February 2026

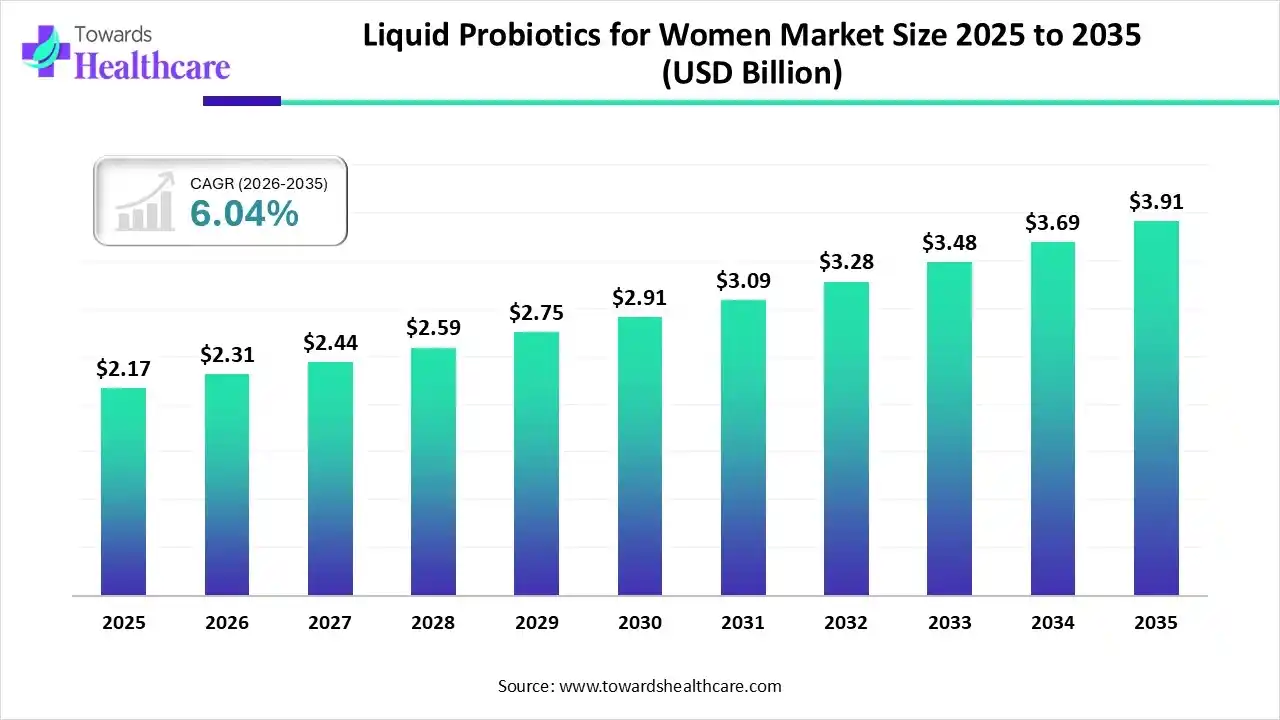

The global liquid probiotics for women market size was estimated at USD 2.17 billion in 2025 and is predicted to increase from USD 2.31 billion in 2026 to approximately USD 3.91 billion by 2035, expanding at a CAGR of 6.04% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.31 Billion |

| Projected Market Size in 2035 | USD 3.91 Billion |

| CAGR (2026 - 2035) | 6.04% |

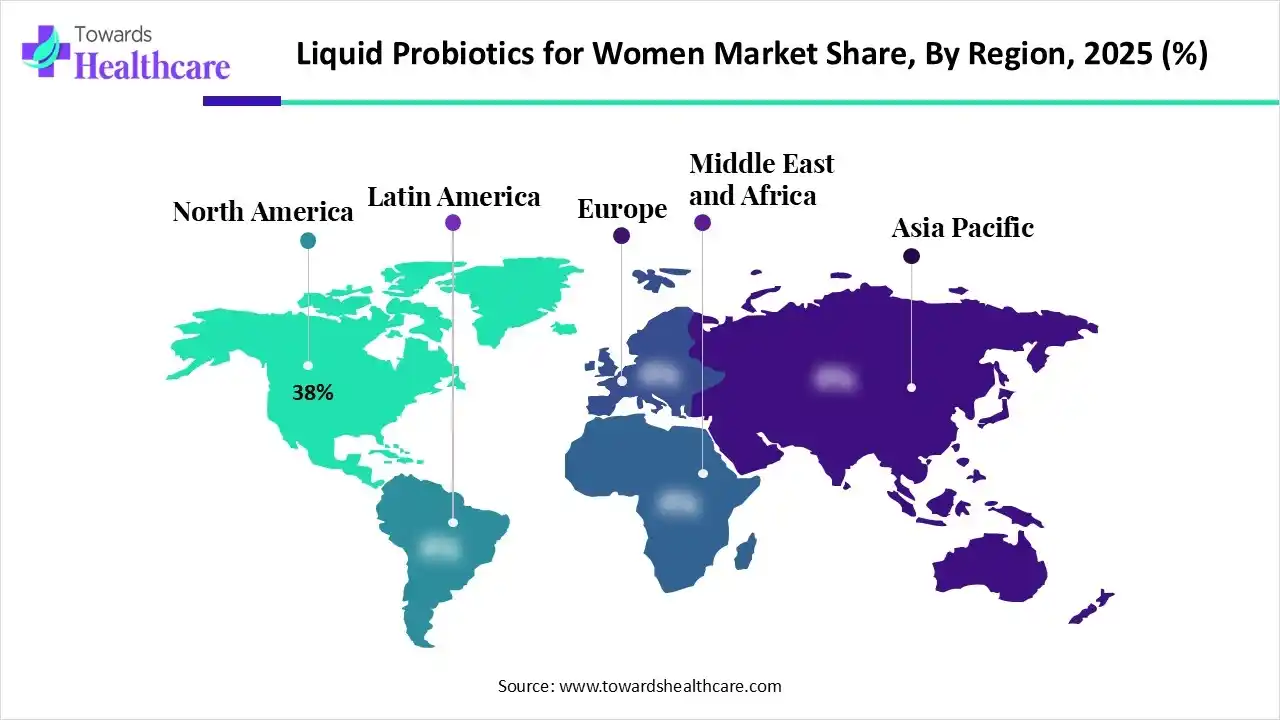

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Application / Health Benefit, By Strain Type / Composition, By Distribution Channel, By End User/Consumer Segment, By Region |

| Top Key Players | Danone S.A., Yakult Honsha Co., Ltd., Denmark, Nestlé Health Science, Glanbia Nutritionals, Probi AB, BioGaia AB |

The Liquid Probiotics for Women Market comprises the development, production, and commercialization of probiotic formulations in liquid or drinkable form specifically designed to support women’s health, including vaginal health, urinary tract health, gut microbiome balance, immunity, and hormonal wellness. These products include single-strain and multi-strain probiotics, functional beverages, fermented drinks, oral suspensions, and ready-to-drink shots, often fortified with prebiotics, vitamins, minerals, and botanical extracts

Growth is driven by increasing awareness of women-specific microbiome health, rising demand for convenient liquid formulations over capsules or tablets, expansion of functional beverage categories, and clinical research supporting probiotics for UTI prevention, vaginal microbiome balance, and digestive health.

The integration of AI-driven technology into liquid probiotics for women propels market growth by enhancing the speed and accuracy of probiotic strain selection. Combining AI-guided antibody engineering with targeted probiotic delivery offers a groundbreaking, microbiota-friendly approach. AI allows for personalized nutrition aimed at specific health outcomes, identifying probiotics that produce antimicrobial peptides and bioactive substances. Furthermore, AI integration in research supports real-time clinical trial monitoring, leading to quicker and more precise evaluations of probiotic effectiveness.

Probiotics have a positive impact on enhancing the balance of gut microbes, improving immune function, and lowering the symptoms of long-term diseases.

Various types of probiotic strains have specific mechanisms of action against pathogens, including bacteriocins that directly kill or inhibit particular pathogens, the destruction of pathogenic toxins, and the reinforcement of the integrity of host cells.

Symbiotic work together to enhance immunity and intestinal health by integrating with probiotics and prebiotics. Postbiotics demonstrated various health advantages, like bioactive molecules shaped during probiotic fermentation.

Which Product Led the Liquid Probiotics for Women Market in 2024?

In 2025, the ready-to-drink liquid shots & beverages segment held the dominant market with a 35% share, as liquid-based probiotic packaging systems with an extraordinarily concentrated amount of advantageous bacteria. Intended to help and nourish a balanced gut microbiome, these shots are often a quick, tasty, and convenient way to take in billions of healthy bacteria and generally come in a broad array of flavors with many nutrients. Probiotic shots improve nutrient absorption by aiding in the breakdown of food components.

Functional Blends with Prebiotics, Vitamins, or Botanicals

Whereas the functional blends with prebiotics, vitamins, or botanicals segment is the fastest growing in the market, as prebiotic ingredients allow for the support of mental health, including for areas like stress, anxiety, and depression. Functional blends including prebiotics, vitamins, or botanicals provide various advantages, significantly by working synergistically to help and improve different bodily functions beyond basic nutrition, with a main focus on gut and immune health.

Why did the Vaginal Health & Microbiome Support Segment Dominate the Market in 2024?

The vaginal health & microbiome support segment captured approximately 30% of the market share of the liquid probiotics for women market in 2025, as probiotics play a significant role in maintaining the stability of the vaginal microenvironment, enhancing immune defence, and blocking the progression of cervical cancer. Vaginal probiotics are important for preserving and preventing infections, maintaining healthy vaginal microbiota, and enhancing overall vaginal health.

Hormonal/Menstrual Wellness

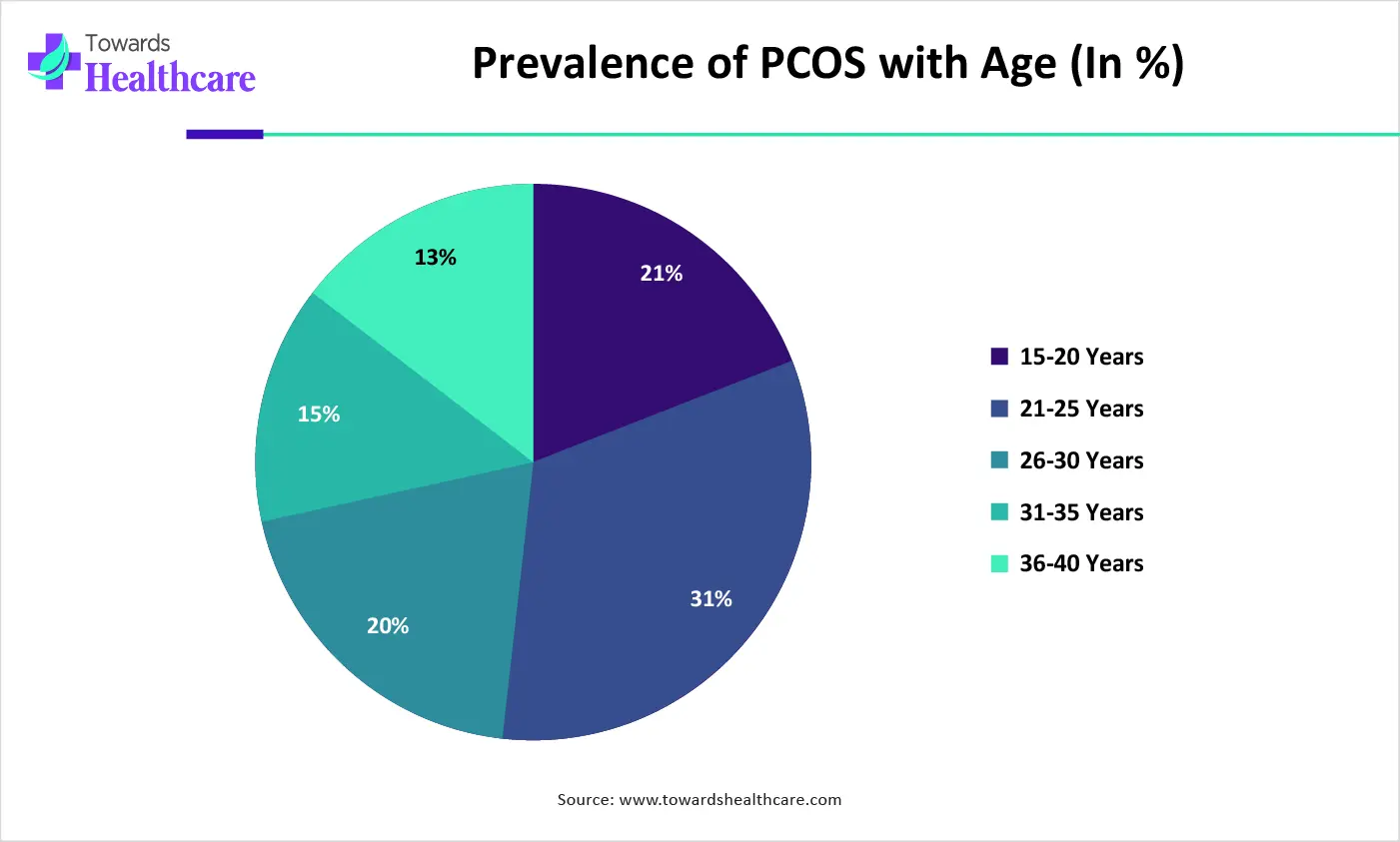

Whereas the hormonal/menstrual wellness segment is the fastest growing in the market, as probiotics are used as a substitute treatment choice for main dysmenorrhea. Probiotic supplements have been shown to colonize the human intestine and confer major health advantages, specifically in inflammatory and immunomodulatory conditions.

Why is the Lactobacillus Strains Segment Dominant in the Market?

In 2025, the Lactobacillus strains segment held the dominant share of approximately 45% share of the liquid probiotics for women market, as Lactobacillus acidophilus is a strain of probiotic bacteria that is broadly applicable due to its potential health benefits. Lactobacillus strains provide advantages such as enhanced digestion, nutrient absorption, and strong immune support by outcompeting bad bacteria and producing antimicrobials, supporting issues from diarrhea and IBS to allergies.

Multi-Strain/Synbiotic Formulations

Whereas the multi-strain/synbiotic formulations segment is the fastest growing in the market, as multi-strain probiotics support lowering inflammation, encouraging a healthier gut lining, and enhancing overall well-being. It offers a synergistic effect in contrast to the applications of a single-strain probiotic (SSP). Multi-strain probiotics are composed of more than one species or strain of bacteria and sometimes involve some fungal species, with advantages to human and animal health conditions.

Why is the Retail / Supermarkets & Hypermarkets Segment Dominant in the Market?

In 2025, the retail/supermarkets & hypermarkets segment held the dominating approximately 40% share of the liquid probiotics for women market, as in retail stores like supermarkets and hypermarkets, significantly centered on superior bioavailability, user convenience, and strong arrangement with the increasing consumer preference for functional drinks and fresh products.

E-commerce / Online Marketplaces

Whereas the e-commerce/online marketplaces segment is the fastest growing in the market, as e-commerce platforms provide a massively convenient shopping experience with home delivery, which is specifically advantageous for women in rural areas who may not have access to specialty health stores. The e-commerce channel helps subscription solutions and direct-to-consumer models that provide targeted nutrition solutions tailored to women's requirements or health goals.

Why is the Adult Women Segment Dominant in the Market?

In 2025, the adult women segment held the dominant approximately 55% share of the liquid probiotics for women market, as probiotics support heart health, skin health , mood, and cognitive functioning, and also counteract the negative effects of antibiotics in adult women. Probiotics are particular living microorganisms, most often bacteria or yeast, which help the body digest food or support symptoms of certain illnesses.

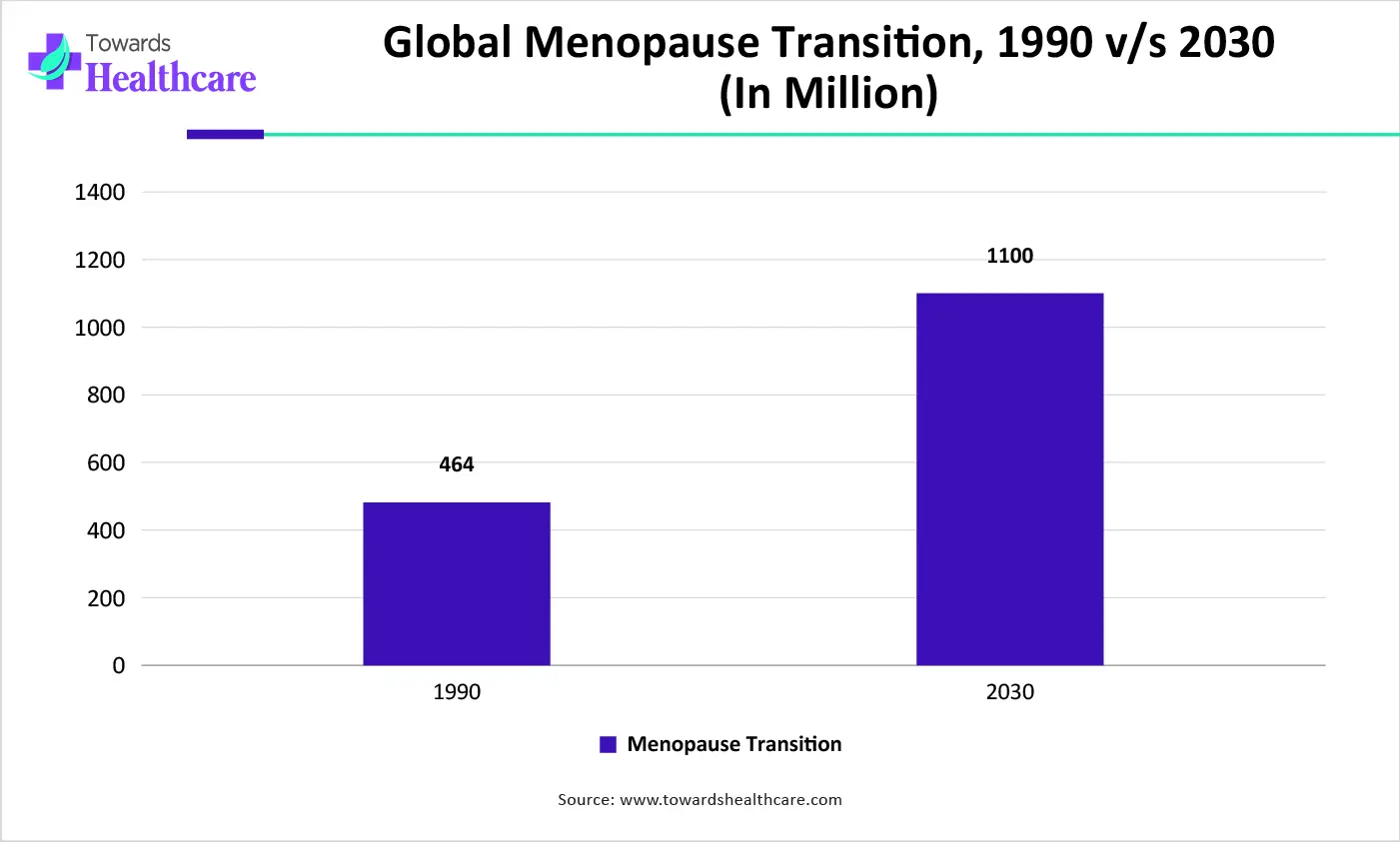

Menopausal Women

Whereas the menopausal women segment is the fastest growing in the market, as probiotics for menopausal women are extremely advantageous to address alleviating digestive issues, supporting immune function, enhancing mental health, and preserving bone health. Probiotics had a positive impact on menopausal symptoms, bone health, urogenital health, and the efficacy and safety of estriol.

In 2025, North America led the liquid probiotics for women market with approximately 38% of share, as North American users are rising, adopting a proactive strategy to health by applications of natural, functional products to maintain well-being and prevent conditions such as digestive disorders, rather than treating them after they arise. Provider in North America repeatedly revolutionizes with varied product formats, involving easy-to-consume oral capsules, gummies, and various types of functional foods and beverages, which contribute to the growth of the market.

For instance,

In the U.S., growing access to health data through blogs, social media, and healthcare providers has mainly increased awareness in U.S. women about the detailed advantages of probiotics for gut, vaginal, and immune health. Also, a strong presence of the biotechnology and pharmaceutical sector, which drives the growth of the market.

Asia Pacific is set to experience rapid growth in the liquid probiotics for women market, as this region is an integration of strong cultural alignment with growing disposable incomes, high consumer health consciousness, fermented foods, and the targeted development of products addressing particular women's health requirements. There is an increasing demand for probiotics that address precise women's health challenges, such as vaginal and urinary tract health, as well as menopause and pregnancy symptoms, which drives the growth of the market.

India has a strong cultural tradition of consuming fermented dairy products such as curd and buttermilk, which are natural sources of probiotics. This current dietary habit makes the acceptance of novel, personalized probiotic products more seamless. Medical care providers, nutritionists, and media influencers are progressively endorsing the benefits of probiotics, promoting their incorporation in daily diets.

Europe is growing significantly in the liquid probiotics for women market as European women have a high level of awareness related to the link between the gut microbiome and overall health, including vaginal and intimate wellness. Many surveys show that high familiarity with probiotics increases the demand for both general wellness and targeted services. There is a general societal shift towards preventive healthcare and natural solutions, which drives the growth of the market.

In the UK strong presence of well-known brands like Optibac (by Womankind), VJJ Health, and Canesten (Bayer) provides dedicated vaginal probiotics, becoming household names. Millions of UK women suffer from yeast infections, Bacterial Vaginosis (BV), and recurrent Urinary Tract Infections (UTIs), driving demand for solutions.

| Company | Headquarters | Latest Update |

| Danone S.A. | Paris | Danone is integrating modern science with ancient fermentation traditions to advance gut health and support healthy ageing. |

| Yakult Honsha Co., Ltd. | Japan | In August 2025, Yakult Danone India Pvt Ltd, a joint venture between Yakult Honsha of Japan and Groupe Danone of France, appointed Bollywood actor Taapsee Pannu as its new brand ambassador. |

| Chr. Hansen Holding A/S | Denmark | In January 2025, the combination of Novozymes and Chr. Hansen is now completed, creating Novonesis – a leading global biosolutions partner. |

| Nestlé Health Science | Switzerland | Nestlé hastens open innovation in nutrition and health through academic partnerships and startups. |

| Glanbia Nutritionals | Ireland | The company provides ingredient services that are used in different product formats, including lozenges and potentially liquid applications, though they focus on the ingredients themselves. |

| Probi AB | Sweden | Probi is proud to announce that Probi Female has won the NutraIngredients Award 2025 in the category Innovation in Women's Health. |

| BioGaia AB | Sweden | BioGaia is a world leader in probiotic research and development. |

By Product Type

By Application / Health Benefit

By Strain Type / Composition

By Distribution Channel

By End User/Consumer Segment

Regional Outlook

February 2026

February 2026

January 2026

January 2026