January 2026

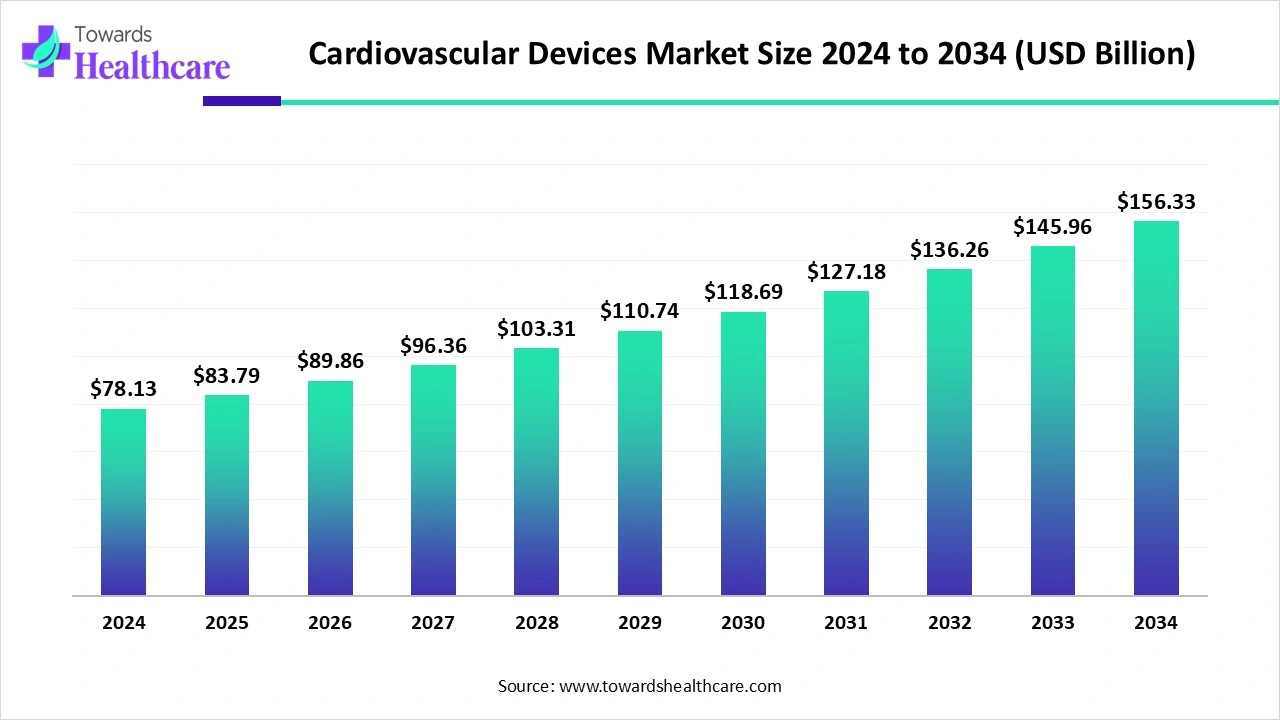

The global cardiovascular devices market size is calculated at US$ 78.13 in 2024, grew to US$ 83.79 billion in 2025, and is projected to reach around US$ 156.33 billion by 2034. The market is expanding at a CAGR of 7.24% between 2025 and 2034.

The use of cardiovascular devices is increasing to treat a variety of cardiovascular diseases. These devices are being used for monitoring, diagnosis, and treatment of these diseases. The growing investments and funding are promoting their development and launches, as well as the collaboration among companies. The use of AI is improving its accuracy, leading to the launch of new platforms. This, in turn, is increasing the demand for cardiovascular devices in different regions. Thus, these developments are promoting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 83.79 Billion |

| Projected Market Size in 2034 | USD 156.33 Billion |

| CAGR (2025 - 2034) | 7.24% |

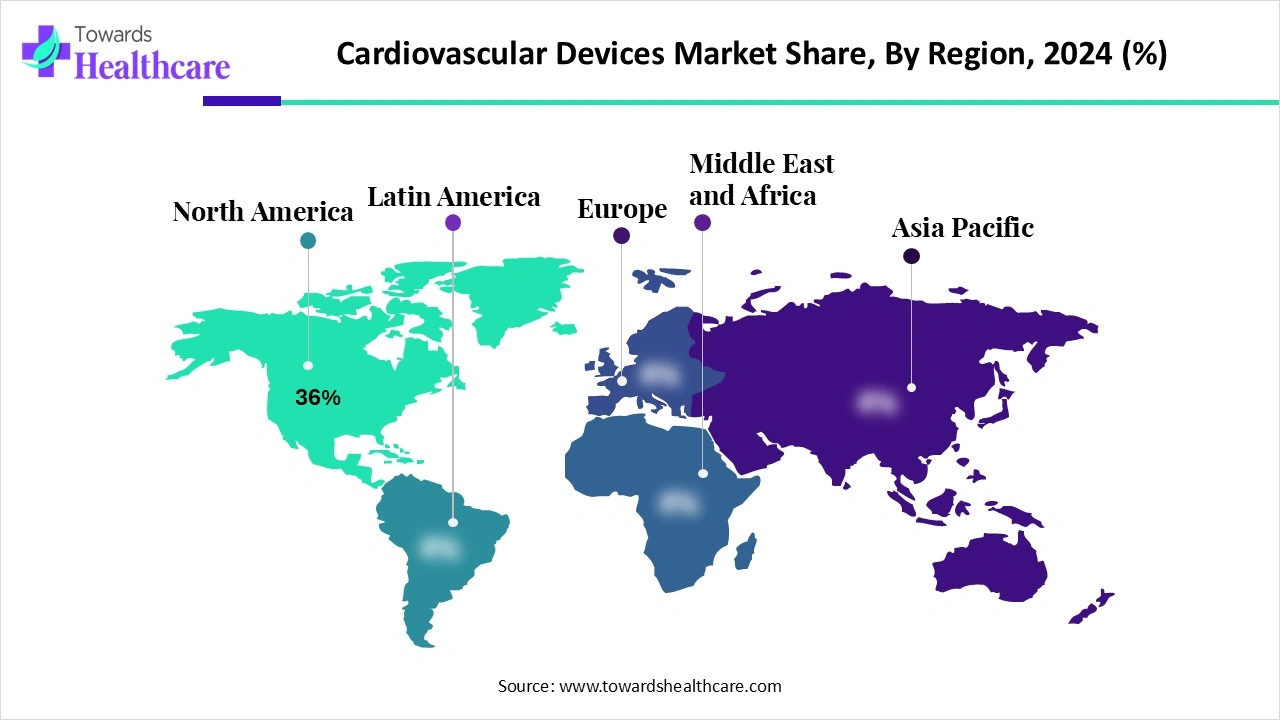

| Leading Region | North America share by 36% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Product Class, By Region |

| Top Key Players | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences Corporation, BIOTRONIK SE & Co. KG, Terumo Corporation, B. Braun Melsungen AG, Johnson & Johnson (Cordis, Biosense Webster), Stryker Corporation, Siemens Healthineers, GE Healthcare, LivaNova PLC, Getinge AB (Maquet), Royal Philips NV, MicroPort Scientific Corporation, Cook Medical, C.R. Bard (BD), Shimadzu Corporation, HeartWare (Medtronic), Shockwave Medical, Inc. |

The cardiovascular devices market encompasses a broad range of medical technologies used for diagnosing, monitoring, and treating heart and blood vessel disorders. These include devices for surgical and interventional procedures, such as pacemakers, stents, catheters, and defibrillators, as well as diagnostic tools like ECG and Holter monitors. With cardiovascular diseases (CVDs) being the leading cause of death globally, demand is driven by aging populations, lifestyle-related risk factors, technological innovation, as well as a growing shift toward minimally invasive procedures.

The growing advancement of AI, ML, and DL in cardiovascular devices plays an important role in transforming the medical sector. AI helps in the diagnosis of cardiovascular diseases as well as provides a treatment plan to the patients. The development of these devices and predicting the performance of the devices inside the body can also be provided by AI. Moreover, to control and test the performance of these devices, ML can be utilized. The properties and irregularities can be predicted by DL. Thus, the performance of the devices can be enhanced using AI.

Increasing Cardiovascular Diseases

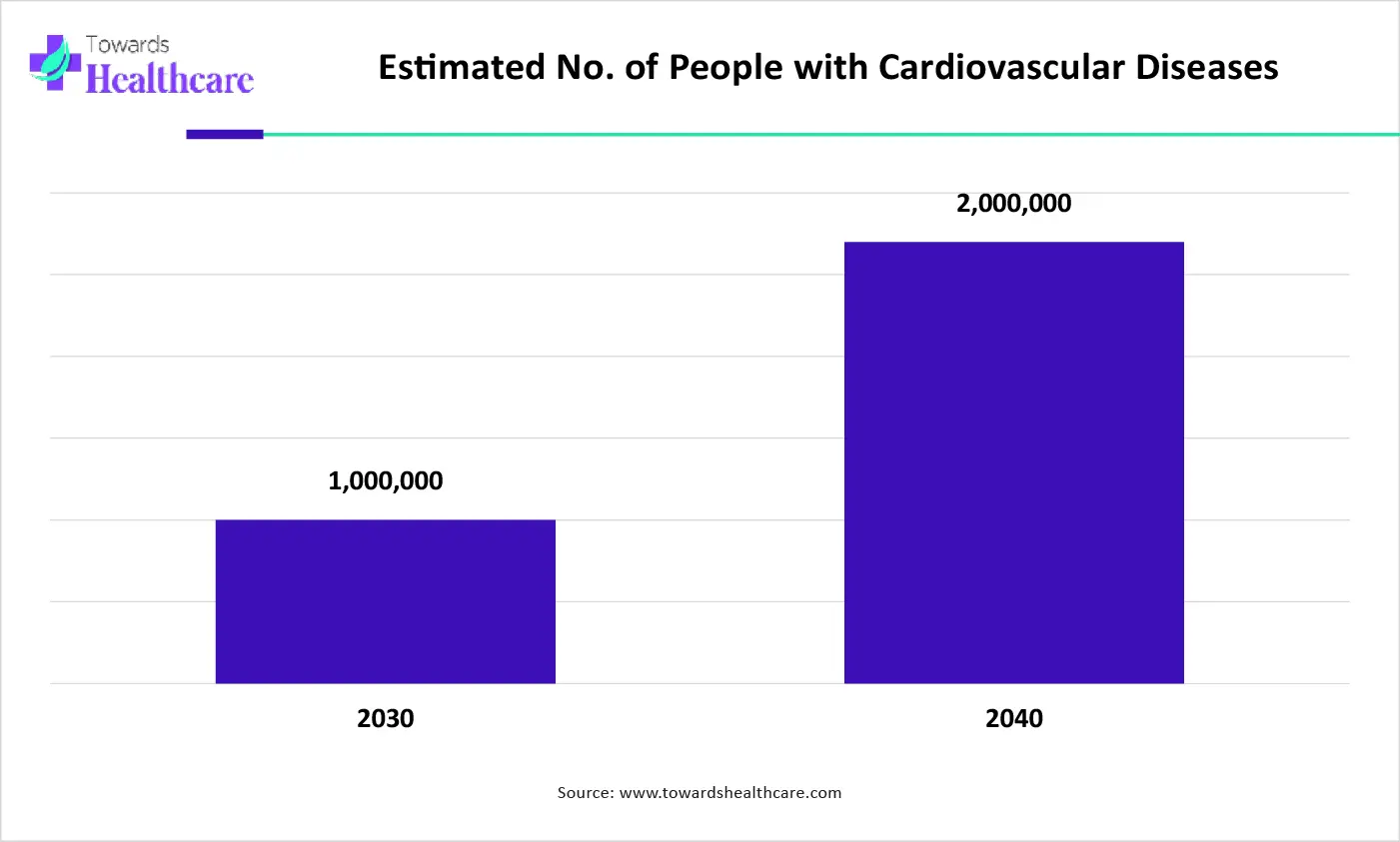

There is a rise in the incidence of cardiovascular diseases. This, in turn, is increasing the demand for cardiovascular devices. These devices can monitor cardiac health, detect any changes, and minimize the risk of complications. Moreover, wearable as well as minimally invasive diagnostic tools are also being used for early diagnosis. This, in turn, is increasing the use of advanced stents, pacemakers, transcatheter valve replacements, etc., by healthcare professionals. Thus, the growing cardiovascular diseases are driving the cardiovascular devices market growth.

The graph represents a comparison between the estimated number of people living with cardiovascular diseases in the year of 2030 and 2040. It indicates that there will be a rise in cardiovascular diseases. Hence, it increases the demand for cardiovascular devices for their effective management. Thus, this, in turn, will ultimately promote the market growth

Expensive Devices

The cardiovascular devices are often associated with a high cost. This makes the patients choose a cheaper option. While hospitals with limited infrastructure cannot afford them, this results in their limited access and use. Additionally, the lack of proper reimbursement policies reduces their use. Thus, the high cost of the devices can minimize their use of these devices.

Why is Growing Innovations an Opportunity in the Cardiovascular Devices Market?

As the use of cardiovascular devices is increasing, the number of innovations is also increasing. Minimally invasive devices are being developed to reduce the risk of complications and recovery time. To treat complex cases, various personalized models or 3D-printed surgical models are also being developed. Similarly, to enhance the safety of the stents, the use of biodegradable materials is increasing. Moreover, the robotic-assisted systems are also being developed to improve the accuracy of the procedures. Thus, all these developments are promoting the cardiovascular devices market growth.

For instance,

By product type, the interventional cardiology devices segment led the market with approximately 32% share in 2024. The interventional cardiology devices provided minimally invasive procedures, which increased their acceptance rates. Additionally, the use of stents and catheters also increased. This contributed to the market growth.

By product type, the structural heart devices segment is expected to show the highest growth at a notable CAGR during the forthcoming years. The increasing cases of valve diseases are increasing the use of structural heart devices. Moreover, the growing awareness is also contributing to the same. Thus, they are providing the patient with new treatment options.

By application type, the coronary artery disease segment held the largest share with approximately 38% of the market in 2024. Due to its growing incidence, the use of cardiovascular devices has increased. These devices were used for diagnosis, monitoring, and treatment. Moreover, the reimbursement policies enhanced their use.

By application type, the structural heart disease segment is expected to show the fastest growth rate during the upcoming years. The growing rates of an aging population with valve disorders are increasing the use of these devices. Furthermore, the demand for minimally invasive devices is increasing. Their growing innovations are also attracting patients

By end user, the hospitals segment led the global market with approximately 55% share in 2024. A large volume of patients were provided with a variety of cardiovascular devices in the hospitals. The advanced infrastructure and skilled personnel enhanced the patient outcomes. Thus, this enhanced the market growth.

By end user, the ambulatory surgical centers segment is expected to show the highest growth during the predicted time. These centers provide advanced cardiovascular devices to the patients. The fast scheduling and affordability are attracting patients. Furthermore, the use of minimally invasive technologies is also contributing to the same.

By technology type, the minimally invasive & transcatheter technologies segment held the dominating share of approximately 45% in the market in 2024. These technologies were the most preferred options as they reduce the risk of complications and the recovery period. Their safety and efficacy enhanced their use by the aging population.

By technology type, the robotic-assisted intervention systems segment is expected to show the highest growth during the upcoming years. These systems are improving the accuracy of the procedures. Moreover, the complex procedures are effectively performed, enhancing patient outcomes. This, in turn, is increasing their adoption.

By product class type, the implantable devices segment led the market with approximately a 62% share in 2024. The implantable devices were widely used to treat chronic heart disorders. They also helped in controlling and monitoring these conditions. This promoted the market growth.

By product class type, the non-implantable devices segment is expected to show the fastest growth rate during the predicted time. The use of these devices is increasing for the early diagnosis of any cardiovascular conditions. The wearable devices are also being developed. Furthermore, the growing advancements are also attracting the population.

North America dominated the cardiovascular devices market share by 36% in 2024. North America consisted of robust industries along with the presence of advanced technologies. This increased the development of cardiovascular devices. Thus, contributed to the market growth.

The growing incidence of cardiovascular diseases in the U.S. is increasing the demand for cardiovascular devices. At the same time, the growing innovations are also increasing their utilization. Moreover, to encourage their use, various reimbursement policies are also being introduced by the government.

The presence of a well-developed healthcare sector in Canada is increasing the use of cardiovascular devices. Additionally, the growing research and development to develop advanced platforms is also increasing. This, in turn, is leading to new collaborations among the industries.

Asia Pacific is expected to host the fastest-growing cardiovascular devices market during the forecast period. The Asia Pacific is experiencing a rise in cardiovascular disease prevalence. This, in turn, is increasing the demand for various cardiovascular devices. Thus, this enhances the market growth.

Due to the large population in China, the cardiovascular disease cases are increasing. Moreover, the aging population is also at risk of these diseases. This, in turn, increases the use of cardiovascular devices. The growing adoption of advanced technologies is also driving their innovations and productions.

The advancing healthcare sector in India is increasing the adoption of cardiovascular devices to tackle the growing cardiovascular disease burden. At the same time, to support these development initiatives from the government is also being introduced. Moreover, the growing medical tourism is also increasing the use of these devices.

Europe is expected to grow significantly in the cardiovascular devices market during the forecast period. The presence of a strong healthcare sector in Europe is increasing the use of different cardiovascular devices. The increasing innovations are also contributing to this growth. Thus, this promotes the market growth.

The healthcare sector of Germany is well-developed, which in turn is boosting the use of cardiovascular devices. At the same time, the industries are focusing on the development and manufacturing of minimally invasive devices. Moreover, the advanced technologies are also being combined with these devices to improve their features.

For the early diagnosis of cardiovascular diseases, the industries in the UK are developing wearable diagnostic devices. Moreover, funding is also being provided by various companies. Hence, the growing development is increasing the clinical trials. Furthermore, to promote their safe and effective use, guidelines are being provided by the regulatory bodies.

By Product Type

By Application

By End User

By Technology

By Product Class

By Region

January 2026

December 2025

December 2025

December 2025