February 2026

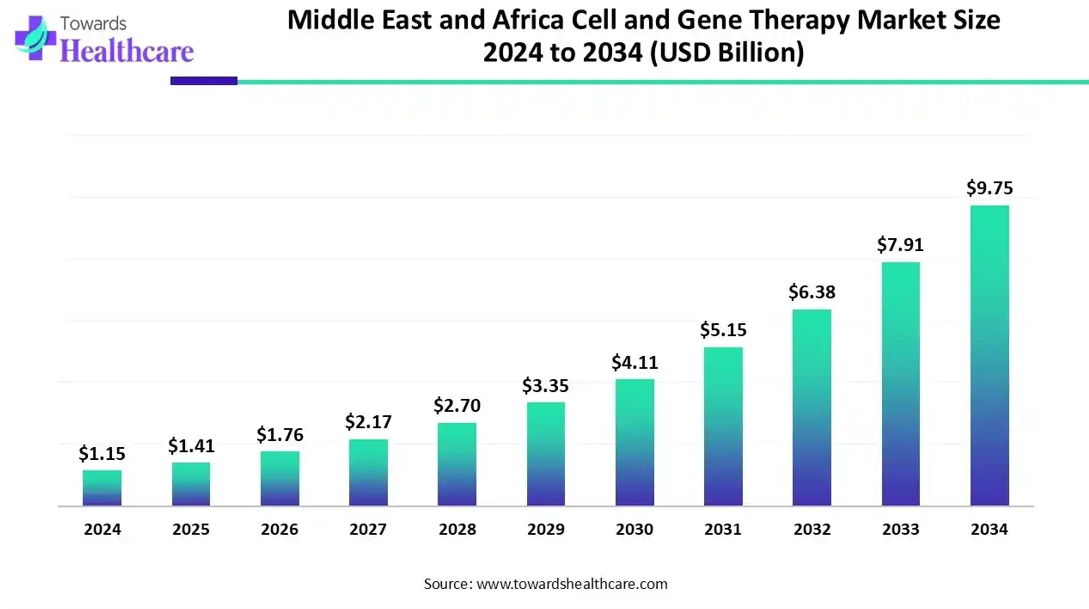

The Middle East and Africa cell and gene therapy market size is calculated at USD 1.15 billion in 2024, grew to USD 1.41 billion in 2025, and is projected to reach around USD 9.75 billion by 2034. The market is expanding at a CAGR of 23.85% between 2025 and 2034.

The Middle East and Africa cell and gene therapy market is primarily driven by the rising adoption of advanced technologies and the increasing prevalence of chronic disorders. Gulf Cooperation Council (GCC) countries are developing advanced manufacturing infrastructure. Government organizations launch initiatives to encourage individuals to take timely intervention and invest heavily in R&D activities. Artificial intelligence (AI) revolutionizes the development of innovative cell and gene therapy.

| Table | Scope |

| Market Size in 2025 | USD 1.41 Billion |

| Projected Market Size in 2034 | USD 9.75 Billion |

| CAGR (2025 - 2034) | 23.85% |

| Market Segmentation | By Therapy Type, By Therapeutic Area, By Vector/Delivery Type, By Cell Source, By Manufacturing Scale & Service, By End-User, By Geography |

| Top Key Players | Novartis, Roche / Spark Therapeutics, Gilead Sciences (Kite Pharma), Pfizer Inc., AstraZeneca, Sanofi, Janssen (Johnson & Johnson), Takeda Pharmaceutical Company, Merck & Co. (MSD), Moderna, Inc., Bluebird Bio, Lonza Group, Catalent, Inc., Thermo Fisher Scientific, Charles River Laboratories, Aspen Pharmacare |

The Middle East and Africa cell and gene therapy market is experiencing robust growth, driven by government-led healthcare modernization, rising prevalence of cancer and rare diseases, investments into biopharma clusters (particularly in the Gulf), and collaborations with global pharmaceutical innovators. It represents the advancement, clinical adoption, and regional commercialization of next-generation therapies across countries such as Saudi Arabia, the United Arab Emirates, Qatar, South Africa, Egypt, and others in the region.

Cell and gene therapy (CGT) includes autologous and allogeneic cell therapies, CAR-T and NK-based immune cell therapies, viral and non-viral gene therapies, and RNA-based modalities used for oncology, genetic disorders, ophthalmology, and metabolic diseases. While the market faces challenges such as fragmented regulatory frameworks and limited local GMP infrastructure, it offers significant opportunities in clinical trial expansion, cost-effective patient access, and increasing CRO/CMO involvement.

AI transforms the research and manufacturing of CGT products by introducing automation. It assists researchers in developing innovative CGT products based on patients’ conditions, enhancing the efficiency and accuracy of cell isolation and gene editing. AI and machine learning (ML) algorithms can analyze vast amounts of data and ensure traceability and compliance throughout the manufacturing process. They can also help deliver appropriate CGT to the right patients, estimate optimal dosing, and predict adverse effects. Thus, AI and ML can accelerate the development and manufacturing of CGT, as well as streamline the regulatory approval and testing processes.

| Countries | Regulatory Agencies |

| UAE | The Department of Health (DOH) |

| South Africa | South African Health Products Regulatory Authority (SAHPRA) |

| Saudi Arabia | The Saudi Food and Drug Authority (SFDA) |

| Oman | Drug Safety Center (DSC) |

| Kuwait | Ministry of Health |

| Qatar | Ministry of Public Health (MoPH) |

| Egypt | The Egyptian Drug Authority (EDA) |

By therapy type, the cell therapy segment held a dominant presence in the market in 2024, with a revenue of approximately 61%, due to the ability to self-renew and differentiate. Cell therapy is either developed from a patient’s own immune cells or from cells of another person. It aids in the repair and regeneration of damaged tissues, including muscle, bone, or nerve cells. Apart from promoting tissue regeneration, cell therapy also modulates the immune system, reduces inflammation, thereby improving the quality of life of individuals. The success rate of cell therapy is higher, accounting for 60%-70% in treating certain types of blood cancers.

By therapy type, the gene therapy segment is expected to grow at the fastest CAGR in the market during the forecast period. Gene therapy alters the genetic material of patients by introducing new genes or replacing defective genes. Advancements in gene editing technologies enable researchers to modify genes based on patients’ conditions, aiding in desired therapeutic effects. Gene therapy cures a disease from its root cause, reducing its chances of recurrence.

By therapeutic area, the oncology segment held the largest revenue share of approximately 47% of the market in 2024, due to the rising prevalence of cancer and its complications. Researchers determine different proteins or targets involved in several cancer types. This enables them to develop tailored therapies to selectively target and kill cancer cells. CGT can activate the immune system by helping it identify antigens. Genetic modifications of immune cells can direct them to search for cancer-specific antigens.

By therapeutic area, the rare genetic disorders segment is expected to grow with the highest CAGR in the market during the studied years. Conventional therapeutics fail to treat rare genetic diseases completely. The increasing prevalence of rare diseases in MEA boosts the segment’s growth. It is estimated that over 2.8 million people in the MEA region live with rare diseases. Cell and gene therapy target the underlying genetic causes, offering potential one-time treatments. It provides long-term management of rare diseases.

By vector/delivery type, the viral vectors segment contributed the biggest revenue share of approximately 67% of the market in 2024, due to the ability of viral vectors to provide long-term transgene expression for chronic conditions. Viral vectors are the most commonly used vehicles for delivering gene therapy. They are less likely to cause an infection as researchers remove the pathogenic material from viruses. The different types of viral vectors include lentiviral vectors, adenoviral vectors, and adeno-associated viral vectors.

By vector/delivery type, the non-viral delivery segment is expected to expand rapidly in the market in the coming years. The growing research and development activities have led to the development of non-viral delivery systems, such as electroporation and lipid nanoparticles. Non-viral vectors can help deliver genetic material through physical or chemical methods. They may facilitate long-term expression of therapeutic genetic materials and do not carry the risk of viral infections.

By cell source, the autologous segment accounted for the highest revenue share of approximately 65% of the market in 2024, due to the minimized risk of immune rejection and long-term healing. Autologous cell therapy refers to extracting cells from a patient’s body, providing personalized treatment. It can lead to better outcomes and faster recovery times, as researchers can modify cells to repair specific cells/tissues. Autologous cell therapy saves time as healthcare professionals do not need to match the compatibility of immune cells.

By cell source, the allogeneic segment is expected to witness the fastest growth in the market over the forecast period. The demand for allogeneic cell therapy is increasing as it is derived from a healthy human and enables large-scale preparation and application. The donor can be either related or unrelated to the patient. Allogeneic cell therapy can make CAR-T therapies more accessible, reducing the burden on the patient and decreasing the time to treatment. It is produced on a large scale, making it more affordable.

By manufacturing scale, the clinical-scale manufacturing segment led the market in 2024, with a revenue of approximately 63%, due to the increasing number of clinical trials and the rising research activities. Clinical trials are conducted to assess the safety and efficacy of CGT products. Regulatory agencies evaluate clinical trial data to approve a product for widespread applications in various disorders. As of September 2025, a total of 19 clinical trials have been registered on the clinicaltrials.gov website within 500 miles of the Middle East & Africa – Sour, Tyre, and Lebanon.

By manufacturing scale, the contract manufacturing & CDMO services segment is expected to show the fastest growth over the forecast period. Large companies outsource their manufacturing capabilities to focus on their core competencies. Small- and mid-sized companies lack suitable manufacturing infrastructure and skilled professionals to conduct CGT manufacturing, potentiating the need for CDMO. The increasing number of CDMOs in the MEA region and the presence of skilled professionals augment the segment’s growth.

By end-user, the biopharma & biotechnology companies segment held a major revenue share of approximately 42% of the market in 2024, due to the availability of favorable infrastructure and suitable capital investment. The rising competition among biopharma companies encourages them to develop innovative CGT products. The expanding product pipelines allow companies to treat a large patient population and strengthen their market position.

By end-user, the hospitals & specialty clinics segment is expected to account for the highest growth in the upcoming years. Hospitals and clinics have a favorable infrastructure to adopt novel CGT products for patients. They have skilled professionals to provide tailored and multidisciplinary expertise to patients. Hospitals and clinics are also part of clinical trials, benefiting patients before market approval of CGT.

The major growth factors that contribute to the market include the rising prevalence of chronic disorders, favorable government support, and increasing R&D investments. Countries are developing an advanced clinical trial infrastructure for CGT products. The rapidly expanding biopharmaceutical and healthcare sectors contribute to market growth. Major players collaborate to access advanced technologies and expand their geographical presence. Regulatory agencies are also making constant efforts to develop a uniform regulatory pathway for CGT.

GCC countries dominated the market in 2024. Countries like Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE are at the forefront of developing innovative CGT products. This is supported by government initiatives and evolving clinical trial landscapes. Companies like Avernus Pharma and Opal Biopharma are the major players that focus on the development of CGT. GCC countries also launched the “GCC Biosimilars Value Framework” to enhance biosimilar acceptance and boost local manufacturing.

Kuwait’s Minister of Health announced that the country is preparing to introduce gene therapy for children over the age of 12 for the treatment of thalassemia and sickle cell anemia. In Kuwait, more than 40 children have successfully undergone stem cell transplants.

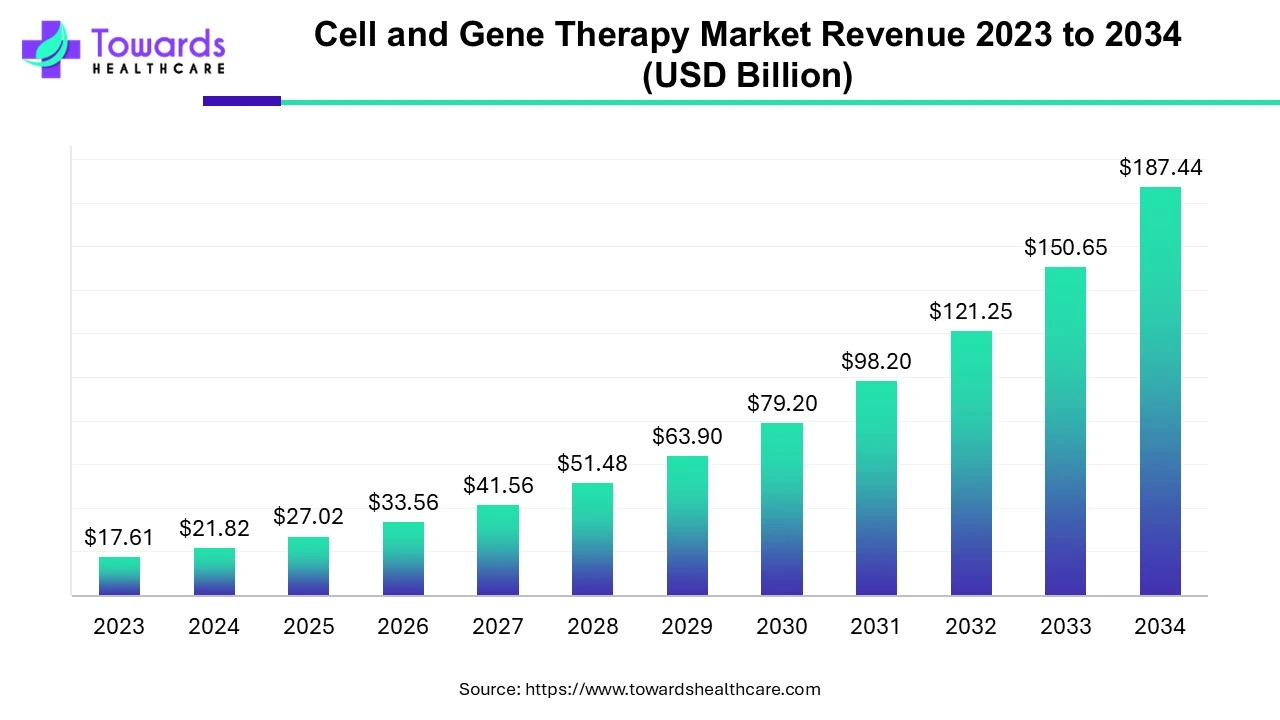

The global cell and gene therapy market is valued at USD 21.82 billion in 2024 and is projected to reach USD 187.44 billion by 2034, growing at a CAGR of 24% during the forecast period from 2024 to 2034, driven by an increase in clinical trials and a growing number of product approvals.

Research activities focus on treating, preventing, and curing chronic disorders. Researchers develop biosimilars of branded CGT to increase affordability and also develop novel delivery systems to improve bioavailability.

Key Players: Charles River Laboratories, Novartis, and CureLeads.

CGT products are assessed on humans to determine their efficacy and toxicity profile. Based on the clinical trial results, regulatory agencies approve a CGT product for market authorization.

Healthcare professionals ensure patients receive the right treatment at the right time and make them comfortable at every stage of their journey.

Our experts analyze that CGT products have a promising future in the MEA region with the evolving regulatory landscape and the presence of a favorable clinical trial infrastructure. People from MEA countries are becoming aware of personalized medicines for the treatment of several chronic disorders, including rare diseases. Government organizations support the development of CGT products through initiatives and funding.

By Therapy Type

By Therapeutic Area

By Vector/Delivery Type (for Gene Therapy)

By Cell Source (for Cell Therapy)

By Manufacturing Scale & Service

By End-User

By Geography

February 2026

February 2026

February 2026

February 2026