November 2025

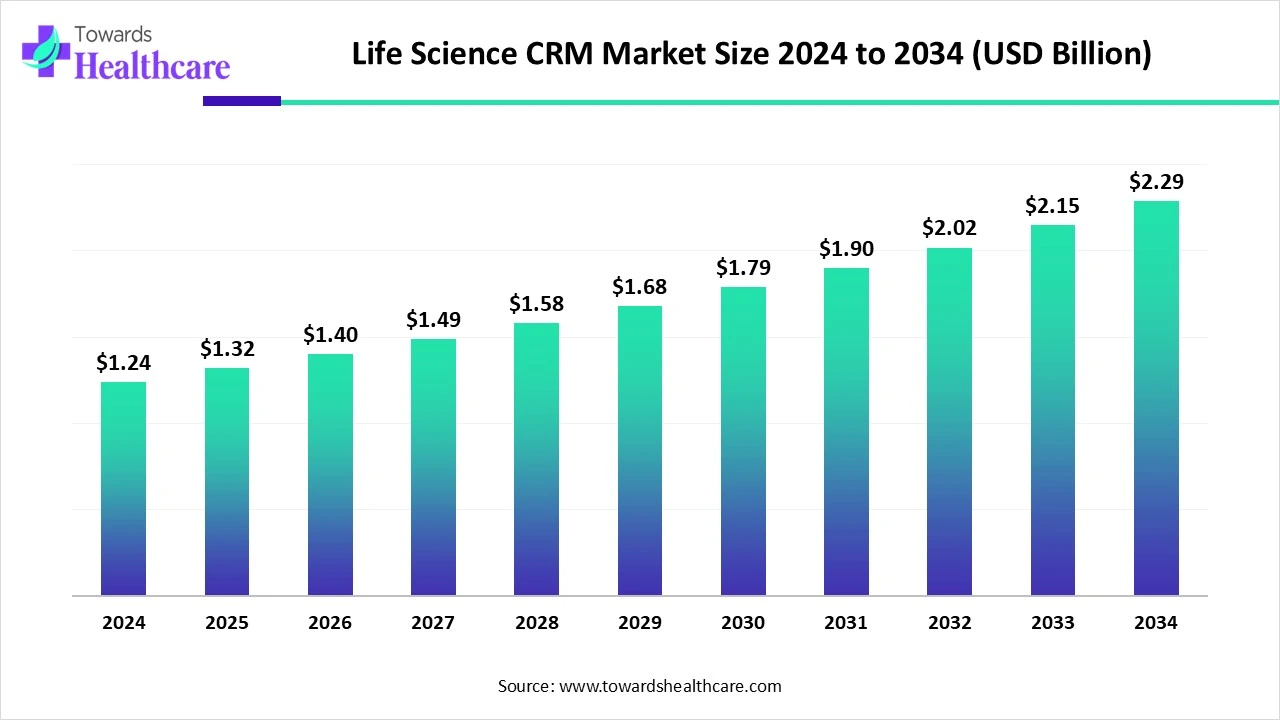

The global life sciences CRM market size is calculated at US$ 1.24 billion in 2024, grew to US$ 1.32 billion in 2025, and is projected to reach around US$ 2.29 billion by 2034. The market is expanding at a CAGR of 6.32% between 2025 and 2034.

CRM systems serve as a system of record for companies planning to launch a drug, medical device, or diagnostic test, or those that have already done so. Consequently, practically everyone has implemented CRM. CRM providers are responding to the changing dynamics of the life science industry, which include the use of AI-based decision support tools, a shift toward customer centricity, and digital-first engagement. CRM providers are also responding to commercial changes, including the growth of portfolios of tailored medicines and related care models, as well as constraints such as accessibility and a stronger focus on the value of goods and treatments. These advancements have enabled CRM businesses to expand their market share and continually refine their offerings.

| Metric | Details |

| Market Size in 2025 | USD 1.32 Billion |

| Projected Market Size in 2034 | USD 2.29 Billion |

| CAGR (2025 - 2034) | 6.32% |

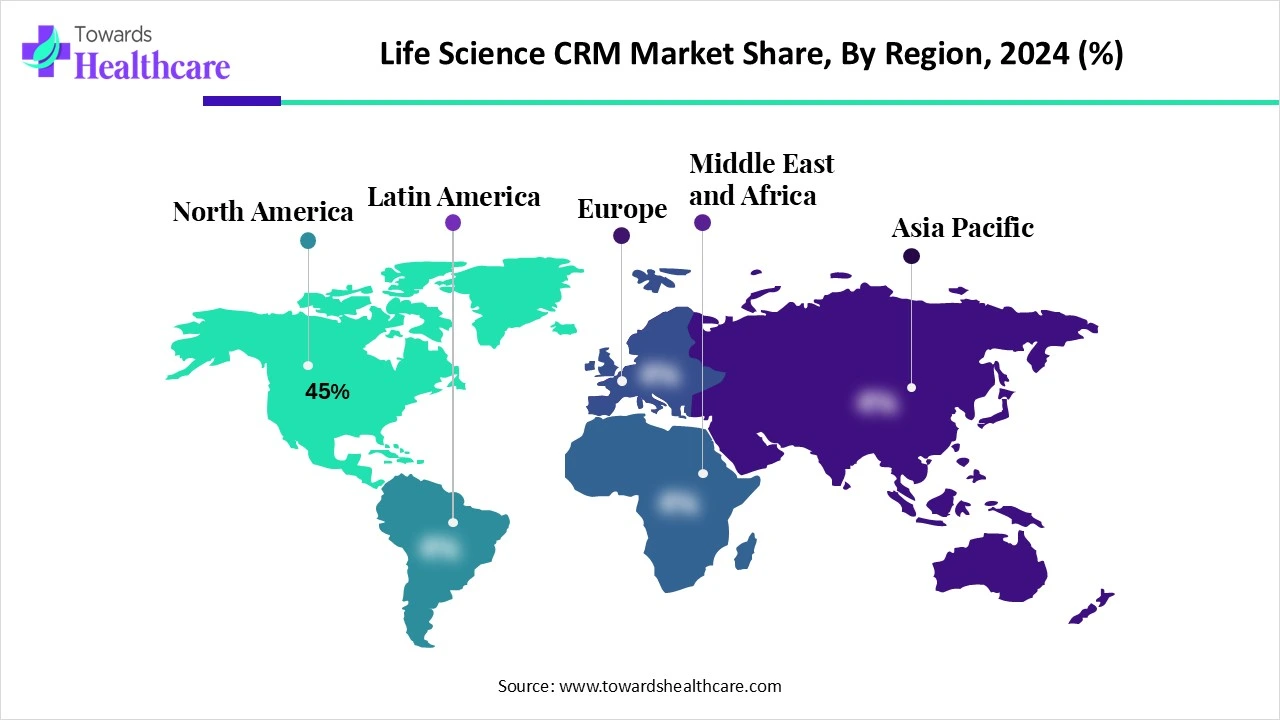

| Leading Region | North America share by 45% |

| Market Segmentation | By Functionality, By Deployment Mode, By Application, By End User, By Region |

| Top Key Players | Veeva Systems, Salesforce, Oracle Life Sciences, IQVIA Technologies, Microsoft Dynamics 365 for Healthcare & Pharma, Zinfi Technologies, Pitcher AG, ACTO Technologies, Apttus (Conga), Sforce, Freshworks, Cegedim Relationship Management, Indegene, Syneos Health, ZS Associates, Kapture CRM, StayinFront, Bainbridge Health, Pegasystems, TrueBlue Life Sciences |

The life sciences CRM market consists of software solutions tailored to the pharmaceutical, biotechnology, medical device, and diagnostics industries for managing customer relationships, sales force operations, marketing automation, field activities, HCP/KOL engagement, and regulatory-compliant communications. Unlike generic CRM platforms, life sciences CRM incorporates features that adhere to GxP, HIPAA, and global marketing codes, enabling companies to manage multi-stakeholder engagement across HCPs, payers, providers, and regulatory authorities. The market is driven by omnichannel transformation, personalized marketing, and digital-first field strategies.

Recently, the life sciences sector has begun to show signs of embracing new business enablers like artificial intelligence (AI), machine learning (ML), and cognitive computing after previously being choosy about implementing new digital consumer engagement models. Businesses in the life sciences may gain from personalized forecasts, suggestions, integrated predictive insights, workflow optimization, and the development of tailored customer products by integrating AI into CRM.

Increased Patient Engagement

By offering crucial features like appointment scheduling, reminders, patient portals for convenient access to medical records, educational resources, and interactive communication channels like secure messaging and telemedicine, CRM platforms facilitate effective patient engagement strategies in healthcare settings. The foundation of healthcare CRM is the meticulous management of patient relationships throughout the patient's medical journey. Personalizing care and enhancing patient satisfaction involves thoroughly documenting medical histories, treatment plans, visit logs, billing information, and requests for feedback.

Security-Related Concerns

Because CRM systems in the life sciences handle sensitive patient data, they are subject to stringent regulations. It can be challenging to preserve data privacy and security, as any breaches may lead to severe penalties and permanent damage to a healthcare provider's reputation. This is reducing adoption rates and negatively impacting the growth of the global life sciences CRM market.

Integration of Advanced Technologies

Modern technologies, such as blockchain, the Internet of Things (IoT), and advanced analytics, can be integrated with CRM systems to create new opportunities for enhancing healthcare services. Blockchain technology can provide safer and more transparent patient data management, while Internet of Things devices can provide real-time health monitoring and data collection. By extracting pertinent insights from patient data, sophisticated analytics can help enhance decision-making processes and patient outcomes. The use of these technologies can result in more creative and robust CRM solutions.

By functionality, the sales force automation (SFA) segment held the major share of the life sciences CRM market in 2024. Sales force automation, or SFA, is becoming a vital tool for companies looking to boost productivity and streamline their sales processes. Thanks to technological improvements, sales teams can now leverage automation solutions to generate revenue, automate processes, and increase efficiency. Numerous features designed to expedite sales processes are among the key uses of sales force automation. These include lead management, contact management, opportunity management, forecasting, reporting, and pipeline tracking.

By functionality, the patient engagement & support programs segment is estimated to grow at the highest CAGR during the upcoming timeframe. A patient engagement program can revolutionize the way healthcare practitioners interact with their patients, leading to happier, healthier patient populations and increased profitability. A carefully thought-out patient engagement program for physicians may improve everything, from care adherence to cultivating engagement. To provide continuous contact, education, and feedback, patient engagement initiatives often utilize technology, including online patient portals, mobile applications, and personalized communications.

By deployment mode, the cloud-based CRM segment dominated the life sciences CRM market in 2024 and is estimated to witness the fastest growth during the forecast period. Most companies have switched to modern cloud CRMs, which run software and store data both online and off-site. Running CRM in the cloud has a number of benefits, including easier setup and management, greater flexibility for quick expansion, and the potential for increased profitability. Through simple interaction with other apps, cloud CRM systems enable the secure, unfettered flow of data, giving a complete picture of the business and its customers.

By deployment mode, the hybrid deployment segment is expected to grow at a significant CAGR during the forecast period. Hybrid cloud solutions provide several distinct advantages by combining the finest features of both worlds. Businesses can swiftly deploy additional computing resources as needed by leveraging the vast potential of public cloud services through hybrid cloud architectures. Performance, security, and overall efficiency can all be improved by implementing hybrid cloud best practices.

By application, the pharmaceutical sales & marketing segment led the market in 2024. Market connections and competition are growing in the pharmaceutical industry. Explains why the provision of pharmaceuticals to the general population requires the essential characteristics of commercialization and scientific and targeted application. Marketing strategies allow them to effectively adjust to changes in the environment, consumer expectations, and organizational capabilities through market research and analysis-based management decisions. Customer service, consumer behavior research, product development, and planning are just a few of the marketing applications.

By application, the specialty care & rare disease CRM segment is anticipated to be the fastest-growing during the forecast period. Every choice, campaign, and medical encounter involving rare illnesses must be carried out with a degree of precision and comprehension that can only be provided by a sophisticated CRM. CRM solutions that preserve the nuances of each patient's experience and transform every encounter into valuable insights, such as Veeva solutions, Salesforce Health Cloud, and Microsoft Dynamics 365 for Pharma, do more than organize data.

By end-user, the pharmaceutical & biotech companies segment held the dominant share of the life sciences CRM market in 2024. In order to handle contacts with different stakeholders, such as physicians, hospitals, pharmacists, patients, and regulators, pharmaceutical and biotech businesses must use customer relationship management, or CRM. While guaranteeing adherence to industry rules, CRM solutions assist these businesses in streamlining procedures, enhancing sales and marketing initiatives, and improving communication.

By end-user, the patient support service providers segment is estimated to grow at the highest rate during 2025-2034. PAPs, provider support, injection and device training field role partnerships, travel and lodging concierge services, clinical trial support, and patient education are just a few of the services that patient support service providers in the pharmaceutical and healthcare industries provide to help patients begin and continue their treatments. Despite the fact that these programs differ based on the therapeutic area and particular drugs, they all aim to help patients overcome obstacles to starting and maintaining therapy, which will eventually improve their health.

North America dominated the life sciences CRM market share by 45% in 2024. The growing prevalence of chronic diseases and the increasing emphasis on preventive care are driving demand for innovative solutions that enhance care coordination and improve patient outcomes, further solidifying North America's market leadership. As healthcare needs rise, investments in state-of-the-art CRM systems are expected further to consolidate North America's position in the worldwide market. Additionally, the large number of leading healthcare IT companies in North America promotes innovation by providing companies with access to cutting-edge resources that meet their needs.

The U.S. is leading in the market in North America due to strong healthcare and life science infrastructure. Apart from this, a lot of top companies belong to the U.S., due to which a lot of service providers are available there. Apart from this, the rise in chronic conditions and demand for personalized treatment is leading to the development of CRM apps and service platforms.

Since the majority of specialist medications in Canada already have patient support programs (PSPs) in place, recent years have seen an emphasis on expanding and strengthening data collection capabilities. The majority of specialized medications introduced in Canada have a corresponding PSP. With over 400 PSPs in operation, including 175 that support cancer medications, Canada has a well-developed PSP infrastructure.

Asia Pacific is estimated to host the fastest-growing life sciences CRM market during the forecast period. The Asia-Pacific market is expanding rapidly due to a combination of factors, including local digitalization, patient needs, and rising healthcare costs. CRMs are being utilized in China, India, and Japan to expand service areas, streamline procedures, and improve patient care. Due to the density and variety of the local population, as well as the growing acceptance of telemedicine and smartphone apps, CRM providers have numerous opportunities.

The Chinese government has made improving its primary care system a top priority. The Chinese government has gradually redirected its attention from developing networks and infrastructure to boosting primary care institutions' service qualities and human resources. There has been significant development, aided by more financing and comprehensive guidelines.

In the Indian healthcare sector, improving patient outcomes, satisfaction, and experience requires the use of patient relationship management, or PRM. The National Digital Health Mission and Ayushman Bharat are two government initiatives that employ PRM as one of the digital technologies to enhance healthcare delivery. Through stakeholder integration and process simplification, these initiatives aim to create a more unified and efficient healthcare setting.

Europe is expected to grow significantly in the life sciences CRM market during the forecast period. Driven by factors such as the rising need for healthcare IT solutions, the increased focus on patient participation, and the growing need for healthcare providers to improve patient outcomes while reducing costs. The United Kingdom, Germany, and France are the three largest marketplaces in Europe.

The burden of providing medical care to Germany's 83 million people is enormous. This healthcare is provided through a network of around 1,900 hospitals, 150,000 physicians, 28,000 outpatient psychotherapists, and nearly 19,500 pharmacies. The concept of solidarity forms the foundation for financing the German healthcare system. Medical treatment is a right for all SHI beneficiaries, irrespective of their income and, consequently, their contributions to health insurance.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In December 2024, according to Uday Kiran Kotla, global leader of Cognizant's CX-CRM group, an enterprise ecosystem must operate as the business itself, rather than just a support system, to deliver best-in-class experiences. By combining Salesforce's AI-based solutions with Cognizant's extensive domain and industry expertise, we aim to deliver scalable, long-lasting solutions through the Salesforce Life Science Cloud that address significant client challenges and enhance patient experiences. (Source - Cognizant)

By Functionality

By Deployment Mode

By Application

By End User

By Region

November 2025

October 2025

October 2025

October 2025