January 2026

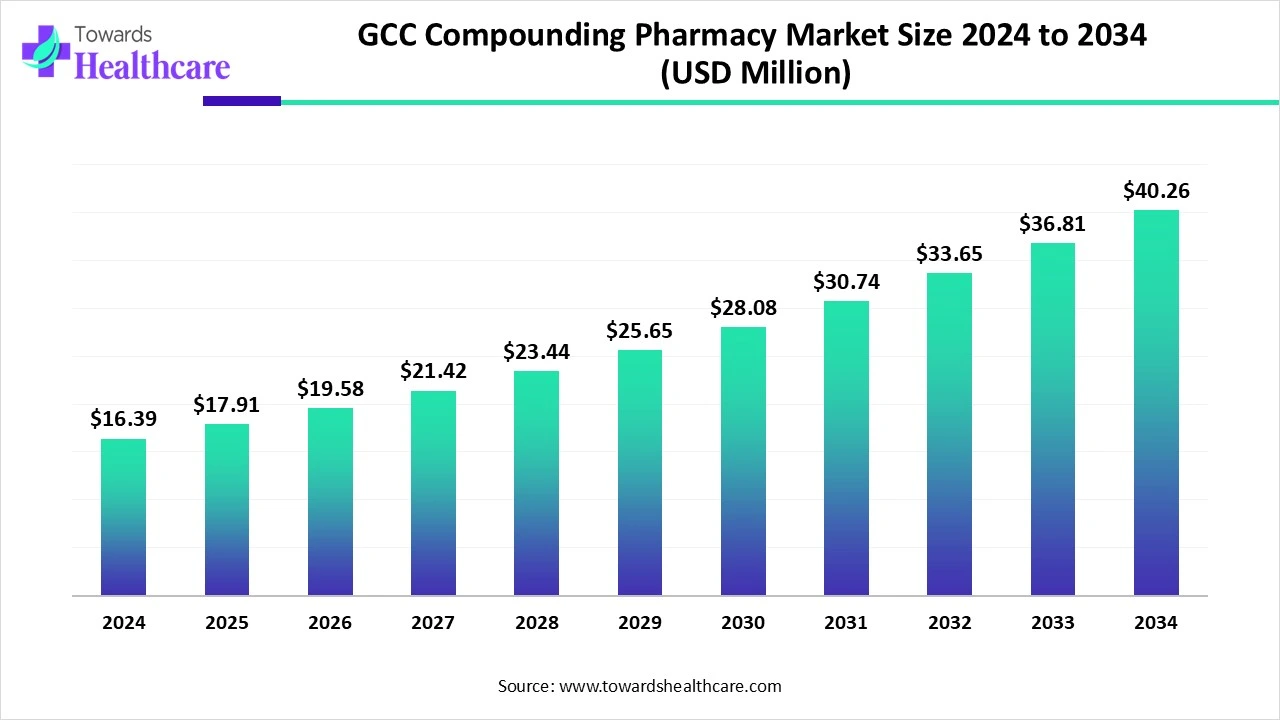

The global GCC compounding pharmacy market size is calculated at USD 17.91 million in 2025, grew to USD 19.57 million in 2026, and is projected to reach around USD 43.46 million by 2035. The market is expanding at a CAGR of 9.27% between 2026 and 2035.

The GCC compounding pharmacy market is primarily driven by the growing demand for personalized medicines. Approved products or medications may cause severe allergies or infections, necessitating pharmacists to provide compounded medications. Government support and increasing investments in compounding pharmacies potentiate market growth. The future looks promising with favorable regulatory policies and the adoption of advanced technologies.

The market includes pharmacies in Gulf Cooperation Council countries (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, Oman), offering customized medication formulations, including hormone therapies, pain management, dermatology, pediatric, and veterinary compounds. These pharmacies tailor dosage form and ingredients to individual patient needs not met by commercial drugs (e.g., patient allergies, dosage requirements, niche therapies). Community pharmacies offer superior benefits, such as improvement in medication adherence, better disease control, and improvement in quality of life.

The major growth factors of the market include the growing need for personalized medicines and patient-centered services. Technological advancements drive the latest innovations in compounding pharmacies by automating the drug delivery system. Favorable regulatory policies by the regulatory agencies of GCC countries support compounding pharmacies. The rising prevalence of chronic disorders and pain disorders augments market growth.

Artificial intelligence (AI) can play a vital role in compounding pharmacy by automating drug dosage preparation and dispensing. It can analyze a patient’s medical history and suggest appropriate dosage and type of excipients to be used. An AI-based barcode system can be used to access patient information and medication history. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and enhance accuracy and consistency in pharmacy compounding. Thus, AI enables pharmacists to make informed decisions, streamline operations, and improve customer experience.

Need for Personalized Medicines

The major growth factor for the GCC compounding pharmacy market is the increasing need for personalized medicines. Certain patients experience adverse reactions to conventional approved medications, such as allergies or intolerance to ingredients like dyes or lactose. Compounding pharmacies can reformulate drugs to remove allergens or modify the dosage forms for easier administration. They can flavor medications to make them more palatable, especially for the geriatric and pediatric populations. A personalized approach to medicines enhances treatment effectiveness by addressing the specific requirements of each patient.

Lack of Skilled Professionals

GCC countries lack a sufficient number of skilled professionals to dispense medications through compounding pharmacies. This results in fewer compounding pharmacies in the region, restricting market growth.

What is the Future of the GCC Compounding Pharmacy Market?

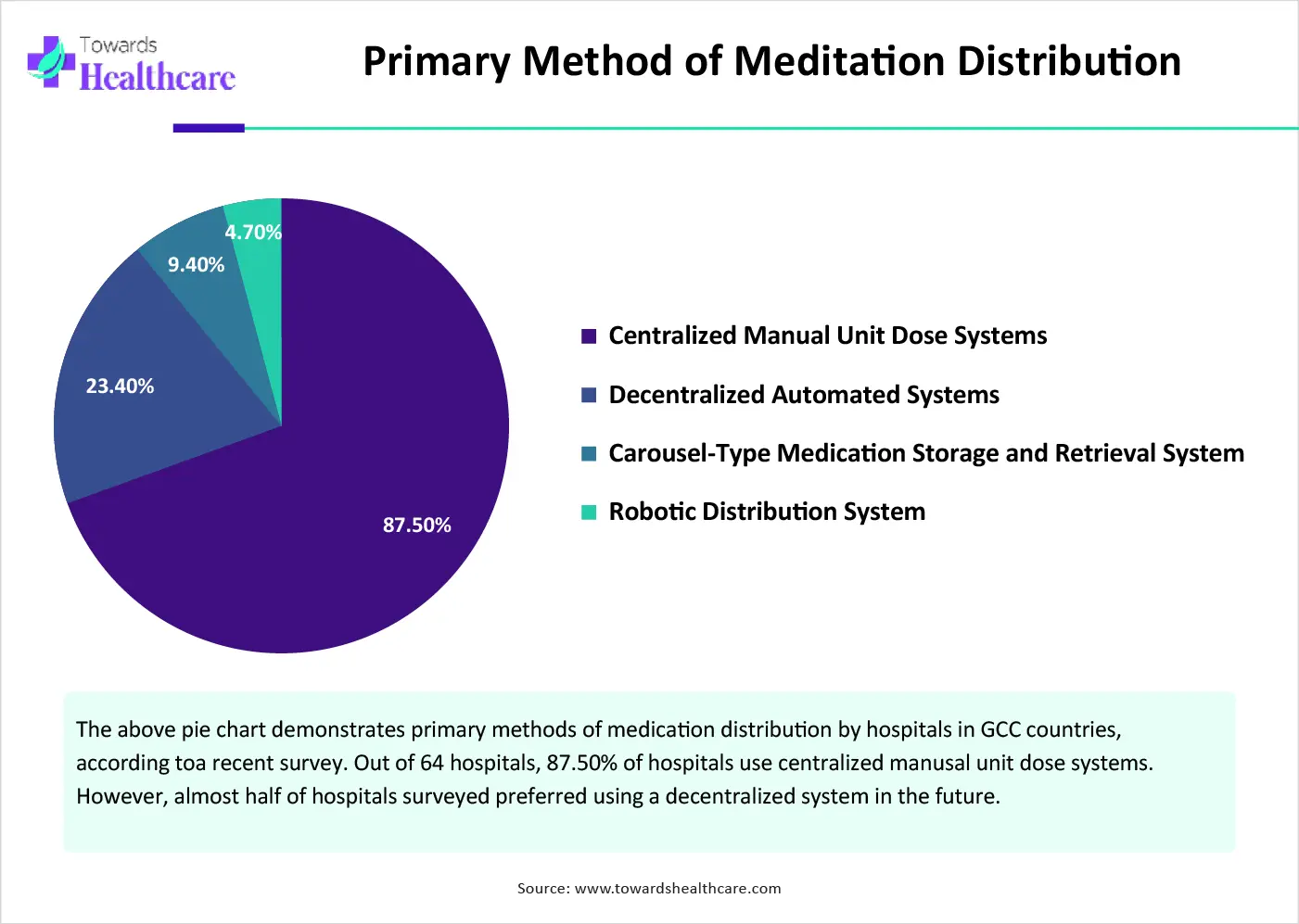

The market future is promising, driven by the development and deployment of automated drug delivery systems. Automated systems simplify various tasks of pharmacists, enabling them to focus on patient care. They reduce manual errors and enhance the efficiency of drug distribution. The computerized system maintains the security of storing and dispensing drugs. Automated systems are used by pharmacists to manage inventory and dispense controlled substances. A machine-readable coding system is used to verify doses while dispensing. According to a recent survey report, approximately 35.9% of hospitals use automated dispensing cabinets for their pharmacy. (Source - Science Direct)

| Metric | Details |

| Market Size in 2026 | USD 19.57 Million |

| Projected Market Size in 2035 | USD 43.46 Million |

| CAGR (2026 - 2035) | 9.27% |

| Leading Region | Saudi Arabia share by 40% |

| Market Segmentation | By Compounding Type, By Therapy Area, By End-User, By Country |

| Top Key Players | Saudi German Hospital Pharmacies (KSA/UAE), King Faisal Specialist Hospital & Research Centre Pharmacy, Cleveland Clinic Abu Dhabi Pharmacy, Mediclinic Middle East Pharmacy, AlZahrawi Medical Center Pharmacy (UAE), Gulf Drug Compounding (Oman), Tabuk Pharmaceuticals (KSA), Julphar Compounding Services (UAE), Bahrain Specialist Hospital Pharmacy, Aster Pharmacy Compounding (UAE), Nouf Pharma (KSA), Qatar Foundation Health Clinics Pharmacy, Kuwait Cancer Control Center Pharmacy, Oman National Hospitality Pharmacy, BioAesthetics Compounding (Bahrain), Pharmed (UAE), Sandooq AlWatan Pharmacy (KSA), MedPharma Services (Qatar), CareWell Pharmacy (Oman), Medicom Compounding Labs (UAE) |

By compounding type, the sterile compounding segment held a dominant presence in the market in 2024. This is due to the growing demand for parenteral formulations and the need for highly pure drugs. Sterile compounding refers to preparing dosage forms in a sterile, controlled environment to prevent contamination. It is mostly used for chronic disorders, such as cancer, ophthalmic, gynecologic, and diabetes. Sterile compounding is also used to administer nutrition through parenteral routes.

By compounding type, the non-sterile compounding segment is expected to grow at the fastest CAGR in the market during the forecast period. Non-sterile compounding is primarily done for products, such as topical creams, syrups, ointments, gels, powders, and pediatric suspensions. It does not require any specialized facility or skilled professionals. The area in which non-sterile formulations are prepared must be clean, but not necessarily free from microorganisms.

By therapy area, the oncology & chemotherapy admixtures segment held the largest revenue share of the market in 2024. This segment dominated due to the rising prevalence of cancer and the demand for personalized medicines. According to the International Agency for Research on Cancer (IARC), approximately 42,475 cancer cases were reported in GCC countries in 2020, and are projected to reach 104,000 cases by 2040, an increase of 116% in Saudi Arabia to 270% in Qatar. (Source - Wiley) Pharmacists can analyze patients’ conditions and provide admixtures of various chemotherapy drugs, enhancing efficacy and reducing side effects.

By therapy area, the pediatric segment is expected to grow with the highest CAGR in the market during the years studied. Pediatric patients require specialized doses and formulations, making formulations more palatable and easier to administer. Pharmacists ensure that young patients receive their medications by considering their specific preferences, allergies, and requirements. Some common formulations designed for pediatrics include syrups, suppositories, topical creams, and gels.

By end-user, the hospital pharmacies & cancer centers segment led the market in 2024. The segmental growth is attributed to favorable infrastructure and suitable capital investment. The increasing hospital admissions and the rising number of specialized cancer centers augment the segment’s growth. Hospital pharmacies play a crucial role in compounding medications based on hospital demands and practices.

By end-user, the outsourced compounding facilities segment is expected to expand rapidly in the market in the coming years. Outsourced compounding facilities are facilities that compound medications in bulk without the requirement of patient-specific prescriptions. They have skilled professionals who provide relevant expertise to hospitals and other healthcare organizations. They offer ready-to-use medications for multiple patients with similar conditions.

Numerous factors influence the market, including favorable government policies and the rising adoption of advanced technologies. Government organizations enact several regulations, legalizing compounding pharmacies in GCC countries. The increasing number of skilled pharmacy professionals in the region also promotes market growth. People are becoming more aware of identifying adverse effects related to approved drugs and the significance of compounding medications.

Saudi Arabia dominated the market share by 40% in 2024. The market is mainly driven by government regulations and a robust healthcare infrastructure. The Saudi Arabian government launched the “Vision 2030” strategy to diversify its economy and establish the Kingdom as a global hub for the biotech and pharmaceutical sectors. The plan aims to expedite the development of novel drugs and medical technology through industry-academia collaborations. (Source - Global Business Outlook)

The UAE is expected to grow at the fastest CAGR in the GCC compounding pharmacy market during the forecast period. The UAE government enacted a new Federal Decree law to govern medical products, the pharmacy profession, and pharma establishments in the region. The law provides a regulatory framework for licensing, supervising, and overseeing pharmaceutical establishments and biobanks. It is applicable for medical products, including medical devices, drugs, pharmaceuticals, and compounding pharmacies. (Source - Gulf News) Other aspects, such as the burgeoning medical tourism sector and free-zone compounding hubs, propel market growth.

Dr. Mohammed Salem al-Hassan, CEO and Medical Director of National Center for Cancer Care and Research (NCCCR) and Chairman at Hamad Medical Corporation, commented that the new sterile compounding pharmacy will have a direct positive impact on patient care. The facility is a key part of NCCCR’s advanced treatment options, establishing its position as a leading cancer care center in the region. (Source - Gulf Times)

In May 2024, the National Center for Cancer Care and Research by Hamad Medical Corporation (HMS) opened a new state-of-the-art sterile compounding pharmacy in Qatar. The facility is equipped with cutting-edge technologies and adheres to stringent standards set by the U.S. Pharmacopoeia. (Source - Gulf Times)

By Compounding Type

By Therapy Area

By End-User

By Country

January 2026

December 2025

February 2026

December 2025