January 2026

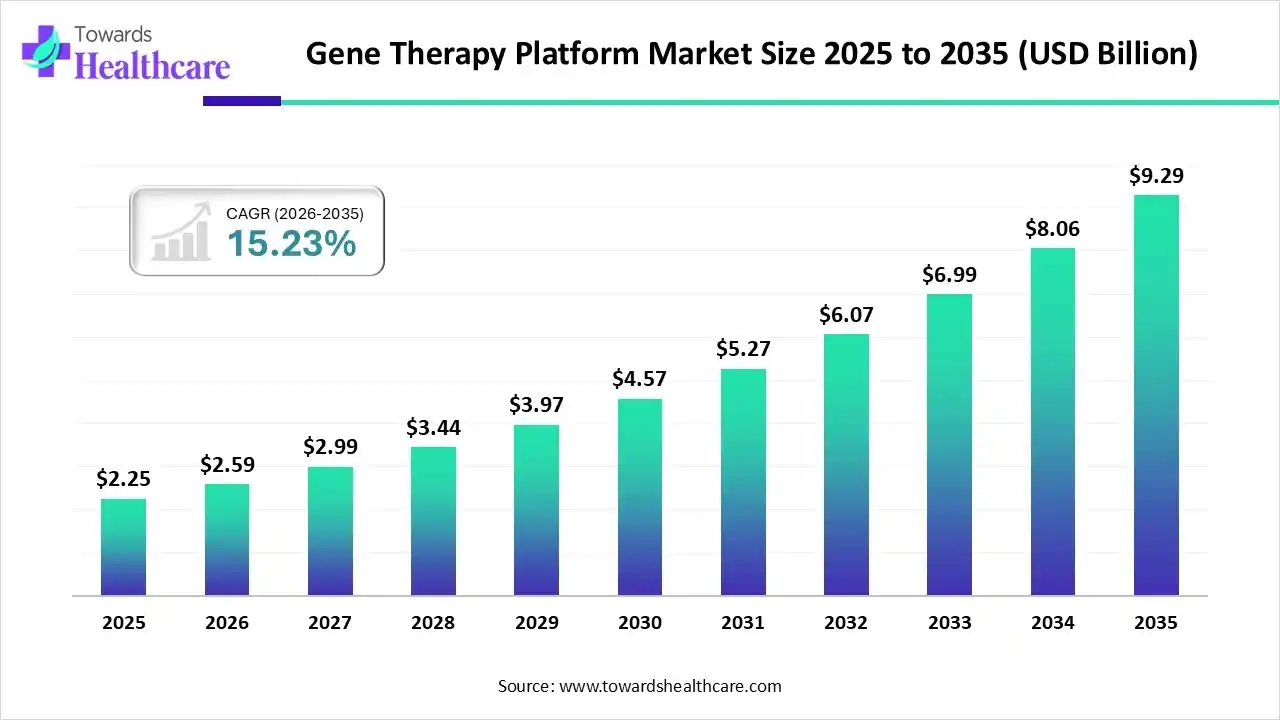

The gene therapy platform market size was valued at US$ 2.25 billion in 2025 and is projected to grow to 2.59 billion in 2026. Forecasts suggest it will reach approximately US$ 9.29 billion by 2035, registering a CAGR of 15.23% during the period.

A gene therapy platform is a foundational technology system for providing therapeutic genes into cells to treat diseases by substituting, adding, or silencing defective genes, using viral vectors or non-viral methods, and progressive tools such as CRISPR for accurate editing, making medicine more effective for genetic disorders such as cancer, hemophilia, or rare diseases, with the goal of achieving long-term cures. It provides faster progress and potentially single-dose, long-lasting treatments compared to traditional drugs.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.59 Billion |

| Projected Market Size in 2035 | USD 9.29 Billion |

| CAGR (2026 - 2035) | 15.23% |

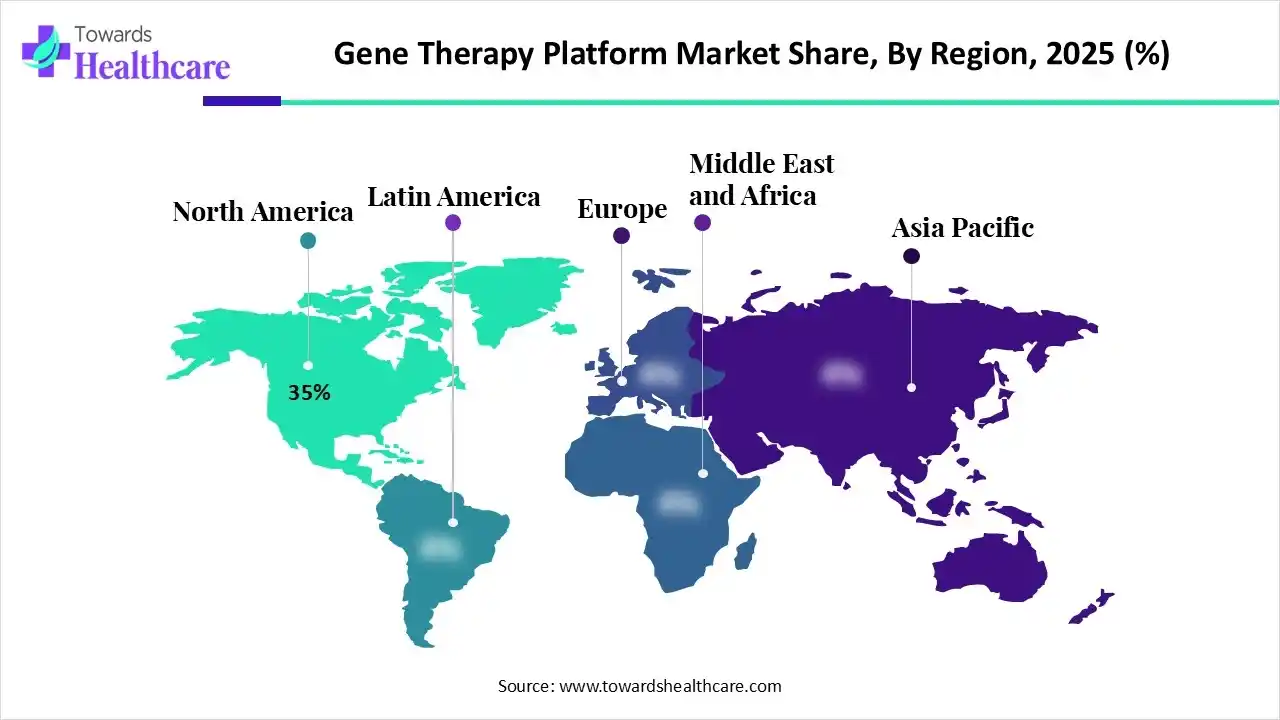

| Leading Region | North America by 35% |

| Market Segmentation | By Product Type, By Deployment Type, By Application, By Region |

| Top Key Players | Novartis AG, Gilead Sciences, Inc., BioMarin Pharmaceutical Inc., Sarepta Therapeutics, Inc., Pfizer Inc., Johnson & Johnson, Bluebird Bio, Inc., uniQure N.V., Audentes Therapeutics |

Integration of AI-driven technology in gene therapy platforms drives the growth of the market, as future gene therapy platforms are probably to incorporate AI-driven technology models that analyze multiple layers of biological data concurrently from genetic sequence data to protein expression and even patient lifestyle data. The advancement of such integrative strategies is significant for refining treatment approaches and predicting long-term results. AI-driven analytical models use historical editing data and massive genomic contexts to recommend gRNA sequences with maximum on-target activity and negligible off-target challenges.

Gene editing platforms have evolved as antiviral therapeutics for treating infectious diseases, also by varying the host genes essential for the virus or by targeting the viral genes necessary for replication.

Technological innovations in advanced technologies could revolutionize gene therapy production to progress scalability and meet patient demand.

Personalized medicine has transformed cancer treatment by applying genomic insights to tailor therapies based on individual molecular profiles. This strategy improves therapeutic effectiveness, reducing adverse effects, and addresses tumor heterogeneity by precision-targeted interventions.

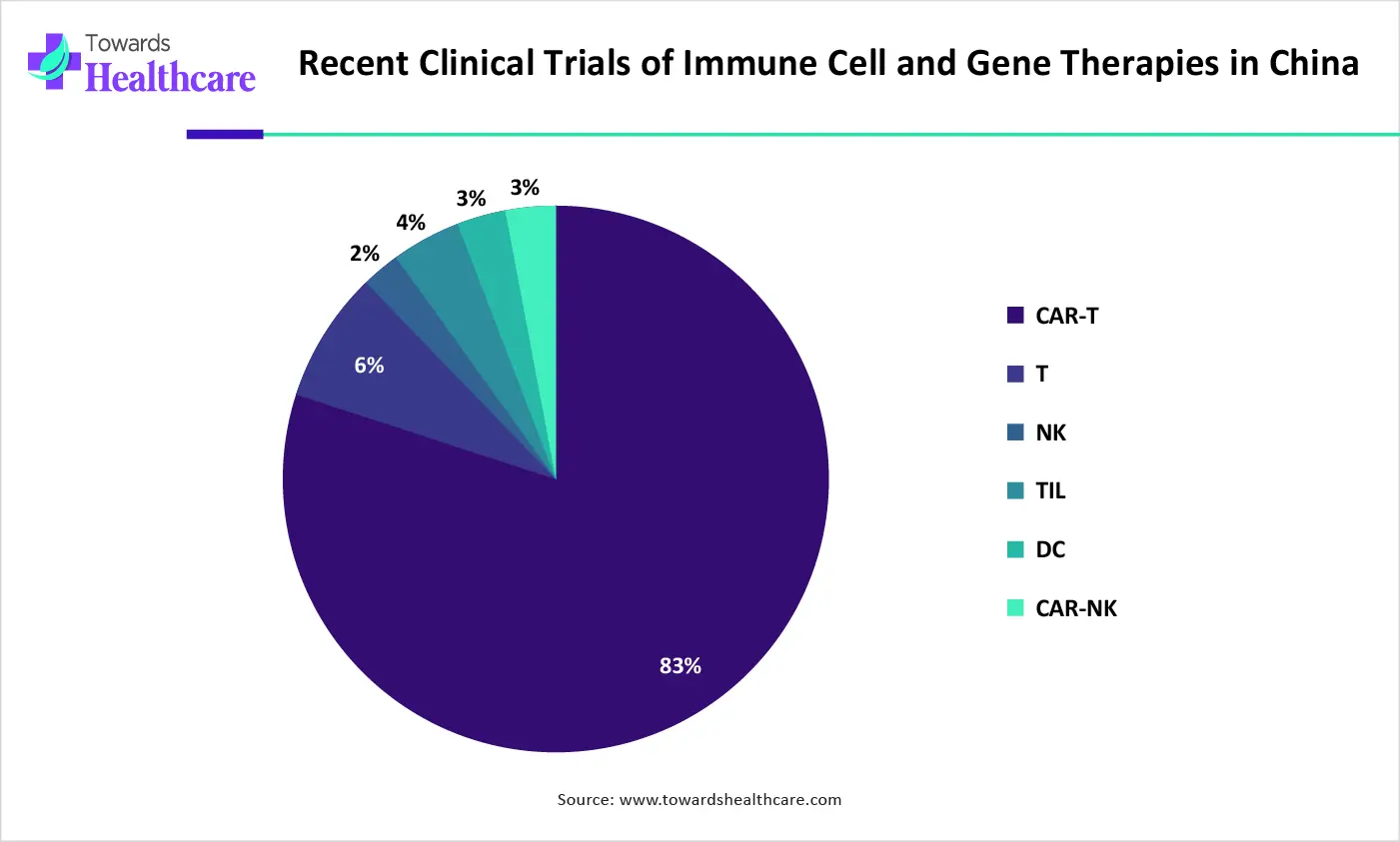

| Disorder | Percentages |

| CAR-T | 83% |

| T | 6% |

| NK | 2% |

| TIL | 4% |

| DC | 3% |

| CAR-NK | 3% |

Which Product Type Led the Gene Therapy Platform Market in 2025?

In 2025, the viral vector-based gene therapy platforms segment held the dominant market with a 50% share, as they contribute to a safer production environment, confirm constant product quality, conserve resources, and streamline government compliance. Viral vector-based gene therapies have attained promising clinical results. Presently, the three key vector plans are based on adeno-associated viruses, adenoviruses, and lentiviruses.

Non-Viral Gene Therapy Platforms

Whereas the non-viral gene therapy platforms segment is the fastest growing in the market, as non-viral vectors such as lipid nanoparticles (LNP) and N-acetylgalactosamine (GalNAc) led to positive gene therapy products. Non-viral vectors are currently a compelling substitute to viral delivery systems, providing less immunogenicity, affordable, and scalability. Non-viral gene delivery methods play a significant role in developing modern gene therapy, providing improved safety, scalability, and flexibility as compared to the viral strategy.

Why did the Android Segment Dominate the Market in 2025?

The on-premise/in-house R&D segment captured the biggest revenue share of the gene therapy platform market in 2025 with a 55% share, as in-house services offer complete control over the complete development and manufacturing process, supply chains, and Chemistry, Manufacturing, and Controls (CMC) operations. This enables rapid decision-making and quick adaptation to process or scheduling changes, which is particularly significant for patient-specific cell therapies with limited shelf life.

Cloud-Based/Remote Analytics

Whereas the cloud-based/remote analytics segment is the fastest growing in the market, as cloud-based antibody discovery platforms offer the flexibility to scale up or down based on the requirements of the project. Organizations simply access the computing resources they require to run their detection programs, without having to invest in luxurious hardware and infrastructure. Cloud technology improves system speed, agility, and flexibility by reducing the hardware or software supply needs, reducing assets for system upkeep, like configuration, testing, and installation.

hy is the Cancer/Oncology Therapies Segment Dominant in the Market?

In 2025, the cancer/oncology therapies segment held the dominating share of the gene therapy platform market with a 45% share, as gene editing has transformed cancer treatment by allowing precise targeting of genetic factors like oncogenes and drug resistance. It provides ground-breaking possibilities for cancer treatment through its ability to address disease origins at the genetic and molecular levels. Gene replacement therapy introduces functional copies of defective or missing genes into cancer cells to restore normal cellular function.

Rare & Genetic Disorders

Whereas the rare & genetic disorders segment is the fastest growing in the market, as gene therapy replaces or restores defective genes responsible for causing exact conditions. This approach is predominantly promising for rare genetic illnesses, as many of these conditions are monogenic, and mutations in a single gene cause them. Gene therapy organizations are altering rare genetic disease cures by using patients’ individual genes.

In 2025, North America led the gene therapy platform market, holding 35% of the share, driven by its status as a hub for major pharmaceutical, biotech firms, and research institutions. This fosters robust investment and innovation in gene therapy technologies. Both public and private funding, including venture capital and NIH grants, bolster research and commercialization, fueling market growth.

For Instance,

The U.S. boasts a strong, growing pipeline, with the FDA prioritizing the approval of these advanced therapies. Its advanced research infrastructure, numerous biotech and pharmaceutical companies, substantial R&D investments, and a supportive regulatory environment contribute to this leadership. According to the American Society of Cell and Gene Therapy, gene, cell, and RNA therapies are expanding rapidly, with nearly 3,500 therapies in preclinical and clinical stages.

Asia Pacific is set to experience rapid growth in the Gene Therapy Platform Market, driven by large healthcare investments, supportive policies in countries like China, Japan, and South Korea, expanding biotech sectors, extensive patient pools for clinical trials, and fast-growing manufacturing capabilities. This positions the region as a leader in R&D, trials, and innovation, particularly in viral vectors and gene editing. The high rates of genetic and chronic diseases generate a large patient population and increasing demand for therapies.

For Instance,

India is becoming a key player in global gene therapy, emphasizing the development of affordable, homegrown platforms for conditions such as cancer and sickle cell anemia. The country benefits from substantial government backing through programs like the National Biotechnology Development Strategy and rising private sector investments from companies including Biocon, Dr. Reddy's Laboratories, and Bharat Biotech.

Europe is experiencing significant growth in the gene therapy platform market, driven by the European Medicines Agency (EMA) approving new therapies and the development of helpful guidelines. Notable approvals include Casgevy (for sickle cell/thalassemia), Libmeldy (for metachromatic leukodystrophy), and Roctavian (for hemophilia). Europe is entering a new era in medicine, particularly in gene therapies for rare genetic diseases, supported by over 320 ongoing clinical trials across the continent.

The UK leads in the number of cell and gene therapy clinical trials in Europe. A robust ecosystem, supported by regulatory organizations like the Cell and Gene Therapy Catapult and manufacturing groups such as the BioIndustry Association (BIA), helps bridge research and commercial viability, fueling market growth.

| Company | Headquarters | Latest Update |

| Novartis AG | Switzerland | In November 2025, Novartis received FDA approval for Itvisma, the only gene replacement therapy for children two years and older, teens, and adults with spinal muscular atrophy (SMA) |

| Gilead Sciences, Inc. | United States | In 2025, Gilead and Kite Showcase Continued Progress in Transforming Blood Cancer Care with New Cell Therapy |

| BioMarin Pharmaceutical Inc. | United States | In October 2025, BioMarin Pharmaceutical opens a novel tab; it plans to divest its gene therapy, a product once expected to be a blockbuster therapy for a type of rare bleeding disorder. |

| Sarepta Therapeutics, Inc. | United States | In July 2025, Sarepta focuses its pipeline on high-impact programs, prioritizing potentially best-in-class siRNA platform assets. |

| Pfizer Inc. | United States | Pfizer is exploring novel, possibly transformative strategies to treat genetic disease by gene therapy. |

| Johnson & Johnson | New Jersey | In November 2025, Johnson & Johnson is set to revolutionize the treatment of cancer with the acquisition of Halda Therapeutics. |

| Bluebird Bio, Inc. | United States | In June 2025, bluebird bio, a pioneer in gene therapies for complex genetic diseases, announced the completion of its sale to funds managed by worldwide investment firms Carlyle and SK Capital Partners, LP. |

| uniQure N.V. | Netherland | uniQure is developing a gene therapy for Huntington's disease (HD), a rare, fatal, neurodegenerative genetic disorder that affects motor function. |

| Audentes Therapeutics | California | Audentes Therapeutics's most recent deal was a Merger/Acquisition with CardioGen Sciences. |

By Product Type

By Deployment Type

By Application

Regional Outlook

January 2026

January 2026

January 2026

January 2026