February 2026

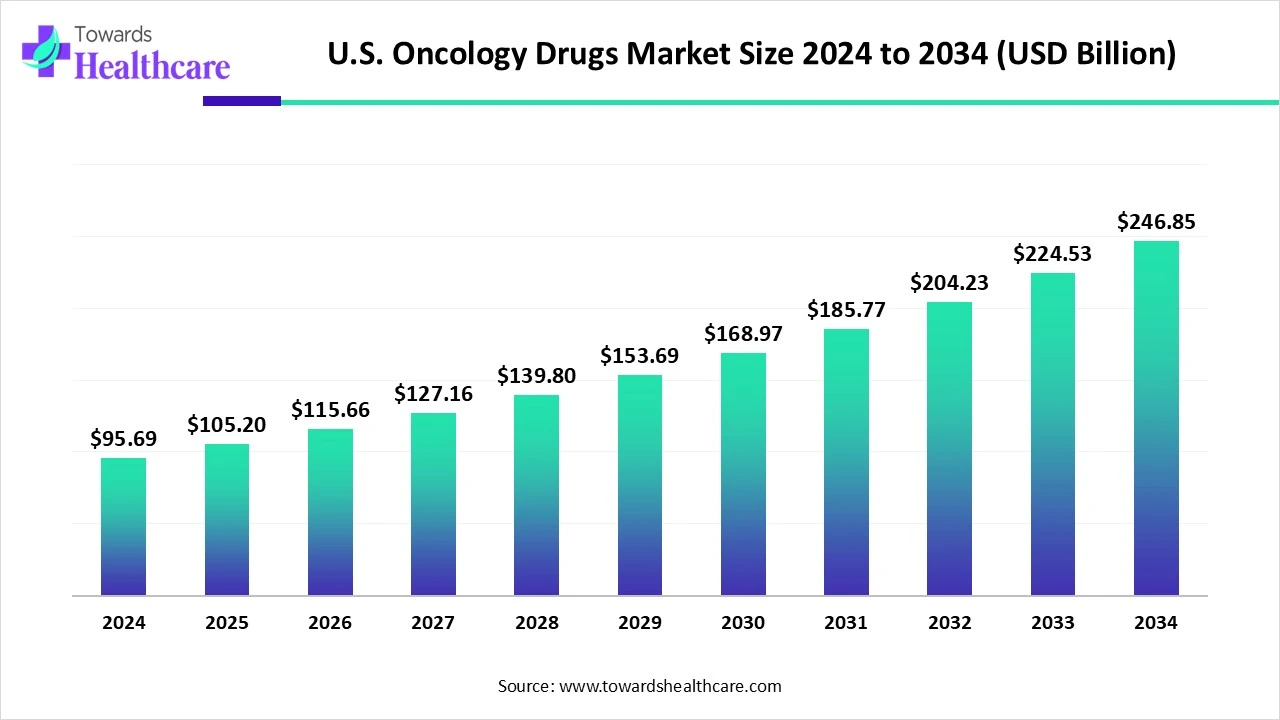

The U.S. oncology drugs market size reached USD 95.69 billion in 2024, grew to USD 105.2 billion in 2025, and is projected to hit around USD 246.85 billion by 2034, expanding at a CAGR of 9.94% during the forecast period from 2025 to 2034.

The cancer drugs are specifically used to treat various cancer types through versatile therapies such as chemotherapy, radiation therapy, hormonal therapy, surgical therapy, immunotherapy, etc. The cancer drugs specific to these therapies play major roles in reducing the cancer prevalence among cancer-affected patients. Some of these oncology drugs include alkylating agents, nitrosoureas, antimetabolites, topoisomerase inhibitors, mitotic inhibitors, antitumor antibiotics, anthracyclines, corticosteroids, and other drugs used in chemotherapy. These cancer-treating medicines are not only used to cure cancerous parts inside the body but also treat autoimmune diseases and blood disorders.

| Table | Scope |

| Market Size in 2025 | USD 105.2 Billion |

| Projected Market Size in 2034 | USD 246.85 Billion |

| CAGR (2025 - 2034) | 9.94% |

| Market Segmentation | By Drug Class, By Therapy Type, By Indication, By Dosage Form, By Distribution Channel |

| Top Key Players | Roche, Novartis, Merck & Co., AstraZeneca, Johnson & Johnson, Bristol-Myers Squibb, Pfizer, Eli Lilly, Amgen, Gilead Sciences, Sanofi, Celgene, Takeda, Incyte, Bayer, GSK |

The U.S. Oncology Drugs Market refers to the segment of the pharmaceutical industry focused on the development, manufacturing, marketing, and distribution of therapeutic drugs for the treatment and management of cancer. This market encompasses a broad spectrum of treatment types, including chemotherapy, immunotherapy, targeted therapy, and hormone therapy, across various cancer types such as lung, breast, prostate, and hematologic cancers. It plays a pivotal role in improving patient survival rates and quality of life, driven by robust R&D, regulatory support, and high cancer prevalence in the U.S.

The funding and financing from the existing investors enable the leading companies to expand their business portfolio. For instance, in January 2024, Kura Oncology, Inc., a pioneering biopharmaceutical company in California, announced the initiative to trade 1,376,813 shares of its common stock for $17.25 per share to raise $150 million in private placement by uniting a group of accredited and institutional healthcare specialist investors.

The leading companies like Novartis have set plans to expand their production capabilities across medicines and end-to-end services. For instance, in April 2025, Novartis announced the expansion of its manufacturing and R&D facilities situated in the U.S. with a total investment of $23 billion over the next 5 years.

Artificial intelligence is advancing the essential knowledge of cancer biology, including cancer screening, diagnosis, drug discovery, and cancer surveillance, etc. AI contributes to improving the speed, accuracy, and reliability of certain cancer screening and detection methods. The FDA-approved AI-based software is used by pathologists to identify certain areas in prostate biopsy images that indicate cancer. Radiologists prefer to use AI to rapidly process certain medical images, like mammograms, to save time for other technical judgments. AI makes high-quality care available and accessible to cancer patients who face challenges visiting cancer specialists due to disparities.

What are the Emerging Shifts in the U.S. Oncology Drugs Market?

According to the American Association for Cancer Research, there will be 50 approvals for cancer medications in 2024, many of which belong to first-in-class therapeutics. These approvals include Lifileucel, the first tumor-infiltrating lymphocyte (TIL) cell therapy, Tarlatamab, the first bispecific T-cell engager for a solid cancer type, etc. In August 2025, Fierce Biotech, situated in Washington D.C., reported that it has acquired $153 million financing of venture capital directed in the industry. In March 2024, Pfizer reported the initiative to turn its business by combining its drug pipeline with Seagen, a cancer drugmaker, to produce at least eight innovative medicines by 2030.

How Challenging is the Cancer Incidence in the U.S.?

According to research and based on ethnic heritage, there is a higher incidence of major cancer types such as lung cancer, kidney cancer, colorectal cancer, etc., among black men than white men. Black women deal with low survival conditions due to stomach cancer and pancreatic cancer, and they are more susceptible to death from uterine cancer than white women. Similarly, there are problems associated with accessibility to cancer medicines and care for cancer patients. With the increased cancer prevalence, the need for high-quality resources, facilities, and medical professionals has also increased. According to research conducted by IQVIA, countries like the U.S., Germany, and France utilize cancer drugs 2 to 3 times more than the UK and South Korea.

What is the Future of the U.S. Oncology Drugs Market?

The U.S. is at the forefront of using several healthcare services for various applications, such as screening, diagnostic tests, new prescriptions, telehealth visits, office and institutional visits, elective procedures, and vaccinations related to flu, adults, and the pediatric population. According to comprehensive research by IQVIA in 2024, the U.S. accounts for a growing use of immunology treatments, novel obesity drugs, and antibiotics. In September 2024, the National Cancer Institute reported its research study on identifying hundreds of potential targets for cancer drugs. Research has been shifted towards studying proteins, genes, and other essential attributes of oncology.

The targeted drugs segment dominated the U.S. oncology drugs market in 2024, owing to the increased effectiveness and reduced side effects of targeted drugs. They are ideally used for personalized treatments and can potentially target previously untreatable cancers. One of the examples of successful targeted drugs includes Imatinib to manage chronic myeloid leukemia, which results in long-term survival in many cancer patients. They minimize harm to healthy tissues and are specific in their mechanism of action. They are widely used in targeted therapies, which can identify gene mutations and proteins in the patient’s tumor to recommend a personalized treatment. These drugs improve the quality of life for cancer patients by allowing programmed cell death in cancer cells.

The immunotherapy/advanced biologics segment is expected to grow at the fastest CAGR in the U.S. oncology drugs market during the forecast period due to the potential of these advanced technologies in targeting precision and specificity. Advanced biologics offer effective and targeted relief from autoimmune and inflammatory conditions, while immunotherapies target cancer cells by strengthening the immune system. Both of these cutting-edge solutions provide long-term efficacy and improved patient outcomes. They elicit fewer side effects than traditional treatments like chemotherapy or radiation.

The targeted therapy segment dominated the U.S. oncology drugs market in 2024, owing to the increased focus on precision targeting and reduced damage to healthy cells. The targeted therapies offer improved efficacy in specific cancers along with fewer side effects. They have the potential to address unmet needs in certain types of cancers and tailor treatments to individuals. They play a crucial role in certain treatments of cancers like gastrointestinal stromal tumors, chronic myeloid leukemia, and renal cell carcinoma. The use of small-molecule drugs in the form of pills or capsules and monoclonal antibodies drives the precision of targeted therapies. The various types of cancers, such as liver cancer, breast cancer, lung cancer, ovarian cancer, thyroid cancer, and many others, can be treated with targeted therapies.

The immunotherapy segment is expected to grow at the fastest CAGR in the U.S. oncology drugs market during the forecast period due to the remarkable importance of immunotherapies in improving long-term survival rates of many types of cancers. They destroy multiple types of tumors and prevent the repeated growth of tumors in some cases. The immunotherapies can treat various cancer types such as melanoma, head and neck cancer, bladder cancer, kidney cancer, lung cancer, and some forms of lymphoma and leukemia. They strengthen the immune response and work in combination with other treatments.

The breast cancer segment dominated the U.S. oncology drugs market in 2024, owing to the significant role of targeted therapies in delivering precision, reduced toxicity, and improved outcomes. The immunotherapies used to treat breast cancer boost the immune response and reduce the risk of disease recurrence. The chemotherapies used to treat breast cancer result in controlling advanced disease progression. Hormonal therapies reduce risks and improve survival rates. A diverse array of personalized treatment approaches improves outcomes for patients by enhancing the natural defense of the human body against cancer. Breast cancer patients receive specific treatments based on their health factors and the stages of cancer.

The lung cancer segment is expected to grow at the fastest CAGR in the U.S. oncology drugs market during the forecast period due to advancements in cancer research and personalized treatment approaches. The emerging trend of biomarker testing has immense potential to recognize unique mutations in a patient’s tumor. These approaches maximize treatment efficacy by minimizing damage to healthy cells. There is great importance of immunotherapy, targeted therapy, and chemotherapy in improving the lives of lung cancer patients.

The injectable segment dominated the U.S. oncology drugs market in 2024, owing to the reduced administration time and increased focus on healthcare resource utilization. The injectables can treat patients who are unable to take oral medications by addressing unmet clinical needs. They cause lower gastrointestinal issues and manage side effects during treatments. They can be combined with other therapies against cancer and deliver improved treatment outcomes. The injectable oncology drugs can be administered via subcutaneous, intravenous, or intramuscular routes, which offer numerous benefits in cancer treatment. The supportive care injectables manage side effects of chemotherapy, which include nausea, pain, and white blood cell count.

The hospital pharmacies segment dominated the U.S. oncology drugs market in 2024, owing to rigorous quality control and reduced medication errors. The expertise of oncology pharmacists in handling hazardous drugs results in proper storage, preparation, and disposal of cytotoxic drugs. The integrated care provided by hospital pharmacies is crucial for cancer patients it also monitors adherence to medications. The hospital pharmacies verify drug reliability and ensure proper storage conditions. They cause reduced medication errors related to prescribing, preparing, and administering chemotherapy or other related drugs. Hospital-based dispensing of medications also reduces medication errors.

The online pharmacies segment is expected to grow at the fastest CAGR in the U.S. oncology drugs market during the forecast period because patients find convenience in ordering medications from home, which saves their time and effort. Several online platforms are accessible to patients with medications that are also helpful in underserved areas. People can connect with these online platforms anywhere and at any time that offer various discounts and competitive pricing. The online pharmacies take care of patients' privacy regarding their medical conditions.

According to the U.S. Food and Drug Administration (FDA), the U.S. represents some of the ongoing clinical oncology projects in 2024, which are supported by the Oncology Center of Excellence to improve the development of oncology products to benefit cancer patients. The National Cancer Institute increased its budget by $120 million in fiscal year 2022. In 2024, the NCI will allocate about 43.3% of its total budget for research project grants. According to the National Institutes of Health, the USA spent $99 billion on anticancer therapies that were orally and clinician-administered in 2023, and this expenditure is expected to increase to $180 billion by 2028. In July 2025, AstraZeneca announced the investment of $50 billion in America for R&D and manufacturing of medicines. In November 2024, AstraZeneca reported an investment of $3.5 billion in the U.S. to increase sales of cancer drugs.

By Drug Class

By Therapy Type

By Indication

By Dosage Form

By Distribution Channel

February 2026

February 2026

February 2026

February 2026