February 2026

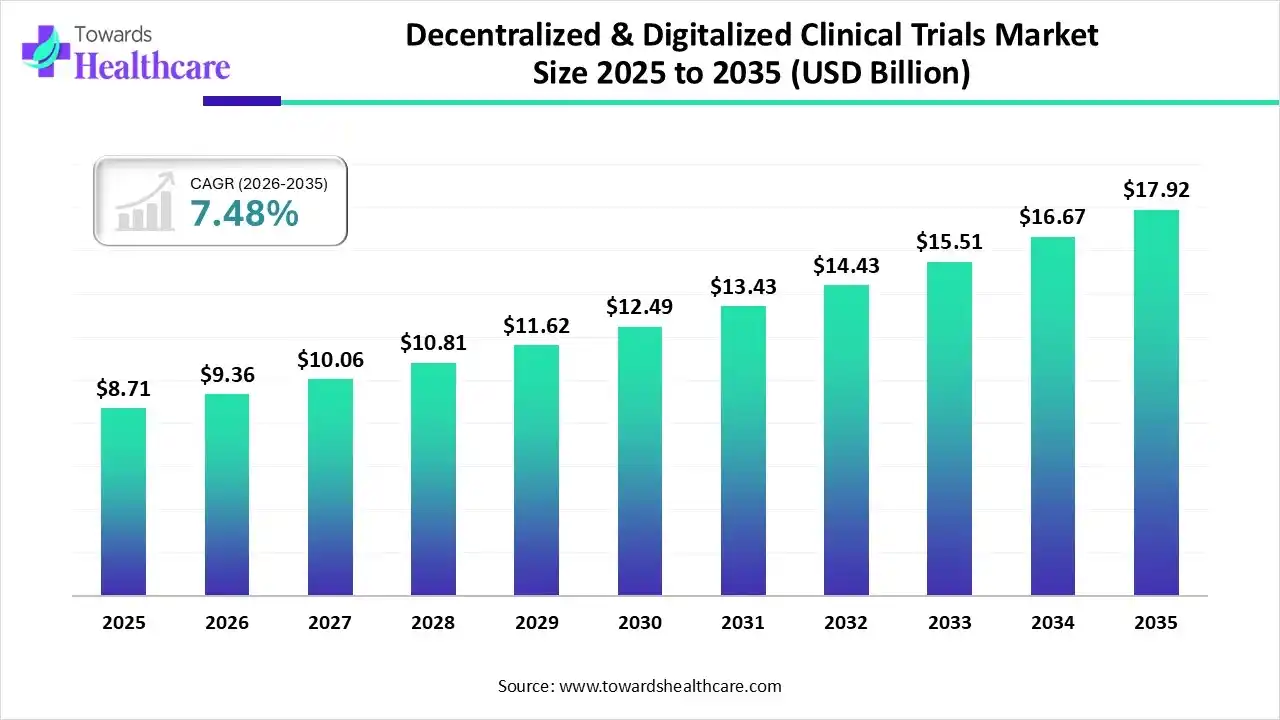

The global decentralized & digitalized clinical trials market size was estimated at USD 8.71 billion in 2025 and is predicted to increase from USD 9.36 billion in 2026 to approximately USD 17.92 billion by 2035, expanding at a CAGR of 7.48% from 2026 to 2035.

With a significant focus on oncology and neurology, the market is leveraging different advanced RPM solutions, like e-consent, wearable sensors, etc. Also, several research activities are shifting towards hybrid models, AI-enhanced analytics, and direct-to-patient logistics.

Primarily, these trials involve conducting research activities at locations other than traditional sites, such as home or local clinics, using digital solutions like wearables, telemedicine, and apps. However, the decentralized & digitalized clinical trials market is propelled by the increasing need for raised patient-centricity, enhanced retention, and expedited recruitment. Currently, sponsors are accelerating the adoption of "menu-of-choices" approaches, which enable participants to pick between in-person visits & home-based monitoring.

Day by day, the market is seeking integrated, cloud-based, and interoperable platforms, such as the unification of eConsent, electronic patient-reported outcomes (ePRO), and electronic clinical outcome assessments (eCOA) into a single platform to allow real-time, transparent data access.

The market is widely exploring direct shipment of investigational medicinal products (IMP) & specialized, temperature-controlled courier services for sample collection.

For this, the firms are adopting "hub and spoke" models where central, virtual offices support smaller, local clinics or community doctors, and expanding access to various patient populations.

| Key Elements | Scope |

| Market Size in 2026 | USD 9.36 Billion |

| Projected Market Size in 2035 | USD 17.92 Billion |

| CAGR (2026 - 2035) | 7.48% |

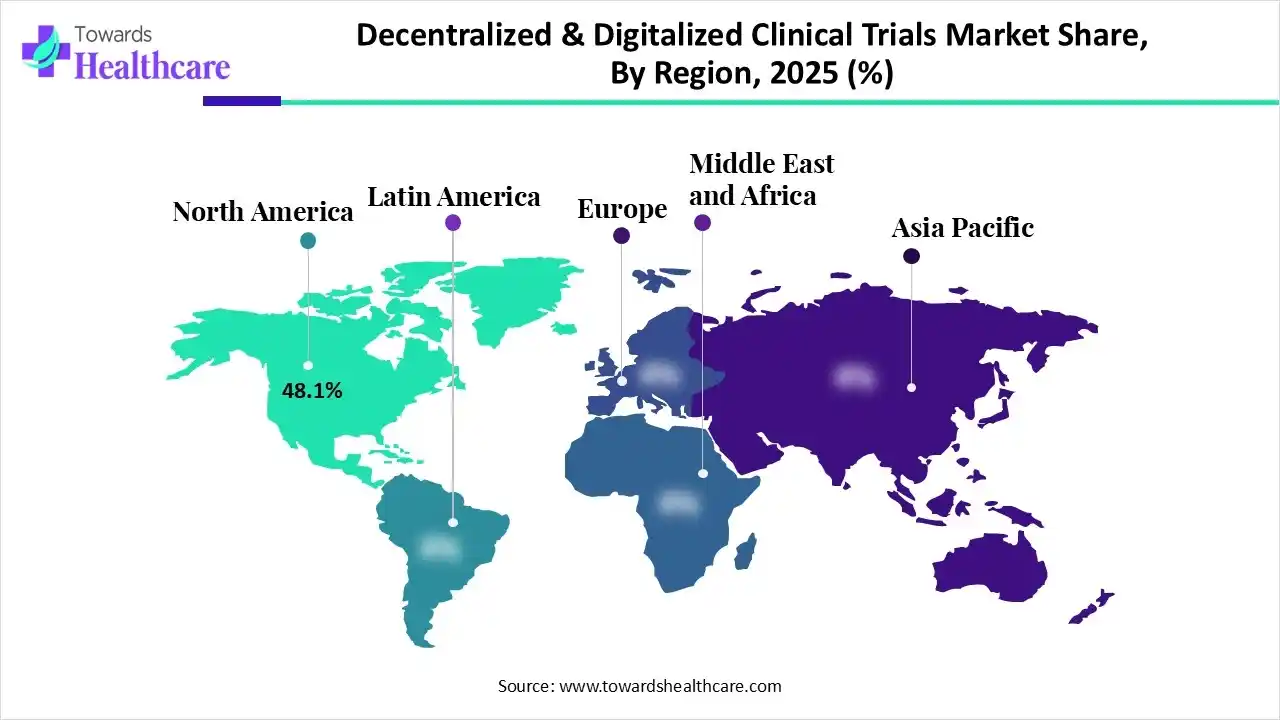

| Leading Region | North America by 48.1% |

| Market Segmentation | By Component , By Therapeutic Area, By Technology Type, By Region |

| Top Key Players | IQVIA, ICON plc, Medidata (Dassault Systèmes), Thermo Fisher Scientific (PPD), Syneos Health, Parexel International, Science 37, Advarra, Clario, Oracle (Cerner) |

Which Component Led the Market in 2025?

The technology platforms segment dominated with approximately 58% share of the decentralized & digitalized clinical trials market in 2025. To raise the patient experience & retention, trials are increasingly leveraging cloud-based platforms, like Medable, Oracle, IQVIA, which unite several modules for end-to-end management, & lower data sprawl. Along with the e-consent solution, these platforms are enabling patients to utilize their own devices (BYOD) for ePRO.

Services

The services segment will expand rapidly. Beyond e-consent & RPM services, the market is focusing on telemedicine & virtual visits, where NCBI NIH’s & Within3’s remote consultations are used for safety checks. Alongside, Castor EDC’s services are offering home delivery of investigational products & at-home sample collection. Extensive efforts in research activities are revolutionizing hybrid models and AI-powered data analytics.

How did the Oncology Segment Dominate the Market in 2025?

In 2025, the oncology segment captured nearly 46% share of the decentralized & digitalized clinical trials market. Its dominance is driven by the growing use of hybrid oncology models, which raises patient accessibility & lowers the need for travel to specialized cancer centers. However, Karkinos Healthcare is broadly using a decentralized approach to facilitate care for patients in rural or underserved areas in India. The TELEPIK trial is emphasizing PIK3CA-mutated breast cancer by using telemedicine and local labs.

Neurology

Moreover, the neurology segment will witness rapid growth, with approximately 15% CAGR during 2026-2025. This is rigorously fueled by the rising need for robust, more patient-centric research for complex diseases, specifically Alzheimer's and Parkinson's. Trials are executing smartphone accelerometers and smartwatches for consistent monitoring of tremors, dyskinesia, and gait, which records real-world symptom data & skips relying on brief, intermittent clinic visits. The ADDRESS-LC trial (NCT06847191) is leveraging digital cognitive assessments, which test a new, brain-permeable agent for Long COVID-associated cognitive impairment.

Why did the Wearables & Biosensors Segment Lead the Market in 2025?

The wearables & biosensors segment held the biggest share of the decentralized & digitalized clinical trials market in 2025. The widespread population is highly demanding at-home platforms, which promote the development of versatile electronics and nanomaterials to smart patches & lab-on-a-patch devices to optimise patient compliance & allow the detection of diverse biomarkers. BioIntelliSense BioSticker & VitalConnect VitalPatch are the latest advances employed for continuous tracking of critical parameters, like heart rate, respiratory rate, skin temperature, & patient mobility, mainly in oncology & chronic disease trials.

AI-Enabled Analytics

Whereas the AI-enabled analytics segment will expand rapidly. This is particularly driven by the greater demand for rapid, more affordable, and patient-centric trials by using AI algorithms for processing large data volumes, automating recruitment, & allowing remote, patient-centric monitoring. Recently, Medidata demonstrated AI tools combined into its Rave EDC system to automate data cleaning, boost patient recruitment, and facilitate real-time monitoring of trial safety in decentralized setups.

In 2025, North America held approximately 48.1% share of the decentralized & digitalized clinical trials market, due to the supportive FDA guidance and mature telehealth infrastructure in the U.S. Recently, Health Canada introduced a public consultation on draft guidance for decentralized trials, which facilitates, for the first time, specific, promised regulatory clarity for running trials over traditional sites.

U.S. Market Trends

In the U.S. market, decentralized trails and hybrid models are shifting towards a substantial standard of operation, which emphasizes bolstering patient variations, retention, and data quality. Recently, the APPROVE trial used Curavit Clinical Research as a virtual site for Amara Therapeutics' RiSolve.

Asia Pacific is estimated to witnes witness the fastest growth in the decentralized & digitalized clinical trials market, as the region is encouraging broader R&D investments in the booming chronic diseases. Like, MSD (Merck & Co.) began the MOBILIZE-1 Phase 3 clinical trial (V181-005) for a Dengue vaccine, initiating with recruitment in Singapore, and planned to comprise more than 30 sites across the APAC. However, Parexel and the Japanese Foundation for Cancer Research joined to increase digital access to oncology trials in Japan.

China Market Trends

China is focusing on human genetic resources (HGR) and using digital platforms to monitor samples & ensure compliance with the strengthened 2023 Implementation Rules and the 2025 Personal Information Protection Audit requirements.

Europe is anticipated to expand notably in the decentralized & digitalized clinical trials market, as recently the European Medicines Agency (EMA) & national agencies evolved guidelines for DCTs, which raises confidence in using wearables & mobile applications for data collection. Alongside, the region is highly using apps and chatbots to handle patient consent, remind them of medication, & record daily symptoms, which rises compliance and data quality.

UK Market Trends

Moreover, Cancer Research UK introduced a landmark trial for a lung cancer vaccine, which utilizes advanced, digitalized approaches to find high-risk patients and manage the trial. Also, the University of Birmingham are conducting the TLC study for Long COVID by using the Atom5 digital platform.

| Company | Description |

| IQVIA | It has developed the Orchestrated Clinical Trials (OCT) platform, which combines data, technology, and clinical services. |

| ICON plc | This offers a complete set of digital and decentralized clinical trial (DCT) solutions, such as ICON Digital Platform (IDP). |

| Medidata (Dassault Systèmes) | Their "Trial Dial" approach is enabling highly personalizable hybrid models ranging from 100% on-site to 100% virtual. |

| Thermo Fisher Scientific (PPD) | It facilitates a patient-first approach to decentralized trials through a combination of mobile, virtual, & hybrid services. |

| Syneos Health | Its offerings include eSuite Digital Services, direct-to-patient (DtP) Solutions, mobile research nursing, etc. |

| Parexel International | It offers services from strategic consultancy to advanced AI-powered data management. |

| Science 37 | It facilitates solutions through its Agile Clinical Trial Operating System (OS). |

| Advarra | This emphasises connecting sponsors, CROs, & sites through simplified data collection, AI-assisted study design, & modernised oversight. |

| Clario | A company provides an endpoint technology platform. |

| Oracle (Cerner) | Its offering focused on the Oracle Life Sciences portfolio and the Oracle Health EHR integration. |

By Component

By Therapeutic Area

By Technology Type

By Region

February 2026

February 2026

January 2026

January 2026