January 2026

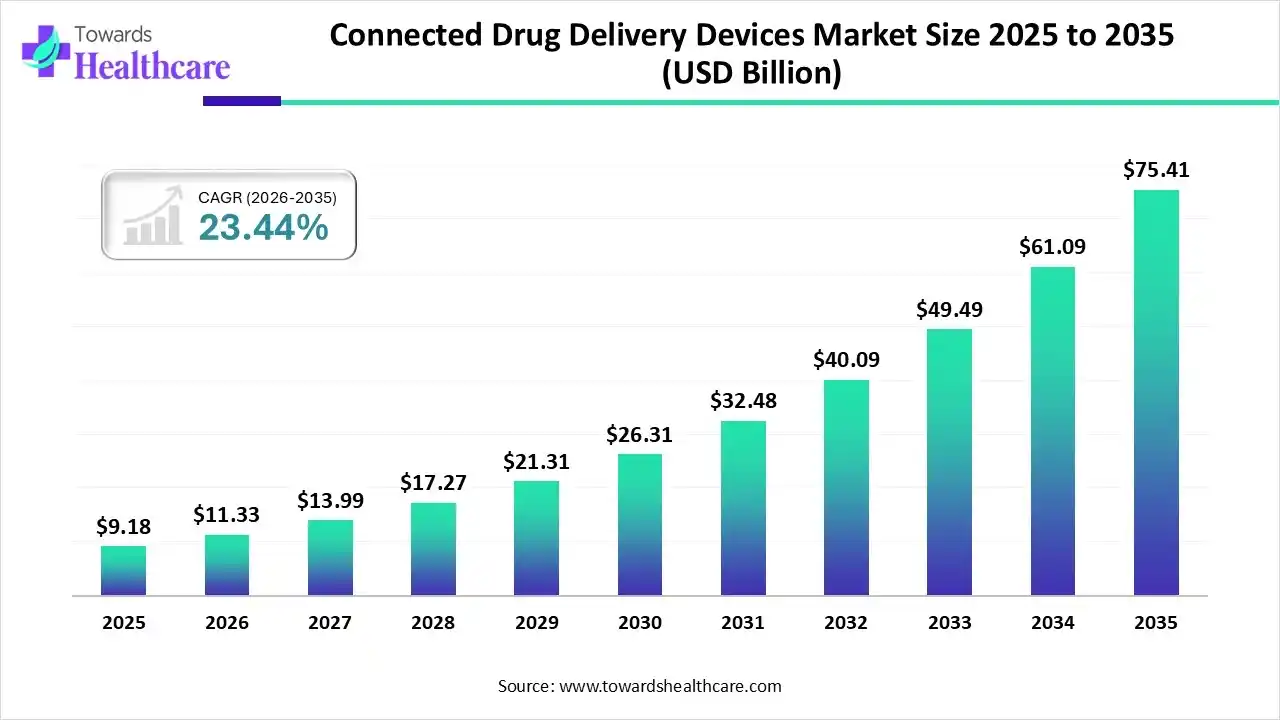

The global connected drug delivery devices market size is calculated at USD 9.18 billion in 2025, grew to USD 11.33 billion in 2026, and is projected to reach around USD 75.41 billion by 2035. The market is expanding at a CAGR of 23.44% between 2026 and 2035.

The connected drug delivery devices market is mainly driven by technological advancements in the healthcare sector and the demand for telemedicine. The rising prevalence of chronic disorders enables patients to use advanced devices for effective treatment. Prominent key players collaborate to develop state-of-the-art technology to improve patients’ lives. The integration of AI and ML in connected drug delivery devices presents future opportunities for key players. Moreover, the use of 3D printing technology for manufacturing customized devices also drives future market growth.

| Metric | Details |

| Market Size in 2026 | USD 11.33 Billion |

| Projected Market Size in 2035 | USD 75.41 Billion |

| CAGR (2026 - 2035) | 23.44% |

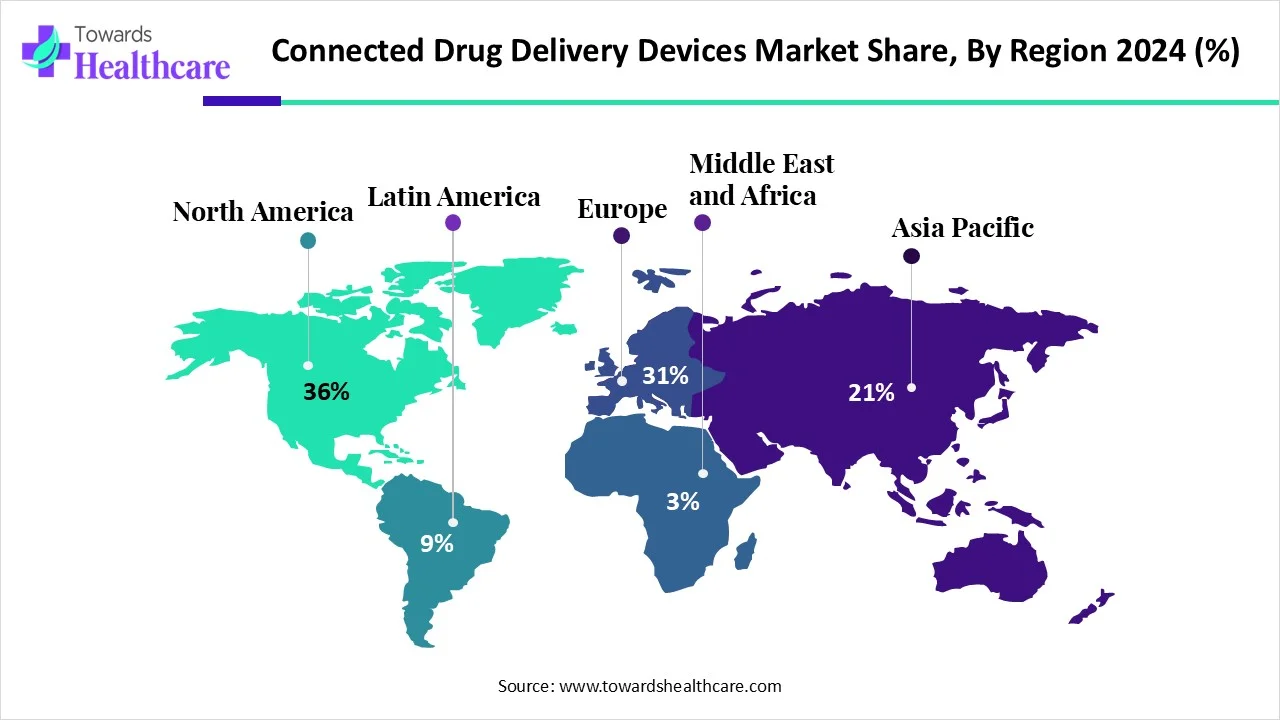

| Leading Region | North America share 36% |

| Market Segmentation | By Product Type, By Route of Administration, By Application, By Region |

| Top Key Players | Aptar Digital Health, Becton, Dickinson and Company, Biocorp, Cohero Health, Inc., Medtronic, Novartis AG, Novo Nordisk, Propeller Health, SHL Medical, Tandem Diabetes Care, West Pharmaceutical Services, Ypsomed Holding |

Connected drug delivery devices refer to devices that can be connected to mobile devices or software. They provide features, such as dosing reminders, adherence trackers, tools for patient education, patient diaries to collect patient-reported outcomes, and monitoring tools with interfaces. These devices provide access to patient information, enabling patients to gain a deeper understanding of their condition and make informed decisions. This allows patients to include their medication regimen more seamlessly into their everyday lives. They have been used for a wide range of chronic disorders, such as multiple sclerosis, diabetes, hypertension, asthma and COPD.

The factors that govern market growth include the rising prevalence of chronic disorders and the growing geriatric population. The growing demand for telemedicine and home healthcare also increases the demand for connected drug delivery devices. The burgeoning medical device sector and favorable government support boost the market. Technological advancements drive the latest innovations in the drug delivery device systems. The rising need to increase patient medication adherence and growing research and development activities augment the market.

Integrating artificial intelligence (AI) plays a vital role in connected drug delivery devices by enhancing device efficiency and automating dosing regimens. AI and machine learning (ML) algorithms analyze vast amounts of patient data and provide details of a patient’s dosing schedule. They also provide reminders for the timely delivery of drugs. Smart drug delivery devices can administer medications in a controlled manner. They are equipped with sensors and connectivity features that adjust dosage levels and provide personalized treatment. They aim to improve medication adherence, enhance patient comfort, and optimize therapeutic outcomes.

Telemedicine

The major growth factor of the connected drug delivery devices market is the rising demand for telemedicine. The need for telemedicine is increasing to deliver personalized care to patients and enable remote monitoring. Telemedicine eliminates the need for patients to visit healthcare organizations frequently. The increasing geriatric population is a major reason to promote telemedicine. Connected drug delivery devices enhance telemedicine by enabling real-time monitoring of medication adherence to patients and healthcare professionals. They can also monitor treatment response and patient health status. This enables patients and healthcare professionals to make informed decisions from a remote location. It is estimated that 80% of people have accessed telemedicine at least once in their lifetime.

Privacy Issues

The major barrier to the adoption of connected drug delivery devices is the data privacy issues. This prevents the sharing of patient data with healthcare professionals. There are also chances of data leakage and breach of cybersecurity.

What is the Future of the Connected Drug Delivery Devices Market?

The future of the market is promising, driven by advancements in manufacturing technologies of connected drug delivery devices. 3D printing is an emerging technology used for manufacturing a variety of products in the healthcare sector. It is increasingly used for producing tailored drug delivery devices based on patients’ requirements. It allows for the fabrication of devices that are difficult to produce using conventional methods. It also significantly reduces material waste, contributing to environmental sustainability. 3D printing can also be used for manufacturing electronic components used in connected drug delivery devices. The future scope of 3D printing involves printing and fabricating multiple materials and designs simultaneously.

By product type, the standalone components & software segment held a dominant presence in the market in 2024. This is due to the growing use of sensors and the Internet of Things (IoT) in drug delivery systems. The standalone components include smart caps and digital sleeves that are attached to inhalers and autoinjectors. They are the essential components in a device and are responsible for advanced functionality. These components enable connectivity features without altering the device’s core function. The increasing demand for software as a medical device (SaMD) also boosts the segment’s growth.

By product type, the integrated devices segment is expected to grow at the fastest CAGR in the market during the forecast period. The increasing use of smartphones and advancements in connectivity technology augment the segment’s growth. Connected drug delivery devices are operated using smartphones for various purposes, including dosing schedules and amounts of drug to be delivered. Integrated devices also offer the means to securely manage and interpret the data these devices provide, and ensure they are kept up to date in accordance with device regulations.

By route of administration, the parenteral devices segment held the largest revenue share of the market in 2024. This segment dominated because the parenteral route is the most preferred route of administration due to the faster onset of action. Through the parenteral route, the drug is directly delivered to the blood, eliminating first-pass metabolism. The development of needle-free injections for painless administration of drugs also potentiates the segment’s growth. These injections eliminate the chances of needle-stick infections. Moreover, they aid in faster drug delivery, unlike the inhalation system.

By route of administration, the inhalation devices segment is expected to grow with the highest CAGR in the market during the studied years. The inhalation route of administration is mostly preferred for respiratory disorders, such as asthma and COPD. Inhalation devices directly deliver the drug to the lungs, providing targeted action and reducing systemic side effects. The drug dose can be controlled through inhalers and nebulizers. Connected inhalers can provide real-time insights about a patient’s severe asthma attacks to healthcare professionals, enabling them to take necessary actions.

By application, the diabetes management segment led the global market in 2024. The segmental growth is attributed to the rising prevalence of diabetes, sedentary lifestyles, and a changing healthcare ecosystem. The International Diabetes Federation (IDF) reported that approximately 589 million people are living with diabetes, and about 853 million people are anticipated to be living with diabetes by 2050. (Source: IDF Org) Numerous people with type 1 and type 2 diabetes are dependent on insulin. Researchers are developing a weekly dose of insulin. Connected drug delivery devices provide reminders to patients about their daily or weekly insulin dose.

By application, the COPD segment is expected to grow significantly over the studied years. The increasing prevalence of COPD and its complexity necessitate early diagnosis and treatment. Chronic obstructive pulmonary disorder (COPD) is a respiratory disorder affecting the lungs. The different types of inhalation devices for COPD management are pressurized metered dose inhalers (pMDI), dry powder inhalers (DPIs), and soft mist inhalers (SMIs). Connected devices can track inhaler usage and adhere to prescribed therapies.

North America dominated the global connected drug delivery devices market share by 36% in 2024. The rising adoption of advanced technologies and robust healthcare infrastructure are the major growth factors of the market in North America. The availability of state-of-the-art research and development facilities enables researchers to develop innovative medical devices for improved patient care. The growing demand for personalized medicines also contributes to market growth. Moreover, people are increasingly aware of remote monitoring, promoting the use of connected devices.

It is estimated that more than 38 million people in the U.S. suffer from diabetes, of whom around 8.4 million are dependent on insulin. According to a recent report by Rock Health Digital Health Consumer Adoption Survey, 44% of Americans use wearable health tracking devices, such as a smartwatch or smart rings.

The Canadian Public Health Association reported that approximately 44% of adults in Canada have at least one chronic disorder, accounting for 67% of all deaths. (Source: Canadian Public Health Association) According to the Canadian Medical Association, Canada’s total health spending was around $344 billion in 2023, accounting for 12.1% of its GDP. Around 14% of the spending is for drugs and 26% for hospitals. (Source: Canadian Medical Association)

Asia-Pacific is expected to grow at the fastest CAGR in the connected drug delivery devices market during the forecast period. The rising prevalence of chronic disorders and the increasing geriatric population drive the market. The rapidly expanding medical device sector and increasing venture capital investments promote the market. Favorable government support and increasing collaborations among academic researchers and key players encourage the faster launch of innovative products in the market.

China’s medical device sector is rapidly evolving from a cost-driven, volume-based model to an innovation-focused ecosystem. The Chinese government encourages foreign direct investment (FDI) in the MedTech sector, promoting technological advancements. These investors and companies can leverage their strengths through strategic partnerships, joint ventures, and co-development initiatives.

The development of eSanjeevani, a government telemedicine platform in India, facilitates quick and easy access to doctors and medical specialists. More than 100 million Indians used the eSanjeevani platform for tele-consultation as of February 2023. (Source: 75th Azadi ka Amrit Mahotsav)

From April to October 2024, India’s medical device exports showed a 5.74% year-on-year increase, with the exports of optical, medical, and surgical instruments. (Source: India briefing)

Europe is expected to grow at a notable CAGR in the connected drug delivery devices market in the foreseeable future. Government organizations launch initiatives and provide funding for pharmaceutical research and medical devices. The presence of key players and the growing research and development activities propel the market. Key players, such as Medtronic, SHL Medical, Biocorp, Novartis AG, and Novo Nordisk, are the major contributors to the market. The increasing collaborations among key players and mergers and acquisitions foster market growth.

Germany is the largest medical technology market in Europe and the third largest in the world. Germany’s per capita medical device spending accounted for US$313. The Federal Institute for Drugs and Medical Devices (BfArM) plays a vital role in regulating drug delivery devices in Germany.

In December 2024, the French government announced an investment of €20.7 million ($22.5 million) through the France 2030 initiative for the Project DEEP by Withings. The project aims to utilize AI and medical device innovation to advance early detection and prevention of cardiometabolic disorders and accelerate the digital transition of the healthcare system globally. (Source: Pulse 2.0)

The Middle East & Africa are expected to grow in the coming years in the connected drug delivery devices market, owing to the burgeoning medical device sector, growing awareness of telemedicine, and the rising adoption of advanced technologies. Favorable government support and evolving regulatory landscapes also favor the use of connected drug delivery devices. Numerous private and government bodies provide suitable reimbursement services to patients, enabling them to access advanced technological products.

The rapidly expanding research infrastructure promotes the development of innovative products. In October 2025, researchers at NYU Abu Dhabi developed a new type of brain implant, SPIRAL, to deliver drugs to multiple regions of the brain with high precision. Government bodies also provide funding for nanoparticle-based research and wearable devices.

Ralph Howald, Chief Technical Officer at SHL Medical, commented that the increasing need for home-based treatments and the evolving healthcare landscape have potentiated the need for collaborative innovation within the drug delivery industry. He envisioned that the company’s partnership with Aptar Digital Health would serve as a first step in a digital ecosystem for injectable drugs, starting with a digital transformation that will impact the end-to-end value chain in the future. (Source: Aptar)

By Product Type

By Route of Administration

By Application

By Region

January 2026

January 2026

January 2026

January 2026