February 2026

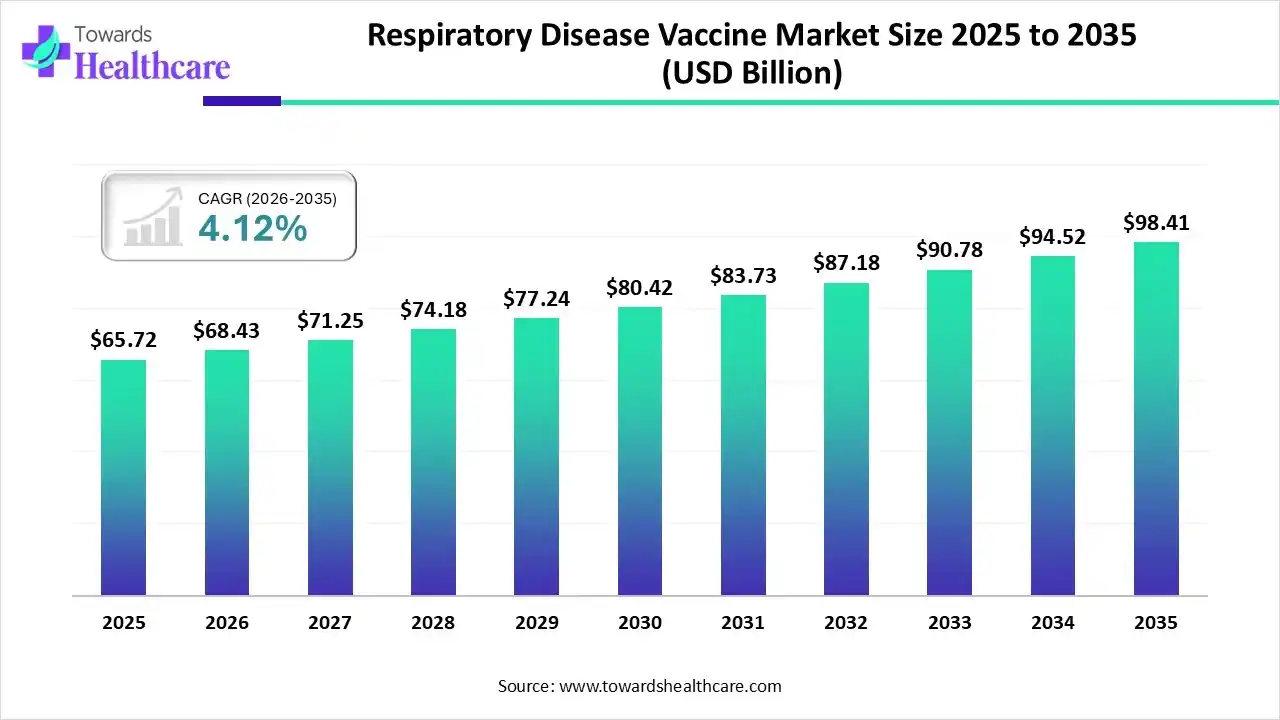

The global respiratory disease vaccine market size is calculated at USD 65.72 billion in 2025, grew to USD 68.43 billion in 2026, and is projected to reach around USD 98.41 billion by 2035. The market is expanding at a CAGR of 4.12% between 2026 and 2035.

The respiratory disease vaccine market is primarily driven by the increasing prevalence of respiratory diseases and the growing awareness of disease prevention. Vaccine manufacturing is favored by rapid adoption and pipeline expansion of mRNA and recombinant platforms. Increasing R&D investments and favorable regulatory policies augment the market. Artificial intelligence (AI) assists researchers in designing novel vaccines and determining their efficacy.

| Key Elements | Scope |

| Market Size in 2025 | USD 65.72 Billion |

| Projected Market Size in 2035 | USD 98.41 Billion |

| CAGR (2026 - 2035) | 4.12% |

| Leading Region | North America |

| Market Segmentation | By Target Disease/Indication, By Vaccine Technology/Platform, By Age Group/Indication Population, By Route/Formulation, By End-User, By Region |

| Top Key Players | Sanofi Pasteur, Seqirus (CSL Group), Bharat Biotech, Serum Institute of India, Novavax, Valneva, Sinovac Biotech, Sinopharm, Bavarian Nordic, Medicago, Inc., SK Bioscience, Anhui Zhifei Longcom |

The respiratory disease vaccine market is experiencing robust growth, driven by public-health vaccination programs, seasonal immunization campaigns, pandemic preparedness, technological innovations, and demographic aging. It comprises vaccines and vaccine delivery technologies developed to prevent or reduce the severity of infectious respiratory diseases, notably influenza, pneumococcal disease, respiratory syncytial virus (RSV), SARS-CoV-2 (COVID-19), pertussis (whooping cough), and other viral/bacterial respiratory pathogens. Includes vaccine development (platforms and formulations), manufacturing (bulk antigen, adjuvants), distribution & immunization programs, and related services (cold chain, surveillance).

AI plays a vital role in the respiratory disease vaccine market by generating effective vaccines and addressing challenges in conventional vaccine development, such as high cost and time-consuming nature. AI and machine learning (ML) algorithms can help predict and detect the target epitopes that activate the immune system. They can analyze vast amounts of data and predict immunological response to a particular vaccine. Moreover, AI and ML can streamline the manufacturing and supply chain for respiratory disease vaccines, ensuring effective distribution to a larger population.

Which Target Disease/Indication Segment Dominated the Respiratory Disease Vaccine Market?

The influenza vaccines segment held a dominant presence in the market with a share of approximately 36% in 2024, due to the rising incidence of seasonal influenza and the availability of broad target populations, such as children, adults, and the elderly. The U.S. reported 489,579 influenza cases during the 2024-25 influenza season, with peak activity observed during the week ending February 2025. As of 2024, three types of influenza vaccines are available: inactivated, recombinant, and live attenuated vaccines.

Respiratory Syncytial Virus (RSV) Vaccines

The respiratory syncytial virus (RSV) vaccines segment is expected to grow at the fastest CAGR in the respiratory disease vaccine market during the forecast period. RSV vaccines are rapidly expanding commercial opportunities for both maternal and older-age immunization programs. They reduce the risk of severe respiratory illnesses, such as pneumonia and bronchiolitis. They are mostly given to pregnant women and older adults 75 years and above.

Pneumococcal Vaccines (PCV & PPSV)

The pneumococcal vaccines segment is expected to grow notably, driven by rising pneumonia incidence and growing demand for pediatric immunization. UNICEF reported 1,400 pneumonia cases per 100,000 children annually in the world. Pneumococcal vaccines are available in conjugate (PCV) and polysaccharide (PPSV) forms for adults and children. They help protect against pneumococcal infections, including invasive disease.

Why Did the Inactivated/Split & Subunit Vaccines Segment Dominate the Respiratory Disease Vaccine Market?

The inactivated/split & subunit vaccines segment held the largest revenue share of approximately 40% in the market in 2024, due to lower chances of virulent activity, ease of production, and high stability. Inactivated vaccines are available in three forms such as whole virus, split virus, and subunit virus. They are highly preferred as they reduce infectivity and prevent the infection. Unlike live vaccines, they do not replicate and are not contraindicated for immunocompromised individuals.

mRNA Vaccines

The mRNA vaccines segment is expected to grow with the highest CAGR in the respiratory disease vaccine market during the studied years. The demand for mRNA vaccines is increasing due to advances in genomic technologies and recent FDA approvals. The COVID-19 pandemic has witnessed a surge in mRNA vaccine development, benefiting the global population. In August 2024, the U.S. FDA approved and granted emergency use authorization (EUA) for updated mRNA COVID-19 vaccines.

Recombinant Protein/Virus-Like Particle (VLP) Vaccines

The recombinant protein/virus-like particle (VLP) vaccines segment is expected to grow in the coming years, especially for RSV and influenza infections. Recombinant vaccines are made using bacterial or yeast cells through recombinant technology. Several studies have demonstrated the efficacy of recombinant F protein vaccines against severe RSV-related lower respiratory tract diseases.

How the Pediatrics Segment Dominated the Respiratory Disease Vaccine Market?

The pediatrics segment contributed the biggest revenue share of the market in 2024, due to favorable immunization programs for pediatrics and increasing awareness. Children receive vaccines against influenza, pneumococcal, pertussis, and measles to reduce acute respiratory infections. The Centers for Disease Control and Prevention (CDC) research found that routine vaccinations for children born during 1994-2023 will have prevented about 508 million illnesses, 32 million hospitalizations, and saved over 1.1 million lives.

Maternal Immunization

The maternal immunization segment is expected to expand rapidly in the respiratory disease vaccine market in the coming years. Maternal immunization is essential for pregnant women to prevent infection in the mother and fetus. It helps pregnant women to pass on disease-specific antibodies to the fetus during the second and early third trimesters. This protects the infant during the most vulnerable time of life.

Adults & Elderly

The adults & elderly segment is expected to show lucrative growth, due to the need for RSV, influenza, pneumonia, and COVID-19 immunization in the adult and elderly population. Adults are becoming more aware of the importance of vaccinations. The increasing travel to international countries also potentiates the need for travel vaccines. Favorable government initiatives propel the segment’s growth.

What Made Intramuscular Injection the Dominant Segment in the Respiratory Disease Vaccine Market?

The intramuscular injection segment accounted for the highest revenue share of the market in 2024, due to high absorption and a strong immune response. Intramuscular injections are administered into the muscle through the skin and subcutaneous tissue. They are rapidly absorbed and have high bioavailability for precise dosage delivery. They have a reduced risk of adverse effects.

Intranasal/Mucosal

The intranasal/mucosal segment is expected to witness the fastest growth in the respiratory disease vaccine market over the forecast period. Intranasal administration of respiratory disease vaccines can prevent people from virus infection, replication, shedding, and disease development. Intranasal vaccines enhance patient convenience and accessibility, reducing injection site adverse effects. They can reduce the risk of injury and cross-contamination with pathogens.

Patch/Needle-Free

The patch/needle-free segment is expected to grow significantly, due to the growing need to reduce needlestick injuries and increasing awareness of targeted delivery of vaccines. Needle-free/patch vaccines enhance patients’ treatment compliance, reducing pain or swelling at the injection site. They also eliminate the need for skilled professionals to deliver vaccine dosages, facilitating self-administration.

Which End-User/Distribution Channel Segment Led the Respiratory Disease Vaccine Market?

The public health programs/government immunization campaigns segment led the market in 2024, due to favorable government support and rising collaboration among intergovernmental organizations. Some programs and campaigns provide free vaccines to people, especially from low- and middle-income groups. They focus on universal immunization, reducing the economic burden of respiratory diseases on the healthcare sector.

Retail Pharmacies & Occupational/Workplace Vaccination

The retail pharmacies & occupational/workplace vaccination segment is expected to show the fastest growth over the forecast period. Retail pharmacies have a favorable infrastructure and suitable capital investment to store and manage vaccines. Workplace vaccination refers to offering accessible, convenient, and efficient immunization services to employees through partnerships with employers.

Hospitals & Clinics

The hospitals & clinics segment is expected to grow in the upcoming years. Hospitals & clinics have skilled professionals to guide patients about vaccination and administer vaccines. They are dominant for the high-risk and elderly population. Several government and private hospitals possess specific vaccines for different respiratory diseases.

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, a robust healthcare infrastructure, and the presence of key players are the factors that govern market growth in North America. Favorable government support and the increasing adoption of advanced technologies foster the market. Government and private bodies provide funding to favor the development and manufacturing of vaccines.

The CDC reported that RSV is the leading cause of hospitalization in the U.S. Hence, appropriate measures are taken to improve vaccination among the elderly. The Infectious Diseases Society of America (IDSA) developed rapid guidelines for the use of U.S.-licensed vaccines against COVID-19, influenza, and RSV in adult and pediatric patients to support evidence-based clinical & shared decision-making during the 2025-2026 respiratory tract infection season.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. Government organizations raise awareness about disease prevention and vaccination among the general population. The increasing prevalence of respiratory diseases and the growing pediatric and geriatric populations augment the market. The rising collaboration among key players and public-private partnerships propels market growth. The MCRI’s Asia-Pacific Vaccine Research Network supports vaccine research and policy in LMICs to boost immunization equity.

India has a suitable manufacturing infrastructure, encouraging foreign companies to set up their manufacturing facilities in the nation. The burgeoning biotech sector and the increasing number of biotech startups also contribute to market growth. As of February 2025, there are over 9,000 biotech startups in India. Bharat Biotech and Serum Institute of India are major local vaccine manufacturers in India.

Europe is considered to be a significantly growing area, due to favorable regulatory support, established adult and pediatric programs, and strong procurement budgets. The European Medicines Agency (EMA) regulates the approval of vaccines in Europe. The region has a strong presence of biotech companies, facilitating vaccine manufacturing. Most European HCPs view vaccination against respiratory disease to be an essential tool for self-protection and patient care.

Key players, such as GlaxoSmithKline and AstraZeneca, are UK-based companies that are the major contributors to the market globally. The UK government formed the Moderna Innovation and Technology Centre, in collaboration with Moderna, to invest £1 billion in UK R&D. This investment will support Moderna to make millions of vaccines for seasonal viruses like COVID-19 and help build a Britain that’s more resilient to pandemics.

The respiratory disease vaccine market in South America is expanding due to rising influenza and pneumonia cases. Governments are prioritizing vaccination campaigns, with improved distribution networks and awareness programs ensuring wider access, especially in rural areas affected by respiratory infections.

Brazil’s respiratory disease vaccine market thrives on government-backed immunization drives and strong public healthcare infrastructure. Increasing adult vaccination coverage and high incidence of influenza and RSV cases are accelerating demand for advanced vaccines, strengthening Brazil’s leadership in respiratory vaccine adoption and distribution nationwide.

The Middle East and Africa are witnessing significant growth in respiratory disease vaccination, supported by increasing investments in healthcare systems and disease awareness programs. With respiratory infections among the leading regional health burdens, immunization strategies are focusing on both preventive coverage and vaccine innovation.

The GCC respiratory disease vaccine market is growing rapidly, supported by strong government initiatives, modern healthcare policies, and public awareness. High prevalence of influenza and pneumonia cases drives large-scale vaccination programs, reinforcing the region’s commitment to respiratory health advancement.

The latest research activities involve developing novel vaccines to deal with viral variants and developing novel drug delivery systems for vaccines.

Key Players: AstraZeneca, Pfizer, and Dr. Reddy’s Laboratories.

Clinical trials are conducted to assess the safety and efficacy of vaccines and study their immune responses in preventing respiratory diseases.

Key Players: GlaxoSmithKline, Medicago, Inc., and Janssen Vaccines & Prevention B.V.

Vaccines are delivered to hospitals and retail pharmacies, either directly through manufacturers or through wholesalers or distributors.

Key Players: FFF Enterprises, Inc., Aark Pharmaceuticals

Patient support & services refer to the focus on education, accessibility, and financial assistance to patients.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Pfizer Biopharmaceuticals Group (Biopharma): Divided into six therapeutic areas/categories: Internal Medicine, Inflammation & Immunology, Oncology, Rare Disease, Hospital (Sterile Injectable Pharmaceuticals and Anti-Infectives), and Vaccines.

Geographic Presence:

Key Offerings (Respiratory Vaccines):

End-Use Industries Served:

Key Developments and Strategic Initiatives:

2022: Completed the acquisition of ReViral, a clinical-stage biopharmaceutical company focused on antiviral therapeutics for Respiratory Syncytial Virus (RSV).

Continues its collaboration with BioNTech for the development and commercialization of mRNA-based vaccines, including updated COVID-19 and combination vaccine candidates.

Development of next-generation mRNA technology platforms to target multiple respiratory pathogens simultaneously (e.g., flu/COVID-19 combination vaccine candidates).

Continues to invest heavily in its manufacturing network to support the global supply of its pneumococcal, COVID-19, and RSV vaccines.

April 2025: Announced the amendment in the marketing authorization for ABRYSVO (RSV vaccine) to include the extension of indication for the prevention of Lower Respiratory Tract Disease (LRTD) caused by RSV in new populations.

Multi-channel approach: Utilizes Hospital Pharmacies and Retail Pharmacies for adult and pediatric vaccinations, and Government Suppliers for national immunization programs globally.

Competitive Positioning:

Recent News and Updates:

Press Releases:

Industry Recognitions/Awards:

Consistently recognized for leadership in vaccine development and manufacturing innovation.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings (Respiratory Vaccines):

End-Use Industries Served:

Key Developments and Strategic Initiatives:

2022: Acquired Affinivax Inc. to enhance its pneumococcal vaccine pipeline, including a next-generation 24-valent pneumococcal vaccine candidate (AFX3772).

June 2023: Announced funding agreement with the Bill & Melinda Gates Foundation and Wellcome to accelerate late-stage development of its tuberculosis vaccine candidate, M72 (TB is a major chronic respiratory disease).

Capacity Expansions/Investments:

Continuously investing in its global manufacturing network to meet high demand for its new and established vaccine products.

Regulatory Approvals:

April 2025: Announced that the CDC's Advisory Committee on Immunization Practices (ACIP) voted to endorse the inclusion of Penmenvy (Meningococcal Groups A, B, C, W, and Y Vaccine) in the adolescent meningococcal vaccination schedule.

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Competitive Positioning:

Recent News and Updates:

Industry Recognitions/Awards:

Frequently recognized for contributions to global immunization and public health, particularly for its innovative adjuvant system.

| Companies | Headquarters | Products | Sales |

| GlaxoSmithKline | London, United Kingdom | Arexvy | £0.3 billion (Q3 2025) |

| Pfizer, Inc. | New York, United States | Abrysvo | $279 million (Q3 2025) |

| Moderna | Massachusetts, United States | mRESVIA | $2 million (Q1 2025) |

| AstraZeneca | Cambridge, United Kingdom | Beyfortus | 1.7 billion euros (FY2024) |

| Merck Group | Darmstadt, Germany | Enflonsia | - |

By Target Disease/Indication

By Vaccine Technology/Platform

By Age Group/Indication Population

By Route/Formulation

By End-User

By Region

February 2026

February 2026

January 2026

January 2026