March 2026

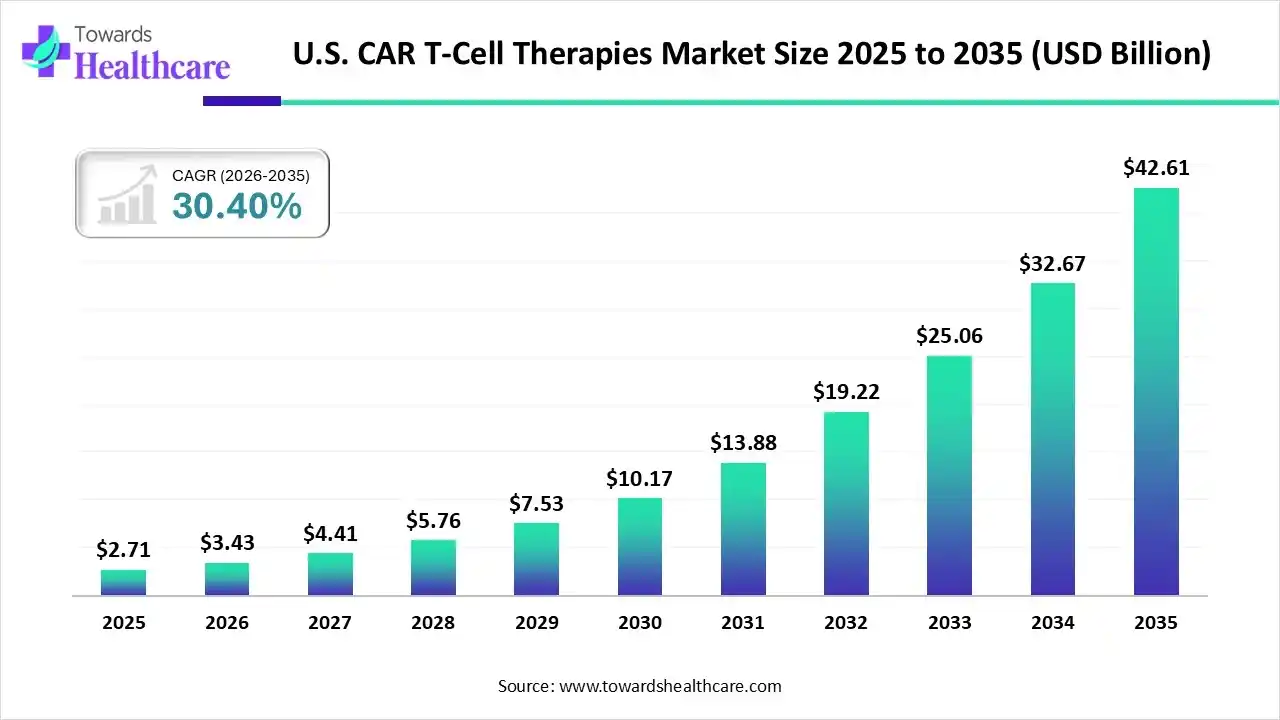

The U.S. CAR T-cell therapies market size was valued at US$ 2.71 billion in 2025 and is projected to grow to 3.43 billion in 2026. Forecasts suggest it will reach approximately US$ 42.61 billion by 2035, registering a CAGR of 30.40% during the period.

The U.S. CAR T-cell therapies market is growing because of the rising prevalence of blood cancers and continuing technological development in biomaterial production and cell engineering. The T-cell therapies come with precision medicine, a strong research and development pipeline with new targets, and increasing awareness in patients and healthcare professionals, which drives the growth of the market.

The U.S. CAR T-cell therapies market is rapidly growing as major biopharmaceutical companies, focused on emerging and commercializing immunotherapies to continue to increase cancer treatment. CAR T-cell therapy refers to a type of immunotherapy used for various types of blood cancer, such as lymphoma, leukemia, and multiple myeloma. It functions by turning T-lymphocytes (T-cells) into more effective cancer-killing machines. In CAR T-cell therapy, medical care professionals introduce a novel gene into T cells that variations cells so them to recognize and kill cancerous cells. Chimeric antigen receptor (CAR)-T-cell therapies have presented amazing efficacy in the treatment of hematologic cancer.

| Major Organization | Investment |

| Bristol Myers Squibb (BMS) | In October 2025, BMS acquired Orbital Therapeutics for $1.5 billion to enter the "in vivo" CAR-T market and expand its existing portfolio. |

| Gilead Sciences | In August 2025, Gilead's Kite Pharma acquired Interius BioTherapeutics for $350 million. |

Integration of AI in North American veterinarian care drives the growth of the market, as increasing application of AI-driven technologies leads to improved production efficiency and precision, optimizes logistics, and lowers the expenses of CAR T-cell therapy. AI-driven technology assists in recognizing suitable patients for therapy and supports monitoring therapy progression and predicting responses to treatment.

AI-based technology in CAR-T cell therapy has huge potential to offer important advances in the manufacturing of CAR-T cells and management of lymphoma and leukemia. This technology has powered sensors that continuously monitor complex parameters such as cell count, growth, and nutrient levels in bioreactors. This offers real-time information for enhancing culture conditions and ensuring a consistent and high-quality product.

| Key Elements | Scope |

| Market Size in 2026 | USD 3.43 Billion |

| Projected Market Size in 2035 | USD 42.61 Billion |

| CAGR (2025 - 2035) | 30.40% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Drug Type, By Indication, By End User |

| Top Key Players | Johnson & Johnson Services, Inc., ALLOGENE THERAPEUTICS, Lonza, Aurora Biopharma, Cartesian Therapeutics, Inc., Novartis, Bristol-Myers Squibb company, Gilead Sciences, Curocell Inc, JW Therapeutics |

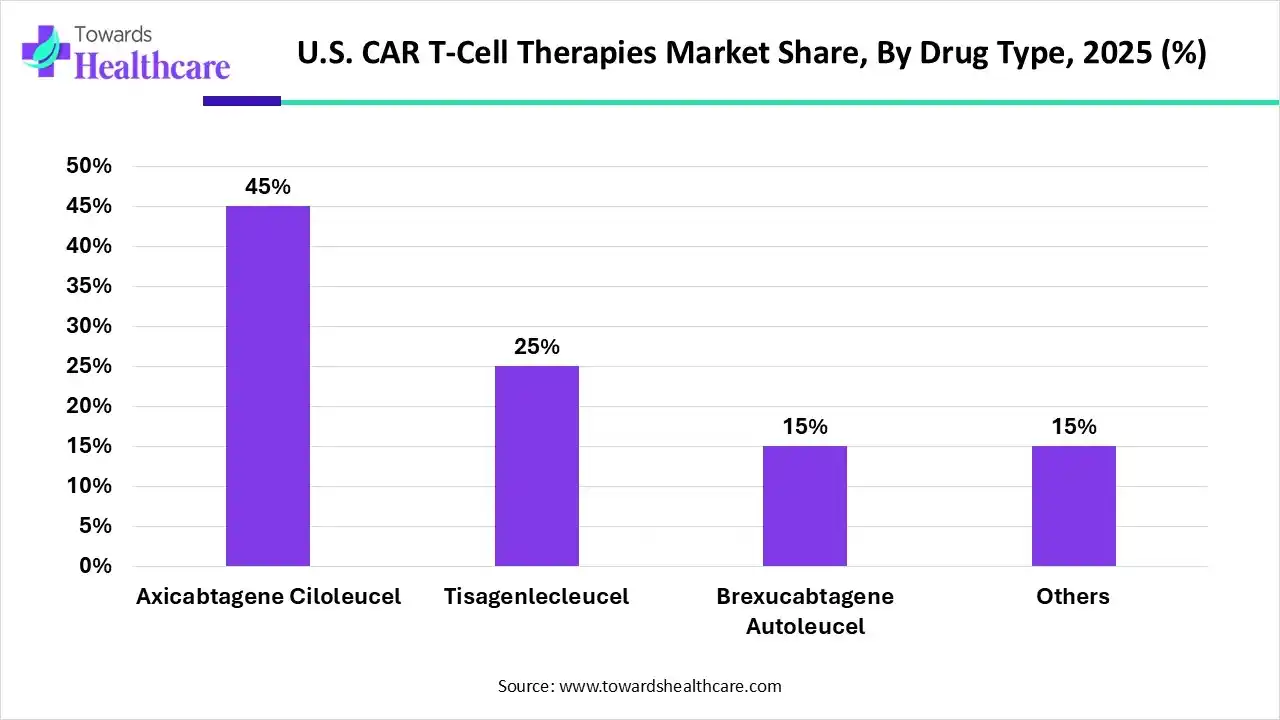

Why the Axicabtagene Ciloleucel Segment Dominated the Market?

By drug type, the Axicabtagene Ciloleucel segment led the U.S. CAR T-cell therapies market by 45% , as Axicabtagene ciloleucel is applied to treat follicular lymphoma and large B-cell lymphoma that has come back or after 2 or more lines of management did not work well.

On the other hand, the tisagenlecleucel segment is projected to experience the fastest CAGR from 2025 to 2034, as it is used to treat B-cell acute lymphoblastic leukemia (ALL) that has come back a second time or later time or after other drugs did not work better in patients up to 25 years of age.

Why the Lymphoma Segment Dominated the Market?

By indication, the lymphoma segment is dominant in the U.S. CAR T-Cell therapies market by 35% in 2025, as in chimeric antigen receptor-modified (CAR) T-cell therapy, personalized CD19 has transformed the treatment of relapsed or refractory B-cell lymphomas. The genetically improved T-cells persist in the body for months or even years, persistently monitoring for and offensive cancer cells to avoid relapse.

The acute lymphocytic leukemia segment is expected to experience the fastest growth from 2025 to 2034, driven by the development of CAR T-cells, which are universally applicable allogeneic products. These CAR T-cells are derived from healthy donors, ensuring a plentiful supply of healthy T-cells that are unaffected by chemotherapy or cancer itself. For patients with highly aggressive ALL that has relapsed after multiple treatments, CAR T-cell therapy provides renewed hope and a potential pathway to a cure.

| Segment | Share 2025 (%) |

| Hospitals | 60% |

| Cancer Treatment Centers | 40% |

Why is the Hospitals Segment Dominant in the Market?

By end-user, the hospitals segment led the U.S. CAR T-cell therapies market by 60% in 2025, as CAR T-cell therapy requires a short treatment time required administered with a single infusion at most, two weeks of inpatient care, and then it’s done. In the hospital, healthcare professionals use CAR T-cell therapy to manage cancer by genetically engineering a patient's own T cells to attack cancer cells. CAR T-cell therapy is often considered for patients who have not responded well to ideal treatments such as chemotherapy or have experienced relapse. The application of CAR T-cell therapy is not limited to specific types of cancer.

The cancer treatment centers segment is projected to experience the fastest CAGR from 2025 to 2034, as this center serves as a central hub for those patients' needs, offering a full spectrum of cancer services, involving screening and prevention, research, treatment, diagnosis, rehabilitation, emotional balance, and survivorship programs. It also offers various psychosocial support services to help patients and their loved ones manage the disease and its treatment.

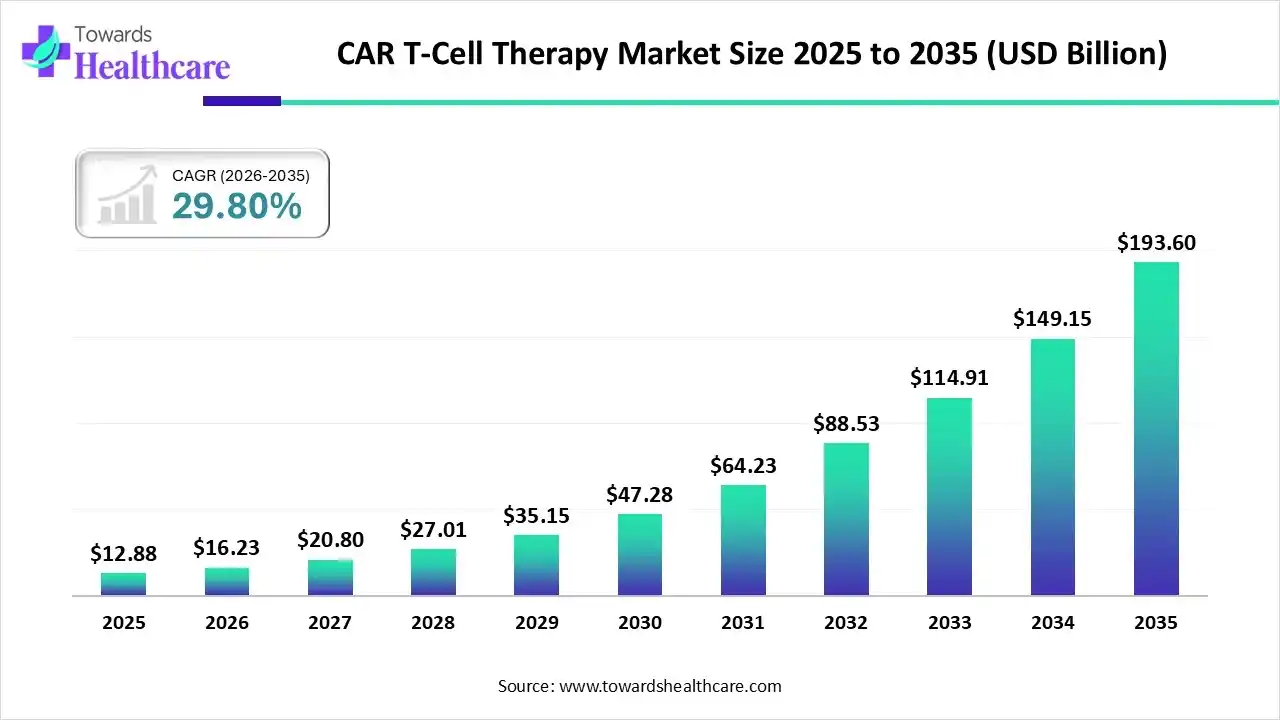

The CAR T-cell therapy market size stood at US$ 12.88 billion in 2025, grew to US$ 16.23 billion in 2026, and is forecast to reach US$ 193.6 billion by 2035, expanding at a CAGR of 29.80% from 2026 to 2035.

The research and development (R&D) technology for U.S. CAR T-cell therapies mainly includes a multi-stage process that includes genetic engineering, cell manufacturing, and extensive quality control.

Key Players: hermo Fisher Scientific and Corning Life Sciences

Clinical trials of U.S. CAR T-cell therapies involve patient evaluation, collection of the patient's T-cells, and their genetic engineering into CAR T-cells in a lab.

Key Players: Merck KGaA and Evonik

CAR T-cell therapy provides patient services such as personalized, targeted treatment, inclusive supportive care, and a huge strength for long-term remission.

Key Players: Collplant Biotechnologies and Chondrex, Inc.

By Drug Type

By Indication

By End User

March 2026

March 2026

February 2026

February 2026