March 2026

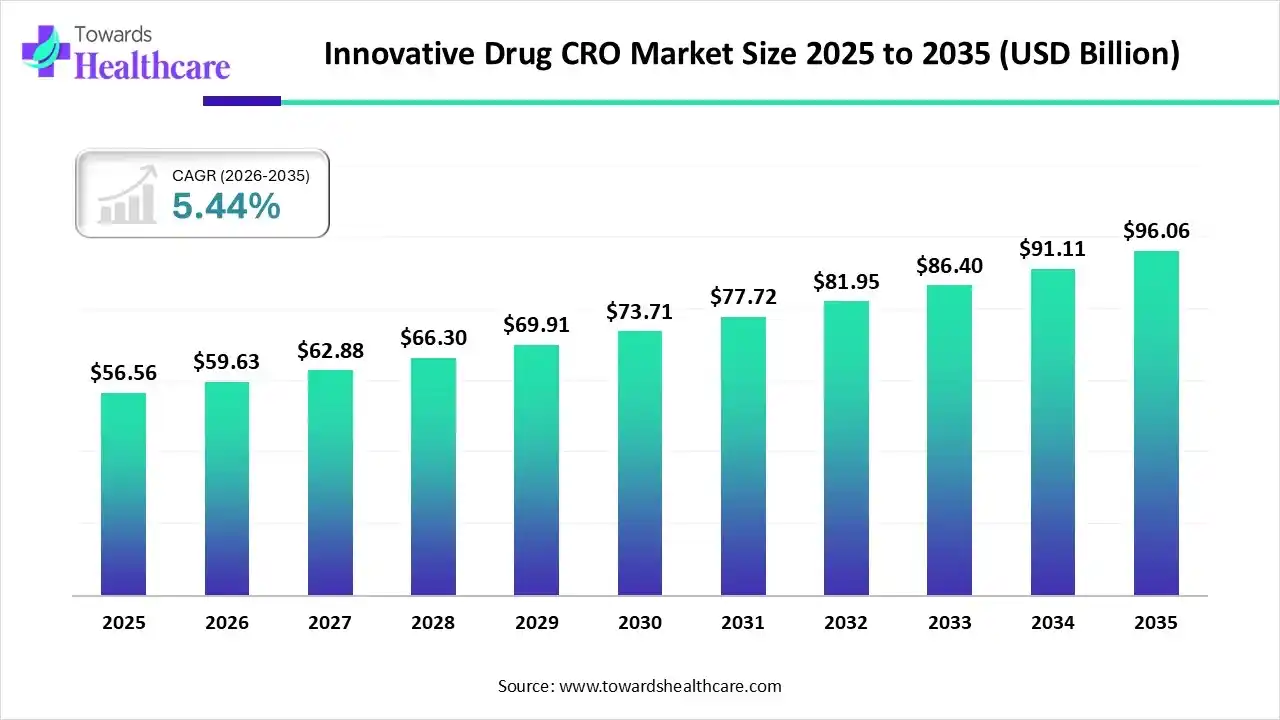

The innovative drug CRO market size was reported at US$ 56.56 billion in 2025 and is expected to rise to US$ 59.63 billion in 2026. According to forecasts, it will grow at a CAGR of 5.44% to reach US$ 96.06 billion by 2035.

The innovative drug CRO market is primarily driven by the increasing investments and the growing need for novel drugs. The rising collaboration among key players enables them to access advanced technologies and develop innovative medicines faster. The increasing adoption of CRO services in emerging markets, such as APAC, Latin America, and the Middle East & Africa, bolsters market growth. Integrating artificial intelligence (AI) in CROs streamlines research activities. The rise of decentralized clinical trials presents future opportunities for innovative drug CROs.

| Key Elements | Scope |

| Market Size in 2026 | USD 59.63 Billion |

| Projected Market Size in 2035 | USD 96.06 Billion |

| CAGR (2026 - 2035) | 5.44% |

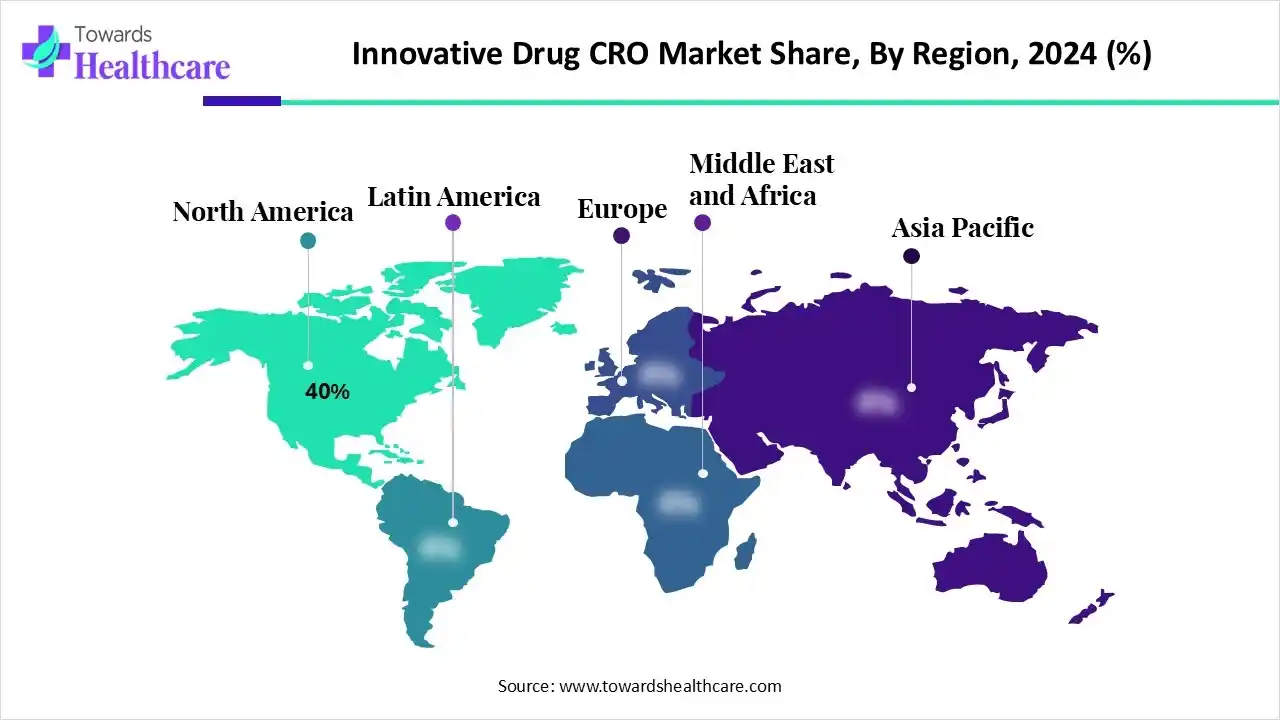

| Leading Region | North America by 40% |

| Market Segmentation | By Service Type, By Therapeutic Area, By End-User, By Business Model, By Technology/Platform Adoption, By Region |

| Top Key Players | Charles River Laboratories, PPD (Thermo Fisher), Medpace, WuXi AppTec, PRA Health Sciences, Pharmaron, Eurofins Scientific, Bioclinica, SGS Life Sciences, Kendle International, Frontage Laboratories, Celerion, Pharmaceutical Product Development (PPD), CTI Clinical Trial & Consulting Services |

The innovative drug CRO market is fueled by increasing R&D outsourcing, rising costs of in-house drug development, and the need for specialized expertise in emerging therapeutic areas. It comprises organizations that provide outsourced research services to pharmaceutical, biotechnology, and academic institutions for the development of novel drugs. CROs support the full spectrum of drug development activities, from research to regulatory consulting. CROs enhance efficiency, reduce timelines, and ensure regulatory compliance for innovative drug pipelines.

AI can revolutionize numerous operations in a CRO, including drug discovery, preclinical studies, clinical trials, and regulatory compliance. It enables CROs to accelerate processes and improve efficiency and accuracy. AI and machine learning (ML) algorithms analyze vast amounts of data and provide real-time updates about several operations. They predict which patients are more likely to experience adverse events in clinical trials. However, the use of AI in CROs is still in its early phase, improving the way new treatments are developed and brought to market.

The Indian government’s National Biopharma Mission focuses on strengthening clinical trial capacities for testing biologicals and vaccines, establishing a data management system for enhanced data analysis and reporting.

The European Union established the Accelerating Clinical Trials in the European Union (ACT EU) initiative to support smarter clinical trials through regulatory, technological, and process innovation. The EU aims to support the transformation of clinical trials and enable collaboration and innovation at all stages of the clinical research lifecycle.

The Saudi Food and Drug Authority (SFDA) supports healthcare innovation through a series of regulatory and technological initiatives, including advancing clinical trials, evaluating cell and gene therapies, and approving innovative medical devices. The SFDA is also developing an integrated electronic system for automated clinical trial submissions.

| Country | Regulatory Agency | New Drug Approval (2024) | Clinical Trials (as of October 10, 2025) |

| United States | Food and Drug Administration (FDA) | 50 | 186,073 |

| China | National Medical Products Administration (NMPA) | 228 | 46,159 |

| Europe | European Medicines Agency (EMA) | 114 | 103,483 |

| India | Central Drugs Standard Control Organization (CDSCO) | 21 | 6,159 |

By service type, the clinical development services segment held a dominant presence in the market with a share of approximately 50% in 2024, due to the increasing number for decentralized and large-scale clinical trials. Decentralized clinical trials require a strong network of healthcare services across diverse geographical locations. CROs provide tailored services to biotech companies by managing complex clinical trials. As of October 10, 2025, 81,983 clinical trials were registered on the clinicaltrials.gov website.

By service type, the laboratory services segment is expected to grow at the fastest CAGR in the market during the forecast period. CRO possesses specialized equipment to perform a wide range of activities, including hematology & coagulation, chemistry & immunoassays, genomics & molecular assays, and protein analysis. The advent of automated systems expedites the development of innovative drugs, enabling traceability and reproducibility of data. Automated solutions perform various functions, from sample tracking and scheduling to analysis.

By therapeutic area, the oncology segment held the largest revenue share of approximately 35% in the market in 2024, due to the rising prevalence of cancer and increasing cancer research. Cancer imposes significant health and economic burden on patients and the healthcare sector. This necessitates researchers to develop novel therapeutics for cancer treatment. The World Health Organization (WHO) projected over 35 million new cancer cases in 2050. The oncology sector accounts for 45% of the biopharma industry’s annual R&D spend.

By therapeutic area, the rare diseases segment is expected to grow with the highest CAGR in the market during the studied years. Biopharma companies collaborate with CROs for rare disease drug development as the latter possess specialized infrastructure. CROs offer unique challenges of small and dispersed population and navigate complex regulations of orphan drugs. It is estimated that more than 300 million individuals in the world are suffering from rare diseases.

By end-user, the pharmaceutical companies segment contributed the biggest revenue share of approximately 45% in the market in 2024, due to the increasing development of small-molecule drugs and growing research activities. Pharmaceutical companies partner CROs to streamline their research activities, from medicinal chemistry and analytical chemistry to pharmacology. CROs enable pharma companies to launch novel drugs faster, reducing their time-to-market approval. This enables pharma companies to expand their product pipeline and strengthen their market position.

By end-user, the biotechnology companies segment is expected to expand rapidly in the market in the coming years. Biotech companies focus on developing targeted therapeutics, such as cell and gene therapies, monoclonal antibodies, and vaccines. Small biotech companies are resource-constrained necessitates them to outsource their services to CROs. CROs can help biotech companies prepare for and mitigate risks, ensuring smoother clinical trials, faster regulatory approvals, and optimal commercial positioning.

By business model, the full-service CROs segment led the market with a share of approximately 50% in 2024, due to the need for centralizing all activities with a single provider. Full-service CROs eliminate the need for multiple vendors for managing projects. They improve communication and governance with their clients. They offer customization, ensuring that trial strategies can be tailored to sponsor needs and adjusted as studies evolve. Thus, full-service CROs can lead to faster problem-solving and greater flexibility.

By business model, the specialty/niche CROs segment is expected to witness the fastest growth in the market over the forecast period. Niche CROs provide specialized solutions for a particular problem, offering greater flexibility. They can offer customized solutions in a focused service area. High-level specialization provides valuable insights and develops in-depth therapeutic expertise. They adopt advanced technologies to provide personalized services.

By technology/platform adoption, the electronic data capture (EDC) & e-clinical platforms segment accounted for the highest revenue share of approximately 35% in the market in 2024, due to the ability to develop faster results. EDC and eClinical platforms streamline the data storage and analysis of clinical trials. They integrate data from EHR, eCRF, laboratory, wearables, and other devices and manage all trial components in one place. Additionally, they monitor study progress and outcomes in real-time.

By technology/platform, the artificial intelligence/machine learning platforms segment is expected to show the fastest growth over the forecast period. AI and ML enhance CRO efficiency and revolutionize clinical trials. They expedite trials through scientific and operational improvements. They assist healthcare professionals in patient selection, monitoring patient progress, and providing real-time updates. They lead to cost-efficiency, enhance stakeholder engagement, and inform decision-making with deeper insights.

North America dominated the market with a share of approximately 40% in 2024. The availability of state-of-the-art research and development facilities, robust healthcare infrastructure, and the presence of a strong base of life science companies are the major growth factors of the market in North America. Favorable regulatory policies lead to the launch of novel drugs. Government organizations launch initiatives to support advanced research and clinical trials.

Key players, such as IQVIA, Charles River Laboratories, and LabCorp, are the major contributors to the market in the U.S. Precision for Medicines, a U.S.-based CRO, won the Fierce CRO Award in 2025 for Innovative Solutions in Drug Development. There were more than 3,000 biotech companies in the U.S. as of 2024. The U.S. conducts the highest number of clinical trials globally, making it a suitable location for drug development CROs.

Canada accounts for 4% of global clinical trials and is the G7 leader in clinical trial productivity. As of October 10, 2025, a total of 30,993 clinical trials were registered on the clinicaltrials.gov website. Roche Canada, Lambda CRO, and NuChem Sciences are some leading CROs in Canada. Health Canada is the competent authority responsible for drug approvals, clinical trial approvals, oversight, and inspections in Canada.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.Government organizations provide funding to leverage advanced technologies and conduct research activities in pharma and biotech companies. The burgeoning pharmaceutical and biotech sectors and increasing collaborations among key players contribute to market growth. Countries like China, India, and Japan are emerging as global hubs in clinical trials due to affordable services.

China’s biotech sector has evolved significantly over the past decades, leading the healthcare innovation. Public funding in the sector amounted to CNY 20 billion (EUR 2.6 billion) in 2023. In 2023, China was the top country for most-cited papers in the field of synthetic biology, genomic sequencing and analysis, and biomanufacturing. The Patent Cooperation Treaty (PCT) granted 1,918 biotech patents, surpassing the EU.

Japan has one of the most developed biotech sectors in the world. It has Asia’s largest bioinformatics database, promoting its significance in the medical and pharmaceutical sectors. The Japanese government actively supports healthcare innovation by introducing new policies to expedite clinical trials for innovative treatments. There were 8,740 clinical trials in Japan.

By Service Type

By Therapeutic Area

By End-User

By Business Model

By Technology/Platform Adoption

By Region

March 2026

March 2026

February 2026

February 2026