March 2026

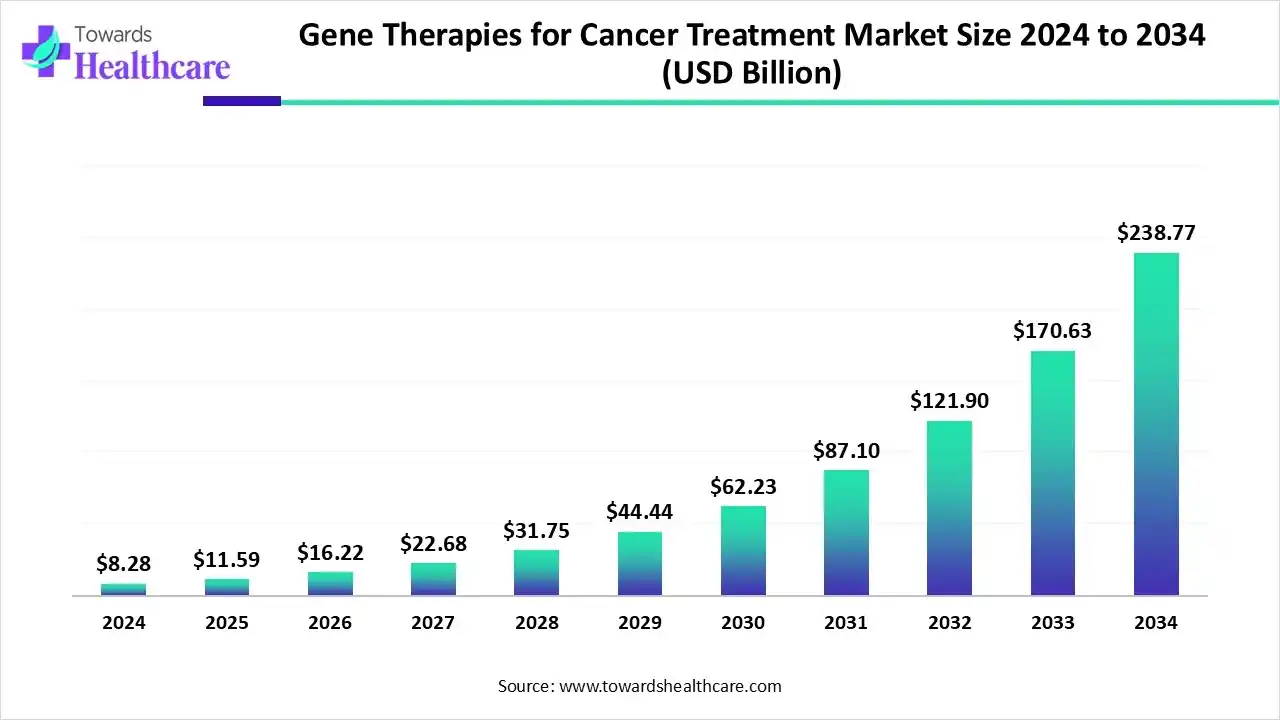

The global gene therapies for cancer treatment market size is calculated at USD 8.28 billion in 2024, grew to USD 11.59 billion in 2025, and is projected to reach around USD 238.77 billion by 2034. The market is expanding at a CAGR of 39.94% between 2025 and 2034.

The gene therapies for cancer treatment market is primarily driven by the increasing demand for targeted treatment and growing research activities. Government organizations provide funding for the research and manufacturing of gene therapies as well as support the precision oncology field. Artificial intelligence (AI) revolutionizes the development of gene therapies, driving precision and accuracy. Advances in genomic technologies present future opportunities for market growth.

| Table | Scope |

| Market Size in 2025 | USD 11.59 Billion |

| Projected Market Size in 2034 | USD 238.77 Billion |

| CAGR (2025 - 2034) | 39.94% |

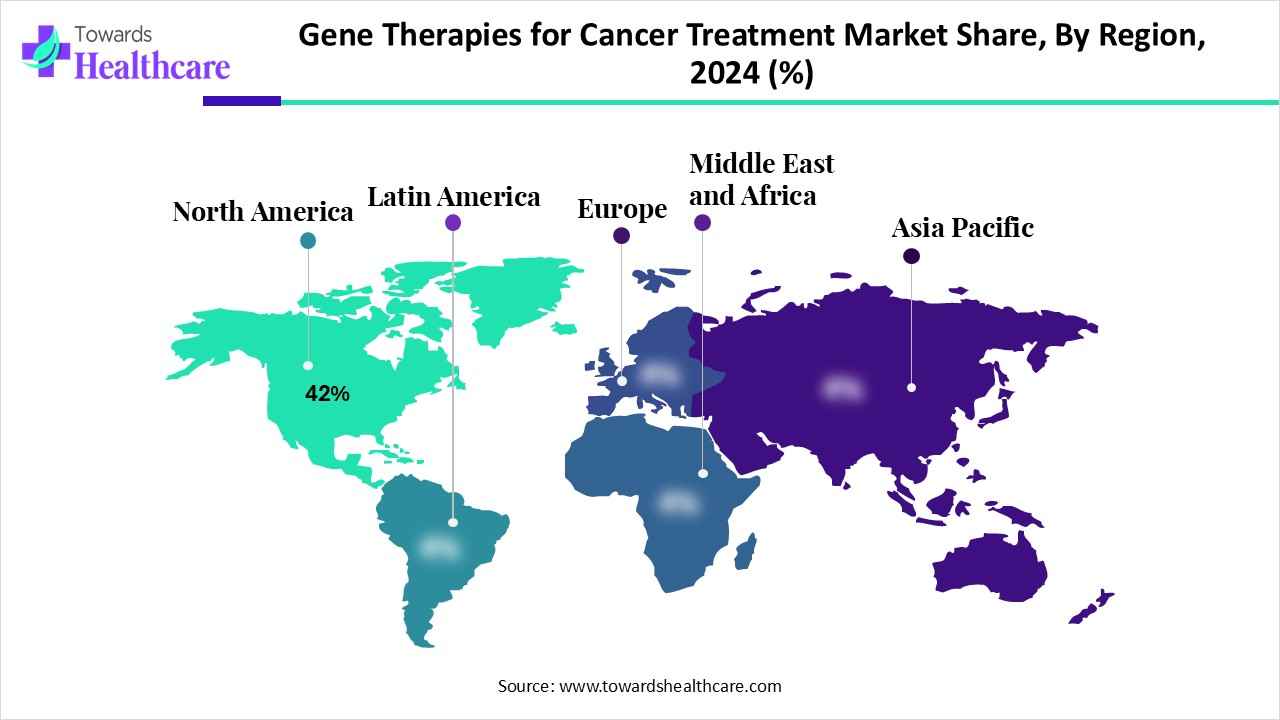

| Leading Region | North America by 42% |

| Market Segmentation | By Therapy Type/Modality, By Cancer Type/Indication, By Vector/Delivery Method, By Treatment Setting, By Distribution Channel, By Region |

| Top Key Players | Immatics, Legend Biotech, Celyad Oncology, BioNTech, Editas Medicine, Astellas Pharma, Kite Pharma, Allogene Therapeutics, OncoImmune, Takeda, Sangamo Therapeutics, Beam Therapeutics, Charles River Laboratories |

The gene therapies for cancer treatment market is fueled by rising incidence of hematologic and solid tumors, advances in cell and gene therapy platforms, increasing regulatory approvals, and growing investment in precision oncology. It involves the use of genetic material to modify a patient’s cells to treat or prevent cancer. Approaches include viral vector-mediated gene delivery, CAR-T (chimeric antigen receptor T-cell) therapy, TCR therapy, oncolytic viruses, RNA-based therapies, and CRISPR-based editing. These therapies can target specific cancer mutations, enhance immune response, or sensitize tumors to other treatments.

AI can improve the development of gene therapies using advanced computational methods, leading to more effective and stable therapeutics. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and identify new biomarkers to assist tumor screening, detection, diagnosis, treatment, and prognosis prediction. They can allow researchers to develop efficacious gene therapies with reduced adverse effects. They can enable healthcare professionals to make proactive clinical decisions.

Tempus, an AI-based precision medicine developer, has generated the xT Platform to increase personalized therapeutic opportunities for cancer patients.

| Product | Disease | Approved By | Approval Year | Company |

| IMLYGIC | Melanoma, pancreatic cancer | FDA | 2015 | BioVex LLC |

| Gendicine (rAd-p53) | Head and neck squamous cell carcinoma | NMPA | 2003 | SiBiono GeneTech Co., Ltd. |

| Oncorine (rAd5-H101) | Nasopharyngeal cancer, lung cancer, liver cancer, pancreatic cancer | NMPA | 2005 | Shanghai Sunway Biotech Co., Ltd. |

| ADSTILADRIN | BCG-unresponsive non-muscle invasive bladder cancer with carcinoma in situ, with or without papillary tumors | FDA | 2022 | Ferring Pharmaceuticals A/S |

| ABECMA | Multiple myeloma | FDA | 2021 | Celgene Corporation |

| CARVYKTI | Multiple myeloma | FDA, EMA | 2022 | Janssen Pharmaceuticals |

| YESCARTA | Melanoma, pancreatic cancer | FDA | 2017 | Kite Pharma, Inc. |

| KYMRIAH | Lymphoma | FDA, EMA | 2018 | Novartis AG |

| BREYANZI | Large B-cell lymphoma | FDA, EMA | 2022 | Bristol Myers Squibb |

| TECARTUS | Acute lymphoblastic leukemia | FDA, EMA | 2020 | Kite Pharma, Inc. |

By therapy type/modality, the CAR-T cell therapy segment held a dominant presence in the gene therapies for cancer treatment market with a share of approximately 35% in 2024, due to the immuno-modulatory effect of CAR-T cells and high specificity. Human T-cells are genetically engineered to express the CAR and are administered into the body to attack cancer cells. They provide long-term effects, preventing disease recurrence. The 2025 Nobel Prize for Physiology/Medicine for T-cell research further lays the foundation for a new field of research and spurs the development of novel treatments.

By therapy type/modality, the oncolytic virus therapy segment is expected to grow at the fastest CAGR in the market during the forecast period. Oncolytic viruses are a type of immunotherapy that uses viruses to infect and destroy cancer cells. They replicate rapidly, destroy the cells by breaking them open, and expose the cell’s contents to the immune system. The U.S. FDA has approved T-VEC, an oncolytic virus, for the treatment of metastatic melanoma.

By cancer type/indication, the hematological cancers segment held the largest revenue share of approximately 42% in the gene therapies for cancer treatment market in 2024, due to the rising prevalence of blood cancers and the availability of licensed therapeutics. Gene therapy offers hope for patients with blood cancers resistant to conventional therapies. Leukemia is estimated to account for 7.1% of all malignancies in men and 6.4% in women in India. Ongoing efforts are made to develop innovative gene therapy that can kill any type of blood cancer cell.

By cancer type/indication, the melanoma & skin cancers segment is expected to grow with the highest CAGR in the market during the studied years. Gene therapy has proved to be vital for treating melanoma by directly targeting the genes involved in causing skin cancer. The American Cancer Society estimated that about 104,960 new melanomas will be diagnosed in 2025 in the U.S. Melanoma is generally caused by long-term exposure to UV radiation, a weakened immune system, and family history.

By vector/delivery method, the lentiviral vectors segment contributed the biggest revenue share of approximately 30% in the gene therapies for cancer treatment market in 2024, due to the large genetic capacity of lentiviral vectors and the ability to transduce dividing and non-dividing cells. Lentiviral vectors have garnered significant attention as vehicles for gene therapy due to their safety and stability. They are also more efficient in delivering the genetic material. Improved bioprocessing methods are developed for customized lentivirus production.

By vector/delivery method, the non-viral delivery segment is expected to expand rapidly in the market in the coming years. Non-viral vectors eliminate the chance of viral infections in humans. Some common examples of non-viral vectors include lipid nanoparticles, exosomes, cationic polymers, hydrogels, and inorganic nanoparticles. They offer several advantages, such as flexible chemical composition, high DNA loading, and easily modulated topology.

By treatment setting/administration, the hospital/oncology centers segment accounted for the highest revenue share of approximately 60% in the gene therapies for cancer treatment market in 2024, due to the availability of favorable infrastructure and the presence of skilled professionals. Hospitals have skilled professionals from various departments, providing multidisciplinary expertise to patients. Suitable capital investments enable hospitals and oncology centers to adopt advanced therapeutics for cancer. The U.S. is home to 73 NCI-designated cancer centers.

By treatment setting/administration, the home/outpatient self-administered programs segment is expected to witness the fastest growth in the market over the forecast period. Healthcare professionals provide personalized treatment by delivering gene therapy to patients in the comfort of their homes. Outpatient programs are conducted to allow patients to return to their work without impacting their productivity. According to a recent study, out of 70% of study participants who received CAR-T cell therapy on an outpatient basis, one-quarter never required hospitalization. Future trends may involve the development of self-administration kits for gene therapy.

By distribution channel, the hospital pharmacies/infusion centers segment led the gene therapies for cancer treatment market with a share of approximately 55% in 2024, due to the increasing number of hospital admissions and favorable regulatory support. Hospital pharmacies and infusion centers possess the desired facility for the reception, storage, reconstitution, administration, and waste disposal of gene therapies. Patients prefer purchasing gene therapies from hospital pharmacies due to suitable reimbursement policies.

By distribution channel, the direct-to-patient/home delivery segment is expected to show the fastest growth over the forecast period. Patients usually prefer gene therapy administration at their homes. Several private healthcare organizations provide at-home services to patients. However, this practice is still in its experimental stage, and healthcare professionals are determining the standard practice for home delivery of gene therapies.

North America dominated the global market with a share of approximately 42% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major factors that govern market growth in North America. Government and private organizations provide funding for the development of innovative gene therapy. They also launch initiatives to create awareness among the general public about personalized medicines.

Numerous U.S.-based companies like Bristol Myers Squibb, Moderna, and Kite Pharma develop and market gene therapy products for cancer patients in the U.S. The U.S. conducts the highest number of clinical trials in the world. Out of the total 1,543 trials related to gene therapies for cancer, about 803 are registered in the U.S. as of October 2025. As of 2023, the U.S. FDA has approved a total of 8 gene therapy products for oncology treatment.

Health Canada regulates the approval of gene therapy products under the Canadian Food and Drugs Act, accounting for 10 gene therapy products. Of these, 6 are CAR-T cell therapies indicated for different cancer types. The Canadian Cancer Society estimates that 2 in 5 Canadians are expected to be diagnosed with cancer in their lifetime. The Canadian government also actively supports gene therapy development and manufacturing. It invested over $2.2 billion from March 2020 to July 2024 to strengthen Canada’s domestic biomanufacturing.

Asia-Pacific is expected to host the fastest-growing gene therapies for cancer treatment market in the coming years. Countries like China, India, Japan, and South Korea are emerging as prominent global manufacturing hubs for gene therapy products due to favorable infrastructure and an affordable workforce. Research institutes and biotech companies conduct seminars, workshops, and conferences to share the latest updates about gene therapy and genomic technologies. The rising prevalence of cancer and the growing geriatric population foster market growth.

The latest research activities for gene therapy include the development of innovative gene therapies with enhanced efficacy. Researchers also develop novel delivery systems for a targeted approach.

Key Players: Intellia Therapeutics, Kite Pharma, Inc., and CRISPR Therapeutics.

Clinical trials are research studies that help healthcare professionals find out whether a gene therapy approach is safe for people. Regulatory agencies approve gene therapy products based on the results of clinical trials.

Key Players: Shenzhen SiBiono GeneTech Co., Ltd., GlaxoSmithKline, and Celgene.

Patient support & services refers to conducting insurance coverage reviews, assisting with prior authorizations and appeals, and offering support through personalized care.

The major companies in the gene therapies for cancer treatment market include:

By Therapy Type/Modality

By Cancer Type/Indication

By Vector/Delivery Method

By Treatment Setting

By Distribution Channel

By Region

March 2026

February 2026

February 2026

February 2026