February 2026

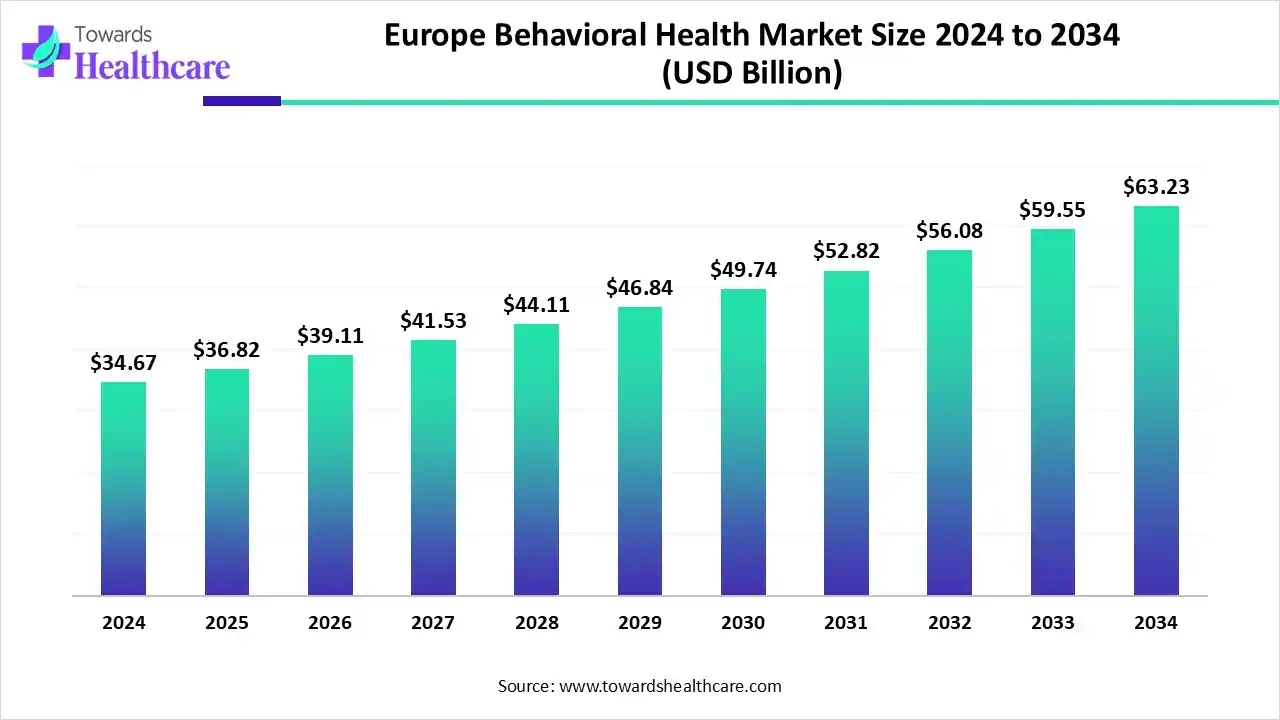

The Europe behavioral health market size is calculated at US$ 36.82 billion in 2025, grew to US$ 39.09 billion in 2026, and is projected to reach around US$ 67.12 billion by 2035. The market is expanding at a CAGR of 6.19% between 2026 and 2035.

The growing mental health disorders across Europe are increasing the use of behavioral health solutions. They are offering various services, treatments, and digital tools or platforms for their detection, cure, and prevention. AI is also being used for the accurate analysis of the conditions and for developing personalized treatment plans, where the companies and government are also investing in these approaches, services, as well as other growing innovations. The companies are launching and developing new treatment options or digital platforms, where these advancements are promoting Europe behavioral health market growth.

| Table | Scope |

| Market Size in 2026 | USD 39.09 Billion |

| Projected Market Size in 2035 | USD 67.12 Billion |

| CAGR (2026 - 2035) | 6.19% |

| Market Segmentation | By Condition Category, By Service Modality, By Patient Age Group, By Payer/Funding |

| Top Key Players | Ramsay Health Care, Acadia Healthcare, Lifepoint Behavioral Health, HCA Healthcare, Magellan Health, Sheppard Pratt Health System, Carelon Behavioral Health, Optum Behavioral Health (UnitedHealth Group), Teladoc Health/BetterHelp, Lyra Health, Talkspace, Modern Health, Headspace Health (Ginger + Headspace), Array Behavioral Care, SonderMind, Spring Health, Brightline, Quartet Health |

The Europe behavioral health market is driven by supportive government policies, increased awareness, and technological adoption. The behavioral health encompasses the treatments, products, services, and technologies used to treat, diagnose, manage, and prevent various behavioral and mental health disorders across Europe. They focus on the emotional, behavioral, and mental well-being of the patient by understanding, improving, treating, and managing their stress, mental illness, trauma, or even addictions. Moreover, they offer medications, virtual care, as well as other services, which are further supported by the policies and investments.

The use of AI in behavioural health is increasing as it helps in its analysis. At the same time, it also helps in the early detection of any mental health disorders, promoting the development of personalized treatment plans. It also provides insights and virtual therapeutic platforms, enhancing the availability of healthcare, which in turn improves the treatment outcomes.

For instance,

Growing mental health problems: There is a rise in mental health problems across Europe, which in turn is increasing the demand for appropriate treatment and services. To deal with their growing incidences, various awareness programs are being conducted. Additionally, investment and government funding are also being provided to increase awareness, enhance the development of various treatment options, and increase access to the services.

For instance,

| Companies | Announcements | Source |

| Biogen Inc. | ZURZUVAE® gained marketing authorization from the European Commission (EC) to treat post-partum depression (PPD) | Biogen Receives European Commission Approval for ZURZUVAE® (zuranolone), the First and Only Treatment Approved for Women with Postpartum Depression in Europe | Biogen |

| Sonomind | A non-invasive, personalised ultrasound brain stimulation platform will be developed to help people living with depression, with recently secured investments. | Sonomind Raises €3M to Advance Depression Therapy |

| Sheffield Health and Social Care NHS Foundation Trust | Name changed to “Sheffield Health Partnership University NHS Foundation Trust”, representing a powerful stride towards advancing mental health research and transforming mental health. | Mental Health Trust becomes Sheffield Health Partnership University NHS Foundation Trust. |

By condition category type, the mood & anxiety disorders segment led the market in 2024, due to their growing incidence rates. At the same time, growth in awareness enhanced their early diagnosis. This, in turn, increased the demand for their treatment options.

By condition category type, the substance use disorders (SUD) segment is expected to show the highest growth during the predicted time. Due to the growing use of alcohol and opioids, these disorders are increasing. Moreover, they are also being overlapped with stress, depression, and anxiety, which is increasing the use of advanced treatment solutions.

By service modality type, the outpatient counseling & psychiatry segment held the largest share of the market in 2024, driven by its wide range of accessibility. At the same time, they also offered affordable services. Additionally, due to their focus on preventive mental health measures, they were preferred.

By service modality type, the tele-behavioral/virtual care segment is expected to show the fastest growth rate during the predicted time. Their use is increasing as they are enhancing patient convenience and increasing their access across remote areas. Moreover, it also helps in maintaining the patient's privacy, increasing their satisfaction.

By patient age group type, the adults segment led the market in 2024, due to an increase in their depression and anxiety conditions. Moreover, this age group is often faced with workplace stress and burnout. This increased the use of various services to deal with the growing mental health disorders.

By patient age group type, the children & adolescents segment is expected to show the highest growth during the upcoming years. Due to the growing use of smartphones and social media, behavioral health problems are increasing in this age group. Moreover, growing awareness through government programs and promoting early diagnosis.

By payer/funding type, the public & social insurance segment held the dominating share of the market in 2024, as they were an essential and universal healthcare system. They were used to cover the medication and counseling of the patient. Moreover, they also helped in enhancing access to behavioral health services.

By payer/funding type, the commercial/employer-sponsored segment is expected to show the fastest growth rate during the upcoming years. Due to growing workplace stress and burnout, these services are providing employers with support. Additionally, mental health coverage and digital therapy platforms are also being launched by the companies.

The Europe behavioral health market is expected to grow significantly during the forecast period, due to growing awareness through various campaigns and programs about mental health issues. This, in turn, is increasing the demand for various curative treatment options as well as driving the adoption of digital solutions, which are enhancing access to the services. At the same time, the government is also introducing new policies and investments, enhancing the development of the mental health infrastructure. Additionally, growing incidences of mental health conditions are also increasing the use of various services such as outpatient care, patient-centered care, etc., which is promoting the market growth.

In September 2025, for mental healthcare services, a total of 4.1 million Euros will be invested in therapeutic XR technologies by the UK government. To use audio, VR, MR, AR, and haptics and immersive software for mental healthcare applications, this investment will be utilized.

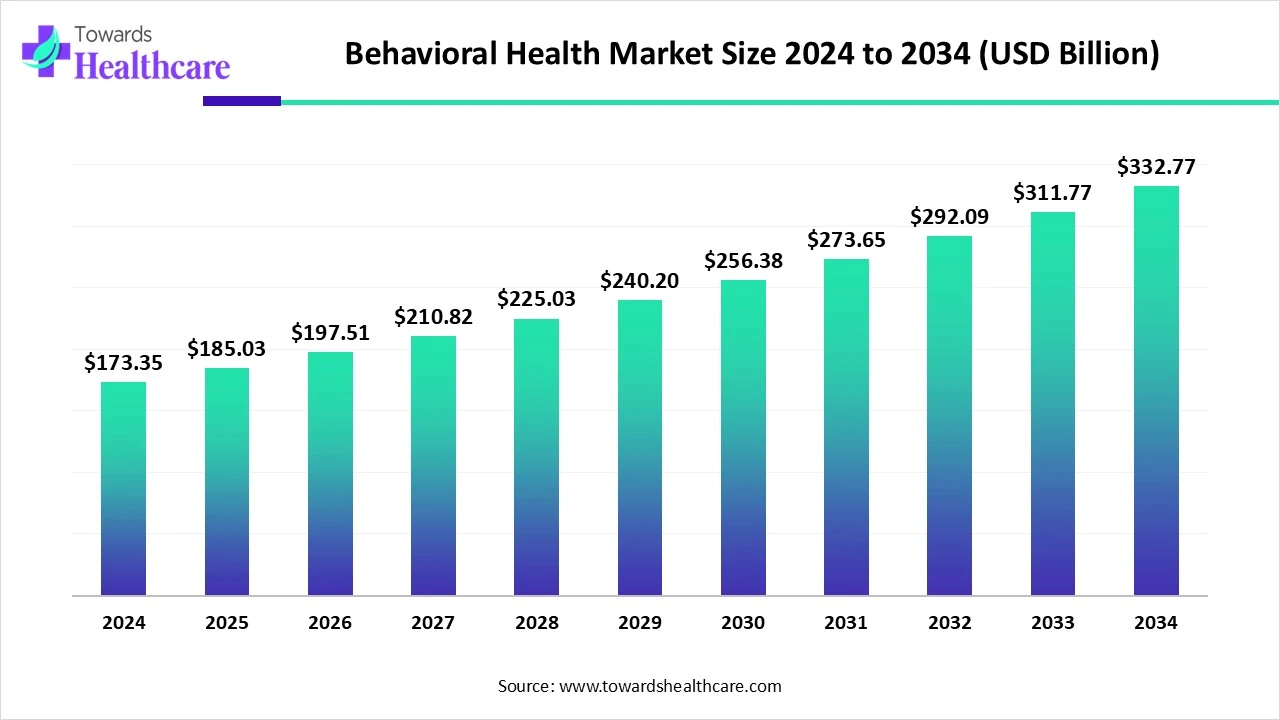

The global behavioral health market is valued at USD 173.35 billion in 2024 and is expected to grow to USD 185.03 billion in 2025. Looking ahead, it’s projected to reach approximately USD 332.77 billion by 2034, expanding at a CAGR of 6.74% from 2025 to 2034.

To develop personalized, effective, and accessible interventions for a wide range of mental health conditions, the R&D of Europe's behavioral health is focusing on leveraging digital technologies such as AI, digital therapeutics (DTx), and virtual reality (VR).

Key Players: Novartis, Roche, Atai Life Sciences.

The clinical trials and regulatory approvals in Europe's behavioral health focus on the dual and distinct pathways for medical products versus digital health solutions.

Key Players: Pfizer, Novartis, Roche, Atai Life Sciences.

The patient support and services of Europre behavioral health include community-based and digital services such as telepsychiatry to specialized non-governmental organizations and digital health companies, where digital tools provide therapy access, personalized monitoring, and medication adherence.

Key Players: HelloBetter, Unmind, Spill, Flow Neuroscience.

By Condition Category

By Service Modality

By Patient Age Group

By Payer/Funding

February 2026

February 2026

January 2026

January 2026