February 2026

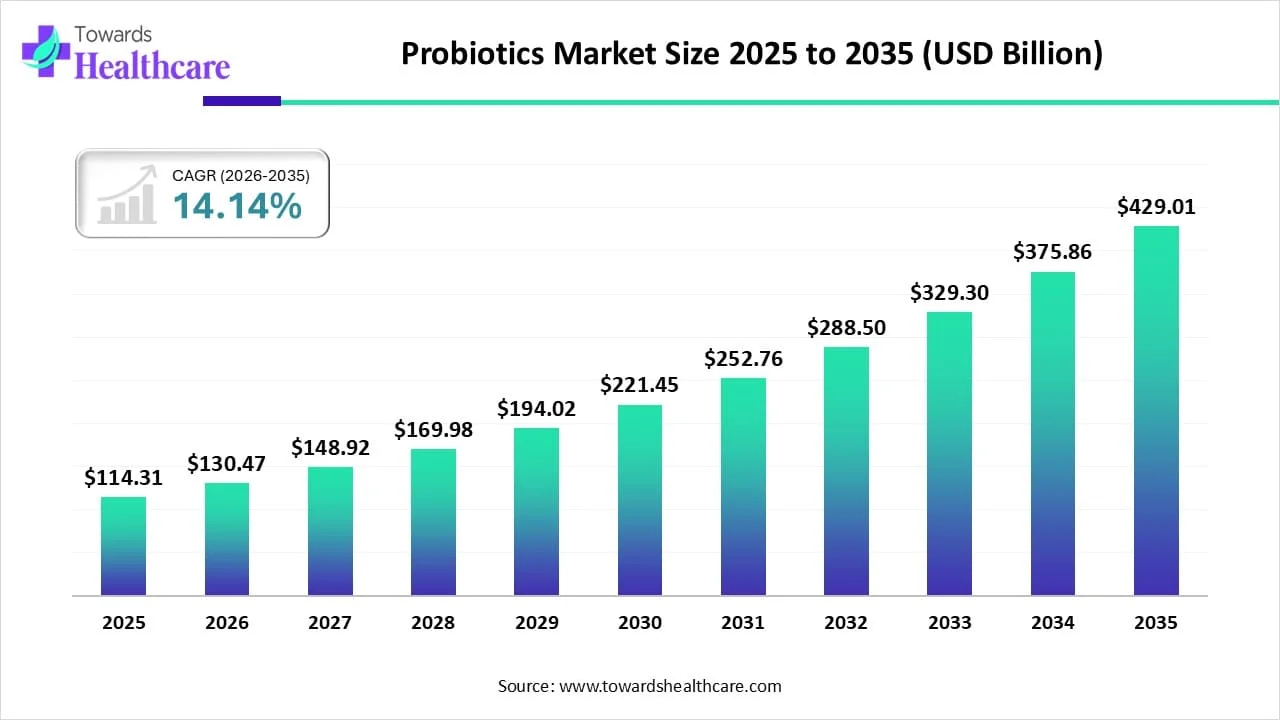

The global probiotics market size is calculated at USD 114.31 billion in 2025, grew to USD 130.47 billion in 2026, and is projected to reach around USD 429.01 billion by 2035. The market is expanding at a CAGR of 14.14% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 114.31 Billion |

| Projected Market Size in 2035 | USD 429.01 Billion |

| CAGR (2026 - 2035) | 14.14% |

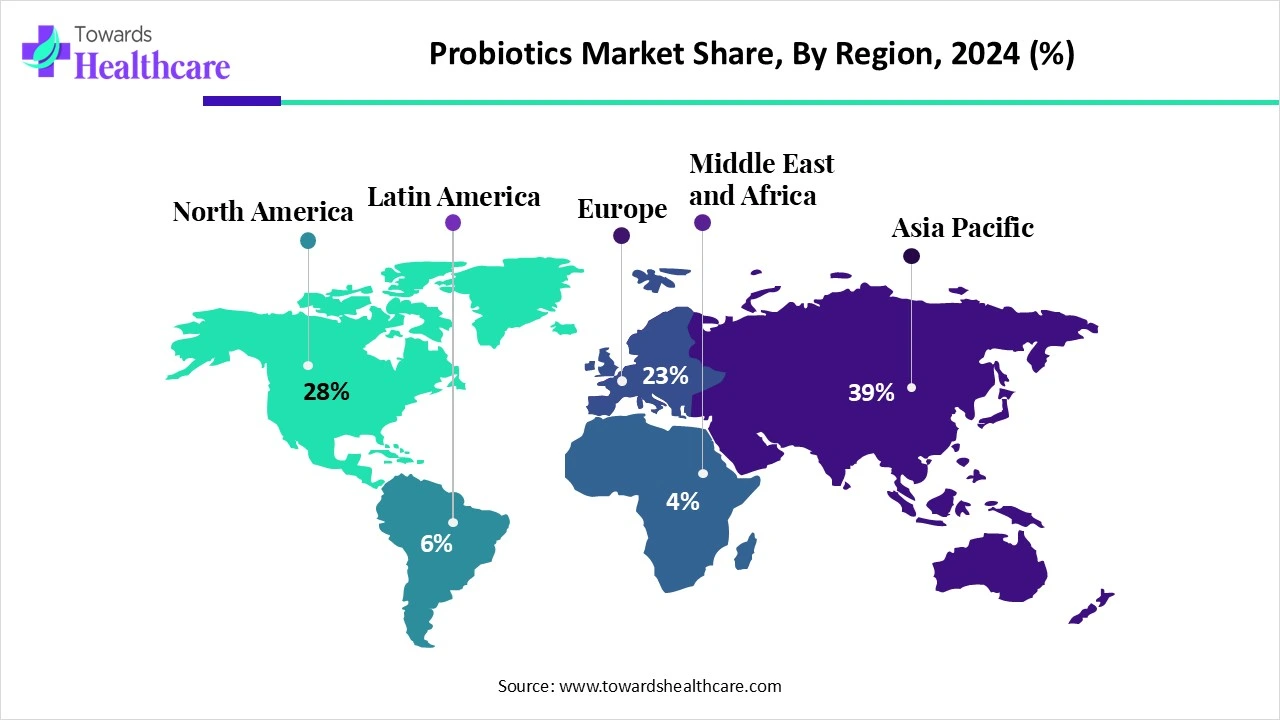

| Leading Region | Asia Pacific share by 39% |

| Market Segmentation | By Product, By Ingredient, By End-use, By Distribution Channel, By Region |

| Top Key Players | Arla Foods, BioGaia, Chr. Hansen Holding A/S, Danone, DuPont De Nemours, Inc., General Mills, Inc., i-Health, Inc., Lallemand Inc., Lifeway Foods Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Kerry Group plc, Nestle S.A., Probi AB, Yakult Honsha Co., Ltd. |

Probiotics are single or mixed cultures of live microorganisms that enhance the properties of the host's natural microflora when given to humans or animals. One of the most urgent issues of the twenty-first century is the need to feed a growing human population while using limited natural resources. According to the literature, the role that a balanced diet plays in preserving human health is a major area of interest for the scientific community. Recent and ongoing research in microbiome science is creating new study pathways for probiotics, and clinical investigations will provide fresh insights into their effects on human health.

With automatic strain optimization, scalable data processing, and quick, high-precision screening, artificial intelligence performs better than traditional techniques. AI models have been shown in case studies to identify bacteria with over 97% accuracy and to discover metabolites more quickly. AI increases the speed and precision of probiotic screening, opening up new avenues for probiotic development and industrialization as well as quick, extensive functional analysis of genetic data.

Rising Awareness About Gut Health

People are keen to purchase goods that help their digestive systems as they become more aware of the importance of gut flora in general health. A natural substance that improves gut health by rebalancing the microbiota, probiotics are becoming more and more well-liked by customers who are concerned about their health. Food and drink items that offer more than just nutrients are gaining popularity among consumers. Functional foods, such as probiotic-containing products, are thought to be a valuable way to support bodily systems and fend off illness.

Contamination Risk

The compounds found in probiotics, which are live bacteria, are reliant on the probiotics' production. It is expected that the development of probiotic goods would be limited by the possibility of contamination by very harmful bacteria.

Is Microbiome Research Useful for the Probiotics Market?

Numerous studies have been conducted and published in esteemed scientific publications regarding the benefits of diet for maintaining general health. Promising therapeutic potential for probiotics has been uncovered by exciting developments in microbiome science, which has raised research expenditures and prompted the creation of novel products. In-depth knowledge of microbial ecosystems propels market expansion and broad use in the medical field.

By product, the probiotic food & beverages segment dominated the probiotics market in 2024. This segment dominated because consumers are now increasingly aware of functional foods that are healthier and more nutrient-dense than traditional foods due to the growing scientific and innovative research. The concept behind functional foods is the use of probiotics, which support better immune function, cognitive responsiveness, and overall health. Functional meals, also referred to as future foods, are excellent at offering health advantages beyond simple nourishment.

By product, the probiotic dietary supplements segment is expected to grow at the fastest CAGR in the probiotics market during the predicted time. Similar to vitamins, probiotics may be purchased as supplements. The advantages are exaggerated by the manufacturers. These include a healthier digestive tract, a more robust immune system, weight loss, and a lower risk of cancer. Some people with Crohn's disease, irritable bowel syndrome, or other health issues may benefit from probiotics found in food or supplements. Probiotic supplements can be created according to dietary preferences, gut microbiota, and other factors as customized medicine gains traction.

By ingredient, the bacteria segment was dominant in the probiotics market in 2024. This segment dominated due to the significance of good bacteria in promoting human gut health and influencing the immune system. Numerous bacteria may be present in probiotics. Bacteria from the Lactobacillus and Bifidobacterium families are the most prevalent. Yeasts like Saccharomyces boulardii and other microorganisms can also be utilized as probiotics. One of the several organizations supporting microbiome research is the National Center for Complementary and Integrative Health (NCCIH). NCCIH-supported researchers are investigating the relationships between dietary ingredients and intestinal microbes. The emphasis is on how interactions between the microbiome and nutrition may result in the synthesis of compounds that have positive health benefits.

By ingredient, the yeast segment is estimated to grow at a significant rate in the probiotics market during the forecast period. In recent years, the potential health advantages of yeasts as probiotics have drawn more attention. New strains of yeast with probiotic qualities are being actively sought after by researchers. This research is broadening the range of possible probiotic yeasts beyond the already researched Saccharomyces boulardii. According to research, some yeast strains have qualities that may help treat ailments like allergies, skin diseases, irritable bowel syndrome, and inflammatory bowel disease.

By end-use, the human probiotics segment held the major share of the probiotics market in 2024. One of the most crucial methods for modifying the gut microbiota for human health is the dietary administration of probiotics. Probiotics can be used to promote gut health in humans. Additionally, a combination of prebiotics has been suggested. As a result, the market for probiotics has expanded quickly, with efforts being made to include them in food and supplements. Probiotic consumption has been suggested as a way to boost immunity and overall health.

By end-use, the animal probiotics segment is anticipated to grow significantly in the probiotics market during the predicted time frame. Over the past 15 years, probiotic usage for agricultural animals has grown significantly. The enhancement of animal health, growth, and output performance is still greatly influenced by biotechnological developments in nutrition and animal health. Many of the problems that cattle production faces globally have been lessened by these biotechnological developments, particularly the use of direct-fed microbials, commonly known as probiotics, whether they are genetically engineered or not. These developments lead to animals that are healthy.

By distribution channel, the hypermarkets/supermarkets segment led the probiotics market in 2024. This segment dominated because supermarkets and hypermarkets are the traditional sales channels for consumer products as well as packaged food and drink items. Probiotic drink shot bottles are frequently offered in cartons of five, twelve, or fifteen bottles. Because they provide sales and discounts, probiotics are thus purchased from supermarket/hypermarket chains including Walmart, Costco, Kroger, and Schwarz Gruppe. As a result, these shops are among the most important sales channels in the global probiotic beverage industry.

By distribution channel, the online stores segment is expected to witness the fastest growth in the probiotics market during 2025-2034. Online shopping has become an essential and unavoidable aspect of lifestyle due to the exponential increase in digital literacy and awareness. Online shopping was previously very popular, but since the pandemic, it has definitely taken center stage and is now one of the most popular and preferred ways for most individuals to make purchases.

Asia Pacific dominated the probiotics market share by 39% in 2024. Due to the aggressive strategies of the multinational firms, the area is witnessing a significant increase in consumer consciousness. Strong demand from India and China contributes to the overall shift. Regional growth is also expected to be aided by the growing population, rising disposable income, and improved standard of living. Additionally, it is projected that the ongoing research and development efforts for the development of new strains with a broad variety of treatment options and the ability to withstand high temperatures would support the growth of the regional market during the projection period.

Demand for probiotics is rising globally, especially in China, as people seek functional ingredients in food and drink items that might enhance their health. The DSM-Firmenich half-year performance report for 2024 was made public. As to the research, DSM-Firmenich's revenues climbed by 7% on an annual basis to reach €3.2 billion in the first half of 2024. With a 25% increase, adjusted EBITDA reached €513 million. Consequently, the firm has increased its full-year projection to €2 billion due to the excellent business momentum.

India took part in the 44th meeting of the Codex Committee on Nutrition and Foods for Special Dietary Uses (CCNFSDU), which took place from October 2–6, 2024, in Dresden, Germany. India was a major contributor and made important contributions in important agenda areas. It extended its support for the development of standardized probiotic recommendations for foods and dietary supplements and offered insightful information on nutritional reference values for individuals aged 6 to 36 months. New Zealand, Canada, Chile, and a number of other nations supported India's position.

North America is estimated to host the fastest-growing probiotics market during the forecast period. Manufacturers' ongoing investments in the food and beverage and pharmaceutical sectors are probably going to help the region's industry expand. The major companies in the area are also spending money on research and development in order to provide new goods that will appeal to customers of all ages and genders. Thus, it is anticipated that all of these factors would drive the probiotics market's expansion in the upcoming years.

Sorting between the science and science fiction of this developing sector is a major task for the U.S. Food and Drug Administration. Owing to the intense interest and quickly developing research in this area, the FDA and the National Institutes of Health jointly offer workshops to discuss products based on microbiomes and how altering the microbiome may be used to cure or prevent a wide range of illnesses.

According to studies, up to 13–20% of Canadians may be impacted at any given moment. A Canadian has a 30% chance of developing IBS throughout their lifetime. Although the cause is yet unknown, IBS appears to affect women far more commonly than men in Canada and the majority of Western countries. In Canada, chronic IBS is a prevalent issue that can significantly affect an IBS sufferer's quality of life. Many patients have found that using high-potency probiotics to modify their gut microbiota is a useful therapy option for managing some of the main symptoms of IBS.

Europe is expected to grow significantly in the probiotics market during the forecast period. As more people in Europe become aware of the health advantages of probiotics and the wide range of products available, the sector is seeing a significant rise in market share. Furthermore, the highest market share in Europe was held by the UK probiotics industry. The European Food Safety Authority (EFSA) in the EU evaluates the health claims made by probiotic products.

Despite Germany's adherence to the European Commission's understanding that the term "probiotic" should only be used as a health claim, probiotics are nonetheless widely used in this nation. In Germany, 38% of respondents said they eat probiotic foods and/or supplements, while over 60% of the German panel said they are aware of what probiotic foods and supplements are. The words "live cultures" (74%) and "live bacteria" (66%) are likewise well-known to consumers. 80% of the public panel said that they would prefer to have the probiotics' indication on the container.

About three-quarters of a billion pounds is spent on probiotics in the UK. One of the biggest markets is the UK food and beverage production sector, where there is a growing need for many probiotic products, especially for use in functional foods and drinks. Growing public knowledge of the many health advantages linked to probiotic use is the main factor driving the market's expansion in the UK. Businesses in the probiotics industry have focused on the UK market, taking advantage of positive consumer attitudes and current trends.

The Middle East & Africa are expected to grow at a considerable CAGR in the probiotics market in the upcoming period. The increasing demand for health awareness and the use of self-medication are the major growth factors of the market in the Middle East & Africa. The growing research and development activities and favorable government support boost the market. The presence of favorable regulatory policies also facilitates the development of probiotics. The rapidly expanding food and beverage production sector, owing to the increasing use of foods and drinks, augments market growth.

According to a recent cross-sectional study in western Saudi Arabia, out of the 697 people involved, 50.2% had already used probiotics in their lives. Another 29.3% of participants agreed that consuming probiotics in all forms is safe for one’s health. Approximately 71.5% of respondents were willing to use probiotics if they were recommended by a healthcare professional. (Source: International Journal of Medicine in Developing Countries)

In March 2024, according to Nikkhil K. Masurkar, CEO of ENTOD Pharmaceuticals, gut flora is essential for controlling immunological responses and inflammation in allergic rhinitis. Research from all around the world has demonstrated that nasal allergy responses can be brought on by an unbalanced and diseased gut flora. Certain lactic acid bacteria strains that have been identified by our research and development team have been demonstrated to stabilize intestinal microflora and enhance its biodiversity, which in turn stabilizes the nasal mucosa and regulates allergic responses in the nose. (Source - Pharma.com)

By Product

By Ingredient

By End-use

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026