February 2026

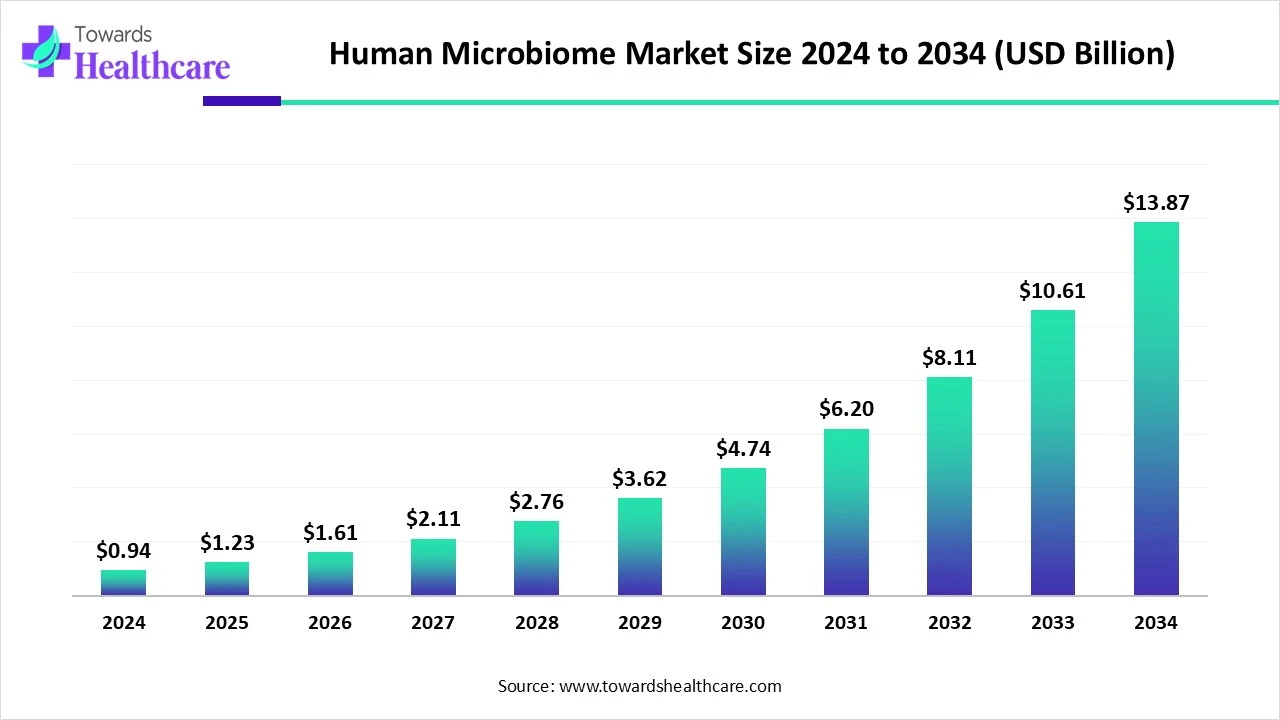

The global human microbiome market size was estimated at US$ 1.23 billion in 2025, projected to increase to US$ 1.61 billion in 2026 and reach US$ 18.27 billion by 2035, showing a healthy CAGR of 30.97% across the forecast years.

The human microbiome market is witnessing rapid growth driven by increasing awareness of the role of gut health in overall well-being and disease management. Rising prevalence of lifestyle-related disorders, coupled with demand for microbiome-based diagnostics, therapeutics, and probiotics is boosting market expansion. Advances in next-generation sequencing and personalized medicine are further supporting innovation. Additionally, growing investments from pharmaceutical companies and research institutions are accelerating product development, making the human microbiome market a key focus in modern healthcare.

| Table | Scope |

| Market Size in 2026 | USD 1.61 Billion |

| Projected Market Size in 2035 | USD 18.27 Billion |

| CAGR (2026 - 2035) | 30.97% |

| Leading Region | North America |

| Market Segmentation | By Therapeutic Indication / Application Area, By End-User / Buyer, By Region |

| Top Key Players | Seres Therapeutics, Nestlé Health Science / Nestlé, Finch Therapeutics, Vedanta Biosciences, Ferring Pharmaceuticals, MaaT Pharma, BiomX Inc., 4D pharma plc, Synlogic, Assembly Biosciences, Eligo Bioscience, Locus Biosciences, Microba Life Sciences, Viome, Seed Health, Pendulum Therapeutics, Second Genome, Karius, Novozymes / Chr. Hansen, BioMe |

The human microbiome market comprises products, therapeutics, diagnostics, and services that measure, modulate, or commercialize the microbial communities that live on and in humans. It spans therapeutics (live biotherapeutic products, engineered microbes, phage therapies, FMT-derived medicines), microbiome-enabled diagnostics & biomarkers (sequencing/metatranscriptomics, metabolomics, predictive algorithms), consumer health & probiotics (clinical-strength probiotics, synbiotics, personalized nutrition), R&D tools & services (bioinformatics, culturomics, microbiome CROs, sample collection kits), and manufacturing & CDMO for live/anaerobic organisms and formulation/encapsulation.

The market includes end-users across pharma/biotech, clinical labs, hospitals, research centres, direct-to-consumer (D2C) wellness, and contract service providers. Innovation is driving the human microbiome market by opening new opportunities in drug discovery, disease prevention, and nutrition. Emerging technologies such as AI-driven microbiome analysis, precision fermentation, and synthetic biology are enabling the development of novel therapeutic and functional foods. Startup and major pharma forms are investing heavily in R&D while innovative partnerships are speeding up translation of research into commercial solutions, making the microbiome a core of modern healthcare advancements.

Growing R&D collaborations - Pharma, biotech, and academic institutions are expanding research and clinical trials.

Expansion of Microbiome Startups - Emerging biotech startups and collaborations are pushing innovation and commercialization.

AI is transforming the market by enabling faster data analysis, accurate interpretation of complex microbial interactions, and identification of novel therapeutic targets. It supports precision medicine by predicting individual responses to probiotics, drugs, and dietary interventions. AI-powered platforms also accelerate microbiome-based drug discovery, clinical trial design, and biomarker development. By integrating big data, machine learning, and personalized healthcare approaches, AI is enhancing innovation, efficiency, and commercialization in the rapidly growing human microbiome market.

Growing Awareness of Gut Health

Awareness about gut health is boosting the human microbiome market because people are becoming more conscious of how gut bacteria influence not just digestion, but also metabolic functions, mental health, and immune responses. This knowledge encourages consumers to adopt microbiome-targeted products, including functional foods, supplements, and personalized nutrition solutions. Consequently, companies are focusing on developing innovative offerings and educational campaigns to meet this growing demand, further accelerating market growth and expanding opportunities across healthcare and wellness sectors.

High Research and Development Costs

The high cost of research and development limits the growth of the human microbiome market because conducting microbiome studies involves sophisticated laboratory setups, skilled personnel, and advanced data analysis tools. These expenses make product development time-consuming and financially challenging, particularly for emerging companies. Moreover, the complexity of studying diverse microbial communities adds to the cost and uncertainty are cautious about investing heavily, which slows the pace of innovation and market expansion.

Revolutionizing Healthcare with Microbiome-based Therapies

The development of microbiome-based therapies is a promising future opportunity in the human microbiome market, as it allows for precision interventions that restore and maintain healthy microbial balance. Such therapies have the potential to address not only digestive issues but also mental health, metabolic disorders, and immune system dysfunctions. With advancements in sequencing technologies, personalized treatment plans, and growing interest from pharmaceutical companies, microbiome-based solutions are poised to transform preventive care and therapy strategies across multiple healthcare sectors.

For Instance,

In 2024, the oncology segment led the market because microbiome-based approaches can optimize the effectiveness of cancer immunotherapies. Studies have shown that modifying gut bacteria may enhance immune system activity against tumors, improving patient outcomes. The rising incidence of cancer worldwide, along with increased clinical trials exploring microbiome interventions in oncology, has driven strong demand in this segment. Additionally, pharmaceutical companies are investing in microbiome-enabled therapies, reinforcing oncology as the largest application area.

The pharmaceutical & biotech companies segment held the largest revenue share in the market because they play a central role in translating microbiome research into commercial therapies. Their capabilities in large-scale production, clinical testing, and regulatory compliance enable faster products. Growing demand for innovative treatments, collaboration with research institutions, and investment in cutting-edge technologies further strengthened their position, making them the primary end-user driving market growth.

The contract research and manufacturing organizations (CROs/CDMOs) segment is projected to witness the fastest growth in the human microbiome market because outsourcing allows companies to access specialized microbiome without heavy upfront investments. These organizations support end-to-end development, from strain identification to clinical-scale production, enabling faster time-to-market. Rising partnership between startups, pharma firms, and CROs/CDMOs, along with growing demand for cost-effective and flexible manufacturing solutions, are key factors driving the rapid expansion of this segment during the forecast period.

In 2024, North America led the dental imaging market because of the early adoption of innovative imaging solutions, such as 3D cone-beam CT and digital X-rays, in dental practices. The region benefits from a high number of dental clinics, skilled professionals, and strong R&D investments by key manufacturers. Additionally, rising awareness about preventive dental care and the integration of advanced imaging technologies into routine diagnostics helped boost demand, allowing North America to secure the largest revenue share in the market.

The U.S. market is growing due to increasing awareness of gut health and its impact on overall wellness, immunity, and chronic disease management. Rising investments by pharmaceutical and biotech companies in microbiome research, coupled with technological advancements in sequencing and bioinformatics, are accelerating product development. Additionally, the growing prevalence of gastrointestinal disorders, cancer, and metabolic diseases drives demand for microbiome-based therapeutics, probiotics, and personalized nutrition solutions, positioning the U.S. as a leading market globally.

The Canadian market is expanding due to growing consumer awareness of gut health and its role in immunity and overall wellness. Increased government and private investments in microbiome research, along with advancements in diagnostics and therapeutics, are fueling innovation. Additionally, the rising prevalence of chronic and lifestyle-related diseases is driving demand for microbiome-based products, including probiotics, supplements, and personalized treatments, supporting steady market growth in Canada.

The Asia-Pacific market is projected to grow rapidly due to rising investments in microbiome research, increasing availability of advanced healthcare technologies, and growing urbanization, leading to lifestyle-related health issues. Emerging markets like China and India are witnessing higher adoption of probiotics, functional foods, and microbiome-based therapies. Moreover, expanding collaborations between local and international biotech firms, along with government support for innovation in healthcare, are accelerating market development, driving a faster CAGR in the region during the forecast period.

Ongoing clinical trials are exploring how manipulating the human microbiome could help treat diverse diseases and support overall health.

Human microbiome patient support emphasizes educating people about gut health and offering resources to help maintain a balanced microbiome. This involves personalized nutrition guidance, access to scientific and clinical information, and tools that empower patients to actively participate in decisions regarding their healthcare.

Distribution of human microbiome products, such as therapeutics, diagnostics, and supplements like probiotics and prebiotics, is expanding to reach hospitals and pharmacies.

In April 2025, Metabolon introduced a combined metagenomics and metabolite panel aimed at simplifying microbiome research workflows. Dr. Karl Bradshaw, Chief Business Officer at Metabolon, stated, “Metabolon is now a one-stop solution for obtaining high-quality metagenomics and metabolomics data, integrated and visualized through an intuitive bioinformatics platform.” He added that this integration allows researchers to gain deeper insights into the microbiome than either method alone, emphasizing that metabolomics complements metagenomics by quickly revealing the biological effects of microbiome changes.

By Therapeutic Indication / Application Area

By End-User / Buyer

By Region

February 2026

February 2026

February 2026

February 2026