January 2026

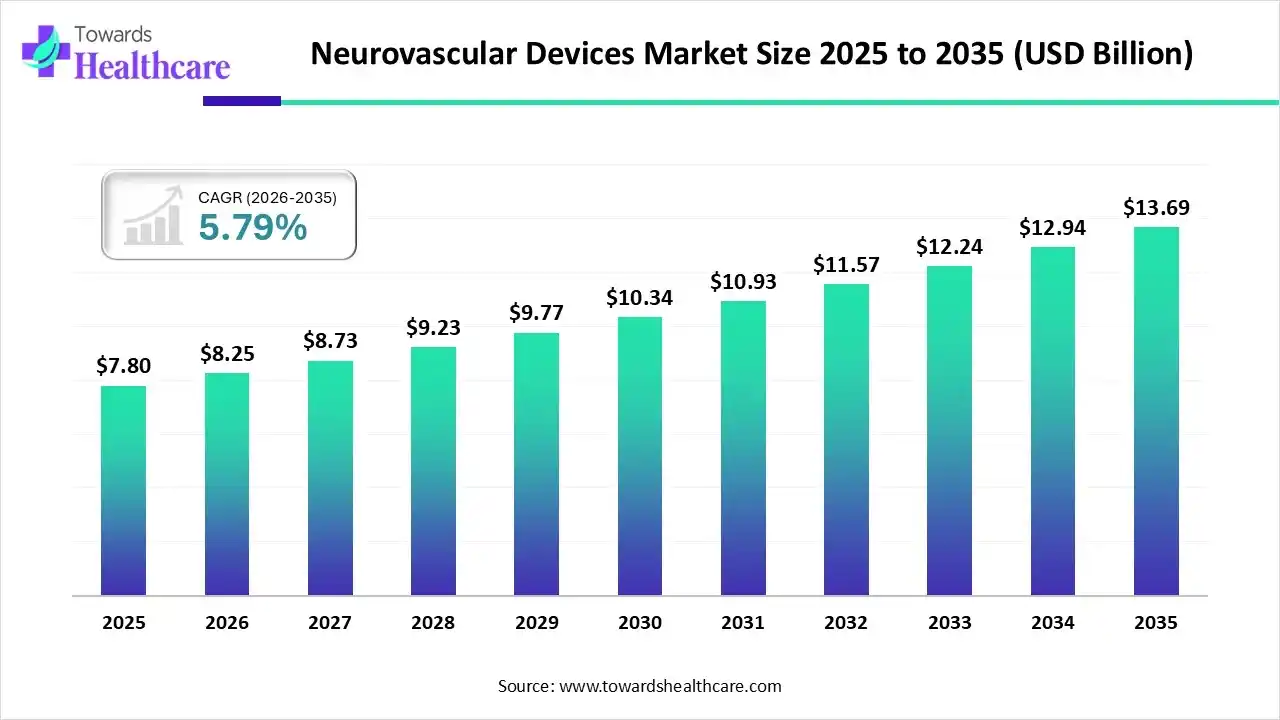

The global neurovascular devices market size is calculated at USD 7.80 billion in 2025, grew to USD 8.25 billion in 2026, and is projected to reach around USD 13.69 billion by 2035. The market is expanding at a CAGR of 5.79% between 2026 and 2035.

The rising incidence of neurovascular disorders, such as stroke and brain aneurysms, is mostly to blame for the growing global patient population. These neurovascular conditions are more prevalent in the elderly. Prominent regional and global corporations have been consistently investing in research and development to provide novel medications and focus on underdeveloped neurovascular therapeutic areas. In order to create pipeline devices with high clinical efficiency, market participants have also placed a great deal of attention on conducting clinical research.

| Metric | Details |

| Market Size in 2026 | USD 8.25 Billion |

| Projected Market Size in 2035 | USD 13.69 Billion |

| CAGR (2026 - 2035) | 5.79% |

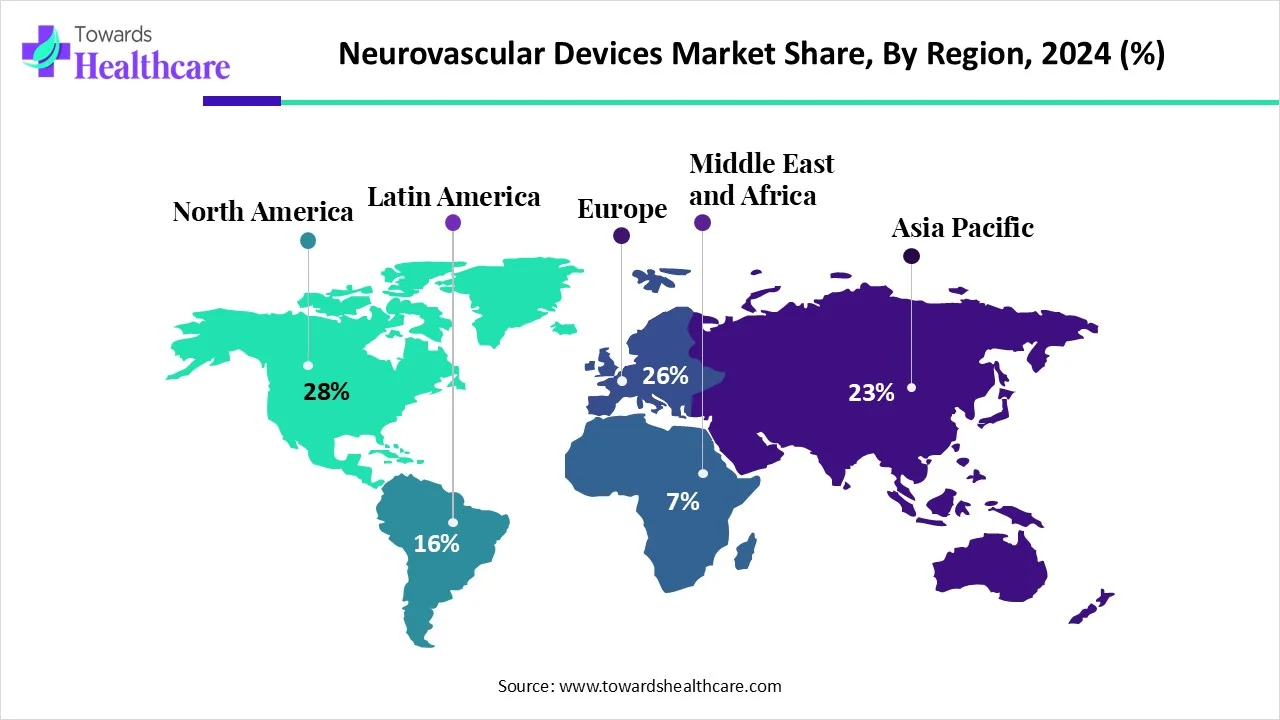

| Leading Region | North America share by 28% |

| Market Segmentation | By Device, By Therapeutic Applications, By Size, By End-Use, By Region |

| Top Key Players | Evasc Neurovascular, Heraeus Medevio, iVascular, Johnson & Johnson, Kaneka Corporation, Medtronic, NeuroVasc Technologies, Penumbra, Inc., Perflow Medical, Rapid Medical, Royal Philips, Stryker Corporation, Terumo Neuro |

Neurovascular devices are primarily used to treat conditions affecting the blood vessels in the brain and spinal cord. Examples of these neurovascular disorders are cerebral aneurysms, ischemic strokes, and arteriovenous malformations. These devices deliver embolic coils and flow diversion stents to prevent aneurysm rupture. They can also destroy or remove cerebral blood clots. Neurovascular devices offer targeted therapy and utilize a minimally invasive approach to provide site-specific treatment. They have been proven to significantly increase the life expectancy of patients suffering from distinct neurovascular disorders and reduce death rates.

Numerous factors contribute to market growth, including the increasing prevalence of neurovascular disorders and advancements in medical devices. The growing demand for personalized treatment and targeted therapy boosts the market. The rising investments by government and private organizations promote the development of novel neurovascular devices. The U.S. Food and Drug Administration (FDA) approved a total of 320 neuroendovascular devices from January 2000 to December 2022. The burgeoning medical device sector also contributes to market growth.

Integrating artificial intelligence (AI) in neurovascular devices can transform their functionality and enhance efficiency. It can facilitate remote monitoring, allowing healthcare professionals to monitor patients and give their suggestions. This helps them to make proactive decisions. AI can also assess the biocompatibility of devices with the patients, avoiding immune reactions. Additionally, AI can analyze neurovascular imaging by automatically detecting and measuring signs of neurovascular disorders. It can also identify and segment blood vessels and other structures in neurovascular images. It can predict patient outcomes and guide neuroendovascular procedures. Thus, AI can drive the future of neurovascular devices.

Rising Prevalence of Neurovascular Disorders

The major growth factor of the neurovascular devices market is the rising prevalence of neurovascular disorders. Neurovascular disorders are a growing concern among individuals, affecting approximately 15 million people and 5 million deaths globally every year. The major risk factors that lead to neurovascular disorders are pathological conditions, such as diabetes, hypertension, and obesity, along with poor lifestyle choices. They are also caused by an increasing geriatric population and environmental factors, such as air pollution. The World Stroke Organization (WSO) Global Stroke Fact Sheet 2025 reported that in 2021, the prevalence of stroke was 93.8 million, and the incidence was 11.9 million. Neurovascular devices provide a customized and minimally invasive approach to patients suffering from neurovascular disorders.

High Cost

The major challenge of the market is the high cost of neurovascular devices. Some devices may cost thousands of dollars per procedure to place devices in human organs. However, the cost of the device depends on the type, manufacturer, and specific procedure required. This limits the affordability of numerous patients from low- and middle-income groups.

What is the Future of the Neurovascular Devices Market?

The future of the market is promising, driven by growing demand for minimally invasive surgeries and the latest advancements in devices. Minimally invasive surgeries result in the fewest skin and tissue incisions, thereby reducing trauma, pain, complications, scarring, and recovery time for patients. They offer numerous benefits, including faster recovery times, cost-effectiveness, and a lower risk of infections. They enhance adherence in patients and improve patient comfort, allowing patients to return to their daily activities sooner. Moreover, several researchers conduct advanced research to develop novel and innovative neurovascular devices. Improved materials are used to enhance the biocompatibility of catheters, coils, and stents within the human body.

By device, the cerebral embolization & aneurysm coiling devices segment held a dominant presence in the market in 2024. Endovascular coiling or embolization refers to a device that blocks blood flow into an aneurysm. The rising prevalence of aneurysms boosts the segment’s growth. The availability of miniaturized coils and the use of soft metals for their development promote the use of cerebral embolization & aneurysm coiling devices. Several researchers have developed coiling devices using different materials and shaped like a spring to enhance the patient’s comfort.

By device, the neurothrombectomy devices segment is expected to grow at the fastest CAGR in the market during the forecast period. Neurothrombectomy devices are generally classified into five types such as clot retrievals, aspiration/suction devices, snare-like devices, ultrasonography technologies, and lasers. The U.S. Food and Drug Administration (FDA) has approved neurothrombectomy devices for acute ischemic stroke treatment. The increasing stroke cases augment the segment’s growth. The growing research and development activities and technological advancements facilitate the development of innovative neurothrombectomy devices.

By therapeutic application, the stroke segment dominated the market in 2024. Stroke is a leading cause of long-term disability and death. According to a recent research report in the CDC’s Morbidity and Mortality Weekly Report indicates that stroke rates have increased by 16% among people of 45 to 64 years, and almost 15% among people of 18 to 44 years. (Source - Health harvard) Strokes occur during a blood clot or broken vessel prevents blood from getting to the brain. The increasing prevalence of cardiovascular diseases potentiates the chances of strokes.

By therapeutic application, the cerebral aneurysm segment is expected to grow with the highest CAGR in the market during the studied years. Cerebral aneurysm is a condition in which the blood vessel wall bulges and potentially ruptures, leading to bleeding in the brain. It is primarily caused by alpha-glucosidase deficiency, polycystic kidney disease, and other chronic and genetic disorders. The global prevalence rate of cerebral aneurysms is approximately 3.2%. It mostly affects elderly people. Hence, the growing geriatric population also fosters the segment’s growth.

By size, the 0.021” segment contributed to the biggest revenue share of the market in 2024. Neurovascular devices with a 0.021” size are generally preferred as they have an optimum size appropriate for all patients. They are widely used for aneurysm treatment, removing blood clots, and managing other vascular issues. 0.021-inch size provides better flexibility and support, making the devices suitable for navigating the complex and narrow vasculature of the brain.

By end-use, the hospital segment led the global market in 2024. The segmental growth is attributed to the increasing number of hospital admissions and the presence of skilled professionals. Hospitals provide multidisciplinary expertise for diagnosing and treating neurovascular disorders. The availability of a favorable infrastructure and suitable capital investments facilitates hospitals in adopting advanced neurovascular devices. Favorable reimbursement policies also encourage patients to prefer hospitals for neurovascular care.

By end-use, the specialty clinics segment is expected to expand rapidly in the market in the coming years. Specialty clinics primarily focus on a particular disease type, such as neurovascular disorders. They possess specialized equipment and skilled professionals to treat such diseases. The increasing number of specialty clinics and rising investments propel the segment’s growth.

North America held the largest share of the neurovascular devices market share by 28% in 2024. The presence of key players and the rising adoption of advanced technologies in the healthcare sector are the major growth factors of the market. Favorable government policies and increasing investments potentiate early diagnosis and treatment of neurovascular disorders. Favorable reimbursement policies by both government and private insurers encourage patients to opt for cutting-edge technologies.

The increasing incidence of aneurysms promotes the need for neurovascular devices. It is estimated that 1 in 50 people, or 6.8 million people in the U.S., have an unruptured brain aneurysm. About 30,000 people in the U.S. suffer a brain aneurysm rupture annually. (Source - Brain Aneurysm) American Brain Coalition (ABC) is a non-profit organization that aims to better understand brain functions and reduce the burden of brain disorders. It invested around $740 million in FY2025 for its BRAIN initiative. (Source - American Brain Coalition)

It is estimated that over 20,000 people are diagnosed with abdominal aortic aneurysm in Canada annually. Hence, the Canadian government supports neurovascular research through initiatives and funding. The federal government announced an investment of $200 million for Brain Canada through the CBRF Program to support neuroscience research in Canada. (Source - Government of Canada)

Asia-Pacific is expected to host the fastest-growing market in the coming years. The rising prevalence of neurovascular disorders and the increasing geriatric population necessitate the use of neurovascular devices. Several government and private institutions conduct seminars, conferences, and workshops to create awareness of neurovascular disorders and their effective treatment. The growing demand for home healthcare and personalized treatment also governs market growth.

The Chinese government initiatives, such as Healthy China 2030 and the China Stroke Prevention Project Committee Stroke Program, aim to reduce stroke prevalence through public awareness and advanced treatment. Apart from this, the Chinese government launched the Foreign Investment Law to support foreign manufacturers in opening their facilities in China through the NMPA’s incentives. (Source - Asiaactual)

The Indian Council of Medical Research (ICMR) study in 2023 reported that brain strokes could lead to 10 million deaths in low- and middle-income countries, including India, by 2050. In order to prevent this, ICMR is making constant efforts to establish stroke care pathways, specialized units, and mobile stroke units. The Union government announced the launch of 500 stroke care units, enhancing accessibility and improving treatment outcomes. (Source - The Hindu)

Europe is considered to be a significantly growing area in the neurovascular devices market, due to the presence of a robust healthcare infrastructure and the growing geriatric population. The presence of major players and the rising mergers & acquisitions, and collaborations augment the market. The burgeoning medical device sector and increasing investments also contribute to market growth. Key players, such as Medtronic, Heraeus Medevio, and iVascular, are the major contributors to the market in Europe.

Germany is the leading provider of state-of-the-art care for neurological and cardiovascular disorders in the world. The availability of suitable insurance policies also supports market growth. The National Health Alliance (NHA) was formed in 2023 to deal with cardiovascular diseases in Germany. In addition, two new pilot programs for the early detection of familial hypercholesterolemia and chronic heart failure were launched under the NHA. (Source - EU SHD)

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The market is driven by the rising prevalence of neurological disorders and the burgeoning medical device sector. Government organizations launch initiatives to support the indigenous development of medical devices. The increasing investments and collaborations also contribute to market growth. People are becoming aware of screening and early diagnosis of neurological disorders

The UAE Ministry of Health and Prevention (MOHAP) organizes campaigns to promote and raise public awareness about neurological disorders, supporting early diagnosis and the development of medical practices. The MOHAP also launched the “National Framework for Healthy Ageing 2025-2031” to enhance the quality of life of older people and prevent dementia.

The latest research focuses on introducing automation in neurovascular devices and facilitating minimally invasive surgery.

Key Players: Penumbra, Terumo Neuro, and Rapid Medical.

Clinical trials assess the safety and efficacy of neurovascular devices. Regulatory agencies approve these devices based on their clinical trial data.

Key Players: Johnson & Johnson, Medtronic, and Stryker Corporation.

Healthcare professionals guide patients about the use and benefits of neurovascular devices.

Mark Dickinson, President of the Neurovascular Division at Johnson & Johnson MedTech, commented on the launch of a large-bore catheter that the company continues to innovate and address the access challenges that physicians face during mechanical thrombectomy procedures. He also said that the Cereglide 92 Catheter System is the latest innovation in the company’s Cereglide and ischemic stroke suite of technologies, assisting physicians to maximize procedural outcomes. (Source - Cardiovascular Business)

By Device

By Therapeutic Applications

By Size (In Inches)

By End-Use

By Region

January 2026

December 2025

December 2025

December 2025