January 2026

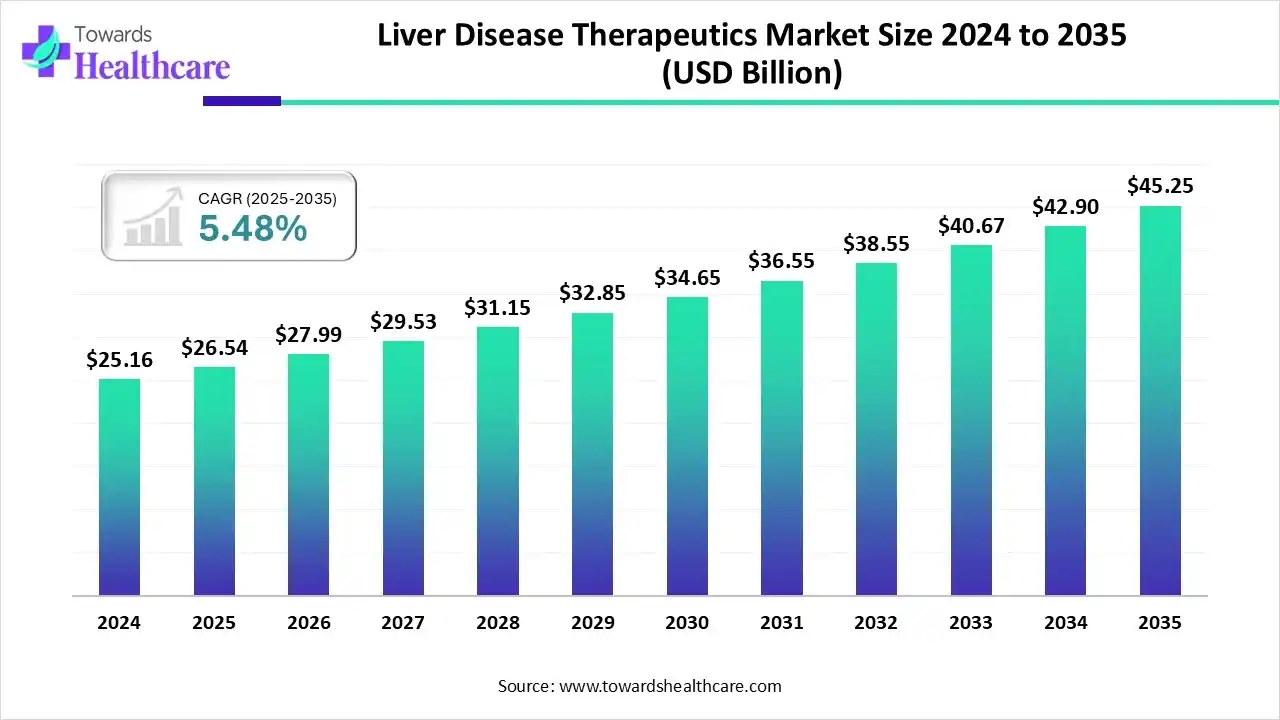

The global liver disease therapeutics market size is calculated at US$ 26.54 billion in 2025, grew to US$ 27.99 billion in 2026, and is projected to reach around US$ 45.25 billion by 2035. The market is expanding at a CAGR of 5.48% between 2026 and 2035.

The rapid aging of the world's population, shifting lifestyles, government and non-governmental organization awareness campaigns, the rise in unhealthy fast food consumption, and increased investment in R&D all contributed to the growth of the global liver disease therapeutics market. The market is expanding due to technological developments in liver disease diagnosis, such as imaging methods, liver function tests, and biomarker-based diagnostics.

| Table | Scope |

| Market Size in 2025 | USD 26.54 Billion |

| Projected Market Size in 2035 | USD 45.25 Billion |

| CAGR (2026 - 2035) | 5.48% |

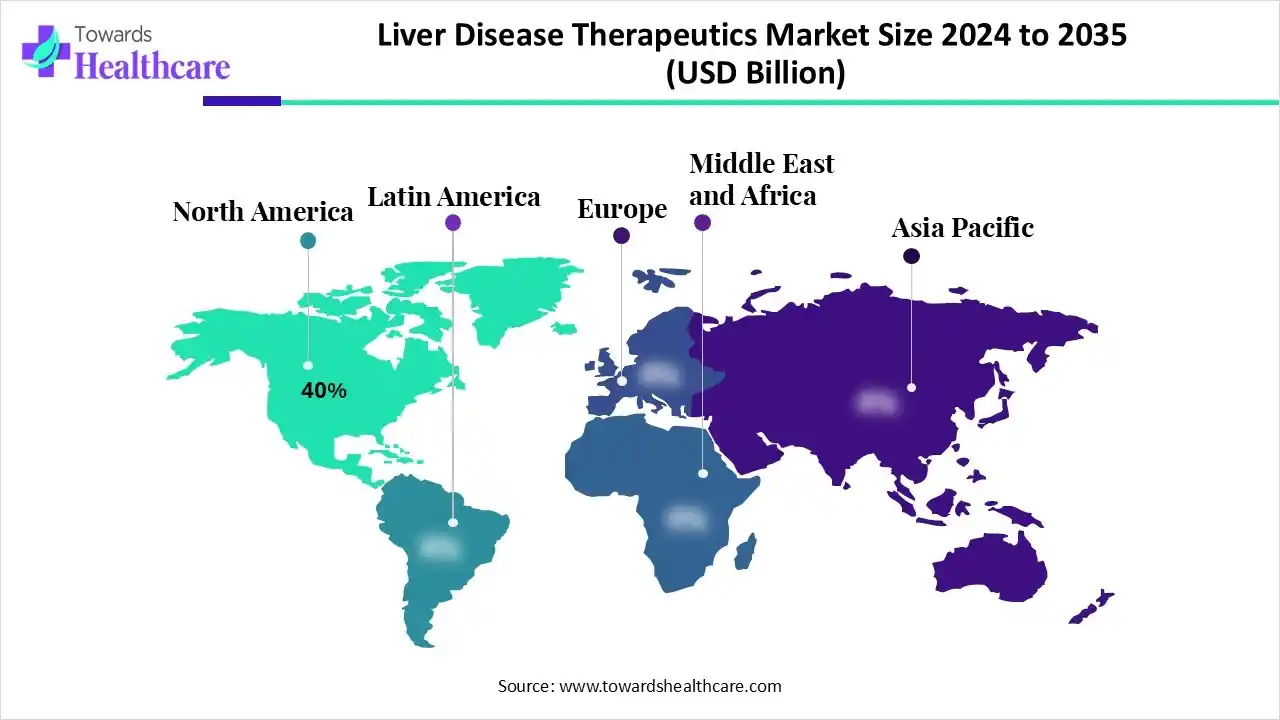

| Leading Region | North America by 40% |

| Market Segmentation | By Indication, By Therapy Type/Mechanism, By Modality/Drug Class, By Route of Administration/Dosage Form, By End-User/Care Setting, By Region |

| Top Key Players | Gilead Sciences, AbbVie, Merck & Co., Roche/Genentech, Bristol-Myers Squibb (BMS), Novartis, Johnson & Johnson (Janssen), Pfizer, Sanofi, Takeda Pharmaceutical, Intercept Pharmaceuticals, Madrigal Pharmaceuticals, Alnylam Pharmaceuticals, Arrowhead Pharmaceuticals, Medivation / Astellas, Eli Lilly, Novo Nordisk, Galmed Pharmaceuticals / Other biotech (representative), Vertex Pharmaceuticals |

The liver disease therapeutics market is driven by global burdens of viral hepatitis and metabolic-associated liver disease, advances in antiviral cures and novel antifibrotic/ metabolic candidates, growing diagnostics and patient awareness, and rising investment into NASH and HCC therapeutics. The market comprises pharmaceuticals, biologics, advanced cell and gene therapies, and supportive care products used to prevent, treat, manage, or slow the progression of liver diseases. Key indications include viral hepatitis (HBV, HCV), non-alcoholic fatty liver disease (NAFLD) and its progressive form, non-alcoholic steatohepatitis (NASH), cirrhosis, hepatocellular carcinoma (HCC), and autoimmune and cholestatic liver diseases.

Every year, liver disease kills more than two million people worldwide. The prevalence of metabolic-associated steatotic liver disease (MASLD) is expected to rise dramatically by 2030 in many areas, contributing to the growing burden of MASLD in 2024. Deaths from viral hepatitis (HBV/HCV) are also a serious concern; by 2030, the WHO wants to reduce mortality by 65%.

The hallmark of clinical care in hepatology is the ability to identify patterns in laboratory data and clinical features. Large language models and machine learning or deep learning are examples of artificial intelligence (AI) tools that offer intriguing ways to support the advancement of care. AI tools offer the chance to replicate the clinician's unconscious decision-making processes and train on large amounts of data.

Which Indication Dominated the Market in 2024?

The viral hepatitis (HBV & HCV) segment led the liver disease therapeutics market in 2024, accounting for approximately 38% of revenue. The World Health Organization's (WHO) 2024 Global Hepatitis Report states that viral hepatitis is becoming a greater cause of death. With 1.3 million deaths annually, the illness is the second most common infectious cause of death worldwide, ranking on par with tuberculosis, which is the leading infectious killer.

Non-Alcoholic Fatty Liver Disease/NASH

The non-alcoholic fatty liver disease/NASH segment is anticipated to showcase the highest CAGR during the studied period. Nearly 30% of people worldwide suffer from nonalcoholic fatty liver disease (NAFLD), a condition that is becoming more prevalent as other metabolic diseases are. NAFLD is extremely common, especially in nations with lower HDI. There is a considerable risk that these people will develop end-stage liver disease due to the continuous rise in adult and pediatric obesity rates worldwide, especially when coexisting NAFLD is present.

Cirrhosis

The cirrhosis segment is growing significantly in the market. Cirrhosis, liver cancer, and other liver disorders are examples of chronic liver diseases (CLD), which continue to be a major global public health concern. They contribute significantly to the burden of mortality, morbidity, and medical expenses.

Why were Antivirals Dominant in the Market in 2024?

The antivirals segment led the liver disease therapeutics market in 2024, accounting for approximately 35% of revenue. Numerous antiviral medications can combat the virus and lessen its capacity to harm your liver. These medications include adefovir (Hepsera), lamivudine (Epivir), tenofovir (Viread), and entecavir (Baraclude).

Antifibrotics/Metabolic Agents

The antifibrotics/metabolic agents segment is anticipated to showcase the highest CAGR during the studied period. There are very few effective treatment options for fibrosis, a common pathological process that can affect almost all of the organs. Over the past few decades, this has sparked a fierce hunt for antifibrotic treatments, and numerous clinical tests are now being conducted.

Immunomodulators & Checkpoint Inhibitors

The immunomodulators & checkpoint inhibitors segment is growing significantly in the liver disease therapeutics market. Hepatocellular (HCC) and biliary tract cancer are among the cancers for which immune checkpoint inhibitors (ICI) have produced ground-breaking advancements in treatment, raising patient survival and enhancing long-standing standards of care.

Why Small-Molecule Therapeutics Dominated the Market in 2024?

The small-molecule therapeutics segment led the liver disease therapeutics market in 2024, accounting for approximately 60% of revenue. Current clinical guidelines from the American Society of Clinical Oncology, European Society for Medical Oncology, and National Comprehensive Cancer Network strongly recommend small-molecule-based targeted therapies (first line: sorafenib and lenvatinib; second line: regorafenib and cabozantinib).

Biologics & Monoclonal Antibodies

The biologics & monoclonal antibodies segment is anticipated to showcase the highest CAGR during the studied period. Because they specifically target underlying mechanisms like inflammation and fibrosis, biologics and monoclonal antibodies are essential in the treatment of liver disease. For ailments like primary biliary cholangitis and autoimmune hepatitis, they provide hope by possibly delaying the course of the illness and enhancing results.

Cell Therapies/Regenerative Approaches

The cell therapies/regenerative approaches segment is growing significantly in the liver disease therapeutics market. Cell-based regenerative therapies employing functional hepatocyte-like cells derived from pluripotent stem cells are being investigated in an effort to create more effective treatments for chronic liver diseases. Thus, it is anticipated that the next generation of regenerative therapies will be cell-based ones that use newly generated or expanded hepatocytes in vitro.

Why was the Oral Segment Dominant in the Market in 2024?

The oral segment led the liver disease therapeutics market in 2024, accounting for approximately 68% of revenue. Significant patient-centric benefits like convenience, ease, and non-invasiveness make oral medications popular for liver disease because they increase patient adherence to long-term treatment plans.

Injectable/Infusible

The injectable/infusible segment is anticipated to showcase the highest CAGR during the studied period. An increasingly popular supportive treatment for liver disease is intravenous therapy. It guarantees quick absorption of vital substances by avoiding the digestive system. IV therapy is given by medical professionals to improve liver function and reduce symptoms.

Topical/Local

The topical/local segment is growing significantly in the liver disease therapeutics market. In order to minimize systemic exposure and lower the risk of adverse effects in other organs, topical/local medications for liver disease, which frequently employ sophisticated delivery systems, are recommended.

Which End-User Dominated the Market in 2024?

The hospitals & tertiary care centers segment led the liver disease therapeutics market in 2024. Because they have access to cutting-edge technology, interdisciplinary specialist teams, and comprehensive care facilities that can handle complicated procedures like liver transplants, hospitals are the preferred option for treating liver disease.

Oncology Centers

The oncology centers segment is anticipated to showcase the highest CAGR during the studied period. Oncology centers such as HCG Manavata Cancer Centre in Nashik, Rajiv Gandhi Cancer Institute & Research Centre (Delhi), and Max Healthcare provide specialized care for liver disease and cancer with advanced therapies like Transarterial Chemoembolization (TACE), chemotherapy, and surgical options like liver resection and transplant. The Cleveland Clinic, Manipal Hospitals, and the Mayo Clinic are other top institutions with liver cancer programs.

Specialist Clinics/Gastroenterology & Hepatology Centers

The specialist clinics/gastroenterology & hepatology centers segment is growing significantly in the market. Prominent international centers for gastroenterology, hepatology, and liver disease treatment are well-known for their multidisciplinary expertise, high success rates, and cutting-edge technology.

North America dominated the liver disease therapeutics market in 2024. The area is known for its advanced medical facilities, high healthcare expenditures, and sizable concentration of well-known biotechnology and pharmaceutical firms. Due to the high incidence of liver diseases in the area, including hepatitis, liver cancer, and non-alcoholic fatty liver disease (NAFLD), there is a significant need for efficient treatments.

About 4,000,000 people in the US are seropositive for HCV, and 270K have a chronic infection, making HCV the most common blood-borne viral disease in the country. In the U.S., 74% of HCV patients have Genotype 1, which has the lowest response rate (up to 50%) to the only medications the FDA has approved to treat it: pegylated interferon with ribavirin. Patients with chronic HCV are the recipients of about half of liver transplants in the U.S.

Asia Pacific is estimated to host the fastest-growing liver disease therapeutics market during the forecast period. A high burden of viral hepatitis is present in countries like China, India, and Southeast Asia because of their large populations and rapidly rising incidence of liver diseases, particularly hepatitis B and C. These countries' low vaccination rates over decades, poor sanitation in some areas, and vertical virus transmission are some of the contributing factors.

Current estimates place the annual number of liver disease deaths in India at about 268,580, or 3.17% of all deaths in the nation. More startlingly, this amounts to 18.3% of liver-related deaths worldwide, placing India as the leading cause of liver disease deaths globally. Fatty liver disease, hepatitis infections, alcohol-induced liver damage, and metabolic disorders linked to lifestyle choices are the main causes of liver disease in India. A poor diet, which is frequently heavy in processed foods, sugar, and unhealthy fats, is a major contributing factor.

Europe is expected to grow at a significant CAGR in the liver disease therapeutics market during the forecast period, caused by aging populations, widespread alcohol use, and the growing prevalence of liver cancer, NAFLD, and hepatitis. National screening programs and increased public health awareness have led to higher early diagnosis rates in the region. Centralized healthcare systems and increased reimbursement coverage are improving access to cutting-edge treatments, such as DAAs and innovative targeted therapies.

Since liver disease is becoming more common in the UK, scientific research into early detection and treatment is more important than ever in order to combat the steadily rising death rate. In the UK, liver disease is predicted to surpass heart disease as the leading cause of premature death, despite the fact that 90% of it is preventable. In Western Europe, the UK currently has one of the highest mortality rates from liver disease.

South America is expected to grow significantly in the liver disease therapeutics market during the forecast period. Consumers and clinicians drive liver therapeutics innovation as diagnostics and access expand across urban centers. Governments and funds support clinical trials and care models, boosting demand for novel treatments and integrated patient management across emerging healthcare landscapes.

Homegrown research and private capital accelerate liver therapeutics development with expanding trial sites and specialised centers. Rising metabolic disease drives treatment innovation, as the ELSA Brasil study found hepatic steatosis prevalence of 35.1% among adults, underscoring urgent clinical needs.

The Middle East and Africa are expected to grow at a lucrative CAGR in the liver disease therapeutics market during the forecast period. Urbanisation and rising obesity propel liver therapeutics interest as healthcare systems expand diagnostics and specialist care. Governments, partners, and industry invest in capacity, regional trials, and workforce development, opening pathways for novel therapies and integrated chronic disease management.

High incomes and healthcare sophistication position the UAE as a premium market for liver therapeutics and personalised care. Projections estimate 372,000 NAFLD cases by 2030 in the UAE, fuelling investment in diagnostics, specialty clinics, and advanced treatment options.

The standard, stringent drug development pipeline, which usually takes more than ten years and consists of five primary stages regulated by organizations like the FDA, is followed in the research and development (R&D) steps for liver disease therapeutics.

Preclinical studies and an IND application are necessary for the development of a treatment for liver disease. Phases 1 (safety), 2 (efficacy/side effects), and 3 (large-scale confirmation) are the stages of clinical trials. A New Drug Application (NDA) and regulatory review (FDA Drug Review) follow from this. Phase 4 measures long-term safety after the product is put on the market.

Liver disease patient support and services include medical, financial, and emotional resources offered by government agencies, non-profits, and healthcare systems to assist in managing the illness and navigating available treatments.

Company Overview:

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Capacity Expansions/Investments:

Significant R&D investment of over $5 billion in 2024 (estimated) across its therapeutic areas.

Regulatory Approvals:

Distribution channel strategy:

Technological Capabilities/R&D Focus:

Innovation Focus Areas:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates (2024-2025):

Company Overview:

Corporate Information (Headquarters, Year Founded, Ownership Type):

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

2024: Acquisition of Landos Biopharma (March 2024) and Cerevel Therapeutics (August 2024) to expand the pipeline in immunology and neuroscience, respectively.

Partnerships & Collaborations:

Product Launches/Innovations:

Capacity Expansions/Investments:

Regulatory Approvals:

Distribution channel strategy:

Utilizes a mix of specialized distribution channels for its HCV and oncology products, ensuring precise patient reach and adherence support.

Technological Capabilities/R&D Focus:

Innovation Focus Areas:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates (2024-2025):

| Company | Focus on Liver Disease Therapeutics | Key Recent Development | Notable Offering | Emerging Strategy |

| Merck & Co. | Viral hepatitis and metabolic liver disease (NASH/MASLD) | Investigational GLP-1/glucagon receptor co-agonist efinopegdutide (MK-6024) received Fast Track designation for NASH in 2024 | Zepatier for chronic HCV and pipeline assets for NASH | Collaboration with Aligos Therapeutics on oligonucleotide therapies for NASH |

| Roche / Genentech | Hepatocellular carcinoma (HCC) and metabolic liver disease | Approved combination of Tecentriq and Avastin for unresectable HCC | First immunotherapy regimen approved for HCC | Acquisition of 89bio for up to USD 3.5 billion to expand into fatty liver treatments |

| Bristol-Myers Squibb (BMS) | Fibrotic liver diseases, including NASH and cirrhosis | Licensed siRNA candidate ND-L02-s0201 from Nitto Denko for advanced fibrosis | Pipeline therapeutics targeting fibrosis pathways | Building a diversified fibrosis portfolio across organs, including the liver |

| Novartis | Non-viral liver diseases, such as NASH and liver regeneration | FXR agonist tropifexor showed biomarker improvements in NASH with fibrosis | Emricasan licensed from Conatus Pharmaceuticals for NASH with advanced fibrosis | Collaboration with Alnylam Pharmaceuticals for siRNA-based therapies to restore liver function |

| Johnson & Johnson (Janssen) | Viral hepatitis (HCV/HBV) and metabolic liver disease | Advanced clinical work on RNAi-based HBV candidate JNJ-3989 and HCV inhibitor portfolio | OLYSIO (simeprevir) for HCV and RNAi candidates for HBV | Expanding RNAi collaboration worth up to USD 3.7 billion with Arrowhead Pharmaceuticals |

Explore further to see how top players are transforming the Liver Disease Therapeutics Market at: https://www.towardshealthcare.com/companies/liver-disease-therapeutics-companies

By Indication

By Therapy Type/Mechanism

By Modality/Drug Class

By Route of Administration/Dosage Form

By End-User/Care Setting

By Region

January 2026

January 2026

January 2026

January 2026