February 2026

The next-generation metabolic therapies market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2026 to 2035. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The growth in the occurrence of various metabolic disorders globally is increasing the demand for effective treatment options, leading to the use of next-generation metabolic therapies, where AI is being used to enhance their innovations and production. The robust healthcare, increasing awareness, and investments are also driving their R&D, where the companies are launching various products across different regions, which is promoting the market growth.

The next-generation metabolic therapies market is driven by the urgent need for the treatment of obesity, type 2 diabetes, proven efficacy of novel multi-agnostic therapies, and an aging population. The next-generation metabolic therapies encompass advanced treatment options such as targeted small molecule therapies, biologics, cell and gene therapies, RNA-based therapies, and microbiome-based therapies, developed for the treatment and management of metabolic disorders like diabetes, obesity, cholesterol disorders, genetic metabolic disease, etc.

AI offers a wide range of applications, which are increasing their use in the next-generation metabolic therapies market. AI helps in the analysis of large biological datasets, predicts metabolic pathways and drug interactions, driving the drug discovery and development, along with personalized therapies development. It also helps in early disease detection and treatment monitoring, promoting the safe and effective use of the products, where its use in clinical trials optimization is also increasing.

The industries are focusing on developing various gene-based treatment options, which are driving the innovation of biologics, gene editing approaches, and RNA-based therapies.

The companies are developing precision medicines with the use of individual genetic and metabolic profiles, which help in delivering target-specific action with enhanced safety and effectiveness.

To accelerate the drug discovery, development, and optimization, advanced technologies are being utilized, which also help in offering real-time monitoring and reducing errors, promoting their clinical trials.

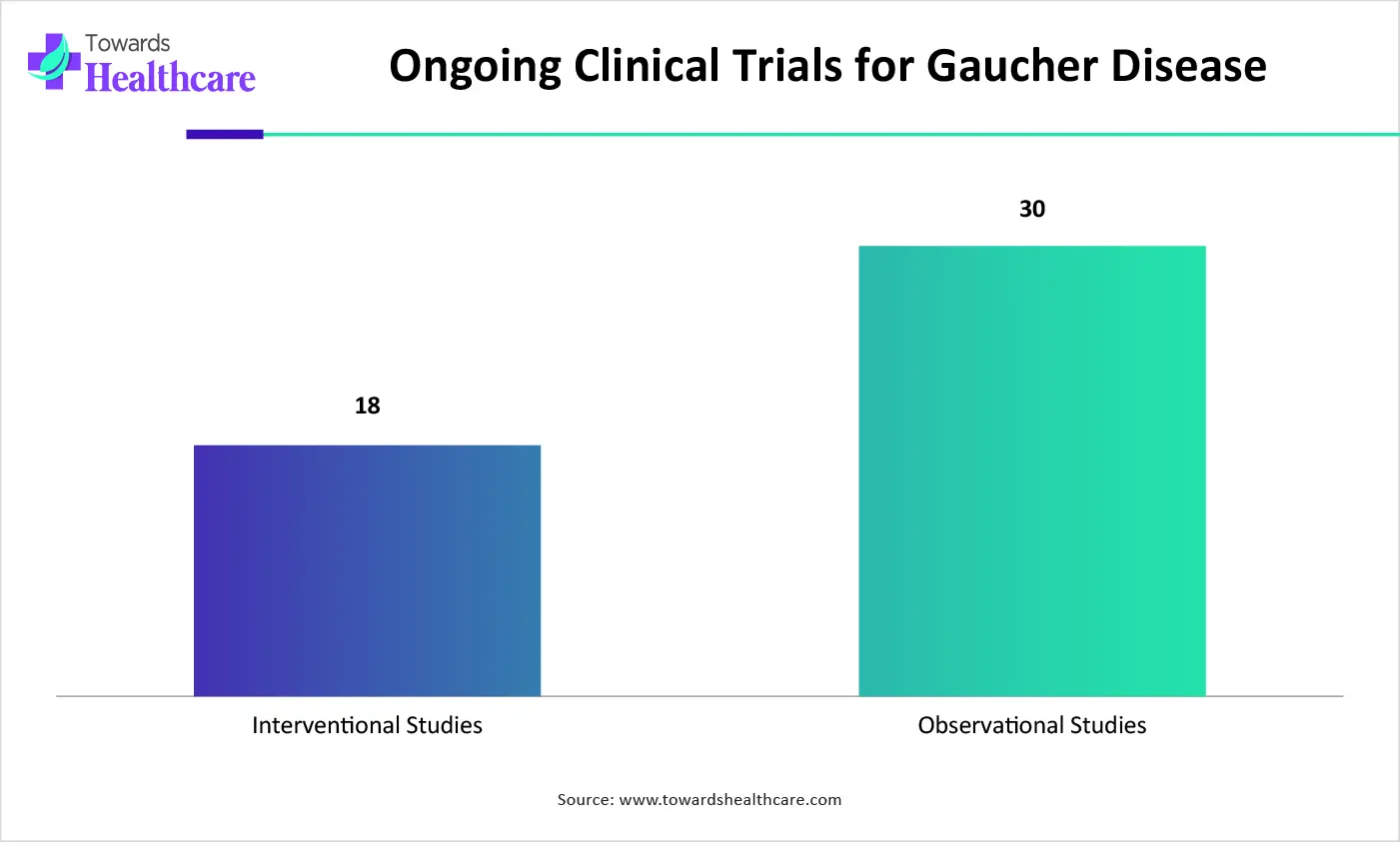

| Type of Gaucher Disease Clinical Trials in 2025 | Total |

| Interventional Studies | 18 |

| Observational Studies | 30 |

Why Did the Gene Therapy Segment Dominate in the Market in 2025?

The gene therapy segment held the largest share in the next-generation metabolic therapies market in 2025, due to its target-specific action. Moreover, their high precision also increased their use for longer durations, where the growth in the advanced technologies also accelerated their production rates.

RNA-based Therapeutics (siRNA, miRNA)

The RNA-based therapeutics (siRNA, miRNA) segment is expected to show the fastest growth rate during the upcoming years, due to their growing applications. At the same time, their enzyme replacement action and reduction in harmful protein production are also increasing their adoption rates.

How RNA Interference/Silencing Agents Segment Dominated the Market in 2025?

The RNA interference/silencing agents segment led the next-generation metabolic therapies market in 2025, driven by their gene-targeting action, high precision, and specificity. This, in turn, increased their success in the treatment of rare and complex genetic metabolic disorders, where their innovation were also backed by investments.

Metabolic Immunomodulators

The metabolic immunomodulators segment is expected to show the highest growth during the upcoming years, due to their dual action, which targets the metabolism and immune pathways. Additionally, the growing incidence of metabolic disorders is also increasing their acceptance rates.

Which Target Indication Type Segment Held the Dominating Share of the Market in 2025?

The obesity & weight management segment held the dominating share in the next-generation metabolic therapies market in 2025, driven by the growing incidence rates. Furthermore, due to insufficient effective treatments, the use of next-generation metabolic therapies also increased, for the improvement of metabolic health and quality of life.

Non-alcoholic Fatty Liver Disease (NAFLD)/NASH

The non-alcoholic fatty liver disease (NAFLD)/NASH segment is expected to show the fastest growth rate during the predicted time, due to unmet medical needs and increasing cases. This is driving the demand for next-generation metabolic therapies and personalized therapies, which are promoting the innovations.

What Made Hospitals & Clinics the Dominant Segment in the Market in 2025?

The hospitals & clinics segment led the next-generation metabolic therapies market in 2025, driven by the high patient volume. At the same time, they also offered complex therapies with regular patient monitoring. Moreover, the presence of specialists also increased the patient outcomes and adherence to the treatment.

Home Healthcare

The home healthcare segment is expected to show the highest growth during the predicted time, as it offers patient convenience and comfort. Additionally, the growing chronic metabolic disorders and telehealth solutions are also promoting the same. Furthermore, their affordability and growing wearable remote monitoring solutions are also increasing the shift towards home healthcare.

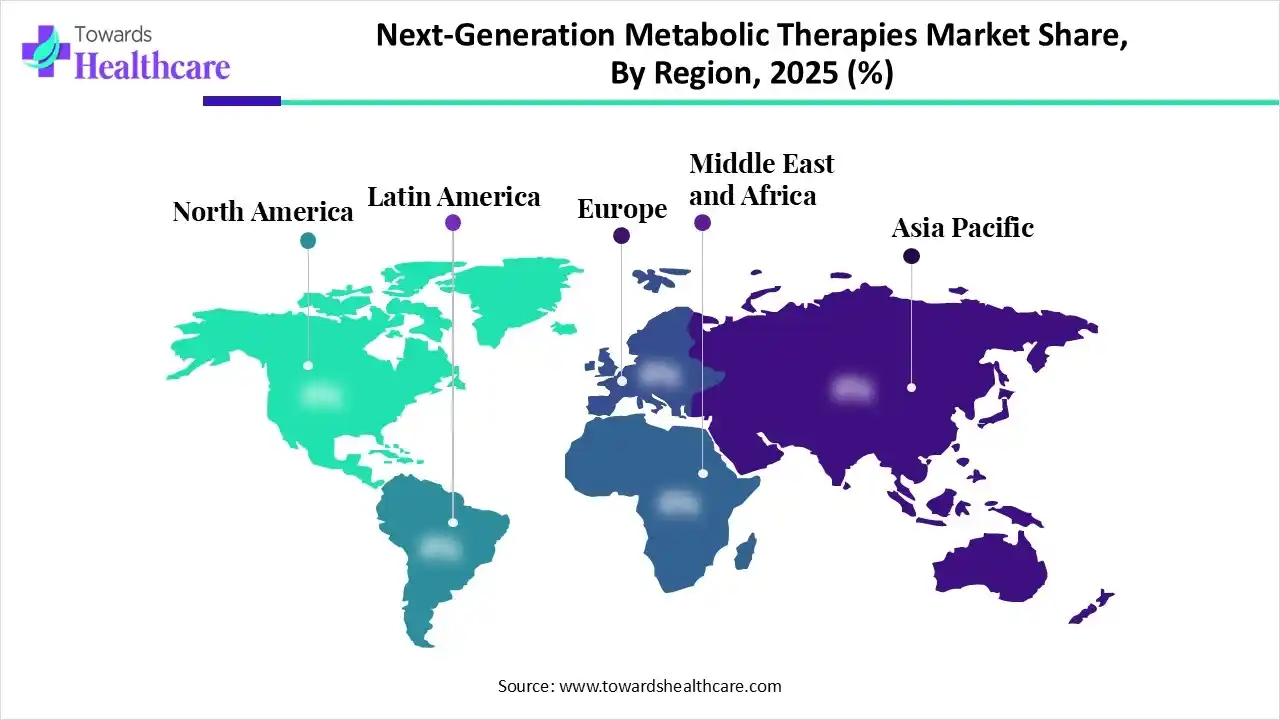

North America dominated the next-generation metabolic therapies market in 2025, due to the presence of advanced healthcare infrastructure. At the same time, the growth in the R&D activities and investments also encouraged their innovations, where the growing diseases also increased their adoption rates. Additionally, the presence of reimbursement policies also enhanced the market growth.

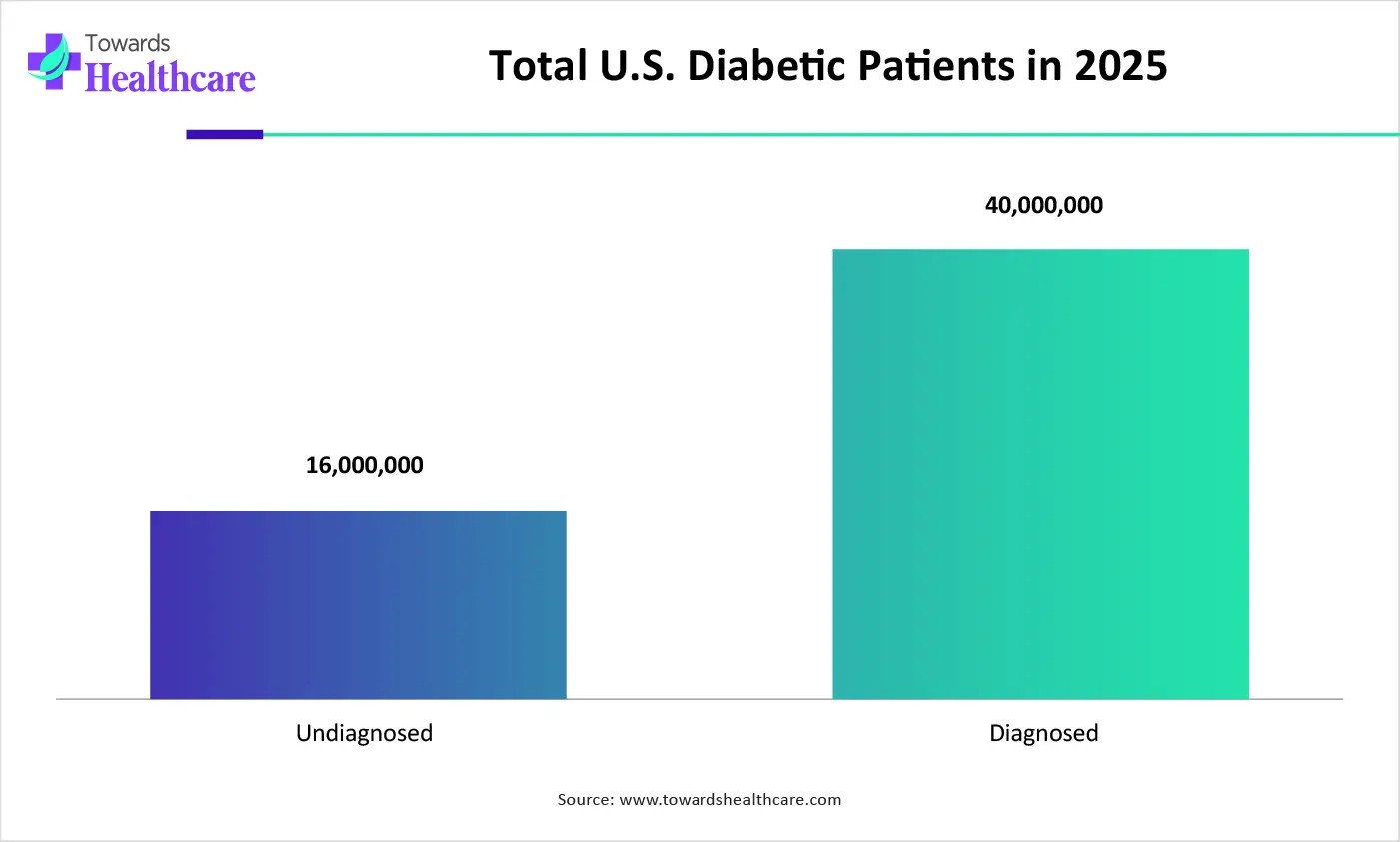

The U.S. consists of robust hospitals and advanced clinics, which are increasing the use of next-generation metabolic therapies supported by reimbursement policies, to tackle the growing incidences of metabolic disorders. The growing regulatory approvals and investments are also promoting innovation and its clinical trials.

| U.S. Diabetes Prevalence | Total Adults |

| Undiagnosed | 16 million |

| Diagnosed | 40 million |

Asia Pacific is expected to host the fastest-growing next-generation metabolic therapies market during the forecast period, due to growing incidences of metabolic disorders, which are driven by rapid urbanization and lifestyle changes. The expanding healthcare and growing health awareness are also increasing their adoption rates. Furthermore, the growing investments are also driving their innovations, contributing to the market growth.

The incidence of metabolic disorders in China is increasing, which is increasing the demand for next-generation metabolic therapies. The growing government initiatives and expanding healthcare are also increasing their use. Additionally, the growing funding and investments are increasing their advancements.

Europe is expected to grow significantly in the next-generation metabolic therapies market during the forecast period, due to growing health awareness, which is increasing the early diagnosis of metabolic disorders, driving the demand for next-generation metabolic therapies. The robust healthcare and R&D infrastructures are also increasing their adoption rates and innovations, which is promoting market growth.

The presence of robust healthcare systems in the UK is increasing the adoption of the next-generation metabolic therapies. At the same time, the growing health awareness is increasing their diagnosis rates, increasing their demand. Additionally, the growing R&D activities are also promoting innovations.

| Companies | Headquarters | Next Generation Metabolic Therapies |

| Novo Nordisk | Bagsvaerd, Denmark | CagriSema |

| Eli Lilly and Company | Indiana, U.S. | Retatrutide |

| Viking Therapeutics | California, U.S. | VK2735 |

| Amgen | California, U.S. | MariTide |

| Boehringer Ingelheim | Ingelheim, Germany | Survodutide |

| Altimmune | Maryland, U.S. | Pemvidutide |

| Structure Therapeutics | California, U.S. | GSBR-1290 |

| Zealand Pharma | Soborg, Denmark | Petrelintide |

| Madrigal Pharmaceuticals | Pennsylvania, U.S. | Rezdiffra |

| Terns Pharmaceuticals | California, U.S. | TERN-601 |

By Therapy Type

By Mechanism of Action

By Target Indication

By End-Use/Treatment Setting

By Region

February 2026

December 2025

October 2025

October 2025