February 2026

The global clinical trial services market size is calculated at US$ 66.07 billion in 2025, grew to US$ 71.92 billion in 2026, and is projected to reach around US$ 154.28 billion by 2035. The market is expanding at a CAGR of 8.85% between 2026 and 2035.

The growing research and development, along with clinical trials, are increasing the demand for the use of clinical trial services. The increasing collaborations and investments by the companies are increasing their use and adoption. AI is also being utilized in these services to enhance their capabilities and make clinical trials more reliable and scalable. At the same time, the presence of a mature CRO ecosystem and expanding sites capabilities are increasing their adoption rates in different regions. Moreover, new such services are also being launched by the companies. Thus, this promotes the market growth.

The clinical trial services market covers end-to-end outsourced and functional services that enable the design, setup, execution, and close-out of human clinical studies. Scope spans protocol/design consulting, site/start-up, patient recruitment & retention, clinical monitoring (CRA), data management & biostatistics, central labs & biomarkers, pharmacovigilance/safety, medical writing & regulatory, clinical supplies/logistics, eClinical/DCT enablement, home health/nursing, and study close-out. Sponsors outsource to accelerate timelines, access global sites/patients, ensure compliance, scale flexibly, and control costs.

Growing investments: The growing incidence of diseases is increasing the research and development by various companies. This is increasing the demand for clinical trial services to boost the development of new treatment approaches. This is leading to a rise in the investments and collaborations to enhance the use of these services, develop new such solutions, and accelerate the trials.

For instance,

AI impacts clinical trial services by empowering CROs in their search for optimal clinical trial sites. It also facilitates the development of actionable insights from a vast amount of data. It also helps in the selection of eligible patient for the trials using their electronic health records. Optimization of protocol design is also conducted using predictive analytics. Moreover, its real-time monitoring helps in early detection of errors and possible risks. Thus, with the use of AI, clinical trials can be made more reliable and scalable.

Growing Demand for Unified Data Platforms

A large volume of data is generated during the clinical trials. This, in turn, increases the demand for unified data platforms to enable their analysis, management, and access. This helps in minimizing the time required for their reconciliation and accelerates the clinical trials. The data are collected in compliance with the regulatory standards, which improves the consistency and minimizes errors. Moreover, the real-time monitoring helps in identifying errors or other risks. This, in turn, is increasing its use in remote areas as well. Thus, this drives the clinical trial services market growth.

Protocol Complexity

The complex protocol increases the duration of the clinical trials, along with a rise in the requirement for clinical trial services. This increases the cost associated with them. Moreover, it also affects the patient recruitment process. The chances of errors, as well as regulatory delays, are also increased. Thus, this limits the adoption of clinical trial services.

Advancements in Full-Service Solutions

There is a rise in the adoption of full-service solutions for the management of clinical trials. They are being used to retain and target the patients, accelerating patient recruitment. This, in turn, is increasing their development to promote remote patient monitoring to enhance patient convenience. To increase the transparency of the trials and real-time data capture, new research and development are being conducted. Moreover, to enhance the regulatory submission by reducing the chances of rejection, new solutions are being developed. Furthermore, innovations to provide tailored solutions, insights, and enhance their efficiency are also being conducted. Thus, this promotes the clinical trial services market growth.

For instance,

Different types of complex and advanced therapies and biologics are being developed, where the growing innovations of various diagnostic and therapeutic options are increasing the demand for clinical trial services.

Due to growing clinical trials and their complexities, there is a rise in the outsourcing trends, which are encouraging the use of clinical trial services for streamlined and faster trials and approvals.

The growing digitalization is promoting the use of various advanced technologies for patient recruitment, data analytics, protocol design, remote monitoring, predictive insights, and telehealth, increasing the shift towards decentralized clinical trial services.

| Table | Scope |

| Market Size in 2026 | USD 71.92 Billion |

| Projected Market Size in 2035 | USD 154.28 Billion |

| CAGR (2026 - 2035) | 8.85% |

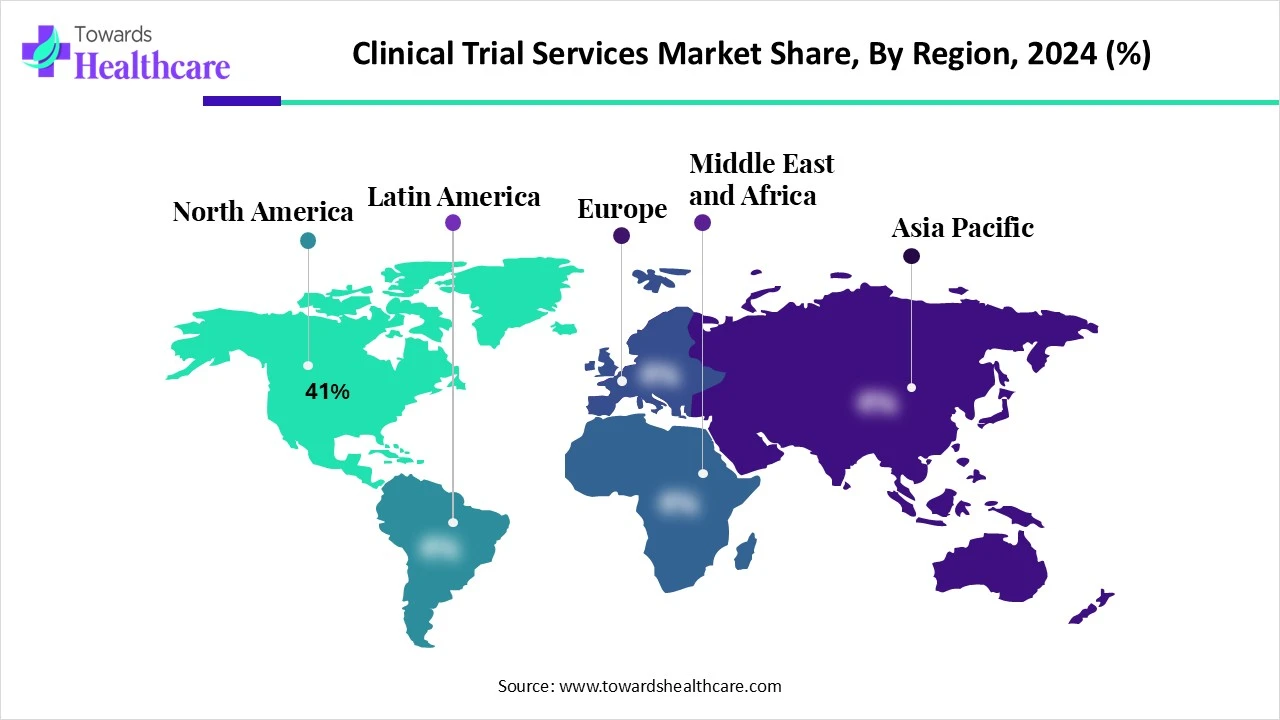

| Leading Region | North America Share 41% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Service Line, By Phase, By Therapeutic Area, By Delivery Model, By Region |

| Top Key Players | IQVIA, Thermo Fisher Scientific, ICON plc, Parexel, Syneos Health, Fortrea, Medpace, WuXi AppTec / WuXi Clinical, Charles River Laboratories, SGS Life Sciences, PSI CRO, Worldwide Clinical Trials, Premier Research, Novotech, Allucent, Veristat, ClinChoice, Cytel, Clario, Labcorp |

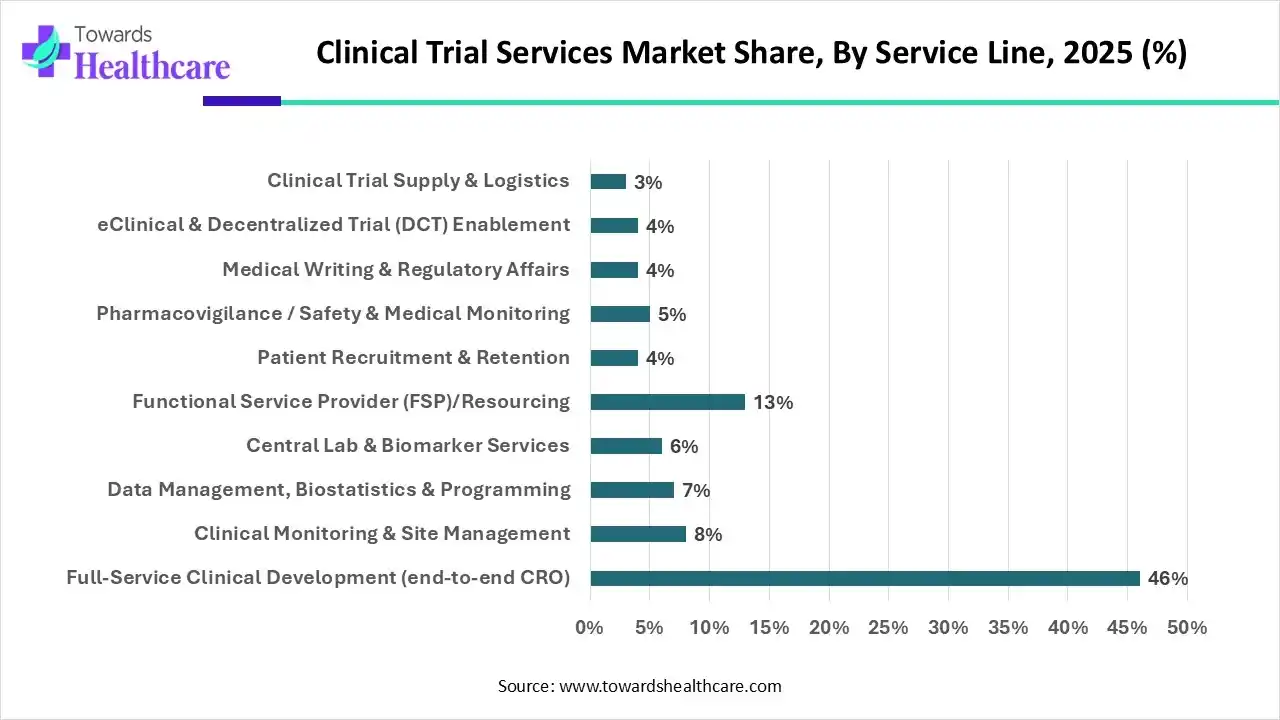

Which Service Line Type Segment Held the Dominating Share of the Clinical Trial Services Market in 2025?

By service line type, the full-service clinical development (end-to-end CRO) segment held the dominating share with approximately 46% in the market in 2025, because it provided complete trial services. This accelerated the clinical trials and improved the efficiency. Moreover, constant data management and the presence of regulatory expertise enhanced its use. Thus, this contributed to the market growth.

By service line type, the functional service provider (FSP)/resourcing segment is expected to show the highest growth at a notable CAGR during the forecast period. It is offering specialized expertise to the sponsors. Moreover, it also enhances the flexibility and scalability of the process. Additionally, due to its operational control during outsourcing, its use is increasing.

| Segment | Share 2025 (%) |

| Phase II/III | 58% |

| Phase I | 20% |

| Phase IV/RWE & Post-Marketing | 22% |

How Phase II/III Segment Dominated the Clinical Trial Services Market in 2025?

By phase type, the phase II/III segment led the market with approximately a 58% share in 2025, due to larger patient volumes. This increased the demand for clinical trial services for their data management and monitoring. The regulatory hurdles increased the use of these services. They were also used due to increased complexities and costs.

By phase type, the phase IV/RWE & post-marketing segment is expected to show the fastest growth rate during the forecast period. The growing DCT adoption is increasing the use of clinical trial services in this phase. They help in understanding the patient's quality of life and their adherence to the treatment.

What Made Oncology the Dominant Segment in the Clinical Trial Services Market in 2025?

By therapeutic area type, the oncology segment held the largest share of approximately 39% share in the market in 2025, due to growing cancer cases. This increased the use of clinical trial services for their research and development. Furthermore, as their trials were complex, the use of clinical trial services has increased. They were supported by the regulatory bodies.

By therapeutic area type, the rare & orphan diseases segment is expected to show the highest growth during the forecast period. The lack of treatment options is increasing their research and development, which increases the demand for clinical trial services. Thus, with their use, the trials are being accelerated, and new targeted therapies are also being developed.

Why Did the Full-Service Outsourcing Segment Dominate in the Clinical Trial Services Market in 2025?

By delivery model type, the full-service outsourcing segment led the market with approximately a 52% share in 2025, as it provided end-to-end solutions. This helped in proving consistent data integration. It also helps in enhancing the trial management, minimizing the time and cost associated with it. Thus, this enhanced the market growth.

By delivery model type, the FSP/functional outsourcing segment is expected to show the fastest growth rate during the forecast period. Their use is increasing due to its flexible and affordable outsourcing. It also offers the sponsors strategic insights. Thus, this is increasing their use in multiple trials.

North America dominated the clinical trial services market share by 41% in 2024. North America consisted of the largest sponsor base, which increased the use of clinical trial services. They were also used for research and development conducted in various industries. This contributed to the market growth.

U.S. Clinical Trial Services Market Trends

The U.S. consists of a mature CRO ecosystem, which provides various clinical trial services. At the same time, the growing research and development in the industries and institutes are increasing their use. Moreover, the guidelines provided by the regulatory bodies are encouraging their development and use.

Canada Clinical Trial Services Market Trends

The use of clinical trial services in Canada is increasing due to growing drug developments. The presence of a well-developed clinical trial site is increasing its adoption. Moreover, advanced tools are being developed with the use of AI and big data analytics. Thus, these advanced services are being used in the growing clinical research and development.

Asia Pacific is expected to host the fastest-growing clinical trial services market during the forecast period. The healthcare sector in the Asia Pacific is expanding, which includes increasing site capacities and investments. This, in turn, is increasing the use of clinical trial services, which are further supported by the government policies and investments. The growing technological advancements and outsourcing trends are also increasing their use. Thus, this enhances the market growth.

Europe is expected to grow significantly in the clinical trial services market during the forecast period, due to the presence of a stringent regulatory framework. The growing advanced technologies adoption and increasing outsourcing trends are also increasing the demand for clinical trial services. Additionally, increasing R&D investments are also enhancing the market growth.

UK Clinical Trial Services Market Trends

The presence of a robust research ecosystem in the UK is increasing the number of innovations, promoting their clinical trials. The stringent regulatory compliance, growing outsourcing trends, and increasing healthcare investments are also increasing the adoption of various clinical trial services.

MEA is expected to grow significantly in the clinical trial services market during the forecast period, due to growing clinical trials. The increasing incidence of chronic disease is fuelling the R&D activities, driving the demand for clinical trial services. The growing healthcare investments, outsourcing trends, and technological innovations are also promoting the market growth.

Saudi Arabia Clinical Trial Services Market Trends

The growing government initiatives are increasing the R&D activities in Saudi Arabia, increasing the use of clinical trial services. Moreover, the growing innovations, chronic diseases, and expanding healthcare are also increasing their demand. The increasing decentralized trials are also leveraging these services.

The R&D in clinical trial services focuses on accelerating drug development and ensuring better outcomes by providing patient engagement improvement, trial efficiency enhancements, and advanced technologies integration.

Key Players: IQVIA, Syneos Health, ICON plc.

The formulation and final dosage preparation in clinical trial services provide support to the manufacturers in all clinical development stages, including pre-formulation work, formulation, dosage form design, and optimization.

The clinical trial patient support services focus on enhancing recruitment and retention rates, along with improving the overall experience of the participants by reducing their financial, logistical, and emotional burdens.

| Companies | Headquarters | Clinical Trial Services |

| IQVIA | North Carolina, U.S. | Decentralized clinical trials, patient recruitment, and AI-driven trial design |

| Labcorp Drug Development | North Carolina, U.S. | Services from preclinical testing to central laboratory services |

| ICON plc | Dublin, Ireland | Regulatory consulting and medical imaging for trials |

| Thermo Fisher Scientific | North Carolina, U.S. | Integrated clinical development solutions |

| Syneos Health | North Carolina, U.S. | Biopharmaceutical accelerator model |

| Parexel International | Massachusetts, U.S. | Decentralized trial technology and regulatory affairs expertise |

| Charles River Laboratories | Massachusetts, U.S. | Early stage discovery, laboratory support, and safety assessment |

In January 2025, President of Global Product Development and Chief Medical Officer of Lyndra Therapeutics, M.D., M.P.H., Dr. Richard Scranton, stated that, they are moving a step closer to their mission to bring long-acting oral therapies, transform how patients take medicine, and offer capabilities to broad markets, with this collaboration for clinical research and manufacturing services with Thermo Fisher. Thus, clinical trial operations and scalable, reliable manufacturing will be ensured for the R&D of long-acting oral therapeutic solutions by this collaboration.

By Service Line

By Phase

By Therapeutic Area

By Delivery Model

By Region

February 2026

February 2026

February 2026

February 2026