January 2026

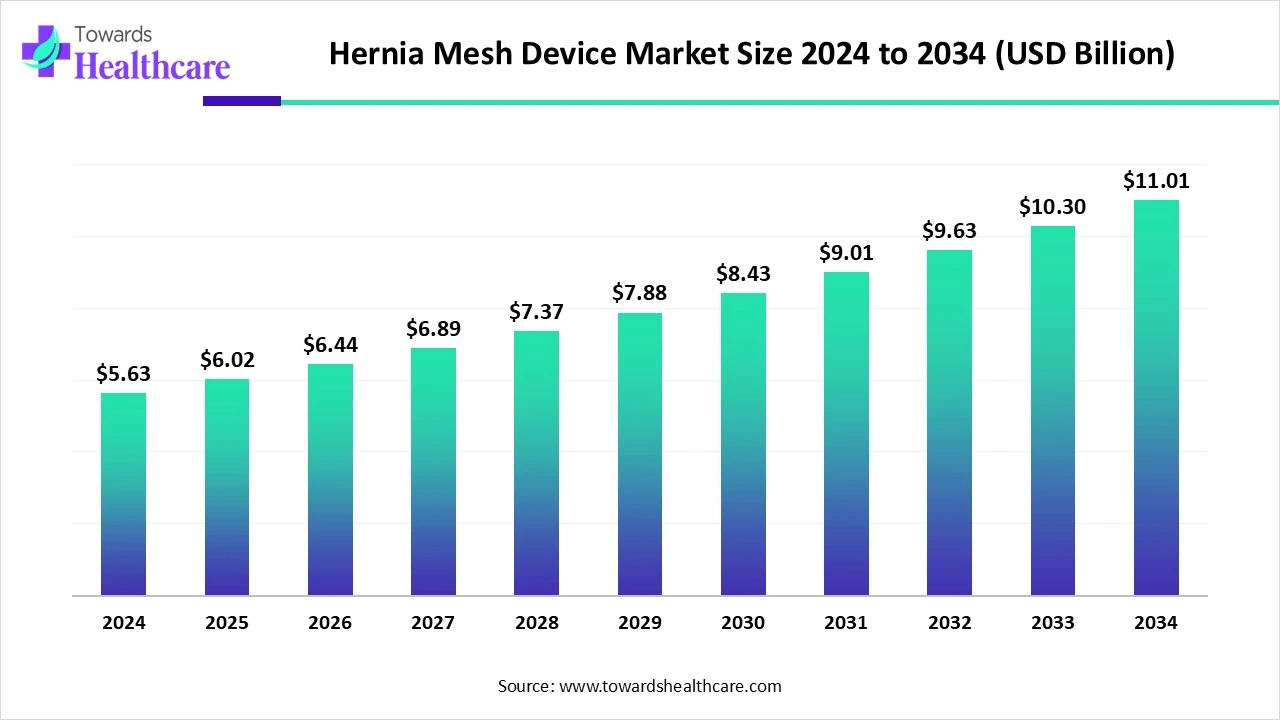

The global hernia mesh device market size is calculated at USD 5.63 billion in 2024, grew to USD 6.02 billion in 2025, and is projected to reach around USD 11.01 billion by 2034. The market is expanding at a CAGR of 6.94% between 2025 and 2034.

The hernia mesh device market is primarily driven by the rising prevalence of hernia and growing research and development activities. Prominent market players collaborate to access advanced technologies and develop novel medical devices. The increasing investments by government and private organizations support the market. The future looks promising, with advancements in medical technology and the growing demand for minimally invasive surgeries.

| Metric | Details |

| Market Size in 2025 |

USD 6.02 Billion |

| Projected Market Size in 2034 | USD 11.01 Billion |

| CAGR (2025 - 2034) | 6.94% |

| Leading Region | North America |

| Market Segmentation | By Mesh Type, By Hernia Type, By Product Type, By Fixation Type, By Procedure Type, By End-User, By Sales Channel, By Region |

| Top Key Players | Becton, Dickinson and Company (BD), Medtronic plc, W. L. Gore & Associates, Inc., B. Braun Melsungen AG, Johnson & Johnson (Ethicon), Cook Medical Inc., Atrium Medical (Maquet/Getinge), Herniamesh S.r.l., Integra LifeSciences Holdings Corporation, LifeCell Corporation (Allergan), Tepha Inc., ACell, Inc., Dipromed Srl, Novus Scientific AB, Cousin Biotech, Betatech Medical, FEG Textiltechnik mbH, Insightra Medical Inc., Medtronic Covidien, Advanced Medical Solutions Group |

The market refers to the industry surrounding the manufacturing and distribution of surgical implants used to provide additional support to weakened or damaged tissue during hernia repair procedures. Hernia mesh devices are primarily used in both open and laparoscopic surgeries and are essential in reducing recurrence rates and improving post-operative outcomes. A hernia refers to a condition where a tissue or organ abnormally protrudes through the wall of the cavity in which it normally resides.

With the increasing prevalence of obesity, aging populations, and the recurrence of hernias, the demand for innovative and biocompatible mesh materials is rising globally. The growing investments and collaborations are leading to a surge in research and development activities, thereby promoting the development of novel devices. The growing demand for minimally invasive surgeries potentiates the need for laparoscopic procedures. Advancements in medical technology drive market growth.

Artificial intelligence (AI) can transform the diagnosis by enhancing efficiency and leading to early diagnosis. This enables healthcare professionals to provide tailored treatments based on patients’ conditions. AI offers significant potential in improving surgical risk assessment and predictive analytics. Integrating AI in hernia surgery holds immense potential for enhancing surgical precision and improving patient outcomes. AI enables the development of innovative mesh devices, providing superior benefits. It can also predict potential complications associated with mesh devices and suggest measures to overcome complications.

Demand for Absorbable Materials

The major growth factor for the hernia mesh device market is the increasing demand for absorbable or bioresorbable materials that mimic normal tissue. Bioresorbable meshes are generally composed of extracellular matrix that is derived from collagen-rich tissues. Traditional synthetic materials in surgical mesh devices are associated with postoperative complications, such as infections. To overcome these limitations, researchers focus on developing mesh devices using biodegradable or bioresorbable materials. Other examples of absorbable materials include polylactide (PLA), polyglycolic acid (PGA), and polycaprolactone (PCL).

Device Complications

Hernia mesh devices, especially those derived from synthetic materials, may cause several side effects, such as chronic pain, large foreign body reaction, hernia recurrence, adhesion, and bowel obstruction. These complications limit the use of hernia mesh devices, restricting market growth.

What is the Future of the Hernia Mesh Device Market?

The market future is promising, driven by the advent of 3D and 4D printing technologies. 3D and 4D printing technologies are emerging and have expanded applications in medicine from anatomic models and surgical guides to implants. They enable the development of custom surgical meshes, allowing for highly visible medical devices with patient-specific geometries. 4D printing allows the manufacture of dynamic devices that stay in long-term contact with biological systems due to their time-dependent stimuli. 3D and 4D printing technologies result in less wastage, contributing to sustainable manufacturing. Surgical mesh devices manufactured from these materials can improve surgical outcomes and lower patient recovery times.

By mesh type, the synthetic mesh segment held a dominant presence in the market in 2024. This is due to the availability of cost-effective polymers and the use of biocompatible polymers. Synthetic materials, such as polypropylene, polytetrafluoroethylene, and polyester. They are absorbable or non-absorbable and provide adequate mechanical support, compared to natural materials. Absorbable materials are used to prevent abdominal compartment syndrome with distended bowels and intra-abdominal infections.

By mesh type, the biologic mesh segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing demand for biologic materials for implant design boosts the segment’s growth. Biologic materials, such as human or animal tissue, offer numerous benefits and reduce complications associated with synthetic materials. They reduce inflammation and promote tissue integration in complex hernia. Biologic mesh easily absorbs into the body.

By hernia type, the inguinal hernia segment held the largest revenue share of the market in 2024, due to the rising prevalence of inguinal hernia. Inguinal hernia is the most common type of hernia and occurs when abdominal tissue bulges through an opening in the lower abdominal wall. It usually affects nearly 25% of men and less than 2% of women. It is mainly caused by increased pressure within the abdomen and straining during bowel movements or urination.

By hernia type, the incisional hernia segment is expected to grow with the highest CAGR in the market during the studied years. Incisional hernia is caused by an incompletely healed surgical wound. The incidence of incisional hernia is around 7.5%, affecting mainly people in the age group of 30-60 years. The rising prevalence of obesity, pregnancy, and the increasing premature physical activity after surgery are the major causes of incisional hernia.

By product type, the flat mesh segment contributed the biggest revenue share of the market in 2024. This segment dominated because healthcare professionals can customize the prosthesis by using flat mesh. They can cut and shape flat meshes depending on the size of the hernia and the area to be reinforced. Flat meshes are widely used to treat both inguinal and abdominal hernias, allowing a wide choice of mesh and surgical techniques.

By product type, the 3D mesh segment is expected to expand rapidly in the market in the coming years. 3D meshes are specifically designed with an anatomically curved shape and sealed edges. The presence of a medial orientation marker in a 3D mesh allows for easy positioning compared to a conventional flat mesh. 3D meshes enhance the speed and simplicity of placement. They also help reduce patient pain as they require less narcotic analgesia.

By fixation type, the suture segment held a major revenue share of the market in 2024. Suture technique is widely preferred due to the availability of absorbable and non-absorbable sutures. Consumables needed for suturing a mesh device are relatively cost-effective. Non-absorbable sutures can retain their strength for a longer time in the body and have lower recurrence rates compared to absorbable sutures.

By fixation type, the glue segment is expected to witness the fastest growth in the market over the forecast period. Bio-adhesive-based solutions offer superior advantages over sutures. Fibrin glue and cyanoacrylic glue are used to secure the mesh. They are used in skin closures and abdominal wall defect repair. Glue fixation results in less frequent early chronic pain compared to suture. Additionally, glue fixation is faster and less painful in open repair surgeries.

By procedure type, the open hernia repair segment led the global market in 2024. Open hernia repair is the most commonly performed procedure worldwide as it allows for reinforcement of the abdominal muscles more securely. This procedure is performed through a long incision over the location of the hernia. The surgery time usually ranges from 45 minutes to 2 hours. This procedure requires simple equipment, including needles, scalpels, forceps, Metzenbaum scissors, and many more.

By procedure type, the robotic-assisted repair segment is expected to gain a higher share of the market over the studied period. Advancements in technology and the increasing benefits of robots in surgeries augment the segment’s growth. Robotic-assisted repair simplifies the task of surgeons, accelerating the speed of surgery and reducing manual errors. The increasing demand for minimally invasive surgery potentiates the use of robots. This enables patients to recover faster with reduced complications.

By end-user, the hospitals segment accounted for the highest revenue share of the market in 2024. The segmental growth is attributed to favorable infrastructure and the presence of skilled professionals. Hospitals have professionals of all disciplines, from general physicians to specialized surgeons, providing multidisciplinary expertise to patients. They also provide favorable reimbursement policies, allowing patients to access quality care at affordable prices.

By end-user, the ambulatory surgical centers (ASCs) segment is expected to show the fastest growth over the forecast period. The growing demand for minimally invasive surgeries and the presence of specialized equipment propel the segment’s growth. ASCs provide same-day discharge to patients and mostly perform minor surgeries. They are comparatively cost-effective and offer a safe environment for many hernia repairs.

By sales channel, the direct sales segment registered its dominance over the global market in 2024. Direct sales of hernia mesh devices are made to hospitals, surgical centers, and pharmacies. This enables suppliers to monitor sales patterns and understand consumer preferences. Direct sales enable manufacturers to design and deliver customized mesh designs based on patients’ conditions. It is beneficial to patients and healthcare professionals as they receive products at cheaper rates.

By sales channel, the e-commerce segment is expected to grow fastest in the upcoming years. The burgeoning e-commerce sector and the increasing adoption of smartphones foster the segment’s growth. Healthcare professionals can select from a wide range of hernia mesh devices. They can also compare the prices of devices. Advancements in connectivity technology provide benefits to professionals from rural areas. The demand for e-commerce services is mainly growing in the Asia-Pacific region.

North America dominated the market in 2024. The presence of key players, the growing geriatric population, and technological advancements are the major growth factors of the market in North America. Government organizations launch initiatives for the early diagnosis of hernia and provide funding for research activities. Favorable regulatory policies also contribute to market growth.

Key players, such as Becton, Dickinson and Company, Medtronic, and Johnson & Johnson, provide cutting-edge surgical mesh devices in the U.S. The U.S. Census Bureau reported that people aged 65 years and older rose by 3.1%, accounting for 61.2 million from 2023 to 2024. It is estimated that over 5 million people in the U.S. suffer from hernia annually.

There were approximately 7.6 million Canadians aged 65 years and older as of June 2023, accounting for almost one-fifth (18.9%) of the total population. It is projected that 21.4% to 23.4% of the total Canadian population will be geriatric by 2030. (Source - Statistic Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the hernia mesh device market during the forecast period. The rising prevalence of hernia and obesity, as well as sedentary lifestyles, are major concerns among individuals in Asia-Pacific countries. The increasing healthcare expenditure and advancements in surgical techniques augment the market. The growing awareness of early disease diagnosis through government initiatives and social media enables healthcare professionals to provide effective treatment.

Based on the national survey on obesity, it was found that 57% of adults were overweight or obese in 2023. In response to the increasing cases, the Chinese government launched a national 3-year weight management campaign in June 2024. The National Health Commission (NHC) director also announced plans to establish weight management clinics through medical institutions worldwide. (Source - The Lancet Diabetes and Endocrinology)

According to a study conducted on 5000 people in Delhi, Noida, Gurgaon, and Ghaziabad, around 15% were found to have a hernia, which would require surgical repair. The Prime Minister of India emphasized preventing, diagnosing, and treating obesity. The recent data from the National Family Health Survey (NFHS-5) revealed that nearly 24% of women and 22.9% of men are classified as obese. (Source - Financial Express)

Europe is expected to grow at a notable CAGR in the hernia mesh device market in the foreseeable future. The rising number of clinical trials and favorable government support boost the market. Out of the total 36 clinical trials related to hernia mesh devices on the clinicaltrials.gov website, 21 are reported in Europe. The increasing investments and collaborations facilitate the development of innovative mesh devices. The growing adoption of advanced technologies also favors market growth.

Germany is Europe’s largest medical technology market and ranks third internationally. The BfArM provides information on the regulatory framework of medical devices, including laws and regulations. There are more than 1,443 medical device manufacturers in Germany and two-thirds of revenues are generated outside its domestic market.

Ron Silverman, Chief Medical Officer at BD, commented that the company is redefining tissue repair through advanced biomaterials and expanding treatment options to meet individual patient needs through proven, reliable alternatives to permanent mesh. He also said that the launch of Phasix ST marks a milestone in hernia repair innovation and further positions BD as a leader in advanced biomaterial science, driving transformative change in tissue reconstruction. (Source - PR Newswire)

By Mesh Type

By Hernia Type

By Product Type

By Fixation Type

By Procedure Type

By End-User

By Sales Channel

By Region

January 2026

January 2026

December 2025

December 2025