small Molecule API Market: https://www.towardshealthcare.com/companies/small-molecule-api-companies

By Product Type

By Therapeutic Area

By Molecule/Chemistry Type

By Dosage/Formulation

By End User

By Region

February 2026

February 2026

February 2026

January 2026