Revenue, 2025

USD 31.45 Billion

Forecast, 2035

USD 56 Billion

Inhaler Solution Market Size, Trends and Key Players with Dynamics

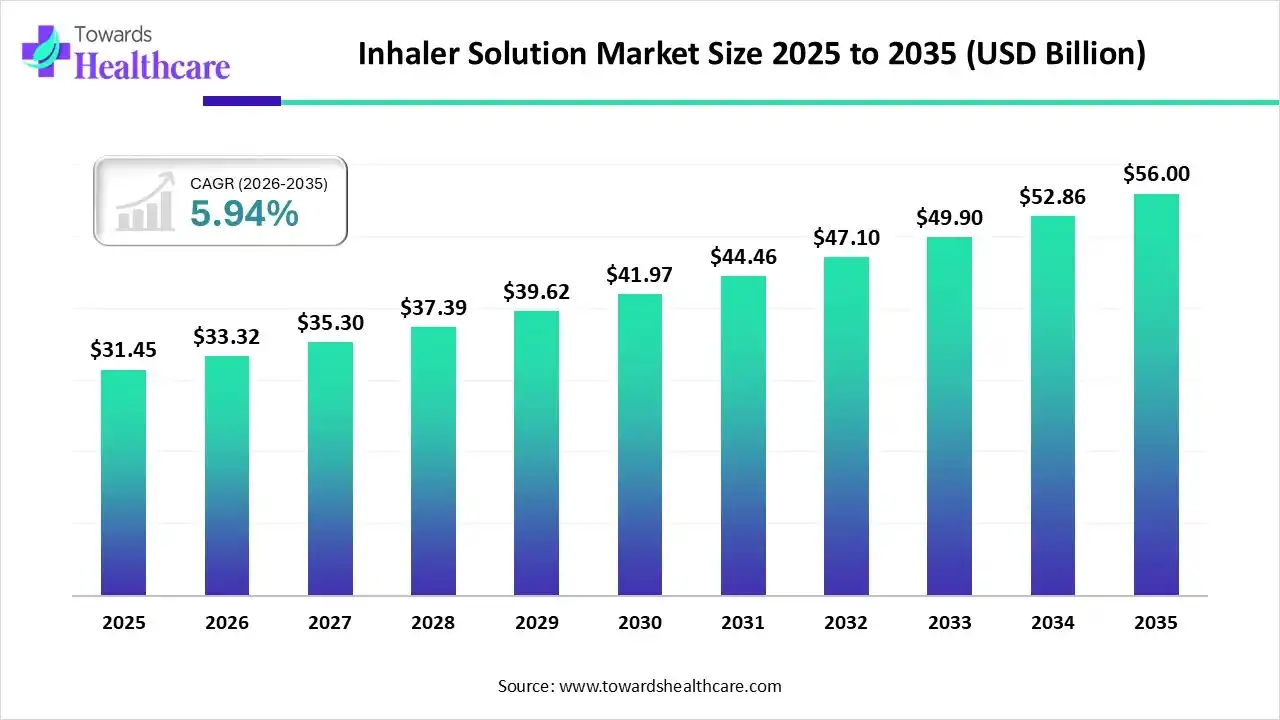

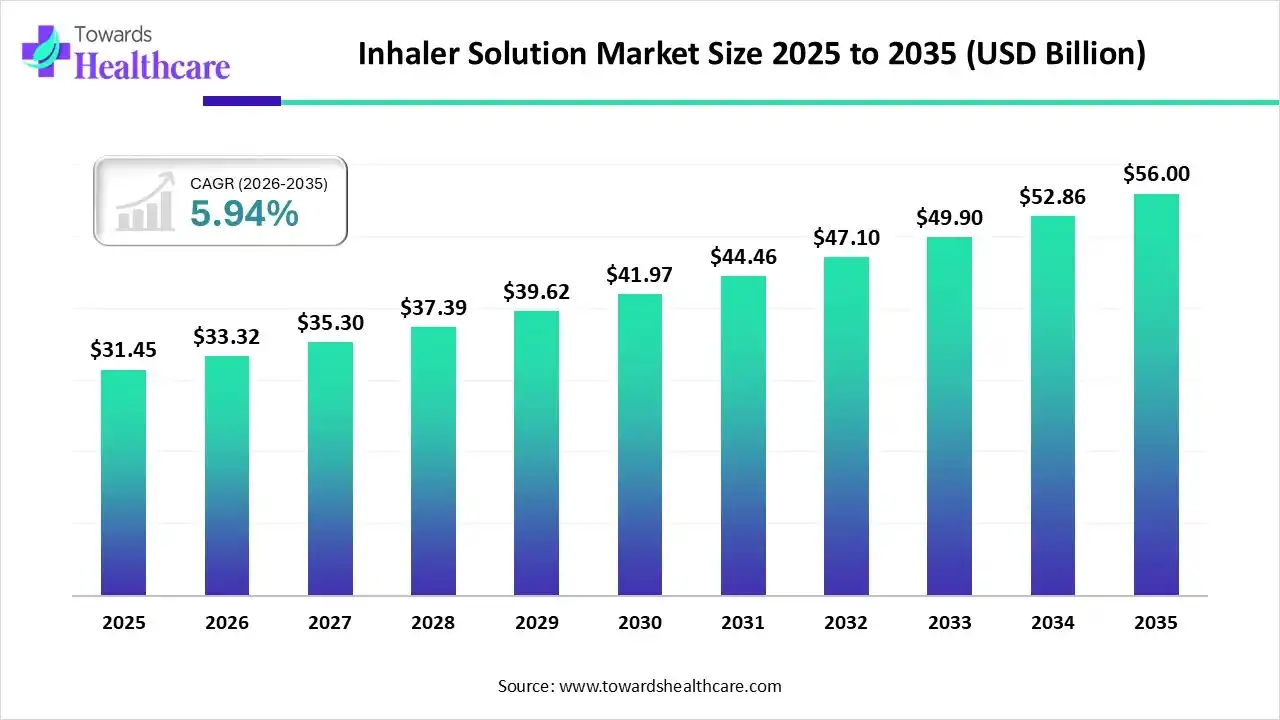

The global inhaler solution market size was estimated at USD 31.45 billion in 2025 and is predicted to increase from USD 33.32 billion in 2026 to approximately USD 56 billion by 2035, expanding at a CAGR of 5.94% from 2026 to 2035.

The inhaler solution market is growing due to its rapid onset of action and reduced systemic side effects. It relieves symptoms of respiratory issues such as COPD, asthma, or cystic fibrosis, making breathing easier and enhancing the functions of the lungs.

Key Takeaways

- Inhaler solution industry poised to reach USD 33.32 billion by 2026.

- Forecasted to grow to USD 56 billion by 2035.

- Expected to maintain a CAGR of 5.94% from 2026 to 2035.

- North America dominated the inhaler solution market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By inhaler type, the pressurized metered-dose inhalers (pMDIs) segment dominated the market in 2025.

- By inhaler type, the soft mist inhalers (SMIs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By drug class, the combination therapies segment led the market in 2025.

- By drug class, the LAMA/LABA segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the asthma segment led the inhaler solution market in 2025.

- By application, the cystic fibrosis segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the retail pharmacies segment led the market in 2025.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast period.

Key Indicators and Highlights

| Key Elements |

Scope |

| Market Size in 2026 |

USD 33.32 Billion |

| Projected Market Size in 2035 |

USD 56 Billion |

| CAGR (2026 - 2035) |

5.94% |

| Leading Region |

North America |

| Market Segmentation |

By Inhaler Type, By Drug Class, By Application, By Distribution Channel, Regional Outlook |

| Top Key Players |

Boehringer Ingelheim, GSK, AstraZeneca, Novartis, Chiesi Farmaceutici, Mundipharma, Orion Corporation |

Market Overview: What is Mental Health Treatment?

- The inhaler solution market involves the research, development, production, and distribution of drugs and inhalers intended for pulmonary (lung) drug delivery. These devices allow you to breathe medicine in via the mouth, directly to the lungs. Various types of inhalers include metered-dose, dry powder, and soft mist inhalers. They generally treat asthma and COPD, but physicians prescribe them for various conditions.

- Inhaled drugs significantly enhance breathing control for patients with COPD and asthma. Inhaled formulations provide efficient medicines which delivered directly to the lung tissue, thus improving efficacy and reducing side effects. It offers a continuous and extended delivery of medication over a period of time, enabling patients to breathe in the mist at their own pace.

How is AI Governing the Inhaler Solution Market?

The integration of AI-driven technology into the inhaler solution drives the growth of the market as AI-based technology, specifically ML, improves asthma management by analysing data from wearables, inhalers, and patient records to predict exacerbations, stratify challenges, and inform targeted treatment. The sensors gather inhaler use information without interruption of the use of the inhaler or troublesome the medication delivery pathway. They are compatible with market-leading inhalers. An AI-based inhaler is effective in monitoring inhalation processes and frequency, capturing parameters like flow acceleration, inhalation flow rate, inhalation volume, inspiration time, and the patient’s handling of the inhaler.

Future Outlook Trends in the Inhaler Solution Market

- Smart Inhalers: Smart inhalers provide patient-focused feedback, reminders, and the strength to targeted treatment regimens, which could predominantly enhance asthma control.

- Eco-Friendly Solutions: DPIs and SMIs have a substantially smaller carbon footprint than do pMDIs. It also provides environmental advantages as it comes from refillable inhalers and longer treatment packages.

- Advanced Drug Formulations: Nanoparticle formulations have many benefits over formulations containing larger particles. Smaller particle size enables a larger number of drug molecules found at the surface rather than inside the particle, with a huge surface area

Government Initiatives

- In July 2025, Sheikh Shakhbout Medical City (SSMC), a flagship hospital in the UAE for serious and complex care and a subsidiary of the PureHealth group, has today announced its collaboration with global biopharmaceutical company AstraZeneca to launch the ‘Pure Air Solution’ (PAS) initiative.

- In December 2025, the Government of India adopted a strategy of Co-location of Ayush facilities at Primary Health Centres (PHCs), Community Health Centres (CHCs), and District Hospitals (DHs), thus enabling choice to the patients for different systems of medicines under a single window.

Segmentation Analysis

Inhaler Type Insights

Which Inhaler Type Led the Inhaler Solution Market in 2025?

In 2025, the pressurized metered-dose inhalers (pMDIs) segment held the dominant market as it metered dose inhalers (MDIs) have offered a reliable, versatile, instantly available, self-contained, low-cost, portable medical aerosol delivery system. MDIs are a practical and efficient strategy for delivering medicines straight to the airways, providing rapid relief from bronchospasm and inflammation.

Soft Mist Inhalers (SMIs)

Whereas the soft mist inhalers (SMIs) segment is the fastest-growing in the market, as they are well-matched with most biologic constructions, improving the shelf life and stability of multifaceted biologics. SMIs enbles for a longer and slower release of aerosol with a smaller ballistic effect. The soft mist inhaler (SMI) was intended to improve drug delivery to the lungs and lower the need for patient management.

Drug Class Insights

Why did the Combination Therapies Segment Dominate the Market in 2025?

The combination therapies segment is dominant in the inhaler solution market in 2025, as it offers low enzymatic exposure, reduced systemic side effects, avoids first-pass metabolism, and concentrated drug amounts at the site of the disease, making it an ideal route for the treatment of pulmonary diseases. A combination inhaler contains two or more medicines in one inhaler. This could be a dry powder inhaler (DPI) or a pressurised metered dose inhaler (pMDI).

LAMA/LABA

Whereas the LAMA/LABA segment is the fastest growing in the market, as LABA inhalers support some patient with long-term lung conditions such as asthma and COPD (chronic obstructive pulmonary disease) to manage their symptoms. It offers a greater enhancement in lung function than LTRAs as an add-on to ICS.

Application Insights

Why did the Asthma Segment Dominate the Market in 2025?

The asthma segment is dominant in the inhaler solution market in 2025, as inhalers are small devices that transport asthma medicine and direct it straight into the lungs. This supports open airways more quickly or keeps them open longer time. Inhalers are an effective way for people with asthma and other lung diseases to access life-saving drugs.

Cystic Fibrosis

Whereas the cystic fibrosis segment is the fastest growing in the market, as it has proven effectiveness in predominantly enhancing lung function, and respiratory symptoms like cough, wheeze, and sputum production. Inhalation of drugs for the treatment of CF-associated lung disease proven to be extremely effective.

Distribution Channel Insights

Why did the Retail Pharmacies Segment Dominate the Market in 2025?

The retail pharmacies segment is dominant in the inhaler solution market in 2025, as it offers a broad selection of medicines and supplementary health products, and tackles diverse healthcare requirements. With inclusive services, including pharmacy and mail order choices, retail pharmacies streamline the medication access procedure. Retail pharmacies are a significant part of health systems and, in major countries, are accountable for dispensing a massive proportion of health products and associated services.

Online Pharmacies

Whereas the online pharmacies segment is the fastest growing in the market, as online pharmacies involves to enhnacing healthcare results and lowering disparities in access to significant treatments. Online pharmacies often provide a more widespread selection of products and medications. It is a significant expense savings for the customer. By operating in a digital space, these platforms often have reduced overhead expenses compared to brick-and-mortar pharmacies.

Regional Distribution

- North America registered dominance in the inhaler solution market in 2025.

- The U.S. led the market by capturing the largest revenue share of the market in 2025.

- Europe is expected to be the fastest-growing region in the studied years.

- The UK is anticipated to grow at a rapid CAGR during the forecast period.

- Asia Pacific held a notable share in 2025 and is expected to grow significantly in the coming years.

- India is expected to grow at a lucrative CAGR during 2026-2035.

How did North America Dominate the Market in 2024?

In 2025, North America led the inhaler solution market, as rising government support, such as the American Lung Association (ALA), is a non-profit, national, voluntary health organization intended to the prevention, cure, and control of all types of lung disease, like asthma, tuberculosis, emphysema, and lung cancer. The growing prevalence of morbidity and mortality in this region is expected to be related to decades of economic and social policies, which drive the growth of the market.

For Instance,

- In December 2025, Amneal Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved the Company’s albuterol sulfate inhalation aerosol (90 mcg per actuation). The product is the generic equivalent of PROAIR HFA, a registered trademark of Teva Respiratory LLC.

U.S. Market Trends

In the U.S., over 35 million people in America are alive with chronic lung diseases such as asthma and COPD. In 2025, there were 226,650 patients diagnosed with lung cancer. There are up to 44 million cases of acute respiratory diseases such as pneumonia, flu, RSV, and COVID-19 every year. Lung cancer is the leading cause of cancer deaths in the U.S., which drives the demand for inhaler services.

Europe: Growing Chronic Respiratory Diseases

Europe is set to experience rapid growth in the inhaler solution market, as growing chronic respiratory disease in Europe comprise air pollution (14% of CRD deaths), extreme temperatures (over 11%), work-related exposure (8%), second-hand smoke (3%), also mould, wildfire smoke and allergenic pollens, which drives the growth of the market. The EU Green Deal aims to drive sustainability in the manufacturing, use, and disposal of products, which encourages the acceptance of ecological propellants and circular economy models for healthcare tools, which drives the growth of the market.

U.K. Market Trends

Asthma is a common condition in the UK. In the UK, 7.2 million people have asthma. This is about 8 in every 100 people, and 1.7 million people are living with COPD in the UK, and about 600,000 are alive and undiagnosed, which increases the requirement of inhaler.

Asia Pacific: Increasing disposable incomes in the Asia Pacific

Asia Pacific is experiencing substantial growth in the inhaler solution market, as growing middle-class populations with increasing disposable incomes are seeking progressive and targeted healthcare services, fuelling the acceptance of inhalers. Extensive research has supported the indication linking town pollution to the onset and exacerbation of diseases, like respiratory conditions; all factors drive the growth of the market.

India Market Trends

Growing prevalence of COPD in India among adults. This increases the need for robust and uniform healthcare technology. India contributes to 13% of the asthma prevalence, it has a threefold higher mortality rate and more than twofold higher DALYs, representing a substantial gap in asthma treatment and diagnosis.

Value Chain Analysis of the Inhaler Solution Market

R&D

- R&D includes molecule selection, formulation optimization, device engineering, aerosol performance testing, stability studies, usability design, manufacturing scale-up planning, intellectual property filing, and preclinical safety evaluations, ensuring efficacy and inhaler performance.

- Companies involved: GSK, AstraZeneca, Boehringer Ingelheim, Novartis, Chiesi, and device partners like 3M and Aptar.

Clinical Trials & Regulatory Approvals

- Clinical development involves phase I–III trials, bioequivalence studies, human factor testing, pharmacovigilance planning, regulatory dossier preparation, inspections, labeling approval, and post-approval commitments to demonstrate safety, quality, and therapeutic effectiveness globally.

- Companies involved: GSK, AstraZeneca, Novartis, alongside CROs such as IQVIA, Parexel, PPD, and regulatory consultants.

Patient Support & Services

- Patient support covers onboarding education, inhaler technique training, adherence monitoring, digital reminders, refill coordination, reimbursement assistance, pharmacovigilance reporting, customer helplines, and outcomes tracking to improve persistence, satisfaction, and real-world effectiveness.

- Companies involved: AstraZeneca, GSK, Novartis, Propeller Health, Adherium, and specialty pharmacy service providers.

Latest Updates of Key Players in the Inhaler Solution Market

| Company |

Headquarters |

Latest Update |

| Boehringer Ingelheim |

Germany |

In December 2025, Boehringer Ingelheim announced a broad agreement with the U.S. Government to lower the cost of medicines for American patients and expand its U.S. footprint. |

| GSK |

United Kingdom |

In October 2025, GSK announced positive pivotal phase III data for the next-generation low-carbon version of Ventolin (salbutamol) metered dose inhaler. |

| AstraZeneca |

United Kingdom |

In July 2025, AstraZeneca progresses Ambition Zero Carbon programme with Honeywell partnership to develop next-generation respiratory inhalers. |

| Novartis |

Switzerland |

MyClientsPlus was a longstanding, affordable EHR built for mental health providers, particularly solo and small-group practices |

| Chiesi Farmaceutici |

Italy |

In December 2025, Chiesi announced the submission of the Carbon Minimal pressurised metered-dose inhaler containing beclometasone in 100 mcg and 200 mcg strengths to the UK Medicines and Healthcare products Regulatory Agency. |

| Mundipharma |

United Kingdom |

In October 2025, Mundipharma announced completion of patient enrolment for the ongoing, global Phase III ReSPECT trial evaluating REZZAYO |

| Orion Corporation |

Finland |

In December 2025, Orion Corporation was informed that it would receive a milestone payment of EUR 180 million related to sales of Nubeqa. |

SWOT Analysis

Strengths

- Inhalers are a useful way for patients with asthma and other lung diseases to access life-saving medications.

- Improvements in using inhalation devices more effectively, in inhaler design for supporting patient compliance, and advances in inhaler processes to assure drug delivery to the lungs.

- Dry powder inhalers (DPIs) are small portable devices considered simple to use in that negligible patient input is required for actuation and inhalation.

Weaknesses

- Metered-dose inhalers depend on fuel to supply medication, which poses risks for patients with sensitivities or allergies to propellant elements.

- When inhaler solution unsettling to experience muscle cramps or spasms, particularly if they wake up in the middle of the night.

Opportunities

- Significant development in inhalation delivery technology to improve daily treatment routines, enhance patient compliance, and optimize drug availability and delivery. Advancements have been made in production technology, drug delivery approaches, and device improvements.

- Smart inhalers alert patients to missed or repeat doses and remind patients to take their doses on time, conveniently and automatically, depending on the time of the last dose. These reminders can arrive wherever the patient is.

- The applications of telemedicine positively affect asthma management by enhancing symptom control, patients’ quality of life, and devotion to the treatment program.

Threats

- Inhaler solution needs precise timing of pressing the canister and inhaling; it is challenging for kids, the elderly, or those with motor problems.

- Using long-acting bronchodilators without inhaled steroids for asthma increases asthma-associated death.

Recent Developments in the Inhaler Solution Market

- In December 2025, CorriXR Therapeutics, ChristianaCare’s first commercial biotherapeutics spinout, launched a major collaboration with InhaTarget Therapeutics and Merxin Ltd to develop an inhaled genetic therapy for lung cancer.

- In November 2025, Glenmark Pharmaceuticals launched the world's first nebulised, fixed-dose triple therapy for Chronic Obstructive Pulmonary Disease (COPD). The product, Nebzmart GFB Smartules and Airz FB Smartules, combines Glycopyrronium, Formoterol, and Budesonide to reduce airway obstruction and inflammation, improving lung function.

- In May 2025, Ritedose Pharmaceuticals, a division of The Ritedose Corporation, was approved by the US Food and Drug Administration (FDA) to manufacture and market generic formoterol fumarate inhalation solution, a treatment for chronic obstructive pulmonary disease (COPD) and other respiratory ailments.

- In July 2025, Aptar Pharma announced its acquisition of the clinical trial materials manufacturing capabilities of Mod3 Pharma from SWK Holdings. This strategic move strengthens Aptar’s support for early-stage drug development by offering formulation, fill, and finish services for Phase 1 and 2 clinical trials.

Segments Covered in the Report

By Inhaler Type

- Pressurized Metered-Dose Inhalers (pMDIs)

- Dry-Powder Inhalers (DPIs)

- Soft Mist Inhalers (SMIs)

By Drug Class

- ICS

- LAMA/LABA

- SAMA/SABA

- Combination Therapies

By Application

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Cystic Fibrosis

- Others

By Distribution Channel

- Retail Pharmacies

- Institutional / Hospital Pharmacies

- Public

- Private

- Online Pharmacies

Regional Outlook

- North America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- South Korea

-

- Latin America

- Brazil

- Argentina

- Middle East and Africa (MEA)

- South Africa