February 2026

The drug discovery SaaS platforms market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

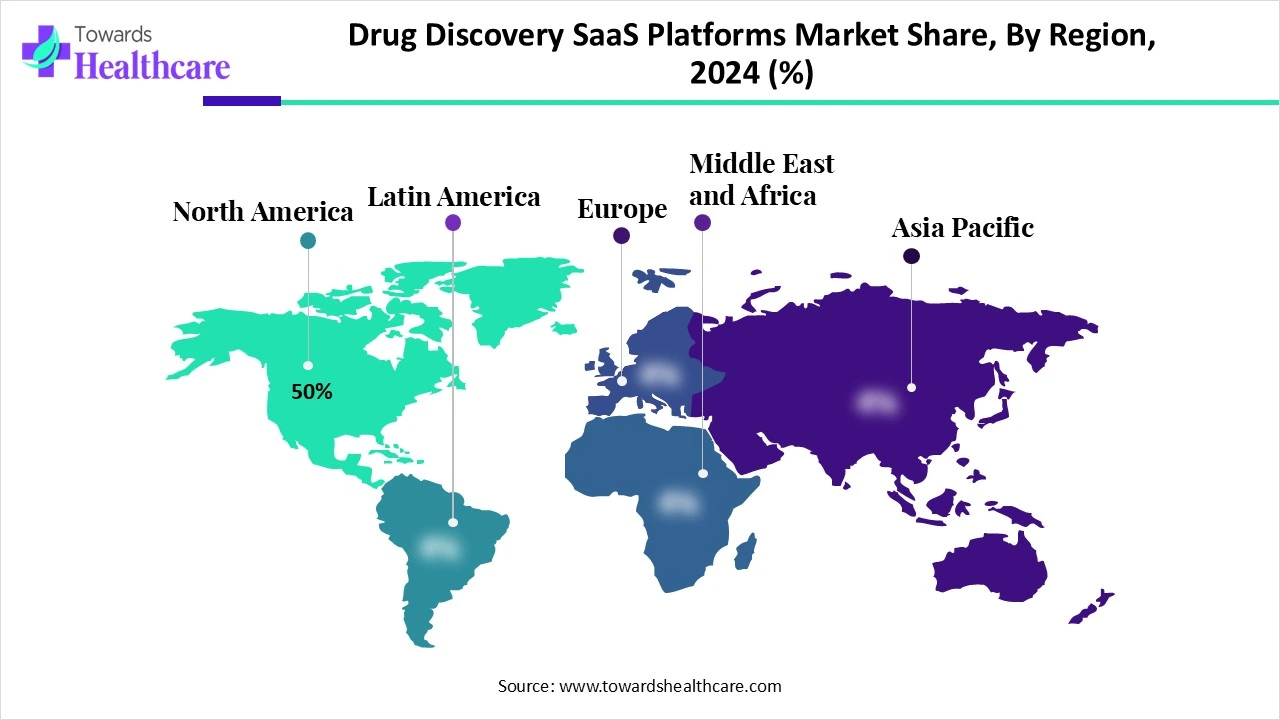

The drug discovery SaaS platforms market is rapidly expanding because of increasing spending in pharmaceutical R&D, growing adoption of AI and machine learning, and demand for affordable and scalable services. North America is dominated in the market as a strong presence of SaaS platform key players and increasing demand for drug discovery to address healthcare challenges, while Asia Pacific is the fastest growing due to increasing digital technology adoption by pharma companies and increasing collaboration with CROs.

Drug Discovery SaaS (Software as a Service) Platforms are cloud-based software solutions designed to streamline and accelerate the drug discovery process. These platforms provide tools for computational modeling, data analysis, collaboration, and project management accessible via the internet without the need for local installation. SaaS drug discovery platforms enable pharmaceutical and biotech companies, CROs, and research institutions to access advanced drug discovery capabilities on demand, offering scalability, cost efficiency, and remote collaboration benefits.

AI integration in drug discovery SaaS platforms is driving the growth of the market as AI-based technology is reforming traditional drug discovery and development procedures by seamlessly incorporating data, computational technology, and algorithms. AI-driven drug discovery platform, developed to address the necessity to speed up the identification and lead optimization in the drug discovery procedure by an underutilized resource, medicinal chemists themselves. Major AI-based companies in the drug discovery space have begun to healthcare sector their services through a set of business models, with SaaS, that complement their expensive partnership.

Increasing Application of SaaS Platforms for Drug Discovery

SaaS platforms are generally more user-friendly and easier to operate than traditional software, making them accessible to a broader audience. This is particularly crucial for companies in People Risk Management, as they often need to train and support their clients’ employees on software use. A SaaS platform is a valuable asset for these companies, enabling more efficient and cost-effective management of clients' personnel safety, which in turn drives the growth of the drug discovery SaaS market.

For Instance,

Security Challenges

Security vulnerabilities represent a major threat to SaaS operations, potentially causing data breaches, non-compliance, and unauthorized access to sensitive information. Without strong security measures, organizations risk exposing confidential data to malicious actors, which can lead to reputational harm, legal issues, and financial losses. This situation hampers the growth of the drug discovery SaaS platforms market.

Increasing Adoption of Vertical SaaS

A key trend in the SaaS sector is the rapid growth of vertical SaaS. Unlike horizontal SaaS platforms that serve various industries with broad solutions, vertical SaaS targets specific industries with tailored features. Developed by experts with deep industry knowledge, these solutions address unique sector-specific processes. Their adoption helps companies automate routine tasks, generate valuable analytics, and improve decision-making. When combined with AI capabilities, vertical SaaS gives industries a competitive edge by increasing efficiency and precision, creating opportunities for the drug discovery SaaS platforms market.

By solution type, the AI/ML-based drug discovery segment held the largest share of the drug discovery SaaS platforms market in 2024, as AI has the huge potential to transform the drug discovery process, providing better efficiency, precision, and speed. AI-based techniques like machine learning (ML) and natural language processing provide the potential to speed up and enhance this process by allowing more accurate and efficient analysis of large amounts of information.

The data management & analytics segment is estimated to grow at the fastest CAGR over the upcoming timeframe, as data analytics provide advantages to the pharmaceutical industry in various ways, such as optimizing clinical trial design, growing drug discovery, enhancing drug safety monitoring, and improving marketing approaches. Through analyzing large datasets, biotech organizations uncover valuable insights that improve innovation and patient outcomes. Management and analytics offer powerful data integration and analysis abilities, enabling pharmaceutical companies to make their big data sets.

By therapeutic area, the oncology segment held the largest revenue of the drug discovery SaaS platforms market in 2024, as SaaS systems can improve data accuracy, optimize costs, and reduce staff burden for the organizations building and managing clinical trials. Healthcare SaaS is a cloud-based software solution that can be used by healthcare providers and other organizations to provide medical-related services.

The infectious diseases segment is anticipated to fastest-growing over the forecast period 2025 to 2035 as healthcare SaaS for infectious diseases makes services better, cheaper, and boosts the ROI (Return on Investment) of the hospitals as well. Transparency in medical information will allow doctors to understand the patient’s history and render them better care.

By end user, the pharmaceutical companies segment led in the drug discovery SaaS platforms market in 2024 with a 55% share, as SaaS platforms can address common challenges in clinical trials, such as patient recruitment and retention, data handling, and regulatory compliance. SaaS platforms can offer features like user-friendly informed consent forms, efficient patient tracking, advanced data analysis tools, robust security measures, and automated compliance monitoring, making clinical trials more efficient, cost-effective, and participant-friendly.

The academic & research institutes segment is expected to fastest-growing over the forecast period 2025 to 2035 as it simplifies academic & research institutes management by bringing new opportunities for schools and students. Provide a versatile set of applications using cloud computing, which lowers the entry barrier to the technology. SaaS technology can eliminate CapEx costs, allowing reinvestment elsewhere and reducing the ongoing maintenance and development costs to support systems. SaaS solutions streamline research workflows, facilitate access to cutting-edge technologies, and accelerate the drug development process.

By deployment mode, the cloud-based SaaS segment is dominant in the drug discovery SaaS platforms market in 2024, with a 75% share, as it is affordable, offers ease of access, and enables workforce mobility by providing access to data and apps from an internet-based device. It is commonly used in business management and operations, communication and collaboration, and data analytics and professional intelligence. Healthcare SaaS enables hospitals and medical institutions to deploy cloud-based and affordable EHRs.

The hybrid deployment segment is expected to fastest-growing over the forecast period 2025 to 2035, as hybrid models provide consumer flexibility over how they choose to use the product, if consumer want to deploy it in their entire stack or only in a few select data environments, and easily add or subtract instances of the service as essential. This permits researchers to leverage the affordability and accessibility of the hybrid deployment for some tasks, while maintaining sensitive data and complex workloads in their secure environment.

North America is dominant in the market with the largest revenue share, 50% share, due to increasing drug discovery in this region, significant government investment in drug research, a growing biopharmaceutical industry, and increasing focus on unmet medical needs. Strong presence of biotech and pharmaceutical companies like Amgen, Pfizer, Merck, and Moderna, these are mostly use SaaS platforms for R&D. Increasing digital healthcare provides a wide range of possibilities and also improves the quality of patient care, which contributes to the growth of the market.

For Instance,

In the U.S., increasing healthcare infrastructure investments and improving supply chain resilience, the U.S. ensures that its digital economy remains innovative, competitive, sustainable, and secure due to rapid technological growth. Increasing digital Government strategy enables the U.S. people to have an increasingly mobile workforce, to access high-quality digital government data and services anytime, anywhere, from any device, and drives the growth of the market.

In Canada, growing investment in R&D contributes to economic growth through presenting novel products, enhancing process efficiencies, and enabling healthcare organizations to enter new drug discovery processes, driving demand for advanced software platforms to accelerate drug development. The presence of SaaS providers such as Hootsuite, Ada, AlayaCare, FreshBooks, Coveo, Shopify, 1Password, Maropost, and Vidyard in Canada provides an end-to-end drug discovery solution.

The Asia Pacific region is projected to experience the fastest growth in the drug discovery SaaS platforms market during the forecast period, because of growing government support to improve the larger medical care infrastructure, containing the avoidance of duplication of data, enhancing the quality and number of doctors, which drives the growth of the market. The growing demand for personalized and genomics medicine in the Asia Pacific drives the demand for cloud-based platforms that manage complex datasets.

China’s medical care system is still in its early stages of digital transformation. There are huge expectations for China’s medical care system to continue advancing rapidly in terms of the adoption of digital technologies, including a SaaS-based platform to advance efficiency and reduce cost. The growing partnership of biotech firms and SaaS companies is increasing drug discovery innovation and driving the growth of the market.

In India, increasing drug discovery research and technology with steady improvements in the Indian healthcare, by increasing expenditure in R&D by the government and by Indian pharmaceutical organizations, which drive the growth of the market. India is poised for continued growth in the life sciences field, due to its government support, strong talent base, and affordable resources, making it an attractive destination for investment, driving the SaaS integration in drug discovery.

Europe is expected to grow significantly in the market during the forecast period, as Europe has advanced science, talent, and ambition, technology to lead in the life sciences and biotech sector, which is increasing adoption of modern technology such as SaaS platforms for early-stage drug discovery and development. Growing clinical trials to address challenging health conditions in Europe, which also growing demand for digital research and analytical platforms.

In Germany, increasing demand for personalized medicine and genomics due to allows rapid and more precise diagnoses and supports medical professionals in identifying the best preventive measures and treatments, requiring a scalable and cloud-based data management solution such as SaaS, which contributes to the growth of the market.

For instance,

In January 2025, Yann Gaston-Mathé, Co-founder and CEO of Iktos, states, “Iktos and Cube biotech announced launch of small molecule AI drug discovery collaboration. By tackling one of the most pressing unmet needs in cardiometabolic disorders, our partnership with Cube Biotech goal to discover enhanced treatments for patients affected by diabetes, obesity, and related conditions.” (Source - Gsk)

By Solution Type

By Therapeutic Area

By End User

By Deployment Mode

By Region

February 2026

February 2026

February 2026

February 2026